Another Leg Lower Is Coming, But What Happens In 2021 Will Leave Traders Speechless

In a recent report by Nordea’s Andreas Steno Larsen, the FX strategist looks at the recent surge in stocks and rhetorically asks “Happy days, right?”, to which his response is that he is not so sure, because “is it really feasible to CTRL+P profits?” (for those confused, since reality is now more absurd than the Onion, the answer is no).

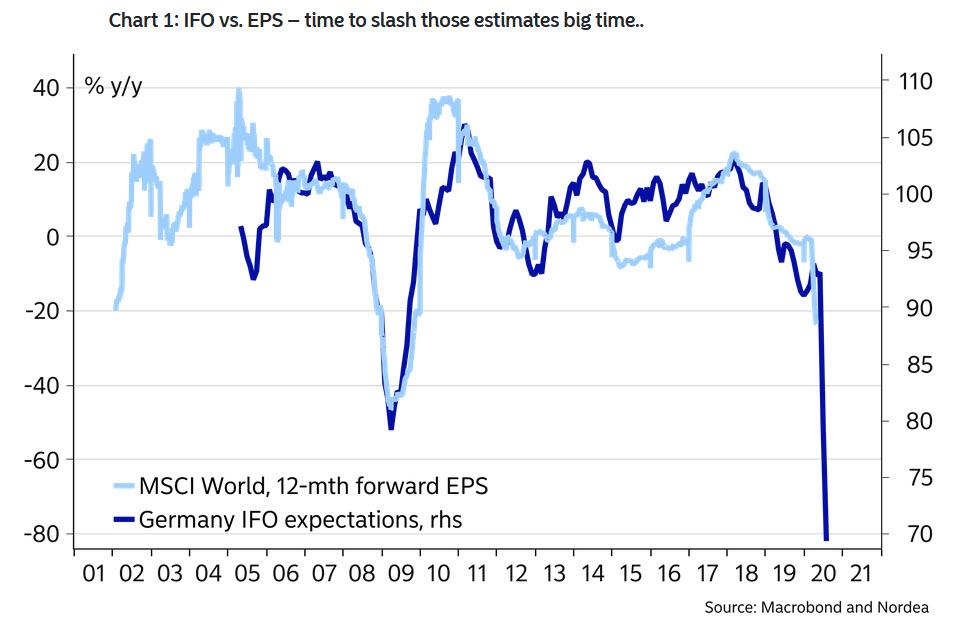

Larsen then looks at the by now infamous chart of collapsing earnings and warns that “EPS may need to be revised down at least 40-50% YoY in a quarter from now, but it seems like most equity analysts have been sipping directly from the magic central bank spring (Certainly less strong than what Elon Musk had the other day) as they look for a “mere” -20% EPS growth this year.” To Larsen this is “historically naïve, sorry, optimistic.”

Why? Because If expected earnings are slashed in the way that Nordea finds expects, forward P/E’s will either have to find bizarre new all-time-highs (as 2020 is deemed an outlier) or else equities will have to give in again. (Larson laconically notes that he “leans towards the latter”)

Of course, as we have observed in recent weeks – and as David Zervos made all too clear today – Wall Street no longer cares about earnings, or the economy, or frankly anything besides the Fed:

Since there is a robust Fed liquidity backstop, and we do not know the depth or duration of the current economic downturn, spending any time looking at economic data releases or focusing on corporate earnings is a colossal waste of time. For economic data, the signal-to-noise ratio is essentially zero, and for corporate earnings, N-T results are meaningless with regard to L-T earnings potential. The item to focus on is the Fed and its direct support for the financial and non-financial IG corporate sectors. – David Zervos

Fine, let’s assume only the Fed matters. What then?

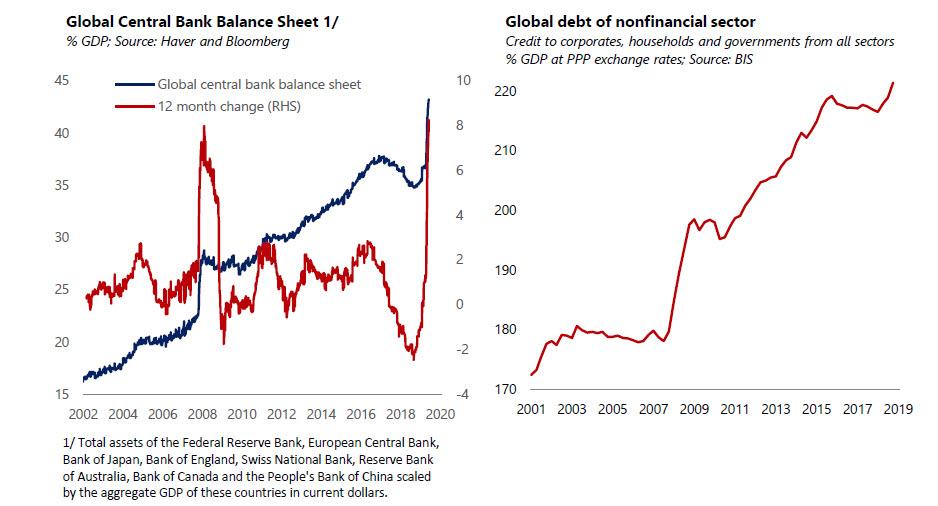

Well, as Paul Tudor Jones wrote in his latest market outlook which has quickly been denounced by basement dwelling members of fintwit due to its endorsement of gold and bitcoin as the antidote to the monetary insanity that has been unleashed, “the depth and magnitude of the economic drop-off [as a result of the coronavirus pandemic] took modern monetary theory—or the direct monetization of massive fiscal spending—from the theoretical to practice without any debate. It has happened globally with such speed that even a market veteran like myself was left speechless. Just since February, a global total of $3.9 trillion (6.6% of global GDP) has been magically created through quantitative easing.” As PTJ summarizes, “we are witnessing the Great Monetary Inflation (GMI)—an unprecedented expansion of every form of money unlike anything the developed world has ever seen.“

One place where the Fed’s unprecedented response has been very visible, is in the level of the M2 monetary aggregate.

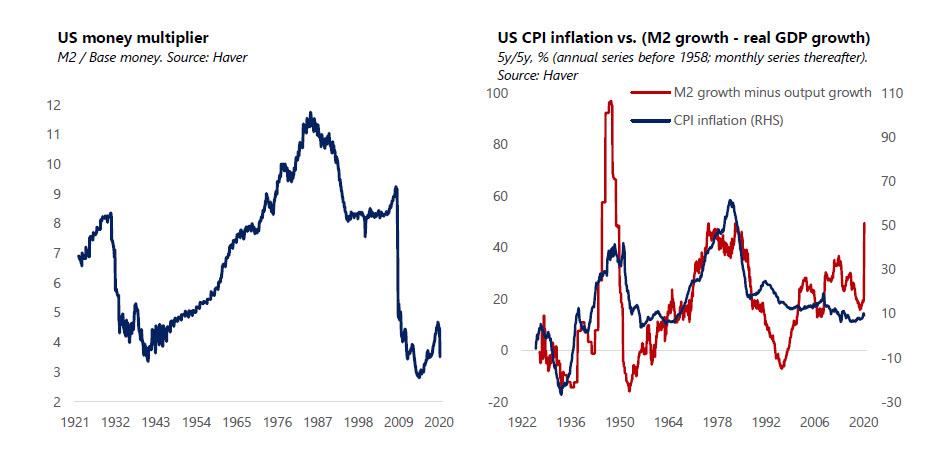

As PTJ writes, “in the last weekly release of the Fed’s Money Stock data, M2 rose 18.5% over a year ago, an unprecedented pace of growth in the history of the weekly time series starting from 1981. It is likely that the annual growth in M2 will continue to increase to somewhere between 20% and 40% by year-end. We got these estimates on M2 from a few of the dinosaurs who still work on Wall Street. Rarely have we ever seen so many economists dismissive of an economic metric than when we asked about their notion on this record M2 growth and its meaning. The last time M2 grew at such a high pace was during World War II, when annual M2 growth peaked at almost 27%.”

Jones then quotes Milton Friedman who stated that “inflation is always and everywhere a monetary phenomenon that arises from a more rapid expansion in the quantity of money than in total output.” And while the relationship between inflation and M2 growth in excess of real output growth has not been stable over short horizons, PTJ notes that “it seems to hold over longer horizons. There are only a few times in history when M2 growth exceeded real output growth over a 5-year span by the same or a faster pace than is currently the case: the inflationary periods of the 1970s–80s and the late 1940s. But remember, it is reasonable to expect inflation to first fall in the coming months, given the large contraction in demand relative to supply.”

Paul Tudor Jones then spends much of the rest of his paper ruminating on whether “a large monetary overhang in the recovery phase will eventually stoke consumer price inflation”, before concluding that it very well may, and is why the legendary hedge fund trader has now endorsed bitcoin as we described in a previous post.

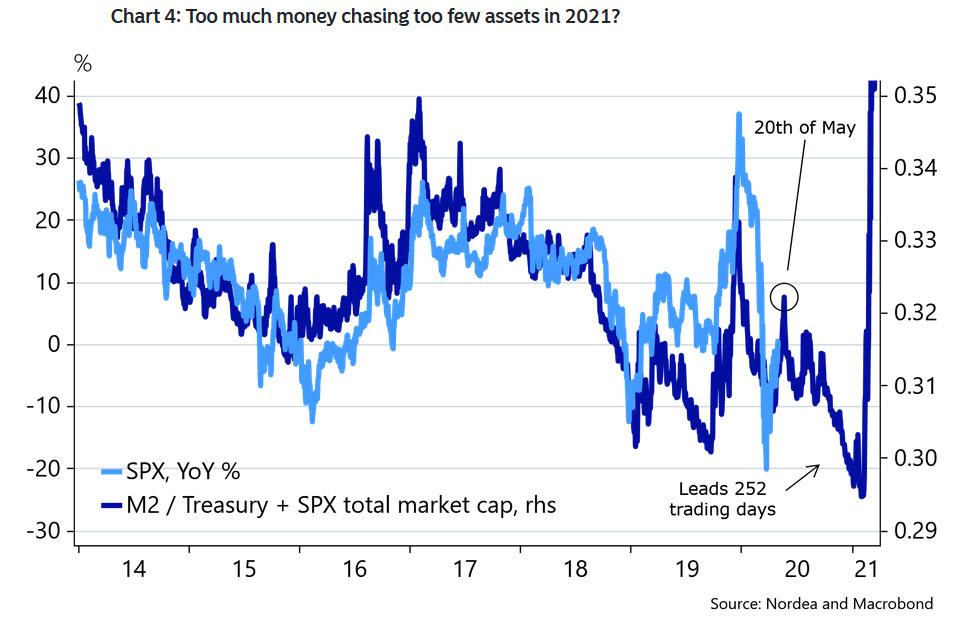

So going back to the Nordea report, Steno Larsen, like PTJ, also focuses on the of M2 only he looks at a slightly modified version of M2, specifically the ratio of M2 to the value of Treasurys and stocks. He then proceeds to observe the correlation between this adjusted M2 indicator and the annual change in the S&P500. What he finds is fascinating: if one applies a lag of roughly 8 months that it takes for M2 to affect risk prices, then the S&P is set to peak around May 20, then slump for the rest of the year before bottoming in early 2021 at which point the S&P will leave traders speechless (and the bears steamrolled), when the S&P explodes by more than 40% Y/Y as the Fed’s liquidity tsunami finally makes its way into the stock market, to wit:

“Sell in May and go away” is maybe one of the most annoying investment clichés but it could prove to work again this year, if lead/lag patterns from the M2 development to risk asset performance persist.

As M2 improves in the US, it is i) a result of much easier Fed policies and ii) a demand for credit that is suddenly revived due to the Corona lock-downs, but it usually also comes with important bearing for risk assets after a while. Judging from usual lead/lag patterns, lackluster M2 developments from 2019 should still act as a drag on risk assets from May and into the second half of the year, while 2021 looks to be the most “ketchupped” market ever, as the bonanza of policy measures will leave too much money chasing too few assets.

And visually:

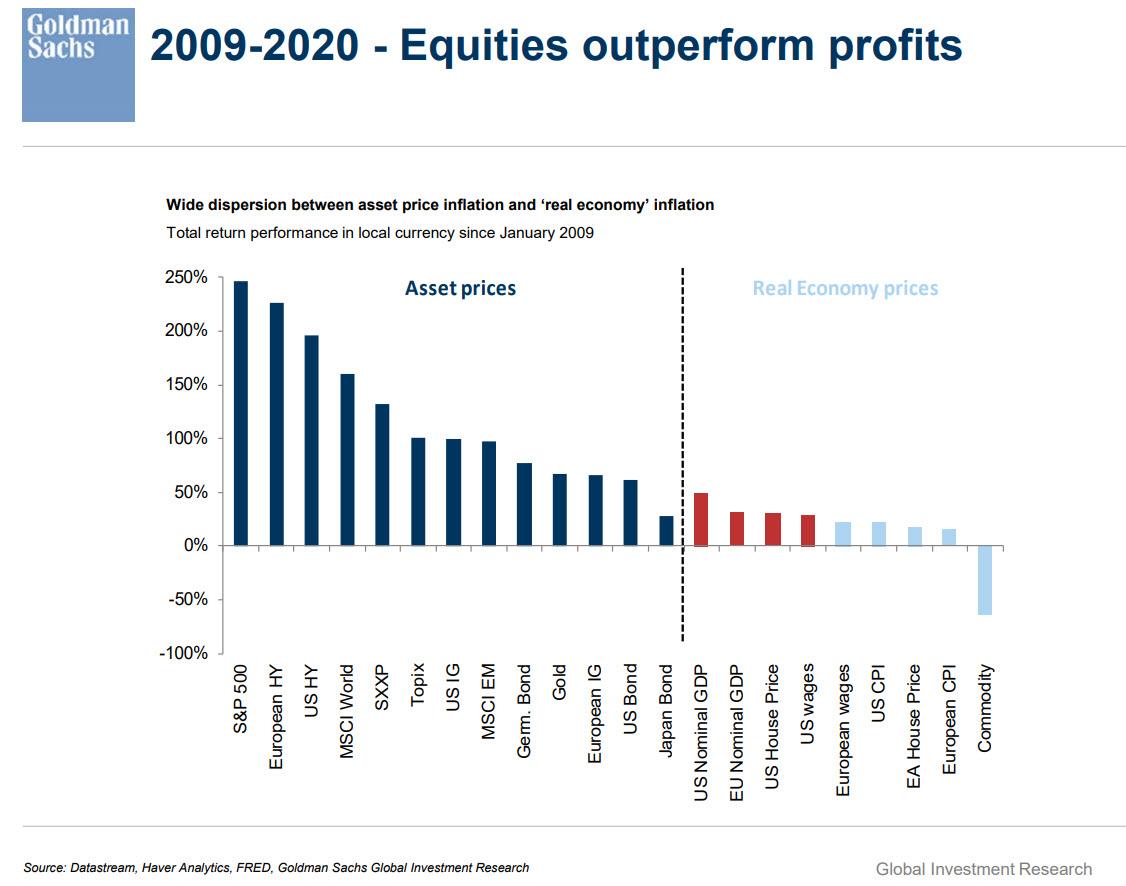

So while it is anyone’s guess if the Fed’s massive monetary injections will translate into inflation across the broader economy, and certainly into higher wages – something which at least one macro strategist believes will not be the case and as a result 2021 will be the year of the Great Stagflation – if Nordea is right, then there is no debate what happens to asset price inflation…

… and while those calling for new lows in the S&P will soon be proven correct, they will then experience the biggest surge in risk assets in 2021 in history as all those trillions in liquidity finally make their way to the stock market.

Tyler Durden

Sun, 05/10/2020 – 22:35![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com