Why An IOER Hike May Not Be In The Cards At Today’s FOMC Meeting

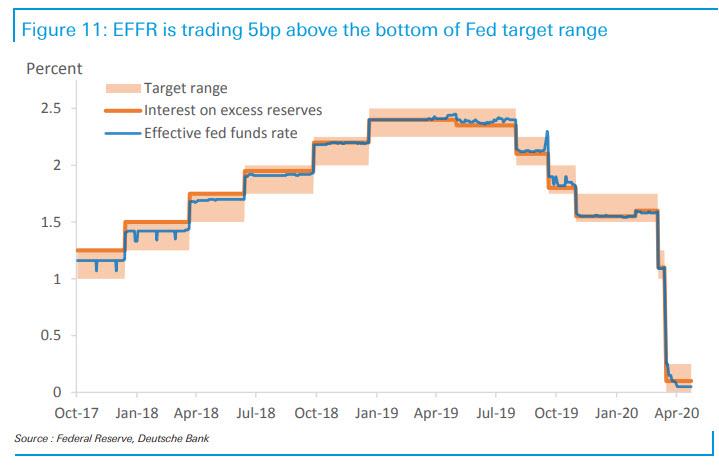

In our preview of what the Fed will announce at 2pm today, we noted that one thing the Fed, which is largely expected to do nothing as it digests the consequences of its battery of interventions in the past month, is likely to do is to hike the Interest On Excess Reserve (IOER) rate from 5bps to at least 10bps to relieve some of the downward pressure on the effective fed funds rate which is trading just 5bps above zero; pushing the IOER higher by 5bps could enable fed funds to trade closer to the mid-point of the 0-25bps range.

However, not everyone is so sure the Fed will go ahead with this attempt to re-normalize the IOER (as a reminder, the Fed cut it several times in 2019 when, during the period of “scare liquidity”, the effective fed funds traded above the IOER).

In a note from Deutsche Bank’s rates strategist Steven Zeng “Why an IOER hike may not be in the cards at the April FOMC meeting”, he explains that currently, the futures market is pricing a 3bp increase to the effective fed funds rate (EFFR) for May, which broadly translates into a 60% chance of a 5bp IOER hike. Indeed, in recent years, the Fed has shown a tendency for adjusting the IOER rate when the EFFR has moved within 5bp of the upper or lower bound of the policy target range, an implementation that it describes as purely technical to support the trading of EFFR closer to the middle of the range. However, the April meeting will take place under a set of new and extraordinary circumstances, with the Fed providing unprecedented amount of support for the financial markets. As such, Zeng thinks the calculus for an IOER adjustment has also changed.

As a result, he presents the argument for why we the Fed will not hike IOER this afternoon, even if it is not the official Deutsche Bank house view.

But first, a quick refresher on IOER arbitrage

Recall that the IOER rate acts as a floor for fed funds, although not a very good one because the Federal Home Loan Banks who are structural cash lenders can trade fed funds but cannot earn IOER. In times of ample reserves, US banks (including branches of foreign bank organizations) borrow from the FHLBanks at rates below IOER and earn the riskless EFFR-IOER spread. These arbitrage activities help IOER act as a magnet for most money market rates and they give the Fed the ability to lift its policy rate by raising IOER rate. Two important things to note:

1) the EFFR-IOER arbitrage is risk-free but not costless. Banks incur a charge associated with these trades because they increase the size of their balance sheet;

2) Since EFFR is a market-determined rate, the EFFR-IOER spread is also driven by market forces. In an ample-reserves environment, this spread mainly reflects the cost of regulatory hurdles banks need to overcome for the arbitrage to be profitable. The higher the hurdle, the wider this spread needs for banks to be willing to engage in the arbitrage. Prior to 2019, two of the biggest regulatory hurdles were the FDIC surcharge and leverage ratio rules. Both of these penalized banks for increasing their balance sheets. These stringent rules resulted in a very wide EFFR-IOER spread prior to 2017, when reserve balances were exceedingly ample.

Less regulatory friction enhances the Fed’s rate control

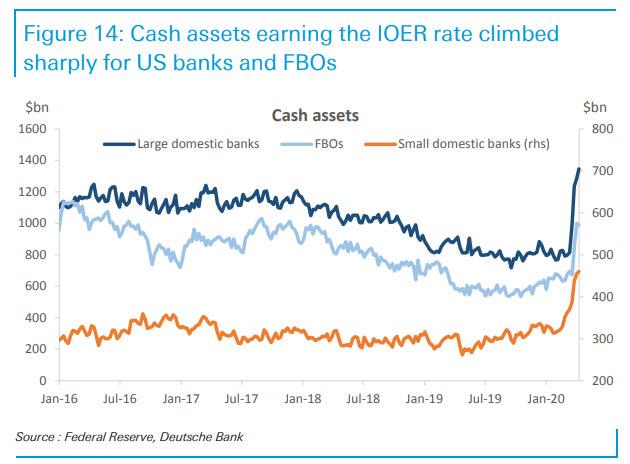

The FDIC surcharge was eliminated in 2019. As the coronavirus pandemic wreaked havoc on financial markets, the Fed temporarily eased leverage ratio rules for banks in April. The changes include the exclusion of central bank cash from the calculation for large banks and a lower leverage ratio for many community banks. Through these measures, the Fed gave banks more flexibility over the size of their balance sheets, a tool that it crucially needs to channel credit through the financial system. As Fed injected hundreds of billions of dollars in liquidity, banks were able to take the cash onto their balance sheets. Moreover, with lower regulatory hurdles banks again began to arbitrage the difference between the fed funds rate and IOER. Their competition for borrowing help drive up the price of fed funds and keep EFFR close to IOER.

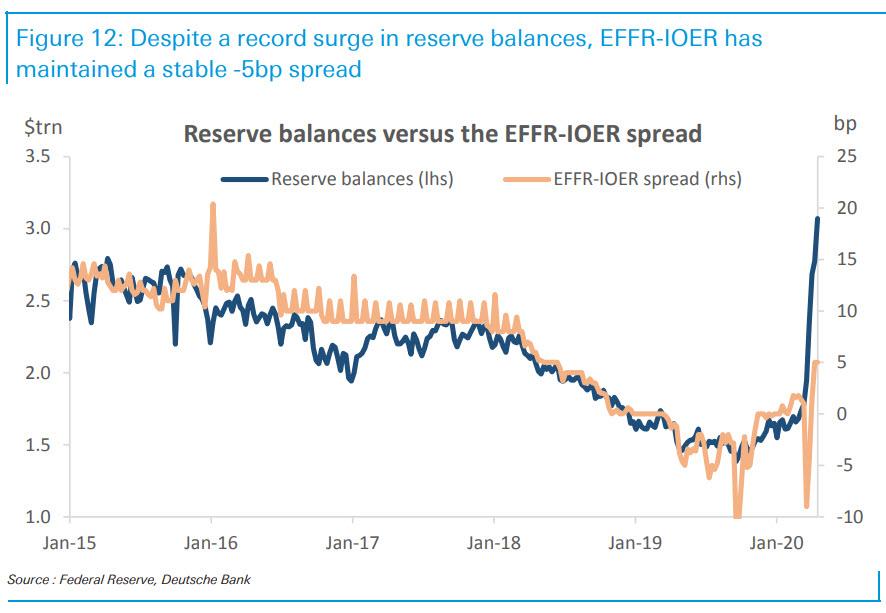

Indeed, as reserve balances surged to a record in April, the EFFR-IOER spread initially fell to -5bp but has stayed at that level since. During this period, fed funds transaction volumes flourished, and cash assets in US commercial banks and FBOs had a commensuration rise, which is strong evidence of IOER arbitrage trades. The stabilization of EFFR-IOER spread seems to reflect a near-term equilibrium of reduced regulatory costs for the arbitrage. To the extent this new equilibrium holds, it should provide a strong linkage between IOER and EFFR, giving the Fed more control over its policy rate and thus weakening the case for an IOER hike at the current juncture.

Pricing impact for the Fed’s easing facilities

An IOER hike and the accompanied repricing in fed funds OIS would lead to tighter pricing for many of the Fed’s easing facilities that are currently in use to ease financial market stresses and stimulate credit lending. These facilities include:

- FIMA Repo Facility (IOER+25)

- Central bank dollar liquidity swap lines (OIS+25)

- Temporary repo operations (OIS+5 for 1-month, OIS+10 for 3-month)

- Commercial Paper Funding Facility (OIS+110 for tier-1 and OIS+200 for tier-2 CP)

- Term Asset-Backed Securities Loan Facility (30D SOFR+150 for CLOs; 2yr and 3yr OIS plus a spread for various ABS collateral).

Most of these facilities are still in their nascent stage, and a tightening of their pricing so soon could blunt their effectiveness. While the Fed can reduce their pricing spreads after an IOER hike to keep overall pricing the same, doing so seems impractical. Finally, one might argue that OIS-based pricing would normalize if EFFR continues drifting lower. But as we noted above, this may not happen because of the stronger linkage between EFFR and IOER.

Low fed funds rate a policy design?

At zero lower bound, the decision to tweak IOER becomes more nuanced. Despite its efforts to paint this move as a simple technical implementation, the Fed is unlikely to completely look past the impact that a recalibration in IOER could have on monetary conditions. In 2012, with the economy slow to recover and the unemployment rate above 8%, the FOMC briefly contemplated slashing IOER by 10bp to push fed funds lower and help provide more monetary policy stimulus. It eventually settled on other measures that produced a bigger easing effect, but this anecdote backs up our view that at ZLB, an IOER recalibration is no longer a mechanical process.

Some people might point out that the Fed did not hesitate to hike the IOER rate in January despite coming off a string of rate cuts in late 2019. We would counter that at that time, the Fed viewed its monetary policy accommodation as broadly appropriate and was neutral in its policy stance. Therefore, an increase to the IOER rate carried less weight than it would today.

Finally, it’s entirely possible (and even highly likely) that the Fed has designed the current set of policies to foster the fed funds rate to trade as low as possible (although rates sliding negative would be severely frowned upon by the Fed). Zeng finds the lack of mention of future IOER adjustments in the March meeting minutes as an endorsement of this view. In that meeting, the Fed launched several emergency measures that would bring reserve balances to moonshot levels within a short span of time. It seems uncharacteristic that a discussion of how to mitigate the effects record reserve levels have on EFFR would be missing, unless there was no intention to mitigate these effects.

In conclusion, with the ON RRP rate supporting fed funds at zero as a hard floor, and relaxed capital rules allowing vigorous trading volumes, the Fed is not at risk of losing control over its policy rate or the fed funds market drying up. The old reasons for adjusting IOER no longer seem to apply in the current context, and as a result the Deutsche Bank rates strategist sees “little motivation for the Fed to hike the IOER rate at its meeting next week “

Tyler Durden

Wed, 04/29/2020 – 13:17![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com