BofA: “QE vs Unemployment” Means Soaring Inflation Will Crush The Dollar

Here are the key takeaways from Michael Hartnett’s latest Flow Show:

-

Lows on corporate bonds & stocks to hold on extreme bearishness & policy stimulus.

-

Policy ended credit crunch but not yet recession…US dollar, oil, HY bonds will signals worst of recession priced-in.

-

Big EPS headwinds: bias asset allocation toward growth, yield, quality alongside stagflation hedges (gold & small cap).

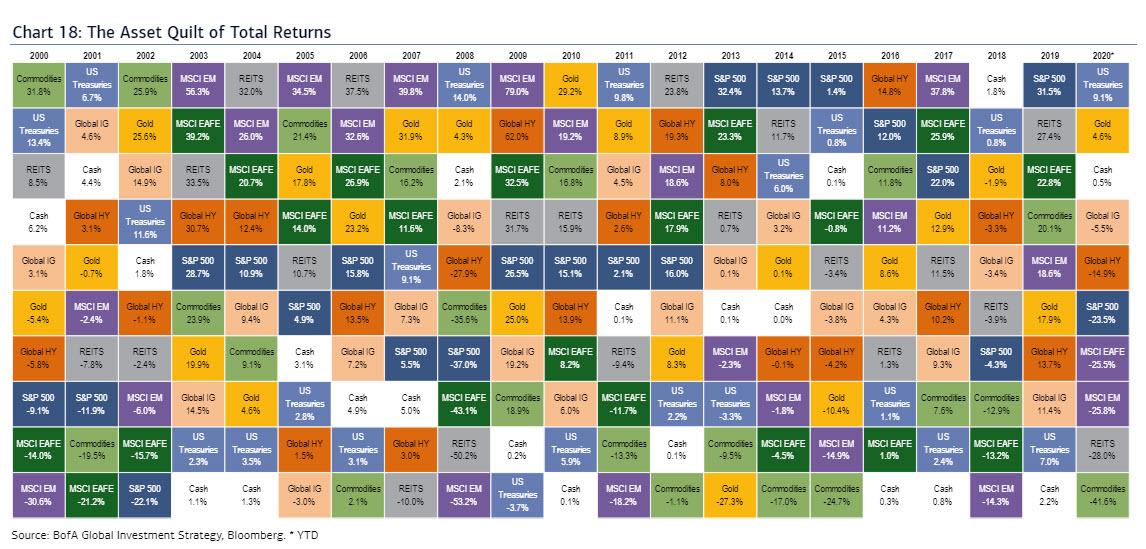

And before we get into the meat of Hartnett’s latest weekly must read, a quick reminder that it’s one of those years where gold is the top performing assets: gold 3.6%, US dollar 3.4%, government bonds 3.0%, cash 0.5%, IG bonds -5.7%, HY bonds -14.9%, global equities -24.2%, commodities -41.6% YTD.

With that in mind, here are the key themes of the current week:

-

March capitulation: historic $284bn out of bonds and $658bn into cash in past 4 weeks ($64bn out of equities = sideshow).

-

Bond capitulation: record month of redemptions from IG bonds ($156bn), EM debt ($47bn), Municipal bonds ($24bn), HY bonds ($23bn).

-

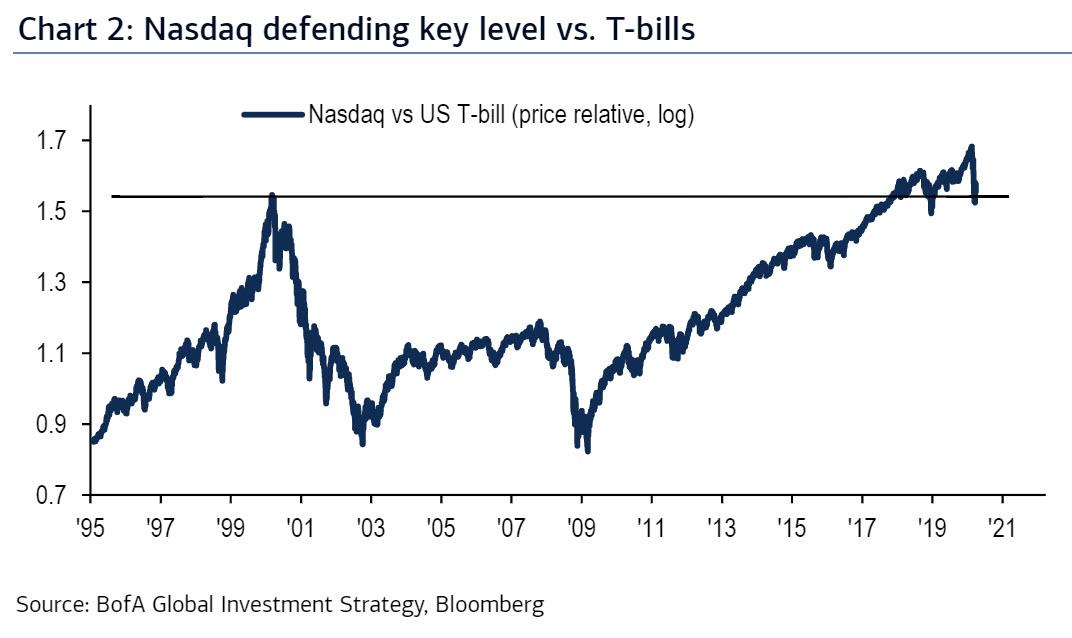

Tech indestructible: $4bn inflows to technology funds in March & inflows throughout 2020 (Chart 3); IG bonds = “glue” holding Wall St together, but tech “glue” for stocks (Nasdaq currently defending v imp asset allocation resistance level vs. T-bills – Chart 2).

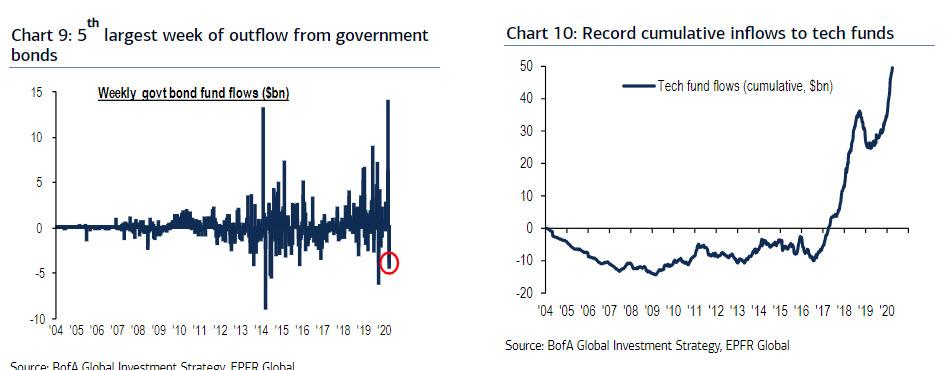

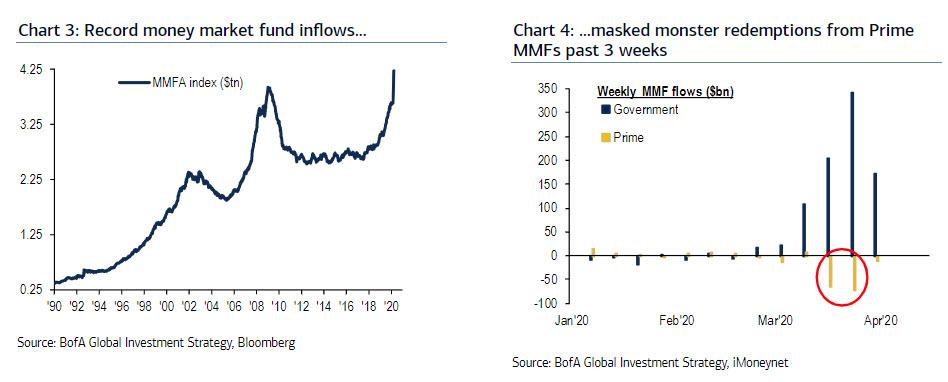

- Weekly flows: record $194.2bn into cash (Chart 3), $8.1bn into equities (largest in 7 weeks), $3.2bn into gold (2nd largest inflow ever), $27.1bn out of bonds; notable weekly flows…record inflows to HY bond ($6.9bn), big redemption week in government bonds ($4.3bn – Chart 9), tech inflows ($1.5bn – Chart 10).

- Most important flow to know: March 11th-18th crash centered on Commercial Paper market & redemptions from Prime MMFs; Fed stepped in as buyer of last resort to end short-term funding panic; $148bn outflows from Prime MMFs past 3 wks but Fed CP buying program has ended systemic panic & outflows stabilizing (Chart 4).

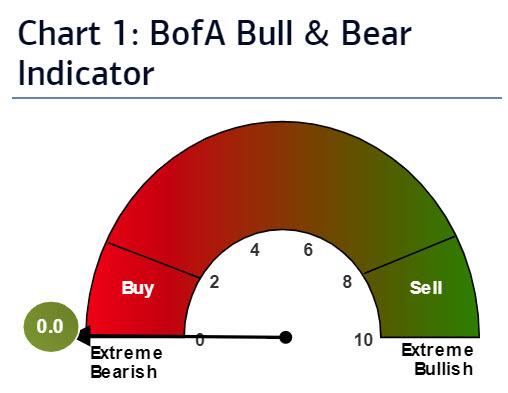

- BofA Bull & Bear Indicator: cross-asset measure of positioning pinned at 0.0 (Chart 1), i.e. investors are extremely bearish which always leads to big bounce except when “Ghost in the Machine”, e.g. Lehman in 9/08; since BofA Bull & Bear Indicator “buy signal” 3/17 SPX (2386) +5.9%, ACWI +5.2% following staggering losses.

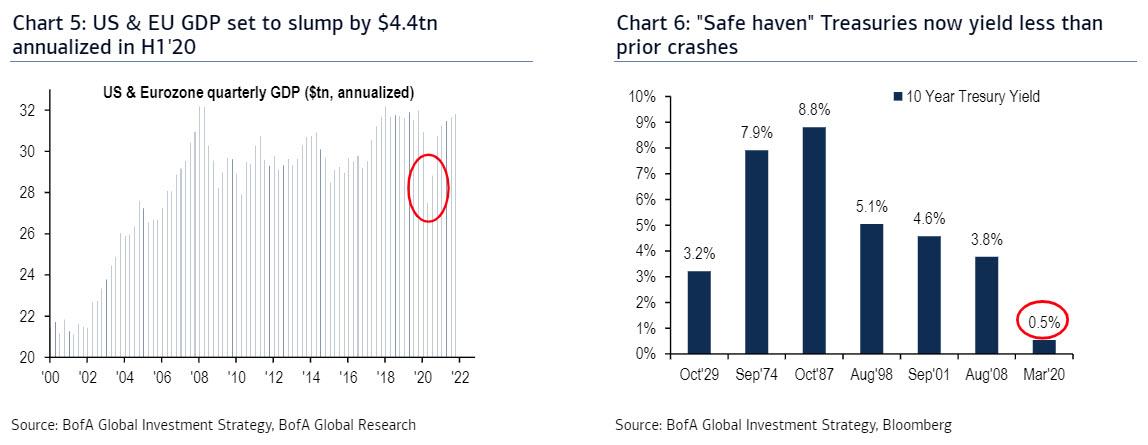

- Brave New World: Q2’2020 begins with investors nursing $20tn loss in global equity market cap, Main Street in midst of $4.4tn H1 annualized forecasted loss in US & Eurozone GDP (Chart 5) & 10 million Americans unemployed in past 2 weeks, $12tn in announced global monetary & fiscal stimulus ($7tn QE + $5tn fiscal), and Money Market Funds holding a record $5.5tn in AUM.

Which brings us to Hartnett’s summary of “Good, Bad, What to Do:” Tough for asset prices & volatility to subside until human beings can safely leave their homes; that said here’s why BofA believes that lows on corporate bond & stock prices are in:

-

Magnitude of crash stocks (>$20tn in market cap) & credit (IG credit spreads 100bps to 400bps) means bulk of selling behind us.

-

New lows require 1929 or 2009 redux; 2020 monetary/fiscal bazooka launched much quicker than in 2008, and Fed credit programs have short-circuited credit event; re 1929 monetary, budget, trade, policies completely different, no Gold Standard, there is FDIC insurance…; extreme bearishness (see BofA Bull & Bear Indicator) + policy stimulus (+ IMF $1tn war-chest for EM, more US/EU/China fiscal stimulus to come) investors buy SPX 2150-2350 range.

-

Second wave virus & credit event can induce fresh Treasury buying but note “safe haven” Treasury yield significantly lower today than in 6 big crashes of past 100 years (Chart 6).

-

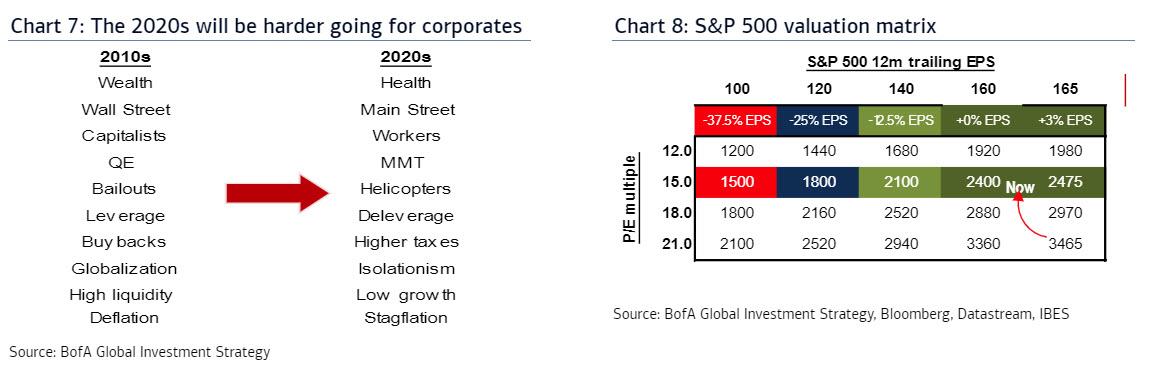

EPS in collapse but SPX 2150 low justified via -25% drop in EPS to $120 and a policy-success PE of 17.5 (Chart 8).

-

And April v likely to be “peak negativity” for COVID-19 and economy; note “mutually-assured destruction” of Saudi/Russia/US oil policy may be coming to end.

After that surprisingly optimistic recap, Hartnett next lays out “What are risks…”:

-

Outperformance of HY vs. IG, value vs. growth, global vs. US stocks, homebuilders vs. utilities, higher Treasury yield & oil price yet to begin, yet to signal worst of COVID-19 & recession priced-in… much of past 10 years macro a sideshow, but economy now main event and in deep recession (BofA economics team downgrades 2020 US GDP growth to -6.0%, Euro-area to -7.6%, US unemployment rate peak at 15.6% in Q2).

-

Similarly US dollar (only true “safe haven” in March) has not convincingly turned lower…concerns of EM dollar-denominated debt blow-up or European financial system event (European ban on bank dividends has destroyed ability to lend – link) and recession preys on peripheral European sovereign debt & €250bn of Spanish and Italian IG credit, 90% of which is BBB).

-

And recovery in EPS in 2020 and 2021 may be tougher than recovery in GDP: US dividend futures imply S&P 500 dividend yield will fall from 2.5% to 1.5%; and economic, financial, social, political, geopolitical secular trends don’t look corporate sector friendly (Chart 7); and of course history teaches that the solutions to debt deflation are either inflation, confiscation, endemic low growth, or war.

So What to Do? Here is the checklist of BofA’s CIO:

-

In April…SPX to hold 2350, LQD to hold $120…stick to deflation playbook.

-

Buy growth: e.g. tech, pharma, biotech, staples (companies that improve quality & quantity of health & education).

-

Buy yield: e.g. high quality munis, MBS, corporate bonds.

-

Buy quality: e.g. best of breed stocks

-

Buy humiliation: via the best stocks in distressed sectors, i.e. “the best house in the worst neighborhood”.

-

Buy stagflation hedges: such as small cap & gold: higher than expected inflation (policies to raise wages, MMT, weak dollar, supply chain disruption/less globalization) and lower than expected growth (higher taxes/regulation, lower wealth, globalization, corporate leverage) coming.

-

Diversification: 25/25/25/25 gold/cash/bonds/stocks likely to preserve wealth in 2020s.

And finally…

- Sell US dollar: German & Japanese psyche scarred by hyperinflation after World War I and World War II respectively, US carries scars of the Great Depression, i.e. Americans fear unemployment, Japanese & Germans inflation…US electorates more tolerant of currency debasement; once US$ starts to fall investors to shift toward 1970s inflation or stagflation portfolios as corporations forced to pay for the recovery out of earnings.

Tyler Durden

Fri, 04/03/2020 – 12:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com