Panic: USDJPY Crashes, Commodity Pairs Plunge, Oil Said To Open Down $10

For a few days at the end of February, traders were stumped when instead of surging – as it normally does during risk off days – the Japanese Yen tumbled alongside stocks, sending the USDJPY to the highest level in nearly a year even as markets were rocked by early coronavirus fears.

In retrospect, that initial reaction (and countless “hot takes” on the topic) turned out to be dead wrong, because since then, the USDJPY has cratered, and is now down nearly 8 big figures in the span of two weeks, with the JPY once again a full-blown “risk off” currency.

And while we wait for equity futures to resume trading at 6pm, the USDJPY is down 1.1% to 104.20, continuing its recent freefall, hinting that between soaring coronavirus fears and the anticipated imminent crash in oil, futures will be a bloodbath… again.

It’s not just everyone’s favorite carry currency that is exploding higher amid a global risk off in early Sunday trading: the carry pairs – Loonie, Aussie and Norwegian Krone are all getting carted out feet first:

- USD/CAD RISES 0.5% IN EARLY TRADE AFTER ARAMCO OIL DECISION

- USD/NOK RISES 0.7% IN EARLY TRADE AFTER ARAMCO OIL DECISION

- AUD/USD DROPS AS MUCH AS 0.5% IN EARLY TRADING

And visually:

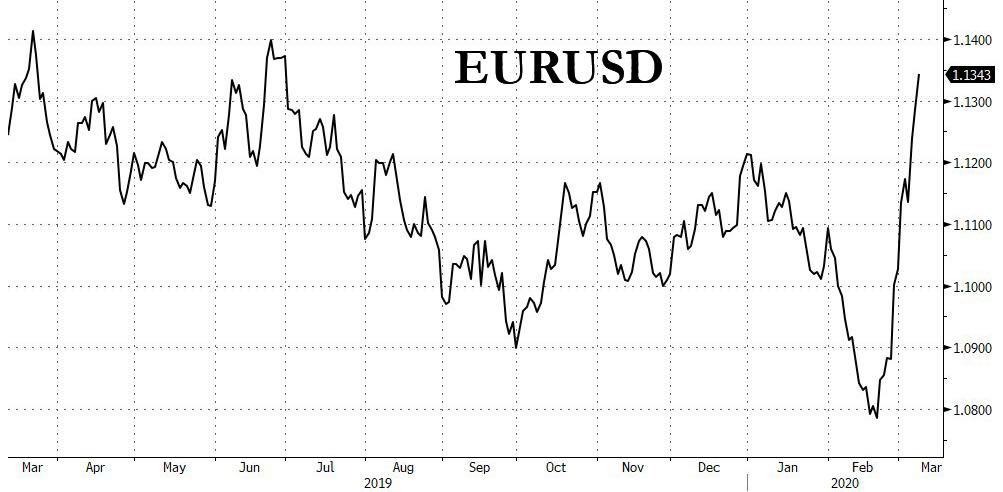

Finally, with the Euro having become a carbon copy of the Yen, some now speculate that the common currency is traders’ next favorite carry currency thanks to the ECB’s record low negative rates, and sure enough, all those carry traders who had the EUR as one of the FX pair legs, are scrambling to get out of their positions, sending the EURUSD soaring in recent days, and another 0.7% on Sunday, reaching its highest level since July.

Incidentally the topic of the Euro as a carry currency was touched upon in Albert Edwards’ latest note, and he had some very ominous words of warning if indeed that is the case (which it clearly is):

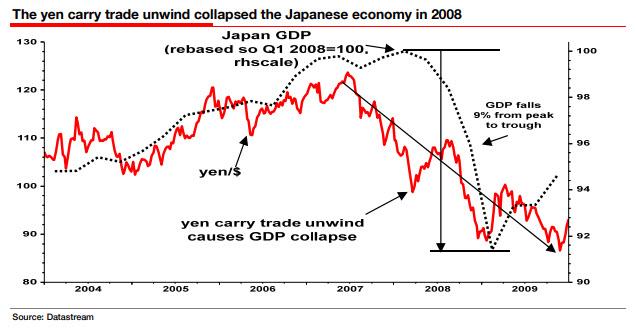

One of the key lessons from the 2008 GFC was to avoid a strong currency. Japans economy suffered a terrible slump, falling some 9% in just a year almost meeting the semi-official definition of a depression. This was around twice that of the drop in GDP in the US and Europe.

The main reason why this slump in the Japanese economy occurred in 2008 was that a seeming successful low interest rate policy blew up in the Japanese policymakers faces. That same fate may just be about to befall the ECB and the eurozone. In the run-up to the GFC, the BoJ interest rate remained close to rock bottom while rates were raised in Europe and the US. Japanese rates were, by some way, the lowest in the G7 and so the yen weakened firstly due to these wide interest rate differentials, and secondly as a weakening yen encouraged carry trades where investors borrow in a low interest rate, depreciating currency (yen) and invest the money in a higher yielding or rising assets abroad. This created a virtuous loop where the yen declined (dollar rallied) through 2005-mid 2007 (see chart below). Then as the asset prices collapsed, investors were forced to close out the carry positions, driving the yen sharply higher as the currency part of the trade was unwound.

The same issue might be set to overwhelm the ECB, which has also been successful in driving down the euro against the dollar by lowering interest rates to a negative 0.5% and being more aggressive with its QE. There is evidence emerging from the BIS that the euro may have become a funding currency for carry trades due to its rock-bottom interest rates, just like the yen did in 2005. To the extent this has occurred it has likely underpinned dollar strength as money has flowed into what is a higher yield, safe investment home.

A surge in the euro might occur irrespective of any additional ECB easing deeper into negative territory. Another 50bp ECB cut is irrelevant compared to the potential losses on assets in a market meltdown. Further ECB rate cuts may occur despite the obvious damage this is doing to the eurozone banking sector. In my view trying to stop a surging euro will be a far higher priority to the ECB than the chronic damage to eurozone bank margins from negative rates.

The priority will be to avoid a strong euro causing a slump in the already fragile eurozone economy and a move into outright deflation. Another deep recession would almost certainly trigger another euro crisis.

And the punchline:

If a carry trade unwind does cause the euro to surge uncontrollably against the dollar towards the $1.2-1.3 zone, the impact on the fragile eurozone economy could be devastating. For despite the euros weakness against the dollar, other countries have also been pursuing weak currency polices. As a result, the euro effective exchange rate (ie measuring the euro against a basket of currencies) is much stronger than the headline euro/$ exchange rate suggests. A surge in the euro from current levels as the carry trade unwinds could crush the eurozone economy. Indeed it could threaten the euro’s very existence.

Ooops.

Finally, since we know that the question on everyone’s lips is where does oil open (we laid out some thoughts yesterday), according to CNBC’s Scott Wapner, who cites trader Mark Fisher, oil is indicated to open below $32 a barrel, nearly $10 below its Friday closing price (although it is unclear what “indications” Fisher is looking at so take this with a big grain of salt).

Mark Fisher tells me oil indicated to open below $32 a barrel tomorrow – a stunning $9.50 below where it closed on Friday. Sounds like it’s full on bananas in the oil markets…

Have to watch high-yield and the banks.

— Scott Wapner (@ScottWapnerCNBC) March 8, 2020

Tyler Durden

Sun, 03/08/2020 – 14:58![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com