Futures Rollercoaster As Global Coronacases Approach 1 Million

Global markets started off the new week wobbly, with stocks around the world trying desperately to find firm footing even as the global coronavirus cases rose above 732,000 on Monday morning and are set to hit 1 million by the end of the week.

U.S. stock index futures see-sawed on Monday after a strong recovery last week, swinging between losses and gains after President Trump abruptly abandoned his ambition to return American life to normal by Easter raising fears of a larger economic hit from the slump in business activity. After opening more than 4% lower on Sunday, futures have stince staged a rebound, and were trading slightly above Friday’s close when stocks sold off after the Fed announced it would taper its Unlimited QE from $75BN to $60BN. Abbott Labs was a standout, jumping in early trading after unveiling a five-minute coronavirus test.

Shares in Europe followed earlier declines across much of Asia, though they too staged a comeback and traded mostly unchanged as traders were transfixed by the surge in new cases, which rose by 60,000 overnight to 732,153 (and 34,686 deaths). Total cases are now expected to hit 1 million in 3-4 days.

Earlier in the session, Asian stocks fell, led by industrials and IT, after rising in the last session. Most markets in the region were down, with Singapore’s Straits Times Index dropping 4.7% and India’s S&P BSE Sensex Index falling 3.7%. The Topix declined 1.6%, with AP Co and PIA falling the most. The Shanghai Composite Index retreated 0.9%, with Beijing Aritime Intelligent Control and Henan Oriental Silver Star Investment posting the biggest slides.

There were some bright spots, with Australian equities posting a standout surge as the government launched a super-sized support program. Australia’s benchmark ASX200 registered a late surge, closing 7% up after Prime Minister Scott Morrison unveiled a $130 billion ($79.86 billion) package to help to save jobs.

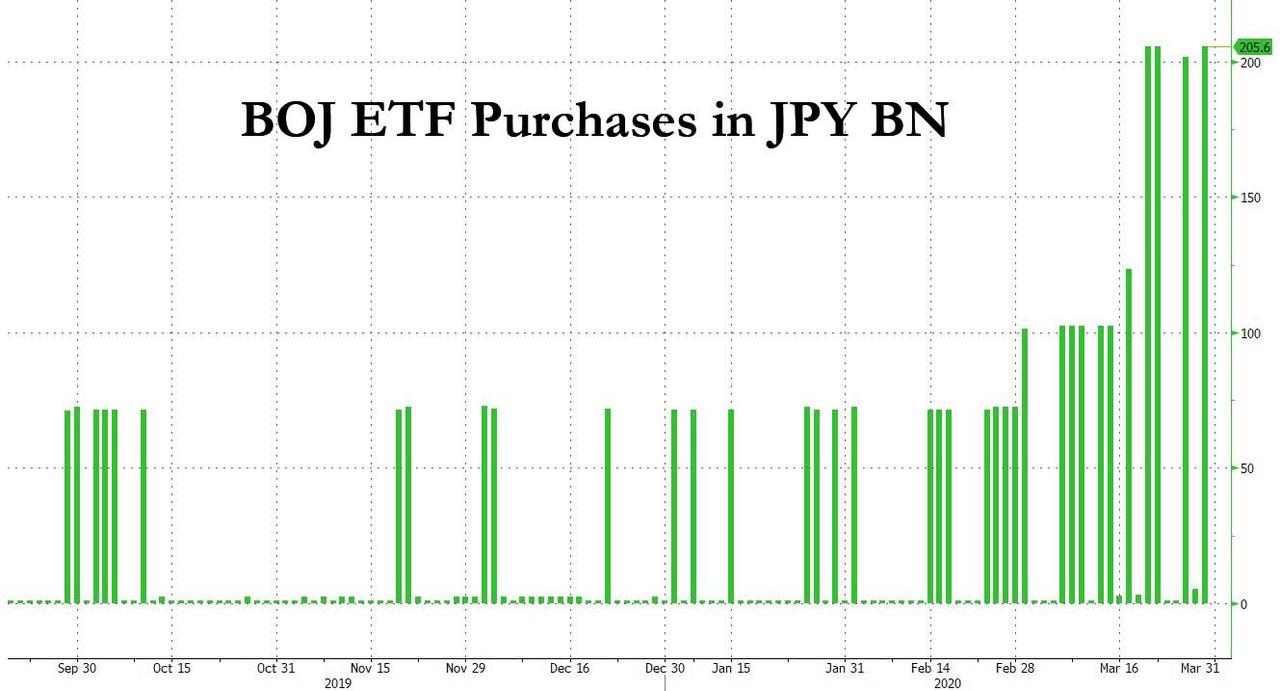

Japan’s Nikkei had led the rest of Asia lower and Europe’s main markets slumped by 1.5-2.5% in early trade, adding to what has already been the region’s worst quarter since 1987. Stocks dropped even as the Bank of Japan purchased another record 201.6b yen of ETFs Monday as it steps up efforts to calm markets.

“I have been in this business almost 30 years and this is the fastest correction I have seen,” Lombard Odier’s Chief Investment Officer Stephane Monier said of this year’s plunge in global markets.

The big standout in overnight trading was oil, which took another eyewatering 8% tumble on Monday, with some now expecting price to drop to zero (or negative) as storage facilities fill up. The rout in oil took crude to its lowest since 2002. Brent was at only $22 a barrel by 0815 GMT, hammering petro currencies such as Russia’s rouble, Mexico’s peso and the Indonesian rupiah by as much as 2%. Brent futures were down 8%, or $2, at $22.50 a barrel – their lowest for 18 years. U.S. West Texas Intermediate (WTI) crude futures fell as far as $19.92, near a 2002 low hit this month.

It didn’t help that the U.S. dollar was back on the climb. The euro and pound were both batted back by about 0.6%, leaving the former near $1.1070 and sterling at $1.2350. On Friday Britain had become the first major economy to have its credit rating cut because of the coronavirus.

JPMorgan now predicts that global GDP could contract at a 10.5% annualized rate in the first half of the year: “We continue to mark down 1H20 global GDP forecasts as our assessment of both the global pandemic’s reach and the damage related to necessary containment policies,” said JPMorgan chief economist Bruce Kasman. As a result, central banks have mounted an all-out effort to bolster activity with rate cuts and massive asset-buying campaigns, which have at least eased liquidity strains in markets.

On Monday, China became the latest to add stimulus, with a cut of 20 basis points to a key repo rate, the largest in nearly five years. Singapore also eased as the city state’s bellwether economy braced for a deep recession while New Zealand’s central bank said it would take corporate debt as collateral for loans.

Rodrigo Catril, a senior FX strategist at NAB, said the main question for markets was whether all the stimulus would be enough to help the global economy withstand the shock: “To answer this question, one needs to know the magnitude of the containment measures and for how long they will be implemented,” he added. “This is the big unknown and it suggests markets are likely to remain volatile until this uncertainty is resolved.”

In rates, bond investors are bracing for a long haul, with European government bond yields dipping and those at the very short end of the U.S. Treasury curve turning negative. 10-year TSYs dropped a steep 26 basis points last week and were last standing at 0.65%. That drop has combined with efforts by the Federal Reserve to pump more U.S. dollars into markets, dragging the currency off recent highs.

Against the yen, the dollar was pinned at 107.74, well off the recent high of 111.71, but its gains against the euro, pound and heavyweight emerging market currencies suggested it was regaining strength.

“Ultimately, we expect the USD will soon reassert itself as one of the strongest currencies,” argued analysts at CBA, noting the dollar’s role as the world’s reserve currency made it a countercyclical hedge for investors. “This means the dollar can rise because of the deteriorating global economic outlook, irrespective of the high likelihood the U.S. is also in recession.”

The dollar’s retreat had provided a fillip for gold, but buying stalled as investors were forced to liquidate profitable positions to cover losses elsewhere. The metal was last at $1,613.6 an ounce, although physical gold was selling for at least 10% higher, and in many places, for much more. The premium of physical silver over spot is as much as 100%.

“Central banks have been easing (monetary policy) and governments have been offering stimulus packages, but they are only supportive measures, not radical treatments.”

Expected data include pending home sales and Dallas Fed Manufacturing Outlook. RH is reporting earnings

Market Snapshot

- S&P 500 futures up 0.4% to 2,533.25

- STOXX Europe 600 down 1.4% to 306.62

- MXAP down 0.8% to 136.73

- MXAPJ down 0.4% to 429.75

- Nikkei down 1.6% to 19,084.97

- Topix down 1.6% to 1,435.54

- Hang Seng Index down 1.3% to 23,175.11

- Shanghai Composite down 0.9% to 2,747.21

- Sensex down 3.4% to 28,813.44

- Australia S&P/ASX 200 up 7% to 5,181.38

- Kospi down 0.04% to 1,717.12

- German 10Y yield fell 6.0 bps to -0.534%

- Euro down 0.6% to $1.1079

- Italian 10Y yield rose 10.0 bps to 1.157%

- Brent futures down 8.5% to $22.82/bbl

- Gold spot down 0.4% to $1,621.29

- U.S. Dollar Index up 0.5% to 98.80

Top Overnight News

- Global coronavirus cases climbed above 720,000 and a top scientist suggested U.S. deaths may reach 200,000, while President Donald Trump abandoned his ambition to return American life to normal by Easter

- European officials warned against loosening lockdowns after the coronavirus outbreak claimed more than 3,000 lives in Spain and Italy over the weekend. Strains in health-care systems increased as Spain said its intensive-care wards are stretched beyond capacity and a German public-health leader said the country may face a ventilator shortage

- China’s central bank cut the interest rate it charges on loans to banks by the biggest amount since 2015, as the authorities ramp up their response to the worsening economic impact from the coronavirus pandemic.

- Oil slumped to a 17-year low as coronavirus lockdowns cascaded through the world’s largest economies, leaving the market overwhelmed by cratering demand and a ballooning surplus of crude

- Australia’s central bank netted about 2.5% of the bond market in its first six days of purchases. Yet, the scale of government fiscal stimulus in the pipeline sees little danger of it following Japan’s path and holding too many securities

- European lenders including UniCredit SpA, ABN Amro Bank NV and ING Groep NV suspended dividend payments on 2019 earnings, bowing to European Central Bank pressure to retain capital

- Japan will issue an extra 16t yen in government bonds from July to cover a stimulus package for coronavirus impact, Reuters reports; The Bank of Japan purchased 201.6b yen of ETFs Monday as it steps up efforts to calm markets

- Just two weeks after South Korea adopted one extra budget, President Moon Jae-in said another is already being planned to help insulate households against the impact of the coronavirus pandemic

Asian equity markets resumed their selling, and US equity futures also began the week on the backfoot (before gradually recouping losses) as coronavirus woes continued to weigh on risk appetite and following last Friday’s declines on Wall St after the US overtook China with the greatest number of coronavirus cases. In addition, President Trump recently announced to extend federal guidelines on coronavirus until April 30th and NIH’s Fauci projected a possible 100k-200k deaths. The risk appetite was dampened across most the regional bourses with losses in Nikkei 225 (-1.6%) exacerbated by the flows into the JPY and with notable weakness seen in Softbank shares after a Co.-backed satellite start-up filed for bankruptcy, while ASX 200 (+7%) bucked the trend on stimulus measures with the government to announce support for employers and employees today. Furthermore, the Australian Banking Association said banks are to permit businesses with up to AUD 10mln in loan facilities to defer repayments up to 6 months which will apply to AUD 100bln of business loans, and regulator APRA announced the deferral of capital reform implementation by 1 year. Hang Seng (-1.3%) and Shanghai Comp. (-0.9%) were downbeat despite PBoC efforts in which it injected liquidity through repos for the first time since mid-Feb and lowered the 7-Day Reverse Repo rate by 20bps. Improved earnings including China’s largest banks did little to spur risk appetite amid the broad cautiousness and with press reports suggesting 100mln jobs could be at risk from the coronavirus fallout, while participants also await this week’s upcoming key data including the latest Chinese PMI numbers. Finally, 10yr JGBs were higher and briefly approached the 153.00 level amid the subdued risk appetite and after recent comments by PM Abe who vowed an unprecedented economic package which will include fiscal and monetary stimulus, while prices also tracked T-notes which gapped higher at the open to briefly test resistance at 139.00.

Top Asian News

- Tokyo Economy Could Face Lockdown From Few Dozen Virus Cases

- How a $100 Billion South Korean Insurer Became a Penny Stock

- Fed May Follow Japan and Australia Into Yield-Curve Regime: HSBC

- Pessimistic Indian Doctors Brace for Tsunami of Virus Cases

A choppy session in the equity space with European futures fully paring its pre-market gains and then some, whilst cash markets move in tandem (Eurostoxx 50 -0.5%). APAC bouses closed the trading day mostly lower, whilst US equity futures reversed earlier upside of almost 1.5% having opened lower by some 1.8%. Stocks in general lack conviction as coronavirus uncertainty feels counterforce (in the short-term at least) from month and quarter-end rebalancing – which models thus far see outflows from Treasuries and inflows into stocks. Back to Europe, major bourses see broad-based losses, whilst in the periphery – Spain’s IBEX (-1.5%) modestly underperforms the region after the county suffered its worst day yet in terms of coronavirus deaths. Subsequently, sectors remain in the red across Europe with defensives faring slightly better than cyclicals at the time of writing. Looking at the breakdown, Travel and Leisure see another session of steep losses, Oil and Gas is also weighed on by price action in respective complexes. However, Banks underperform having been dealt with the prospect of prolonged share buyback and dividend suspensions alongside a lower yield environment. As such, ING (-6.7%) sees itself towards the bottom of the Stoxx 600 after it announced a dividend suspension until at least 1st October, whilst rebuffing FY20 interim payments. Meanwhile, ABN AMRO (-7.4%) is pressured by anticipated Q1 losses, FY and interim dividend postponements. In terms of other movers – Airbus (-7.5%) tackles subdued aircraft demand as airlines ground their fleets, with easyJet (-6.9%) announcing its entire fleet will be non-operational with no timeframe for the resumption of commercial flights. Elsewhere, Hammerson (-18%) rests at the foot of the pan-European index after noting material impacts on 2020 results and withdrawing dividend and guidance. On the flip side, ASML (+2.8%) sees some reprieve after announcing that its supply chain issues have been resolved, albeit the Co. decided to refrain from Q2 share buybacks.

Top European News

- Giant Oil-Field Boost Is Bad for Market, Good for Norway

- Euro- Area Confidence Posts Record Drop With Economy in Lockdown

- German Bonds Extend Gains After State Inflation Data Disappoint

- Stelios Tells EasyJet Need to Cancel GBP4.5-Billion Airbus Order

In FX, it’s debatable whether the Dollar is benefiting from supportive rebalancing flows for the final trading day of March, the current quarter and the 2019/2020 financial year, or improving chart impulses alongside weakness in rival currencies on specific bearish factors, but suffice to say that the Greenback has pared more of its recent losses. Indeed, the DXY has bounced further from Friday’s low (98.284) towards 99.000 and is currently close to a potentially pivotal technical marker around 98.810 that roughly coincides with a Fib retracement and the 21 DMA. However, jittery risk sentiment and arguably greater demand for the Yen over month/Q1/Japanese half fy end appears to be capping the index.

- JPY – Bucking the overall G10 trend as noted above, with Usd/Jpy meeting heavy offers above 108.00 from Japanese exporters and various domestic names repatriating funds for tomorrow. The headline pair is now hovering around 107.50 after a knee-jerk spike above the big figure on reports that JGB issuance will be ramped up to fund the fiscal fight against COVID-19, while taking a 4th record equalling amount of BoJ ETF buying in stride.

- CAD/GBP/CHF/EUR/NZD/AUD – All overwhelmed if not completely consumed by the Buck’s partial recovery, as the Loonie also digests the latest BoC rate cut and venture into the realms of QE, including commercial paper, on top of another downturn in crude prices. Usd/Cad is towards the top of a 1.4097-1.3993 range, while Cable is sub-1.2400 within 1.2467-1.2319 parameters and Eur/Gbp meandering between 0.8988-21 following Fitch’s 1 run UK ratings downgrade and seemingly 2-way flows into March 31. Nevertheless, the Euro is nearer the base of 1.1143-1.1062 extremes against the Dollar as the coronavirus case and fatality totals continue to pile up in Spain and Italy, and the single currency is also lagging vs the Franc (Eur/Chf sub-1.0600) even though Usd/Chf is hugging 0.9550 from just over 0.9500 at one stage in wake of latest Swiss sight deposits implying increased intervention. Elsewhere, the Kiwi is underperforming down under, or in fact the Aussie is outperforming on the back of bigger financial support efforts from the Government overnight that boosted the ASX. Nzd/Usd is only just keeping afloat of 0.6000 in contrast to Aud/Usd pivoting 0.6150 and the Aud/Nzd cross looking more comfortable on the 1.0200 handle after a brief dip below.

- EM – Broad losses vs the Usd against the backdrop fluctuating/fickle risk asset moves, but with the Rouble undermined by Brent’s retracement as well, while the Rand hit fresh record lows circa 18.0750 following Moody’s SA cut to junk, albeit widely anticipated. Conversely, the Singapore Dollar was not unduly ruffled by limited MAS tweaks to the currency peg as it kept the midpoint and corridor unchanged after trimming the band to zero, and the offshore Yuan is off lows post-PBoC 20 bp repo rate cut.

In commodities, another detrimental session for the crude markets thus far amid further crystallisation of the demand impact from the virus outbreak as global economies come to a standstill, whilst supply-side woes refuse to subside. Over the weekend, Saudi Arabia opposed an emergency meeting that the OPEC President was urging as oil markets continue to tumble. This rejection would mean that the market will have to wait until the scheduled meeting in June for any revision of output policy. Analysts at ING believe that this will be too late to counter the surplus expected over Q2, and as such the Dutch bank has cut its ICE Brent forecasts to USD 20/bbl vs. Pre. USD 33/bbl for Q2 2020. Meanwhile, Goldman Sachs stated that oil demand this week is seen lower by 26mln BPD and suggested it is impossible to shut down that level of demand with the absence of large and persistent ramifications to supply. In terms of today’s trade, WTI front-month prices briefly dipped below USD 20/bbl to fresh 17yr lows but meander around the level at the time of writing, meanwhile, its Brent counterpart modestly underperforms with added pressure from OPEC – prices breached USD 23/bbl to the downside. Elsewhere, spot gold remains relatively uneventful on either side of USD 1615/oz ahead of this week’s key risk data releases, and with the macro themes also in the fray. Copper prices meanwhile mimic the choppy action in stock markets – with the red metal having given up its APAC gains during early European trade.

US Event Calendar

- 10am: Pending Home Sales MoM, est. -2.0%, prior 5.2%

- 10am: Pending Home Sales NSA YoY, est. 6.0%, prior 6.7%

- 10:30am: Dallas Fed Manf. Activity, est. -10, prior 1.2

DB’s Jim Reid concludes the overnight wrap

I hope you had as good a weekend as is possible in these strange and troubled times. As forewarned last week we erected a 16 foot trampoline over the weekend in what were pretty icy temperatures. If you have nothing better to do in the lockdown and you want to see how we got on via a time lapse video then look at the link on my Bloomberg header. Failing that search for “Trampoline Travails with Twins” in YouTube. As you’ll see at the end the kids and Trudi got rid of a week of self-isolation frustrations.

Talking of which, it does feel like the last week has been one big rush of adrenaline for markets as unparalleled stimulus has swept through the main economies. However while we all talk about “epi curves” it feels like the stimulus curve is now going to start flattening out after the shock and awe of the last couple of weeks. We are instead going to be left with having to deal with a decline in activity that will be as sharp as anything seen since the Great Depression and likely greater in some countries.

Indeed going forward now, the bad news will come from the real time data and earnings reports that could in some cases create existential risks. The good news will come from a run of slower new virus case growth numbers and mortality rates around the world. If investors can get some visibility on when western economies can re-open and what the pace of such re-openings will look like then they are more likely to look through the worst of the upcoming news. The economic/earnings news will be very bad though in many places and not all companies (or their bond and equity holders) will make it through or will see a significant scar. One area we’ve discussed a lot over the last couple of years is the huge fallen angel risk when we do see the next downturn. This risk is now upon us and this morning Nick and Craig in my team have updated the analysis of what has already been downgraded to HY from IG and names that are potentials. Lots of stats and graphs for your perusal. Link to the complete report here.

Back to the virus and the full round up of the very latest on growth of new cases and mortality rates are in the new “Corona Crisis Daily” which has lots of tables and graphs showing the latest evolution of covid-19. This will be out around the same time as this. However in brief, the highlights are that the percentage growth in new cases and mortality are slowing in the Western economies furthest along the “epi curve”. So for this and more on the latest news see our new sister daily.

To Asia now where markets have kicked off the week on the back foot with the Nikkei (-2.96%), Hang Seng (-1.29%), Shanghai Comp (-1.59%) and Kospi (-1.21%) all down. The Nikkei is leading declines as most Japanese stocks are trading ex-dividend. In FX, the US dollar index is up +0.34% while sterling is down -0.72% following Fitch downgrading the UK’s credit rating to AA- from AA with negative outlook on Friday evening. Elsewhere, futures on the S&P 500 are down -0.40% while Brent crude oil prices are down -6.14%.

The moves in China this morning follow the PBoC cutting the 7-day reverse repo rate to 2.2% from 2.4%. That is the biggest cut since 2015 and should set the stage for the MLF rate cut in April. Meanwhile, the Monetary Authority of Singapore also lowered the midpoint of the currency band and reduced the slope to zero, implying that the central bank will allow for a weaker exchange rate to help support export-driven growth and to ward off deflationary threats.

In other overnight news, President Trump said in a press conference that social distancing protocols would remain in place through all of April, stepping back from hopes of opening the economy back up by Easter. He also added that the hoped the country would reach the “the bottom of the hill” by June 1st.

Moving on. As we move into Q2 later this week the highlights will be the final global PMIs on Wednesday (manufacturing) and Friday (services) and the weekly US initial claims on Thursday which will probably be more real time than the payrolls report on Friday. Note that China’s first set of PMIs will come very early tomorrow London time.

For the final PMIs they rarely change too much from the flash numbers but given the fast moving shutdowns in the second half of this month there’s a chance that they will fall even more from what were already record lows across many of the indices. Italy and Spain’s numbers will be interesting given that we didn’t get a flash number and with them being the worst hit European countries by the virus at the moment. Maybe some comfort could come in China’s numbers (from tomorrow) as activity progressively rebooted during the month. A decent bounce is expected which may give some optimism for all those further behind the “epi curve”. For the rest of the week ahead see the day by day diary at the end.

Recapping last week now and markets across the globe rallied as stimulus in Europe and the US caused optimism to return even as Covid-19 cases in Italy and the US climbed above those reported in China by the end of the week. The S&P 500 recorded its best week since 2009, following on from the worst week since around the same time. Last week the index rose +10.26% (-3.37% Friday), but in total the index is still down -24.95% from the all-time highs. European equity markets slightly underperformed their US counterparts, though that follows on from their outperformance the week before. The STOXX 600 rallied +6.09% over the week (-3.26% Friday), for the largest one week gain since December 2011 and breaking a 5 week losing streak. The DAX gained +7.88% (-3.68% Friday), the IBEX +5.19% (-3.63% Friday) and the FTSE MIB +6.16% over the 5 days (-5.25% Friday) as the three most highly infected countries in Europe saw a stimulus fueled rebound even if Friday saw weakness.

Asian equities also joined in the rally, led by the Nikkei. Japanese equities rallied +17.14% (+3.88% Friday), while the Kospi rallied +9.68% (+1.87%) on the week. With S&P 500 daily move remaining elevated, the VIX was mostly unchanged on the week, finishing just -2.9 points lower at 59.1. Even as equites rallied on the week, other risk assets like crude continued to sell off. Brent and WTI crude oil fell -7.60% (-5.35% Friday) and -4.10% (-4.82% Friday) as both types of crude fell for the 5th straight week with the economic slowdown and price war showing limited to no signs of abating. Elsewhere in commodities, Gold had its best week since December 2008 as the typical haven asset rose on delivery issues and due to the huge stimulus being pumped into the system. The Dollar index sold off over the last 4 days of the week after a 10-day rally, as stress in the funding market dissipated somewhat.

Even with risk rallying, sovereign bonds rose on the week possibly because of all the new QE in the system and that likely coming. However most of the rally occurred on Friday when risk-off came back to town. The 10yr U.S. Treasury yields ended the week -17.1 bps lower at 0.675% (-17.0bps Friday). 10yr Bund yields fell -15.3 bps on the week (-11.3bps Friday) to finish at -0.47%. Peripheral debt tightened over the week, even as spreads widened on Friday. French, Italian, and Spanish 10yr bonds all tightened to 10yr Bunds by -2bps, -15bps, and -4bps over the week respectively but note that the Italian spread widened +21 bps on Friday as EU leaders were unable to agree on further fiscal aid the previous evening. Credit spreads had a much better week, especially US IG after the Fed’s corporate bond buying program was unveiled. US HY cash spreads were -110bps tighter on the week (-30bps Friday), while IG was -63bps tighter on the week (-9bps Friday). In Europe, HY cash spreads were -77bps tighter over the 5 days (-5bps tighter Friday), while IG was 9bps wider on the week (-1bp tighter Friday).

Tyler Durden

Mon, 03/30/2020 – 08:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com