“Overstated?” – Laying Out The Bullish & Bearish Stock Arguments From Here

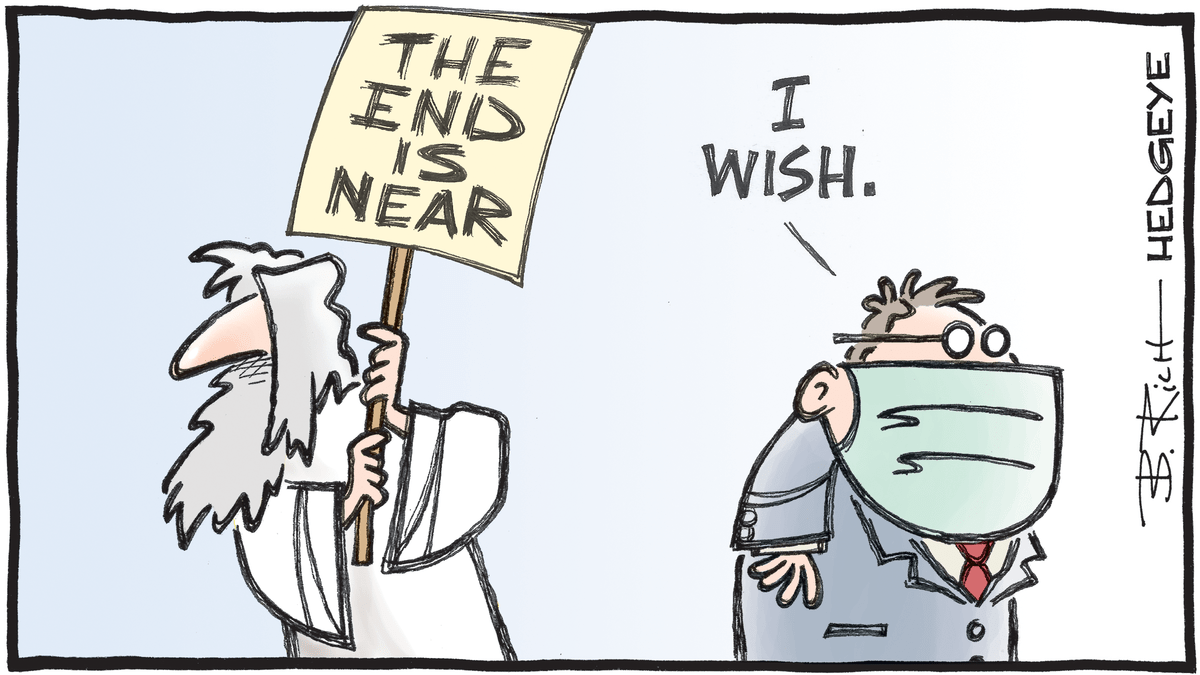

The somewhat unprecedented bounce back in stocks – after the fastest collapse on record – has as many bulls as bears frothing at the bit to add to their positions one way or another as either “the buying opportunity of a lifetime” or “the end of the beginning of the greatest bear market ever.”

So which is it? Bull or Bear from here?

Bloomberg strategist Mark Cudmore has surveyed his colleagues, his clients, and his own experience to lay out the arguments both ways… and which is “overstated.”

The vast majority of the MLIV team believe stocks will have another major decline in the months ahead. However, we have received reasonable feedback that, for the first time in more than three years, the blog may not be providing a sufficiently diverse set of perspectives.

As a team, we cannot afford to fall into our own echo chamber. So we have tried to collate the best bullish and bearish arguments that we may be underestimating one way or another.

Here is the bulls’ case on equities…

-

“Don’t fight the Fed.” In fact, almost every government has your back: they are providing record stimulus. There is effectively a buyer of first and last resort for most financial assets and that makes economic fundamentals irrelevant

-

The Fed buying junk specifically is a game-changer. This will maintain an orderly corporate bond market and prevent the wave of defaults that many bears were counting on

-

Money is so cheap that equity multiples should rocket higher; any comparison to the past is useless

-

That animal spirits will conquer all. If the biggest names in finance, such as JPMorgan and Goldman, say the bottom is in for stocks, that will help suspend belief in economics for as long as necessary. It’s about cheerleading and fist-pumping and it can work if enough people buy into it. It’s not a Ponzi scheme as reality only needs to be suspended long enough for the pandemic to abate and the economy to recover

-

Too many people are excessively long cash and that is now as worthless as trash. They will be forced to buy no matter the fundamentals

-

Virus optimism such that global economic activity will be back to almost-normal very soon — versions of either it’s contained already, peak threat has passed or belief in the imminent mass distribution of retrovirals/vaccines

-

The resilience of humanity. The ability of labor, capital and management to work together is being underestimated. For example, New York City shut down and there was no surge in crime. Companies are doing amazing stuff. People quickly figure out how to use Zoom and order food for delivery

-

The positive impact of substantially cheaper oil

-

That Trump will do and spend whatever it takes to get the market higher by November

There are bearish stocks arguments that may be the most overstated…

Here are reasons for pessimism that we see at most risk of being wrong:

-

That asset prices will reflect economic pain — has central bank policy entirely broken the connection between economics and financial markets?

-

That earnings matter — maybe the crisis makes such numbers irrelevant and brand name and responsive management matter more?

-

That stock valuations matter — who cares how expensive a stock is when more money is being pumped into the system at such pace?

-

That the economic damage will be deep — maybe the lockdowns haven’t restricted economic activity nearly as much as we think?

We acknowledge these risks.

But I will restate that the majority of us remain bearish for all the reasons that we are accused of citing too often on the blog – just a few of which are:

-

The scale of the economic contraction that will be seen

-

That virus fears will prevent business resuming as normal for many months

-

That the impacts of the unemployment and consumption shocks are being understated

-

Dividends being slashed and buybacks disappearing

Most importantly, we don’t buy the idea that no matter how bad 2020 gets, it’s irrelevant just because it’s hopefully temporary. Try telling your risk-manager to just ignore your 2020 P/L, no matter how bad your losses are, as it’s just one year and to instead pay you on the theoretical promise of trading profits you optimistically aim to deliver in 2021.

The whole concept of buying companies with negative cash flow will look flawed when survival becomes the main objective, which we would argue will be the case for many businesses later this year.

Tyler Durden

Wed, 04/15/2020 – 12:06![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com