“We’re Not Sure What’s Going On”: Markets Hit “Sell Everything” Moment After “Largest On Record” 8-Sigma Crash

Last week, following a series of unprecedented, shocking market moves, we explained that a big reason behind the decorrelated cross-asset rollercoaster was due to an unprecedented, the biggest ever VaR shock, that forced risk parity funds, which until 2 months ago were the most levered ever, to engage in an unprecedented liquidation and delever to levels that were more suitable for the current, well, market crash.

We thought there was no way this market-dislocating move could ever be repeated. We were wrong, because as we showed yesterday, on Wednesday markets just suffered the biggest balanced portfolio drop in history, surpassing both the insanity of last week and the global financial crisis.

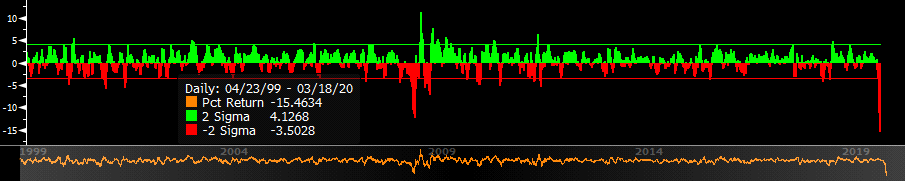

This morning, in a detail postmortem of just this move, Nomura’s Charlie McElligott writes that the move shown above in the model “60/40” balanced portfolio may have marked the peak “sell everything” moment, with a record 15.5% drawdown in 18 days, which represents an 8-sigma move, and is the largest on record.

Drilling into this historic move which saw the conventional “bonds as your hedge” trade going completely wrong-way, especially for risk parity funds in-light of what McElligott notes is the “liquidate financial assets/cash at all costs” environment—and a potential “paradigm shift” of unprecedented and experimental fiscal stimulus in-the-pipe, “we now see the past 18d period of returns for our model “World 60/40” fund -15.5%, greater than a -8 SD move and truly unprecedented dating-back to our model’s 1999 start-date”

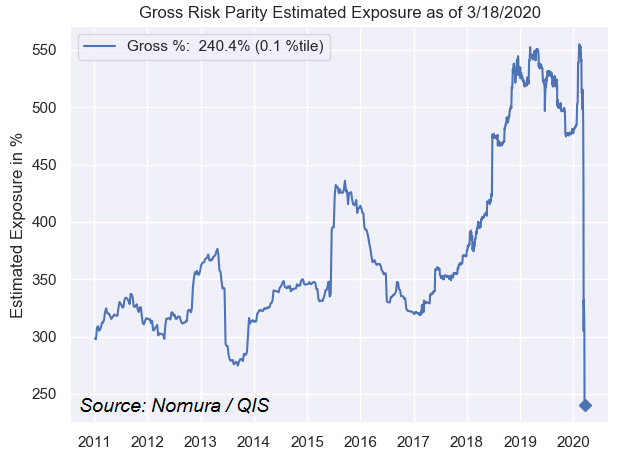

Why does this matter? Because “the feedback loop of forced deleveraging/stop-outs in light of the extreme realized volatility mechanically “triggering” and de-risking is best seen by the “remarkable slashing” of gross-exposure within Nomura’s Risk Parity model, where there has been a reduction from the 100th percentile, a reading of 555% on Feb 10th, to this morning’s 240%/0th percentile estimated gross-exposure reading.

Digging through the market plumbing, McElligott points out the “kitchen sink” of central bank emergency announcements overnight…

- Fed announced a new emergency program (MMLF) to aid money markets

- ECB “no limits” bazooka (“Pandemic Purchase Program w/ $820B of QE)

- RBA 25bps cut to ELB, introduces QE and targeted YCC

- Japan discussing $276B packed including “cash payouts” to households

- S Korea new $40B package

- Brazilian 50bps rate cut

- US Senate passes 2nd stimulus bill and negotiating the 3rd ($1.3T)

- Fresh headlines from Bloomberg *GERMANY MAY AUTHORIZE EMERGENCY DEBT AS SOON AS NEXT WEEK

- BOE emergency rate cut to 0.1% and GBP200BN QE expansion

… and notes that all these extraordinary policy measures roll-in alongside the abovementioned liquidation into cash and “stop-out” behavior, flows from UST/Rates business which have been “…decisively bearish for the last week, with heavy selling from foreign and domestic RM, deleveraging in basis/off the runs/tips from hedge funds (RV/Macro/RP strats etc)”

Worse, the Nomura quant believes that it is nowhere close to done, as this morning there is an extension of the infamous UST/Futures “basis stress” (particularly in the long-end) which we first described in “The Fed Was Suddenly Facing Multiple LTCMs”: BIS Offers A Stunning Explanation Of What Really Happened On Repocalypse Day, and which Nomura’s rates strategist Darren Shames puts as follows:

- “WN basis is bid at 8 ticks this morning which converts to a ~1.70 implied repo rate – as a reminder GC was SUB 20bps this morning. That’s the most stressed level we have ever seen in this basis historically. We’re not sure what is going on but all basis markets are getting hit down in tandem.

- For your guide, the current price in WN (ie. if you buy at 8 ticks gross) you are likely to deliver something like 17-20 TICKS if you are able to fund to term!”

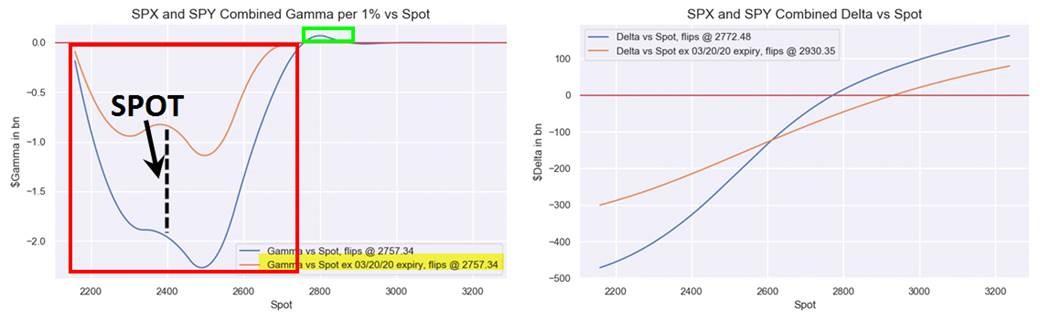

Meanwhile, as discussed previously, McElligott reminds us that US stocks have now passed a first critical hurdle with regard to technical factors which have kept moves so extreme over the past month, which was the clearing of yesterday’s VIX March “serial” expiration.

As stated recently, the extreme “short Gamma” position for Dealers in VIX products (particularly in-light of the massive VIX Call Wing buyer for the Feb and Mar expiries) is now incrementally normalizing following yesterday’s expiration, and should then make hedging-driven moves “less chase-y” for them—i.e. not having to buy the rips / sell the dips to the same extent as prior

But before the “all clear” sign is given, markets still need to clear the index and ETF “short Gamma” dynamic, which remains considerable due to the enormous S&P “Put Wing” flows. They also need to get through Friday’s “Quad Witch” expiry where Nomura calculates there is now the potential “for nearly 47% of the $Gamma to drop-off.”

What happens then?

Well, if a large part of the gamma drop-off were to materialize, Nomura expects that this “large decline in the gamma post-expiration” should allow markets to pivot back to a much more “neutral”/less extreme hedging stance for Dealers, “meaning incrementally less sensitivity to changes in underlying Delta and thus, forced hedging “momentum” (selling into selloffs, buying into rallies)—and could even ultimately move us closer to a place where “rich vol” may in-fact be sold again to Dealers, which could then mean a partial return to standard “long Gamma” insulating flows (hedging flows which buy dips, sell strength)—although CLEARLY still, all of this is subject to the progression of the Virus and the impact it will have on global growth and risk-sentiment.”

Tyler Durden

Thu, 03/19/2020 – 12:15![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com