Futures Soar On Optimism Worst Of Virus Pandemic Is Behind Us (But Is It)

As prompted by Trump’s optimistic speech on Sunday evening in which the president said he saw signs the pandemic is beginning to level off, which came after a sharp drop in the latest number of NY corona cases, an optimistic mood of trader euphoria that the peak of the coronavirus pandemic is behind us helped boost stocks around the globe, and sent US equity futures as much as 4% higher.

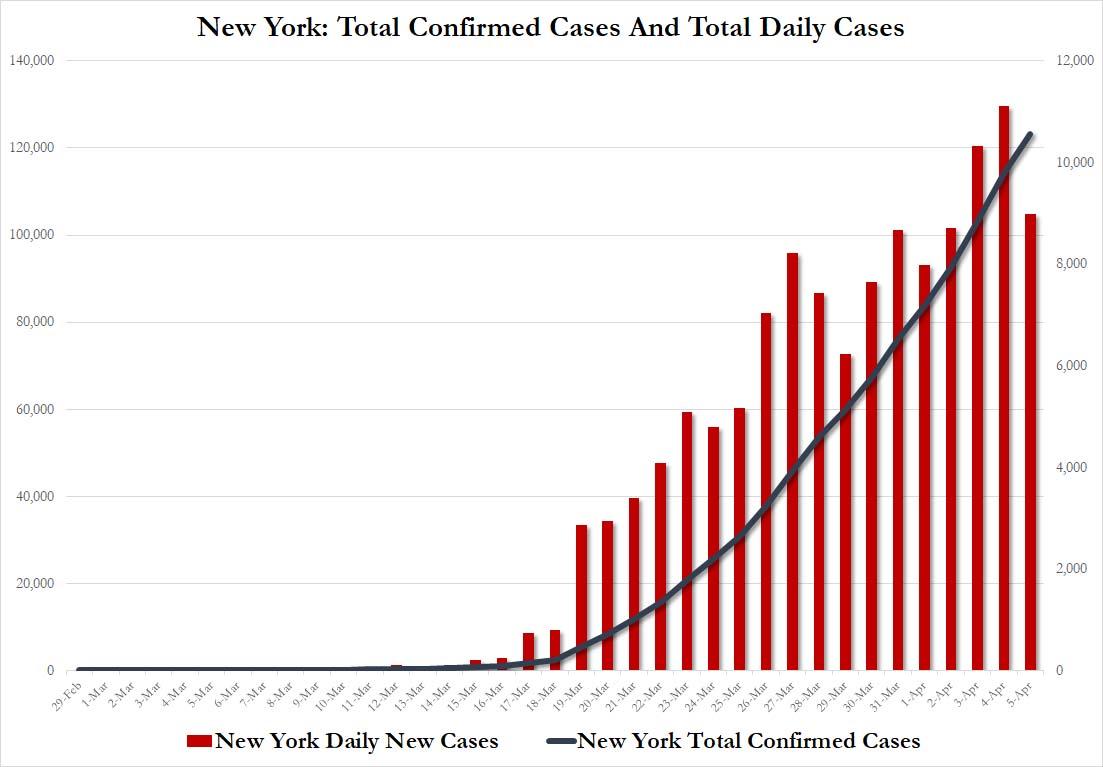

Besides a potential inflection point in the global coroanvirus epicenter of New York, which however was challenged that there appears to be an odd decline for the second weekend in a row which then rebound sharply…

… Equity investors were encouraged as the death toll from the virus slowed across major European nations including France and Italy. London’s FTSE raced up 2%, indexes in Paris and Milan rose 3% and Germany’s DAX gained more than 4% after Japan’s Nikkei finished with similar gains overnight. Safe havens such as Treasuries and the yen fell, even as the dollar stay oddly strong and gold soared as new global coronavirus cases declined for two days in a row.

* “Global deaths 4.7k, down two days in a row

* NY: Gross new hospitalized down two days in a row; .. peak strain now exp within a week

* Italy: ICU declined first time

* Spain: Deaths down 3 days in a row

* France: ICU slowing; deaths flattening”

(via @CowenResearch) pic.twitter.com/LWvvoAIQhJ

— Carl Quintanilla (@carlquintanilla) April 6, 2020

https://platform.twitter.com/widgets.js

In Europe, the Stoxx Europe 600 Index jumped led by automakers and travel and leisure shares after Italy and Spain said they had the fewest deaths in more than two weeks, and Germany and France reported the lowest numbers in days. Corona-optimism was so widespread it allowed traders to ignore the total collapse in the economy: iInvestor morale in the euro zone fell to an all-time low in April and the currency bloc’s economy is now in deep recession due to the coronavirus, which is “holding the world economy in a stranglehold”, a Sentix survey showed. Orders for German-made goods had already dropped 1.4% in February, German data showed. British car sales slumped 40% last month and Norweigen Air’s traffic plummeted 60%.

“Never before has the assessment of the current situation collapsed so sharply in all regions of the world within one month,” Sentix managing director Patrick Hussy said. “The situation is … much worse than in 2009,” Hussy said. “Economic forecasts to date underestimate the shrinking process. The recession will go much deeper and longer.”

Still, it wasn’t one of those days when data would spoil trader mood, and Wall Street S&P500 emini futures were up almost 4%, close to their upper limit too, bouyed by comments from U.S. President Donald Trump that his country was also seeing a “levelling off” of the crisis. “What is driving the market is the evidence that the number of new cases has started to turn the corner,” said Rabobank’s Head of Macro Strategy Elwin de Groot. As well as a slowdown in deaths in Italy, he said, improvements were starting to become visible in Spain and even in the United States there had been a little bit of a let-up. “When you see that happening you can start gauging when lockdowns can start to be gradually lifted. That gives a little bit more visibility and that is vital,” he added, although he stressed there were still huge uncertainties and risks.

Earlier in the session, Asian stocks were also mostly higher, with Australia’s benchmark index up 4.33%, Japan’s Nikkei added 4.24% even as that country moved closer to declaring a state of emergency. South Korea’s KOSPI index climbed 3.85%. Hong Kong’s Hang Seng index was 2.18% higher. That sent MSCI’s broadest index of Asian shares outside of Japan up 2%, on track for its best performance in more than a week. Markets in mainland China were closed for a public holiday.

The upbeat tone follows another negative week, and the mood among investors remains divided. As Bloomberg notes, bulls are pointing to more attractive valuations, unprecedented stimulus and now slowing death rates in several major countries. Bears are fretting the continued spread of the disease, dismal economic data and the rising corporate costs of the pandemic and subsequent shutdown.

“We are still optimistic that the administration will be able to get this virus under control and reopen the economy by the end of April, early May,” Lindsey Piegza, chief economist at Stifel Nicolaus & Co., said on Bloomberg TV. “If that does occur, it’s likely that we’re able to control the downturn from a depressionary scenario into a recessionary scenario.”

Worryingly, the number of new coronavirus cases jumped in China on Sunday, while the number of asymptomatic cases surged too as Beijing continued to struggle to extinguish the outbreak despite drastic containment efforts. “Focus in markets will now turn to the path out of lockdown and to what extent containment measures can be lifted without risking a second wave of infections,” National Australia Bank analyst Tapas Strickland wrote in a note. “Key to a strong rebound in China will be the ongoing lifting of containment measures, with Wuhan – the epicentre of the outbreak – set to lift containment measures on April 8.”

Optimism aside, there was plenty of news to demonstrate just how brutal the virus has been: eye-popping plunges in car sales and air travel in Europe, Britain’s prime minister being hospitalised, and Japan preparing to declare a state of emergency. But the markets appeared hopeful.

Beside the ramp in stock, the other big overnight move was in crude which pared a decline of as much as 11% though it remained lower as uncertainty swirled over a proposed meeting of the world’s top producers.

In FX, the dollar barely budged against the euro; the yen weakened as haven demand receded and Japanese Prime Minister Shinzo Abe said he will propose to declare a state of emergency in prefectures including Tokyo and Osaka for about a month. Commodity currencies advanced, led by Norway’s krone, after the reported death tolls in some of the world’s coronavirus hot spots showed signs of easing over the weekend. The Mexican peso slumped over 3% to a record low in Asian trading before paring losses after the nation’s stimulus pledge fell short of some investors’ expectations The pound fluctuated before turning higher even as U.K. Prime Minister Boris Johnson was admitted to hospital for tests after suffering from the coronavirus for 10 days.

In rates, the 10Y yield jump as high as 0.67% after trading around 0.60% on Friday; yields on safe-haven German government bonds crept higher in fixed income markets too, reflecting the slightly brighter tone in world markets despite some painful data.

Market Snapshot

- S&P 500 futures up 3.6% to 2,572.75

- STOXX Europe 600 up 2.5% to 316.64

- MXAP up 2.5% to 135.67

- MXAPJ up 2.1% to 437.12

- Nikkei up 4.2% to 18,576.30

- Topix up 3.9% to 1,376.30

- Hang Seng Index up 2.2% to 23,749.12

- Shanghai Composite down 0.6% to 2,763.99

- Sensex down 2.4% to 27,590.95

- Australia S&P/ASX 200 up 4.3% to 5,286.81

- Kospi up 3.9% to 1,791.88

- German 10Y yield rose 1.8 bps to -0.423%

- Euro down 0.06% to $1.0794

- Italian 10Y yield rose 8.3 bps to 1.379%

- Spanish 10Y yield fell 2.0 bps to 0.722%

- Brent futures down 2.2% to $33.36/bbl

- Gold spot up 0.7% to $1,632.32

- U.S. Dollar Index up 0.2% to 100.74

Top Overnight News from Bloomberg

- Germany saw the lowest number of new coronavirus cases in six days, a tentative sign that lockdown measures are easing the outbreak

- Oil pared earlier losses amid signs Saudi Arabia and Russia are making progress on an agreement to curb crude output as the coronavirus wreaks havoc on the global economy

- Congress‘s near unanimity on last month’s $2.2 trillion coronavirus rescue bill has given way to partisan finger-pointing that threatens to poison the debate when lawmakers try to construct another emergency boost to the struggling economy

- The Bank of Japan set itself up to buy more bonds in the key 5-to-10 year maturities, showing an intent to maintain yield-curve control amid growing expectations of further debt-fueled stimulus from the government

Asian equity markets traded mostly positive and US equity futures also began the week on the front-foot as participants saw a glimmer of hope from a slowdown in the pace of coronavirus deaths for several hotspots including New York, Spain and Italy in which the latter had its lowest daily death toll since March 19th. ASX 200 (+4.3%) was underpinned amid broad gains across its sectors and with notable outperformance in healthcare following reports that Australian scientists found that Ivermectin which is produced by Merck for treatment of parasites and head lice was successful in killing coronavirus within 48 hours and that the next phase will be for human trials. Nikkei 225 (+4.2%) coat tailed on the favourable currency moves and ahead of this week’s expected roll out of the stimulus package which is said to include increased subsidies, tax deferrals and cash payments to households. Hang Seng (+2.2%) was also positive following the recent monetary policy efforts in the region including the PBoC’s 100bps RRR cut announcement and with the HKMA halving the amount of reserves banks are required to set aside against bad loans, although gains were somewhat limited amid a lack of mainland participants due to the Ching Ming holiday in China. Finally, 10yr JGBs were lower with prices pressured amid gains in stocks and anticipation for increased supply with the Japanese government set to announce a stimulus package and state of emergency declaration which could occur as early as tomorrow.

Top Asian News

- Japan’s Abe Moves to Declare Emergencies in Tokyo, Osaka Areas

- Japan Banks Weigh Branch Cutbacks Ahead of State of Emergency

- Japan Consumer Confidence Tanks to Lowest Since Financial Crisis

- Singapore Adds S$5.1 Billion to Stimulus, Boosts Handouts

European equities remain firm (Eurostoxx 50 +3.8%) following a similarly positive APAC session, in which sentiment was bolstered amid positive COVID signals in key hotspots across Europe. In terms of regional performance, UK’s FTSE 100 (+2.0%) lags its peers across the channel as exporters in the index are weighed on by a firmer Sterling, whilst heavyweight energy names (Shell -0.5%, BP -2.5%) also pressure the index amid price action in the complex, with the latter also reducing production at three US refineries by ~15%. European sectors are mostly in the green (ex-energy) with cyclicals outpacing the defensives – reflecting risk appetite. Looking at the sector breakdown, Travel & Leisure leads the gains following multiple consecutive sessions of underperformance, while oil and gas reside at the bottom. Despite the energy sector overall on the backfoot, Tullow Oil (+47%) and Subsea 7 (+8%) see themselves at the top of the Stoxx 600, having seen detrimental losses from the oil market crash. Looking at other individual movers, Rolls-Royce (+14.8%) shares soared higher after announcing the securing of an additional GBP 1.5bln (vs. Exp. above GBP 1bln) revolving credit facility, thus increasing overall liquidity to GBP 6.7bln. Co. also announced that around GBP 300mln of headwinds are seen from COVID-19, whilst cost-cutting measures include a minimum 10% reductions in salaries across the global workforce this year. Rolls-Royce also confirmed it is withdrawing its FY20 guidance. GVC Holdings (+6.4%) sees strength on the back of an undrawn credit facility worth GBP 550mln, whilst expecting a virus impact of GBP 50mln per month. Pirelli (+1.9%) trades higher after announcing further cost-cutting measures, albeit the Co. reduced its FY revenue guidance to EUR 4.3-4.4bln from EUR 5.4bln whilst cutting its EBIT margin target to 14-15% from 17%. Elsewhere, NN Group (-9.5%) resides at the foot of the pan-European index after postponing its dividend and suspending its EUR 250mln share buyback scheme. Broker-led price action includes BBVA (+7.8%), ADP (+6.2%), Carrefour (+2.5%), Carlsberg (+1.5%) and Nokian Renkaat (-1.0%). Finally, as US equity futures hover near session highs, it is worth keeping tabs on today’s limit-up levels: E-Mini S&P (M0) 2601.50, E-Mini Nasdaq (M0) 7888.00 and E-Mini Dow (M0) 21972 – levels which have not yet been reached.

Top European News

- Europe’s Virus Outbreak Shows Signs of Slowing on Lockdowns; Europe Stocks Rise Most in Nearly Two Weeks

- Germany Tells Italy, Spain to Tap ESM If They Want Quick Aid

- Dividend Halt Puts HSBC at Risk of Losing Core Investors

- Tullow Jumps Most in at Least 31 Years; Volume Quadruples

In FX, Somewhat contrasting starts to the new week for the Euro and Pound as the former loses grip of the 1.0800 handle again vs the Dollar, but the latter pares losses close to 1.2200 and briefly trips stops at 1.2300 on the way to a circa 1.2320 recovery high on news that UK PM Johnson may be heading back to 10 Downing Street soon having been hospitalised over the weekend for nCoV related tests. Eur/Usd has been undermined by a sharp deterioration in the Eurozone Sentix Index and Eur/Gbp selling that has cushioned Sterling to an extent from a deeper than anticipated sub-50 collapse in the UK construction PMI.

- AUD/NZD/CAD/NOK/SEK – A clear risk on divide across the rest of the G10 currency spectrum, but with the Greenback gleaning more traction to counter post-NFP weakness via gains vs safer havens that have a greater weighting in the DXY basket. Indeed, the index is nudging the upper end of a 100.850-460 range even though the Aussie, Kiwi and Loonie are all benefiting from less angst over COVID-19 following a decline in the number of confirmed cases and fatalities recorded in epicentres outside China including Italy and Spain. Aud/Usd is firmly back up above 0.6000 eyeing Tuesday’s RBA policy meeting when rates are expected to remain unchanged after recent emergency and scheduled easing, although money market pricing is more even between another 25 bp reduction and no further move. Nzd/Usd has reclaimed 0.5900+ status ahead of NZIER Q1 confidence, while Usd/Cad is hovering around 1.4100 vs 1.4260 at one stage as oil prices recover from another sharp retreat on a degree of OPEC+ disappointment given a delay to the emergency meeting from today until Thursday, at least. Relative calm in crude is also underpinning the Norwegian Krona along with reports that the Government may mull cutting oil output if there is general international consensus, and the Swedish Crown is tagging along.

- JPY/CHF – The major laggards amidst renewed risk appetite on the aforementioned seemingly encouraging coronavirus developments, as the Yen falls below 109.00 and Franc meanders between 0.9762-89 in the run up to BoJ and SNB FX reserves data due tomorrow that will be monitored to see how much intervention, if any has been curbing demand for the safe havens. On that note, latest weekly Swiss bank sight deposits already reveal hefty activity as Eur/Chf remains entrenched around 1.0560.

- EM – Whippy trade in regional currencies as positive vibes from overall risk sentiment vie with far less upbeat independent factors, like the Rand having to digest another ratings cut following Fitch deciding to downgrade SA deeper into junk territory. However, Usd/Zar has managed to pare back from new 19.3400+ record highs and Eur/Huf is off its all time peak around 368.00 awaiting Hungarian PM Orban’s economic stimulus plan that could equate to 20% of GDP.

In commodities, WTI and Brent front-month futures remain subdued, albeit way off the lows posted at the electronic open in which the contracts fell some 10% after OPEC+ postponed its tentative meeting, whilst Saudi and Russia played the blame game over the weekend. In terms of where we stand, the OPEC+ meeting will now be conducted on Thursday instead of the initially planned Monday – with sources noting the delay was to convince other countries to join in on output curtailment plant. Prices were also pressured after Russian President Putin partly blamed Saudi Arabia for the collapse in prices, whilst the Kingdom points the finger at Moscow’s hesitation at the March OPEC meeting – sources also noted that a lack of US commitment is complicating talks. That being said, the CEO of RDIF Dmitriev noted that Moscow and Riyadh are said to be “very, very close” to a deal on oil production cuts. Meanwhile, US President Trump on the weekend said he was considering slapping tariffs on oil imports, or even take other such measures, in order to protect the US energy sector from falling oil prices; Canada is reportedly considering similar measures. Following calls by leading lawmakers in recent weeks for such action. For reference, the US’ imports of petroleum were around 9.1mln BPD in 2019, of which Saudi and Russian imports measured just over 500k each. WTI May futures dipped below its 21 DMA (USD 25.89/bbl) at the open to a low of USD 25.28/bbl before recouping losses amid the overall risk appetite and the prospect of US intervention in the oil markets. Similarly, Brent June printed a low of USD 30.00/bbl, ahead of its respective 21 DMA at USD 29.26/bbl, with prices eyeing USD 34/bbl at the time of writing. The spread between the contracts has also widened to ~USD 6/bbl from Friday’s almost USD 4/bbl. Elsewhere, spot gold gains ground above USD 1600/oz as the USD retreats, and from a technical standpoint, the yellow metal could see mild resistance at USD 1637.50/oz (30 Mar high) before some psychological play at USD 1640/oz. In terms of news-flow for gold, gold refiners PAMP, Valcambi and Argor-Heraeus have been given approval to restart operations at 50% max capacity, having been asked to shut operations in late March. Copper meanwhile remains contained within the tight USD 2.15-2.25/lb range seen over the past 4 sessions, with the red metal again mimicking price action in global stocks.

US Event Calendar

- Nothing major scheduled

DB’s Jim Reid concludes the overnight wrap

I listened to a talk radio show on Saturday that was unsurprisingly centred around the current pandemic. A 95 year old dialled in and said he lived through the global flu pandemics of the late 1950s and 1960s and was amazed at how much our thinking had changed over the last 50 years. Back then he said that people had so many threats to life that they just accepted the health risks of a new virus and got on with everyday life. He cited that Polio killed over half a million people per year worldwide at its peak in the 1940s and 1950s. Other illnesses that are now trivial also killed numerous people. It made me think that our generation and that of our parents have been so brilliant and successful in minimising death by contagious infections and disease that we really struggle when we are exposed to a new threat. Maybe in around 300,000 years of human existence this is the first pandemic where we have a near zero tolerance for risk given all that we’ve achieved medically over the last several decades and as such this is the first that has prompted a near global economic shut down.

On this it is still unclear to me what the exit strategy will be in the West from the lockdowns. In our note of the same name from last week (link here ) we used our Hubei model to speculate that restrictions would likely start to be lifted around mid-May with some countries slightly earlier and some slightly later. These restrictions would be eased in phases with domestic functioning economies prevailing with limited international travel for a while. At the point of publishing I felt the risks were balanced between a slightly better outcome than this and a worse one. However in a week where we’ve seen new cases emerge (albeit in relatively small numbers) in HK, Singapore and China with new restrictions being put in place, I’m starting to wonder how you can loosen restrictions in the West very quickly without seeing new cases increase again. Another argument for a later date of restrictions being lifted is the fact that while those most advanced through the cycle, namely Italy and Spain, are seeing their new case and fatality growth rate slow encouragingly, if you look at the graphs in our Corona Crisis Daily they are not falling as quickly as Hubei province did. I suspect to successfully reopen economies without fear of subsequent mini shutdowns or holding back significant amounts of activity we will need the antibody test rolled out so that a certain part of the population can work through regardless of the state of the viral spread. That will be the real breakthrough until we get a vaccine. Without that I fear it’s going to be tough to fully control the virus in the West. The U.K. is on the more liberal side of the lockdowns restrictions at the moment and from media reports it was noticeable that a very sunny weekend led to a number of people using parks and outdoor places more than the current restrictions intended. All this and we are only coming to the end of the second week of official lockdown here. It wouldn’t be a surprise if the U.K. felt the need to move to more strict rules in the days ahead.

In terms of new cases and fatality rate growth rates the U.K. had a better weekend as you’ll see in the Corona Crisis Daily. However we did see a similar trend over the last two weekends with the numbers not catching up until early in the “working” week. So if Monday and Tuesday’s numbers continue to see percentage growth rates slow then this is good news. But we need to be cautious for now. Elsewhere Italy and Spain growth rates in both variables continue to slow but as discussed above the absolute number of deaths are not falling on a daily basis as aggressively as Hubei/China saw at a similar stage. Overall global new case growth and fatalities are slowing but are they slowing quickly enough to work out when economies can reopen?

As we start Easter week, Asian markets are on the front foot this morning with the Nikkei (+2.33%), Hang Seng (+1.11%) and Kospi (+2.55%) all up. Chinese markets are closed for a holiday and futures on the S&P 500 are up +3.36%. In FX, Sterling is down -0.28% after Prime Minister Boris Johnson was admitted to hospital for tests after suffering from the coronavirus for 10 days. Elsewhere, yields on 10y treasuries are up +3.1bps to 0.628%.

Oil has fallen overnight with Brent currently down -2.23% and WTI -3.99% however that does compare to drops in the double digits when markets opened. This follows news over the weekend that the OPEC+ meeting planned for today has been pushed back and only tentatively rearranged for Thursday with the main protagonists in behind the scenes chat as to whether there is scope for production cuts.

Overnight, Bloomberg is reporting that the Japanese government will release the economic stimulus package in response to the coronavirus pandemic in two phases with the first phase of measures designed to prevent job losses and bankruptcies. The second phase of the package will be implemented once the spread of the virus is contained to support a V-shaped recovery. Meanwhile, various Japanese media outlets are reporting this morning that PM Shinzo Abe is set to declare a state of emergency within days, after coronavirus cases in Tokyo jumped over the weekend to top 1,000 for the first time and raised worries of a more explosive surge. The Yomiuri newspaper reported that Abe will announce the plan as soon as today, with the formal declaration for the Tokyo area coming as early as Tuesday.

In other overnight news, the FT has reported that the largest US banks will defend their plans to pay dividends in their annual capital plans due for submission to the Federal Reserve. Elsewhere, President Donald Trump and Vice President Mike Pence said overnight that they are seeing signs that the US coronavirus outbreak is beginning to level off or stabilize, citing a day-to-day reduction in deaths in New York.

The highlight this week could be the Eurogroup meeting held tomorrow via video conference which follows the invitation from the European Council on 26 March for the Eurogroup to present proposals within two weeks. I had the fortune of speaking to DB’s Mark Wall yesterday who gave me some advice on what to expect tomorrow. He said that various press reports suggest that the Eurogroup will be debating a three-part proposal for a centralised response. This is said to consist of a healthcare funding plan from the ESM worth up to EUR200bn, EIB credit guarantees worth as much as EUR200bn and an EU-wide short-shift or partial unemployment scheme from the European Commission modelled on the German Kurzarbeit scheme worth EUR100bn. A package of this size would be an impressive 4.5% of GDP. The ESB, EIB and Commission each issue the equivalent of common European bonds, so the need for a “coronabond” would be circumvented in the interest of expediency. The details will matter and the three elements are only temporary. As the risk of a protracted pandemic rises, so too does the need to follow up this plan with a centralised demand stimulus package, for example, a large-scale EIB investment programme. So a big meeting to watch.

Elsewhere the Fed minutes from the unscheduled emergency meeting on March 15th will be released. This was the meeting they cut rates 100bps and announced that they would increase their holdings of Treasury securities by at least $500bn and of agency mortgage-backed securities by at least $200bn. Things have moved on since and they injected more stimulus and announced new schemes but it will still be interesting to see how they were thinking at the time. For the rest of the week ahead see the day by day guide at the end.

Looking back at last week and Friday now. Economic data across the world showed massive signs of deterioration last week, especially employment numbers and service sector PMIs, as the economic shutdowns continued to take their toll. Equity markets were relatively calm in the face of it though but with most of the big stimulus announced in the prior two weeks they struggled for positive momentum. Overall, after 3 weeks of over 8% absolute weekly moves, the S&P 500 fell a relatively tame -2.08% over the week (-1.51% Friday), even as the US became the clear epicentre of the coronavirus crisis with over one quarter of the total cases worldwide. The index now sits -26.5% down from the recent all-time highs. Large cap European equities outperformed their US counterparts slightly on the week, with the Stoxx 600 down just -0.59% (-0.97% Friday), though European banks in particular lagged the index, down -13.17% on the week (-3.52% Friday). Equities were down across the continent as countries extended lockdowns even as new case growth recedes in the harder hit regions – Spain and Italy in particular. The DAX fell -1.11% (-0.47% Friday), the IBEX dropped -2.90% (+0.11% Friday) with the FTSE MIB -2.61% (-2.67% Friday), after the three indices gained over 5% the previous week. Asian equities were mixed on the week. The Nikkei fell -8.09% (+0.01% Friday), while the CSI was mostly unchanged at +0.09% (-0.19% Friday) and the Kospi was up slightly at +0.45% (+0.03%) on the week. The VIX fell -18.7pts over the course of the week (-4.1pts Friday) to finish at 46.8 as the S&P 500 saw relatively smaller daily moves. On the back of China increasing oil reserves and President Trump citing the need for intervention in the Russia and Saudi Arabia oil price war, both Brent and WTI crude oil rallied strongly. Brent crude was up +36.82% (+13.93% Friday) and WTI was up +31.75% (+11.93%) on the week. It was the best week for Brent since the data starts in 1988 and far outpaces the next largest 1 week gain – +22.3% in January 2009, while WTI similarly had its best week on record, beating the previous 1 week gain of +28.4% in August of 1986.

Fixed income also saw smaller weekly moves as markets attempted to settle into the new QE regime. US 10yr Treasury yields fell -8bps (-0.2bps Friday) to finish at 0.595%, just 5.4bps from the lowest closing levels on record. Meanwhile in Europe, 10yr Bunds saw yields rise +3.3bps (-0.8bps Friday) to -0.44%. The bigger moves in sovereign bonds last week were with spreads widening to Bunds. French 10yr yields widened +10.0 bps on the week (+3.1bps Friday), while Italian yields widened +19.1bps over the 5 days (+9.2bps Friday), and Spanish 10yr bonds widened +17.0bps (+4.2bps Friday). Credit spreads bifurcated last week. US HY cash spreads were 44bps wider on the week (+26bps Friday), while IG was -16bps tighter on the week (+2bps Friday). In Europe, HY cash spreads were -13bps tighter over the 5 days (-1bp tighter Friday), while IG was 1bp tighter on the week (+1bps Friday).

Friday’s services and composite PMI readings from around the world showed large declines in activity. The final Euro Area composite PMI fell to 29.7, a record low and below the flash reading of 31.4. In February, the PMI had been at 51.6, above the 50-mark that separates expansion from contraction. Germany saw their composite index fall to 35 from 50.7, while the UK’s composite came in at 36.0, down 53.0 a month ago. The Italian numbers were the worst of the major European economies, with the composite PMI falling to 20.2 and the services PMI coming in at 17.4. Incredible numbers. The US Markit service PMI fell to 39.8, slightly up from the flash reading of 39.1. The composite came in at 40.9 vs the flash of 40.5, and down 8.7 points from a month ago.

Also in the US on Friday nonfarm payroll data was released, falling by -701k in March, far below the -100k decline expected. This is the first time nonfarm payrolls have shrunk since September 2010 and this is the largest monthly decline since the -800k reading in March 2009. Notably, the survey reference period was for the calendar week containing the 12th of the month, so the jobs report did not cover the second half of the month when the more serious levels of economic disruption occurred, when nearly 10 million jobless claims were filed. Given that shutdowns in the US are due to stretch to the end of April, next month’s data is likely to be off the charts.

Tyler Durden

Mon, 04/06/2020 – 08:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com