Small Businesses, Many Of Which Couldn’t Get PPP Loans, Have “A Few Months Or Less” To Survive

Small business impacted by the coronavirus pandemic have had difficulty obtaining loans from the Paycheck Protection Program (PPP), according to a CNBC/SurveyMonkey Small Business Survey released Monday.

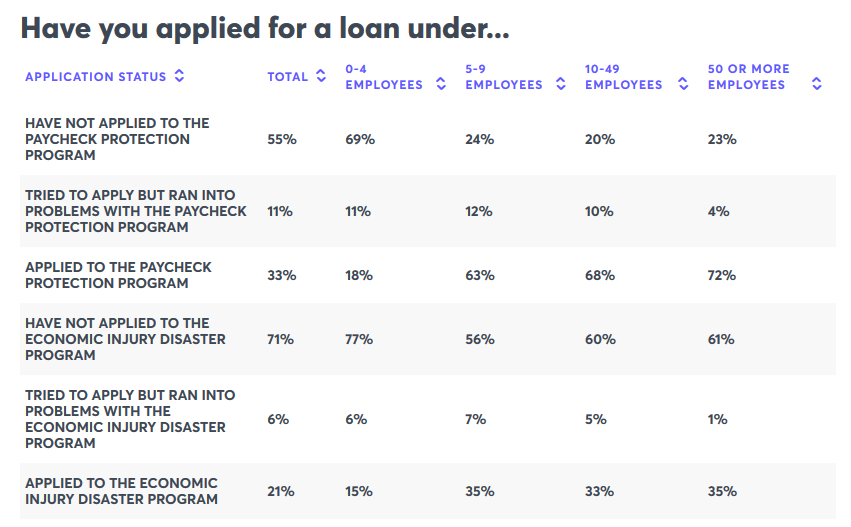

Of 2,200 small businesses owners polled, just 13% of the 45% who applied for a PPP loan were approved. 7% of respondents had already received financing, while 18% are still waiting on a response from a lender, according to CNBC.

Those applying for a different program, the $10,000 Economic Injury Disaster Loan, fared worse – with just 3% of small business owners reporting that they were approved, and 16% still awaiting a response.

Both relief programs are run by the Small Business Administration. PPP loans are capped at $100,000 per employee and can range in size. The $10,000 advance from EIDL does not have to be repaid, making it effectively a grant.

Sole proprietorships that represent 81% of all small businesses in America is a group particularly hard hit in this credit crunch. For them the window for relief loans opened late, giving them a shorter time opportunity to garner the money desperately needed to ensure they can remain in business. –CNBC

Dire straits

Meanwhile, 43% of small businesses surveyed report that they can survive for a few more months or less – with 31% reporting a ‘few months,’ 7% ‘less than a month’ and 6% less than a week under the current economic lockdown.

Rohit Arora, CEO of online lending platform Biz2Credit, which lends to small businesses, confirms what we’ve been reporting for weeks – that multiple problems plagued the PPP rollout for small businesses.

“The law was murky, and both applicants and bank loan officers were ill-equipped to process the data, as requirements were changing so fast.”

“Another issue is the fact that as a general rule, large banks haven’t focused on small business loans given to companies with less than 50 employees,” said Arora. “They have deemed it too labor intensive.”

Meanwhile, small community banks were ill-equipped to handle the flood of applications and were quickly overwhelmed by the massive volume of data being fed into their system in a short period of time.

Karen Kerrigan, CEO of the Small Business & Entrepreneurship Council, says the regulations imposed on borrowers under the PPP has also been a challenge, and many business owners have decided not to tap the program for that reason. Among them: the 25/75 rule that says business owners must use 75% of the funds they receive only for payroll, and 25% for rent, mortgage payments, utilities and other operating expenses in order to get loan forgiveness.

“In many cases this has been a deal breaker. Rent and other operating expenses are high, and getting only a quarter of the loan to cover those costs is not enough,” she explains.

Another requirement for loan forgiveness is that business owners have eight weeks to bring back employees after the money hits their bank accounts. “What happens to those small business owners operating in hard-hit places like New York and New Jersey, where stay-at-home orders are still in place and no one knows when the shutdown orders will be lifted?” she says. –CNBC

In a potentially promising sign for future disbursements, several fintech companies such as Square, PayPal and Intuit are now authorized PPP lenders.

“These companies serve millions of small business owners, many of whom are sole proprietorships and mom and pops. They have the AI and advanced technology to process these loans, as well as strong relationships with many borrowers who regularly use their concierge-type services,” said Kerrigan.

On Sunday, White House National Economic Director Larry Kudlow said that a third round of stimulus may be necessary, but that the Trump administration had made no decision on further funding.

Read the rest of the report here.

Tyler Durden

Mon, 05/04/2020 – 14:31![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com