New York Fed Responds To Gundlach, Reveals It Will Start Buying ETFs In “Early May”

Responding indirectly to Jeff Gunlach’s late Friday tweet, in which the bond king observed something we had noted previously, namely that “the Fed has not actually bought any Corporate Bonds via the shell company set up to circumvent the restrictions of the Federal Reserve Act of 1913” adding that this “must be the most effective jawboning success in Fed history if that is true”…

I am told the Fed has not actually bought any Corporate Bonds via the shell company set up to circumvent the restrictions of the Federal Reserve Act of 1913. Must be the most effective jawboning success in Fed history if that is true.

— Jeffrey Gundlach (@TruthGundlach) May 1, 2020

https://platform.twitter.com/widgets.js

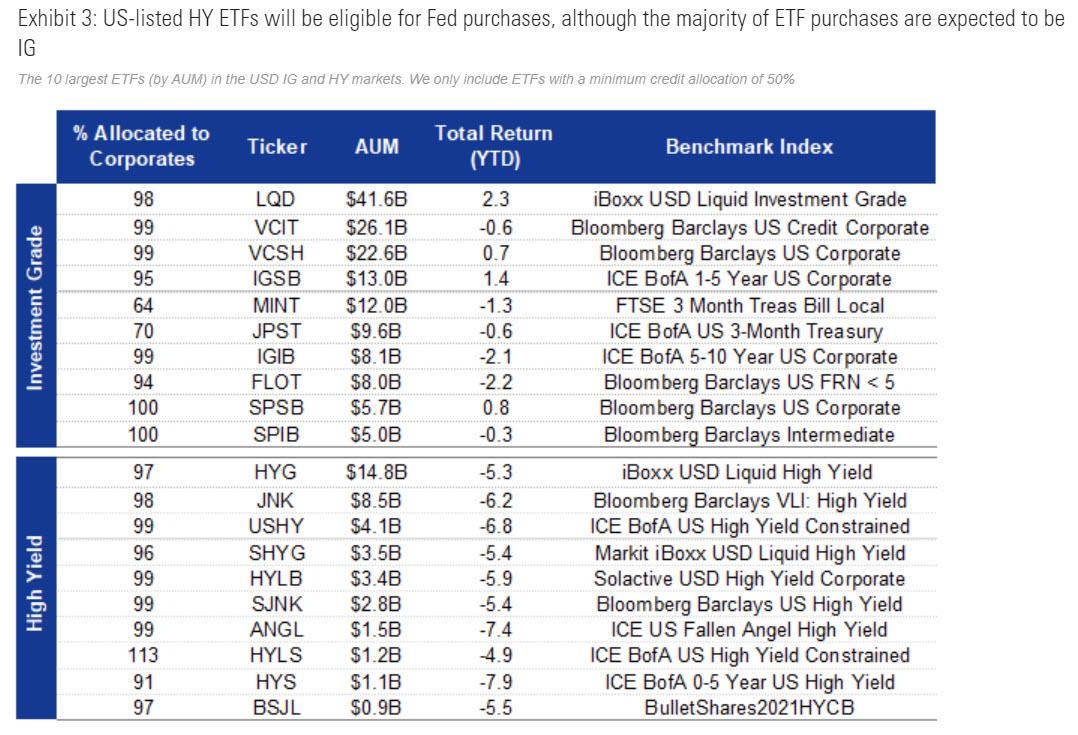

… moments ago the The New York Fed announced on its website that it expects to begin purchasing eligible ETFs, most notably the LQD and JNK, but also many others as detailed previously…

… as part of its emergency lending programs in “early May.”

The SMCCF is expected to begin purchasing eligible ETFs in early May. The PMCCF is expected to become operational and the SMCCF is expected to begin purchasing eligible corporate bonds soon thereafter. Additional details on timing will be made available as those dates approach.

The Fed’s “secondary market corporate credit facility” and “primary market corporate credit facility” will then begin lending via purchases of corporate bonds soon thereafter.

“Additional details on timing will be made available as those dates approach,” the Fed said, which is odd since “early May” is – well – now, so it wasn’t clear just how much longer the Fed plans on waiting.

And with that any risk of a selloff following Gundlach’s announcement that so far “the Fed had been all hat and no cattle”, i.e., only jawboning, has been alleviated as bond investors can now look forward to the Fed buying their trash from them instead of having to just flip it among each other. As for what “early May” means, we will just have to wait and see.

Tyler Durden

Mon, 05/04/2020 – 09:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com