Assume Crash Positions: Goldman Cuts Brent Price Target To $30 “With Possible Dips Near $20”

When we discussed Saudi Arabia’s shocking decision on Saturday to reverse on years of prudent oil output following Friday’s stunning collapse of OPEC+, with the kingdom now set to obliterate the OPEC cartel by flooding the market with heavily discounted oil in hopes of sending its price plunging, crippling competitors (such as US shale producers) and capturing market share (a repeat of what Saudi Arabia unsucessfully attempted back in Nov 2014), we made the following assessment on what the Saudi decision could to the price of oil once oil resumed on Sunday:

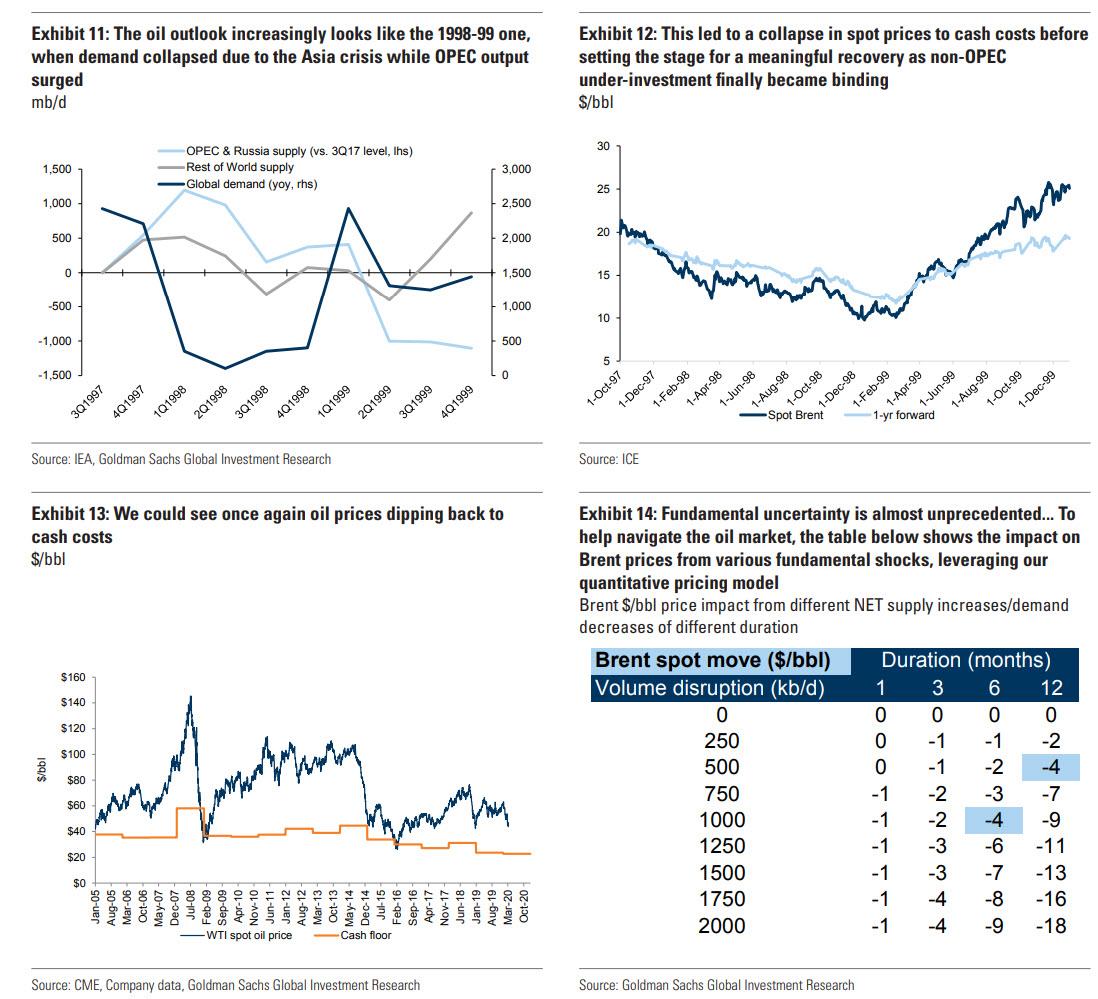

According to preliminary estimates, with Brent trading at $45, a flood of Saudi supply as demand is in freefall, could send oil into the $20s if not teens, in a shock move lower as speculators puke on long positions in what Goldman calls periodically a “negative convexity” event…. Oil traders are looking to historical charts for an indication of how low prices could go. One potential target is $27.10 a barrel, reached in 2016 during the last price war. But some believe the market could go even lower.

… those wondering what is the worst case scenario for oil prices, consider that Brent traded at an all time low of $9.55 a barrel in December 1998, during one of the rare price wars that Saudi Arabia has launched over the last 40 years… similar to just now.

In retrospect, one difference between the oil supply shock of 1998 and now, is that back then there was no concurrent demand shock. Instead, to find the last combo of both a positive oil supply shock and a massive negative demand shock, one would have to go to the depths of the Great Depression as Rapidian Energy notes in a WSJ article:

It’s the very rare combo of a massive negative #oil demand shock, positive supply shock & no swing producer that makes #crude ‘s looming price implosion as historic as deep. Last time this terrible trifecta happened – 1930-1931. @RapidanEnergy https://t.co/yNMBr0WAui pic.twitter.com/RVrNDEszRE

— Bob McNally (@Bob_McNally) March 8, 2020

https://platform.twitter.com/widgets.js

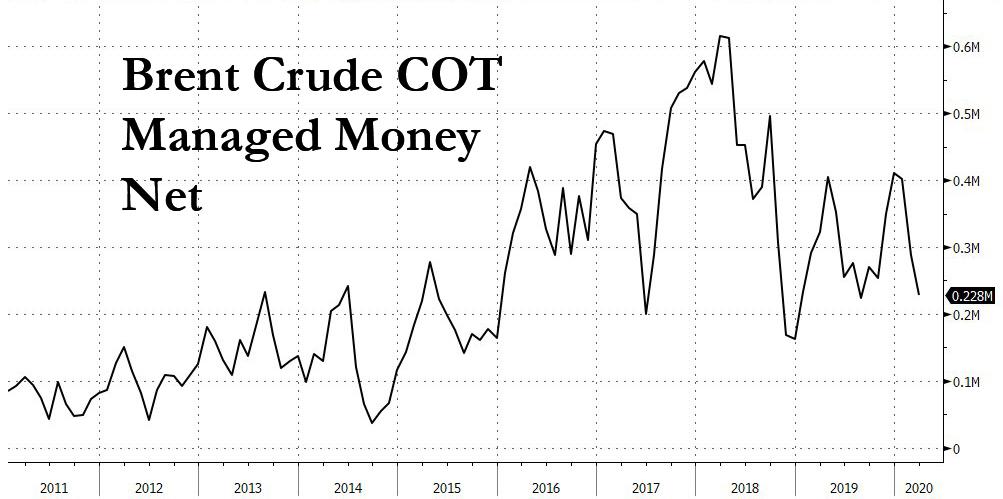

This suggests that the worst case scenario is potentially even more dire than that observed in 1998. Furthermore, considering the high number of Brent net specs, there is the potential for an even more violent puke as countless speculators are stopped out of margined underwater positions.

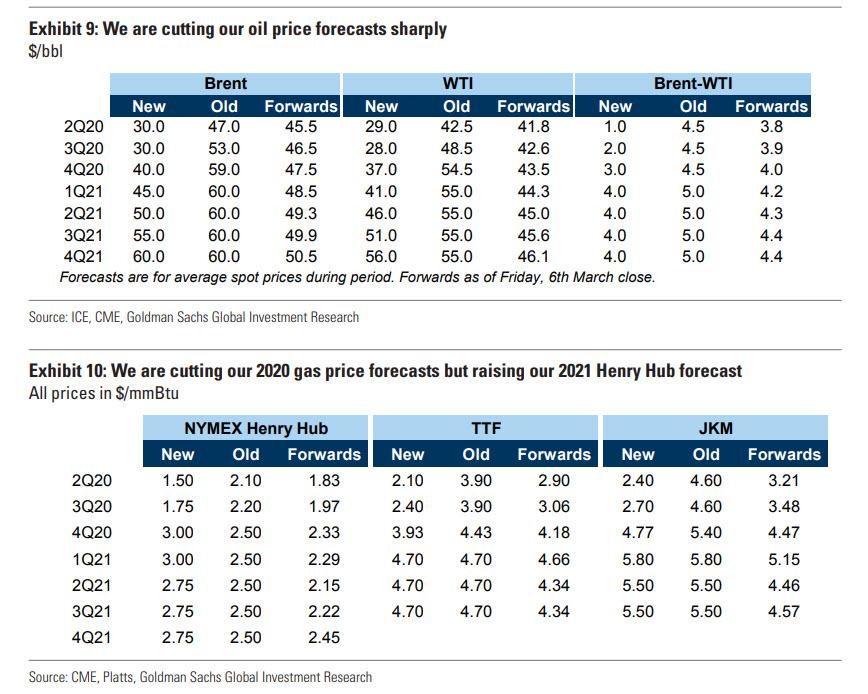

Of course, we will know for sure what happens in just a few hours when Brent reopens but first, moments ago Goldman’s commodities team just blasted out a note titled “The Revenge of the New Oil Order”, which has some very bad news for oil longs: Goldman now sees Q2 and Q3 2020 Brent prices plunging to $30/bbl from its previous forecast of $47/$53 for Q2/Q3, “with possible dips in prices to operational stress levels and well-head cash costs near $20/bbl.”

In short (as we also said on Saturday): there will be blood… perhaps literally.

Below are the highlights from the Goldman note which, if correct, would spell the apocalypse for the US shale sector and potentially result in millions of unemployed shale workers in the coming months coupled with a catastrophic selloff in junk bonds, because as Vital Knowledge’s Adam Criasfuli writes, “energy is the ‘FANG’ of high-yield, accounting for >10% of the entire market, the extreme stress facing credit is shaking the foundations of the whole financial system.”

Here is Goldman’s summary:

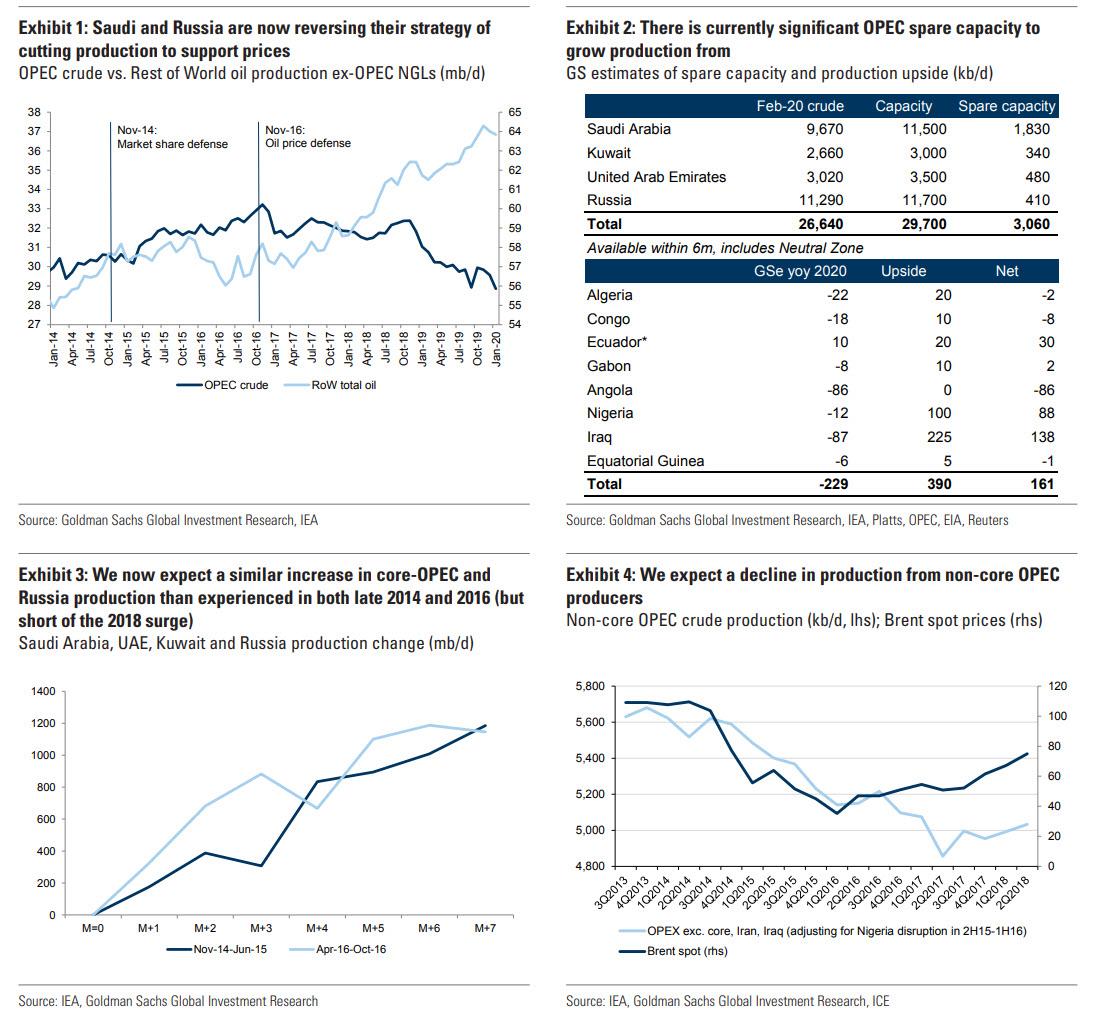

We believe the OPEC and Russia oil price war unequivocally started this weekend when Saudi Arabia aggressively cut the relative price at which it sells its crude by the most in at least 20 years. This completely changes the outlook for the oil and gas markets, in our view, and brings back the playbook of the New Oil Order, with low cost producers increasing supply from their spare capacity to force higher cost producers to reduce output.

In fact, the prognosis for the oil market is even more dire than in November 2014, when such a price war last started, as it comes to a head with the significant collapse in oil demand due to the coronavirus. This is the equivalent of a 1Q09 demand shock amid a 2Q15 OPEC production surge for a likely 1Q16 price outcome. As a result, we are cutting our 2Q and 3Q20 Brent price forecasts to $30/bbl with possible dips in prices to operational stress levels and well-head cash costs near $20/bbl.

While we can’t rule out an OPEC+ deal in coming months, we also believe that this agreement was inherently imbalanced and its production cuts economically unfounded. As such, we base case for now that no such deal occurs, with any response only likely at sharply lower prices anyways. In fact, we expect this Revenge of the New Oil Order to be swifter than its first foray given the already distressed state of the shale industry, likely reducing the likelihood of another quick policy reversal.

And the details:

1. At its core, the decision from Russia to unwind the artificial price support that OPEC+ had created since 2016 is rational. As we argued previously, these cuts to defend prices instead of market share defied the economic incentive of large low-cost producers without pricing power, with Russia’s economy able to cope with lower oil prices. Since November 2016, OPEC and Russia production was cut by 4.4 mb/d while the rest of the world increased output by 5.7 mb/d. Media reports over the weekend relayed that Russia’s decision was indeed squarely targeted at the shale sector given its current financial distress but also at the US administration in response to recent US sanctions on its Nord Stream 2 gas pipeline and Rosneft.

2. Such a sanction motivation, Russia’s comment on Friday to continue cooperation within the OPEC+ charter, Saudi’s aggressive OSP retaliation and the stress that low oil prices would create on its economy (itself already on weaker footing than in 2014) all suggest that a reversal in coming months could be possible, bringing us back to our post-coronavirus price forecast. While we can’t rule out such an outcome, we also believe that the OPEC+ agreement was inherently imbalanced and its production cuts economically unfounded. The aggressive cut to Saudi’s OSPs and Russia’s reluctance to be pushed into a deal on Friday both also point to a low probability of an immediate agreement. As such, we base case that no such deal occurs in coming quarters, with any response only likely at sharply lower prices anyways.

3. The oil market is now faced with two highly uncertain bearish shocks with the clear outcome of a sharp price sell-off. While there is so much that we still don’t know about oil fundamentals in coming months, we also know very well from 2015-16 how such a rebalancing will take place. Our initial attempt to frame this supply vs. demand divergence points to a 2Q20 record large surplus of c. 2.9 mb/d. This reflects the “price war” scenario we laid out on Friday, with an 1.0 mb/d aggressive ramp-up in core-OPEC and Russia output through 2Q, similar to what occurred in both 2014 and 2016 (and consistent with news reports that Saudi Arabia is already looking to lift April production well above 10 mb/d). On our quantitative pricing model, this would point to Brent prices averaging $30/bbl in the quarter with clear risks that prices at times overshoot to the downside.

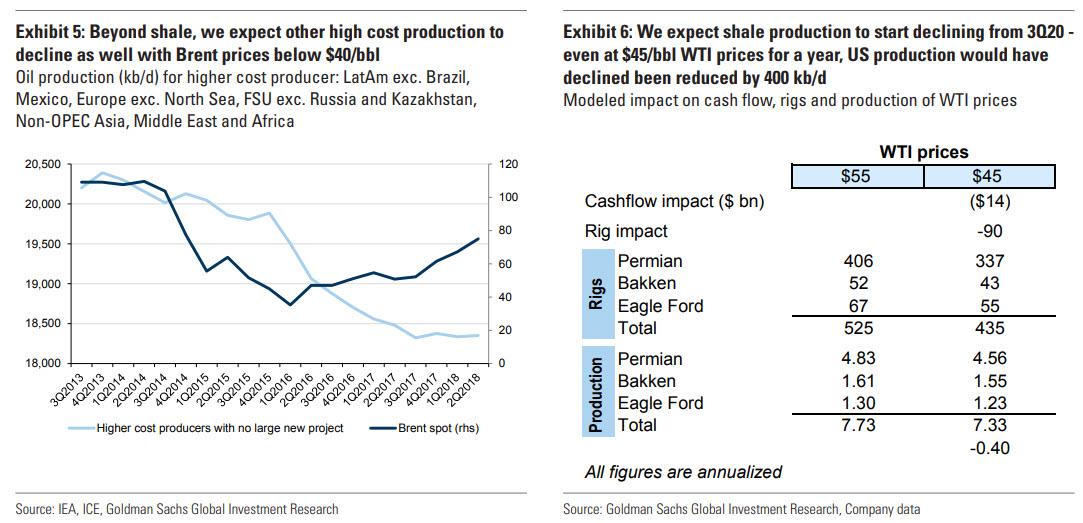

4. Such price levels will start creating acute financial stress and declining production from shale as well as other high cost producers. Specifically, we assume legacy production decline rates outside of core-OPEC, Russia and shale increase by 3% to 5% to return to their 2016 highs. In the case of shale, we assume a negligible response in 2Q but with production falling sequentially in 3Q by 75 kb/d and with declines increasing to 250 kb/d qoq in 4Q20. This will not, however, prevent a 3Q20 surplus of 1.2 mb/d and inventories peaking above their 2016 highs and Brent spot prices staying at $30/bbl on average. In fact the negative feedback loop of lower oil prices on energy exporting economies could exacerbate the decline in oil demand. At that point, the fundamental rebalancing could require oil prices falling to operational stress levels for high cost producers with well-head cash costs near $20/bbl.

5. Assuming no change in production policy, we would expect a market deficit to start in 4Q20 and that would run down excess inventories through 2021, with the outlook for draws helping prices rebound that quarter to $40/bbl like they did in the spring of 2Q16. Our 2021 quarterly Brent price forecasts are now $45/bbl, $50/bbl, $55/bbl and $60/bbl with a long-dated price of $45/bbl Brent. This lower equilibrium reflects a lower marginal cost of production in coming years due to steady growth in core-OPEC and Russia production (from their spare capacity initially and new drilling subsequently). The significant level of spare and disrupted capacity (each more than 3 mb/d) as well as resilient non-OPEC growth above $60/bbl Brent were ultimately the reasons why we didn’t expect upstream under-investment to become bullish for oil prices for another few years. This Revenge of the New Oil Order, while bearish initially, will finally start the clock on such a binding under-investment, with a clearer line of sight on higher equilibrium prices in 2 to 4 years.

6. Reusing our template from 2015-16, we expect this fundamental rebalancing to occur in three phases: 1) the survival phase, with the capitulation of large producers in dropping investment; 2) the inflection phase where inventories peak and the least fit producers engage in significant capital restructuring, including shuttering of assets; and 3) eventually the regeneration phase of a new industry with stranded assets ultimately shuttered or optimized.

7. While phases 1 and 2 played out over more than a year last time around (Nov-14 to Apr-16) and phase 3 never happened, we expect a much faster rebalancing this time around as shale and high-cost oil producers were already facing sharply higher costs of capital over the past year due to persistently poor shareholder returns. For example, as of last Thursday before the collapse of the OPEC+ agreement, US HY Energy credit spreads were already above 1000 bps, a level they had last traded at in March 2016 when WTI prices were trading at $35/bbl. This faster rebalancing – which may in fact be even quicker than our first path given the ongoing coronavirus-led contraction – may itself be the catalyst for Russia to hold off on any output agreement until it is completed and may help explain why this market share battle is happening now. In particular, there is no longer a wave of long-cycle projects coming online, with the last of these projects starting in 2020. Illustrating this point, our new global 4Q20 supply forecast ends up being lower without a OPEC+ cut than our prior expectations which featured a 1 mb/d cut from 2Q20.

8. From a market perspective, we expect the price decline to play out in two steps. First, already started large inventory builds will lead to a sharp steepening of the forward curve into contango to cover the quickly rising costs of storing all these barrels. We therefore recommend closing the long Dec-20 vs. Dec-21 Brent timespread trade that we initiated on 3-Feb-20 but keeping the accompanying long Jun-19 $49/bbl Brent put position added on 14-Feb-10, with the portfolio so far performing positively. Second, reflecting the structural nature of this repricing, long-dated prices will also fall to the market’s new clearing marginal cost of production likely initially near $40/bbl for Brent. During the inflection phase when inventories are at their peak, we could see a flattening of the forward curve near the trough in prices, the typical sign of producer capitulation and distressed hedging. This inflection phase is also a period where we would expect price volatility to surge to potentially new highs. From there, the path to a rebalanced market will eventually lead to sustained backwardation.

9. From a crude differential perspective, we expect the initial sell-off to come alongside a sharp compression of the WTI-Brent differential to potentially near parity like experienced in Jan-16, reflecting the cheaper cost of storing crude in the US and the lack of buying of uncontracted US crude by foreign refiners facing both weak demand and cheap seaborne Middle East crudes. From a product market perspective, we expect highly volatile cracks given the diverging forces of collapsing demand and surging excess crude supply. After a likely rebound on the first days of the crude price collapse, cracks should retrace given the ongoing demand shock (especially since refiners respond to % margin incentives against a backdrop of lower crude prices). Once refiners cut run, we would then expect the crude surplus to prevail and help margins recover even if the demand recovery remains shallow.

10. The impact of this structural shift will of course be felt well beyond the oil market, with likely significant distress for energy exposed sovereigns and sectors. In particular, we don’t expect the gas market to be spared. If Russia is indeed responding to both the competition from shale and the US sanctions on its new EU gas pipeline, we would expect its gas exports to Europe to rise as well. Such risks of higher Russian flows just make an already unsustainable balance potentially worse. As a result, we now base-case that the oversupply in the EU gas market will require a shut-in of the US LNG exports, and ultimately a shut-in of Appalachia gas production. Admittedly, this is a less surprising outcome than for oil since the global gas market has been heading that way following the collapse in Chinese demand due to the coronavirus, a notable surge in US LNG exports in February and the impact of a very warm winter on heating-related gas demand.

11. With a collapse in shale oil drilling, we are however increasingly comfortable forecasting a tightening US gas market and rising Henry Hub prices in both 2021 and 2022, with new Appalachia and Haynesville drilling required to balance the US market. That is because even if Russia raised export levels in Europe, we would expect the global LNG market to still sequentially tighten from its 2019-20 oversupply (assuming normal winters ahead) and allow for steadily rising US LNG exports. Based on these views, we are cutting our 2Q and 3Q20 Henry Hub forecast to $1.50 and $1.75 but raising our 4Q20-1Q21 forecast to $3.00/mmBtu with our 2021 summer forecast now up to $2.75/mmBtu. Our 2Q-3Q20 TTF price forecast is now $2.10 and $2.40 with winter staying at $4.70/mmBtu. Our 2Q-3Q20 JKM price forecast is now $2.40 and $2.70 with winter staying at $5.80/mmBtu.

f

Tyler Durden

Sun, 03/08/2020 – 16:23![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com