COVID-Chaos Triggers Record Losses For Swiss National Bank

In the first quarter of 2020, the hedge fund known as the Swiss National Bank (SNB) suffered its worst quarterly loss in over a century. The central bank posted a record loss of 38.2 billion Swiss francs (or about $39.34 billion) for the quarter on Thursday morning. It said the coronavirus outbreak “seriously impacted financial markets.”

The SNB recorded a loss of 31.9 billion francs ($32.69 billion) from its equity portfolio while suffering an exchange rate-related loss of 17.1 billion francs ($17.52 billion) as the increase in the franc reduced the value of its foreign stocks and bonds.

“The first quarter of 2020 was dominated by the global spread of coronavirus. The measures taken to contain the pandemic seriously impacted the financial markets from mid-quarter onwards, and accordingly also the SNB’s result,” SNB wrote in a press release.

Reuters said the loss was the largest decline in SNB’s history, dating back to when it was founded in 1907. UBS economists were projecting a loss of around 30 billion francs ($30.74 billion).

As market panic unfolded in the latter half of the first quarter, SNB’s losses were countered by an increase in the value of its gold holdings, which rose in value 2.8 billion francs ($2.87 billion).

SNB shares have clawed back some losses after it was nearly halved in the latest market rout.

“The scale of the adverse economic impact of the COVID-19 crisis is still difficult to assess and we would caution that we may also see further reserve build and impairments in the coming quarters,” the SNB warned.

“We are well prepared to continue to serve our clients and we believe we can maintain a resilient financial performance through this crisis.”

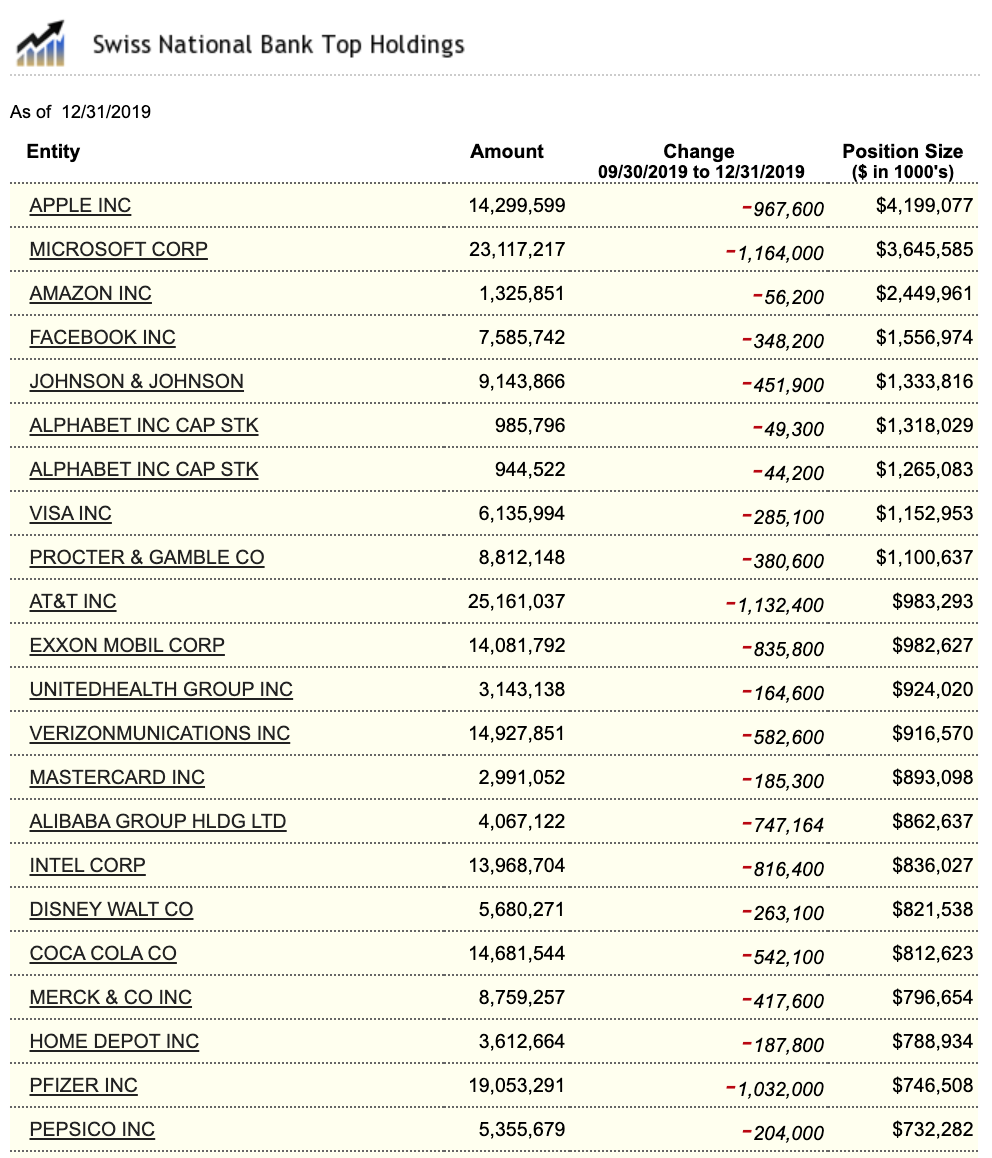

SNB’s 800 billion francs ($820 billion) portfolio makes it one of the largest institutional investors in the world. We noted in November, the central bank owned a record amount of US stocks, including Facebook, Apple, Netflix, and Google.

SNB’s Form 13F filing for the fourth quarter of 2019 also showed it was a seller as markets ripped to new highs before the virus pandemic.

And with global central banks printing trillions in stimulus last month, with trillions more expected this month, we suspect the SNB has become a buyer of stocks once more…

Tyler Durden

Fri, 04/24/2020 – 02:35![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com