“That’s Pretty Terrible, It’s A Death Signal”: Cliff Assnes’ AQR Loses $43 Billion In 2020

When financial crises strike, some funds – such as Mark Spitznagel’s Universa which spend “all their time thinking about looming disaster” – make a killing, in this case returning a staggering 3,612% in the month of March after suffering thousands of little cuts over the past decade in anticipation for the inevitable “fat tail” event while hoping its LPs will be patient enough not to jump ship in anticipation of the big pay day. And then there are funds which are totally unprepared for the sheer chaos that unfolds in days, if not hours and minutes, after years of peacefully collecting pennies in front of a steamroller and without a care in the world about the future.

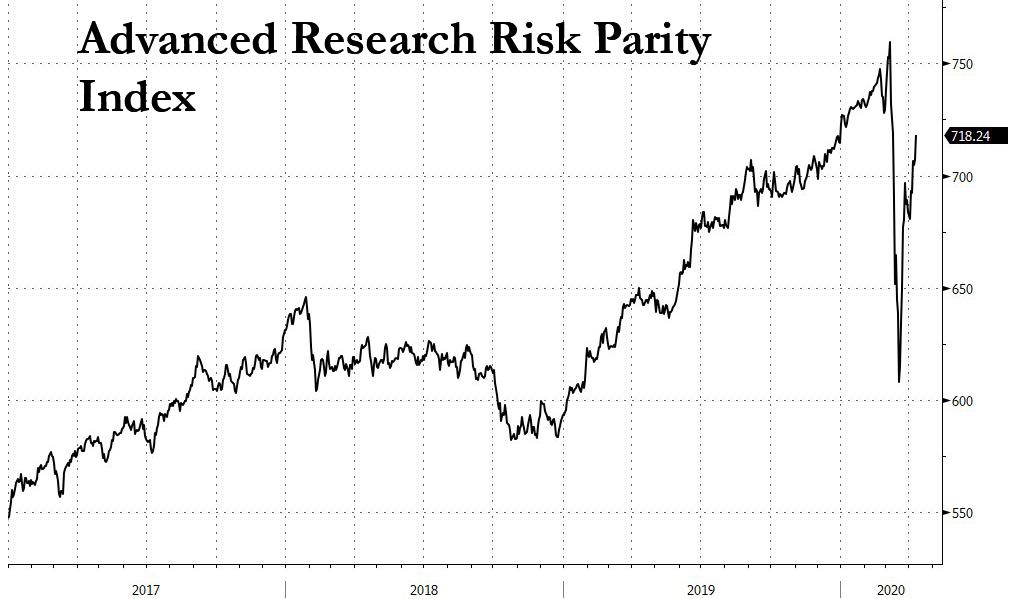

An example of the latter is “risk parity”, the group of funds which is basically a levered bet on the Fed’s continued dominance of capital markets, i.e., propping up both stock and bond prices in perpetuation of the biggest asset bubble ever, and which largely imitates a “balanced fund” approach of 60/40 long bonds and stocks. While this strategy works when all assets are rising, as they did for the most part since the Global Financial Crisis, it goes spectacularly wrong when the strategy goes haywire, as it did in March when both stocks and bonds were trampled for a few days, resulting in unprecedented losses as the following chart showing the Advanced Research Risk Parity Index shows.

We previously reported that the world’s most famous risk parity fund, Ray Dalio’s Bridgewater’s All Weather fund, suffered dramatic losses and tumbling as much as 14% through the first half of March, not long after Dalio infamously said that “cash is trash.” However what is less known is that another major quant fund which is heavy into risk parity (and occasionally dabbles in HFT but pretends not to), Cliff Asness’ AQR Capital, appears to have had a far more painful start to the year.

The reason: after reporting some $186 billion in assets under management as recently as January as the following wayback machine snapshot shows…

… the AUM amount has since plunged to just $143 billion as of the fund’s latest update, a staggering $43 billion loss.

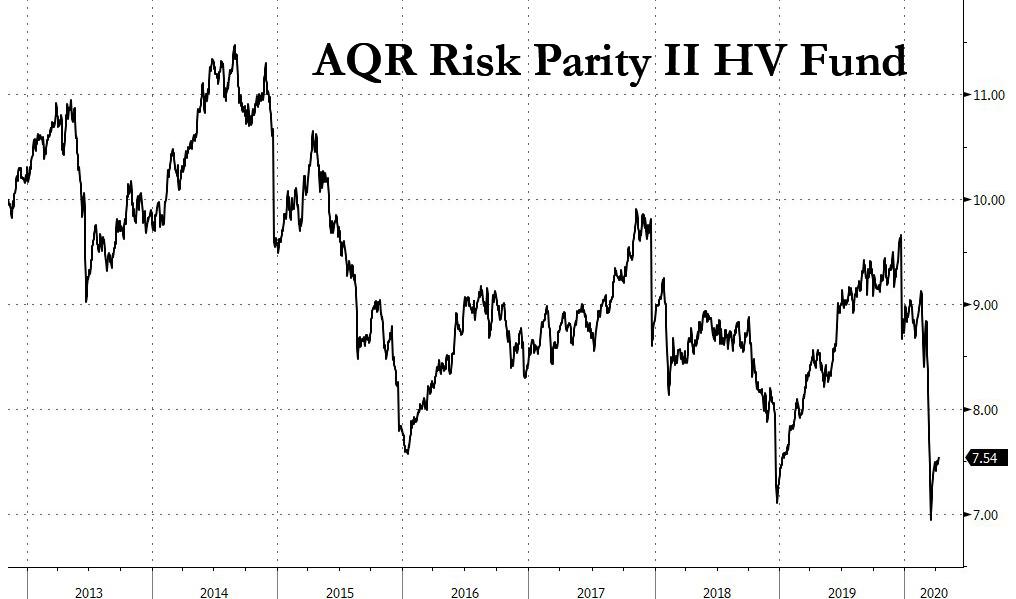

To be sure, it is unclear just how much of the fund’s massive 23% YTD drop in assets is the result of losses versus investor redemptions, or what percentage of the AUM decline is the result of risk-parity strategies gone wrong, but a quick look at the performance of the AQR Risk Parity II HV open-end fund shows that whereas the rest of the risk-parity sector managed to recover much of its early March losses, AQR surprisingly has not.

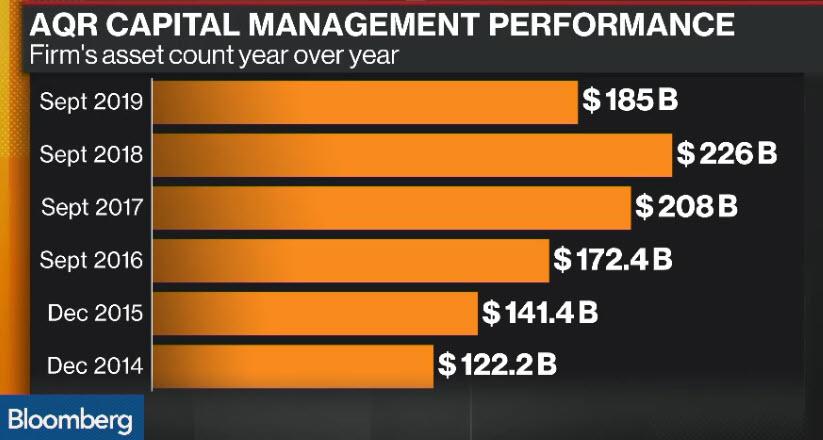

Furthermore, while the AQR website has blamed the terrible returns on the coronavirus pandemic which has shut down the global economy and batters the stock market, unfortunately for the fund’s notorious outspoken and volatile boss, Cliff Asness, 53, AQR has long been suffering from redemptions amid sagging performance well before the current coronavirus black swan (or black bat) event, which incidentally a “hedge” fund should have perhaps hedged against… something which as Universa showed, can be done.

As the NY Post reports, the firm’s Multi-Strategy Alternative fund is down 22% this year following declines of 10% in 2019, and a surge in redemptions; meanwhile its Small-Cap Multi-Style fund, which was up 20% last year, has given up all gains and then some, and is now down 29%.

While investors across the board have gotten hammered this year – because nobody could possible predict that stocks at all time highs in February could possibly go down – industry watchers – correctly – told the NY Post that the declines at AQR, which manages both hedge funds and traditional stock and bond funds, stand out.

“That’s pretty terrible”, one hedge fund manager told The Post. “Things are bad out there, but $43 billion is a death signal.”

But not for Asness. The firm’s twitter-trolling boss, known among other things for claiming stock buybacks don’t artificially prop up stock prices (we wonder if his view has changed now that even his former employer Goldman has warned of a “significant” adverse impact on stocks as 2020 buybacks are cut in half), for slamming critics on twitter, for smashing computer screens on his Greenwich trading floor when displeased, “has scowled in the face of redemption threats before, according to reports (although back then he was managing more than $225 billion).”

As the Post recounts, citing a Nov. 2018 Institutional Investor report, Asness lashed out at a Twitter critic who claimed to be an AQR investor: “Please redeem now as I find posturing fools in our funds ‘beyond concerning.’ Bye bye.”

He also dismissed the critic who called one of Asness’ expletive-laden tweet storms “beyond concerning as a fiduciary and as one of your investors” as a “fake investor.”

Yet even as his funds foundered, instead of bothering to figure out what he did wrong, Asness – who is confident that it is the market that is wrong, not him – saying in a 2019 conference that he would “stick like grim death to his beliefs”, blaming the fund’s continued underperformance not on “strategy” but an “intuition” problem, was more focused on proving to his twitter followers how cool he is, and in a recent tweet rushed to the defense of fellow hedgie Bill Ackman in response to a New York Post column accusing wealthy hedge fund managers like Ackman, who cleared a cool $2.6 billion shorting the stock market in March, of making profits off the virus.

“I don’t know Ackman,” Asness tweeted on March 27. “But this is a particularly idiotic hit piece.”

That said, even before the corona-crisis struck, in January AQR cut staff for the second straight year, eliminating up to 10% of its workers, as investors redeemed funds in the wake of 2019’s sagging results, which pulled the fund’s assets to $185 billion… before tumbling to just $143 billion most recently, the lowest in five years.

There is some good news: “AQR has no layoffs planned for the second quarter of 2020,” a spokesperson from AQR told The Post (the third and fourth quarter were left open); That said we are confident that spokesman was not Asness who instead took the “high road” again and did what he does best: responded in furious fashion to the NY Post article, and instead of seeking to convince his LPs that the fund will eventually recover and maybe even turn a profit, wasted about an hour attacking the “hack of a journalist” who wrote the NY Post article…

Well this is fun: https://t.co/vgAmdwmxHF

Where to begin?

First, I won’t be engaging with the hack #journalist (late of deal breaker and business insider who finally made it to the brass ring for liars, the NY Post).

Life does suck for our business right now.

— Clifford Asness (@CliffordAsness) April 9, 2020

https://platform.twitter.com/widgets.js

… demonstrating again that any hopes of a quick turnaround at AQR are misguided, and that perhaps this one time “reports of AQR’s death” won’t be exaggerated.

Tyler Durden

Fri, 04/10/2020 – 17:10![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com