Markets Go Manic Thanks To Money-Printing, Moderna, & Merkel

Tyler Durden

Mon, 05/18/2020 – 16:01

“I mean, that really got out of hand fast…”

[youtube https://www.youtube.com/watch?v=FONN-0uoTHI]

Futures show the mania started early (Powell), was extended before the open (Moderna‘s vaccine headlines), and extended around the EU close (Merkel & Macron)…Small Caps were the biggest gainers (futs were limit up just ahead of open) with Nasdaq the laggard on the day…a weak close was notable however…

But all major US indices (ex-Transports) are now green for May…

Source: Bloomberg

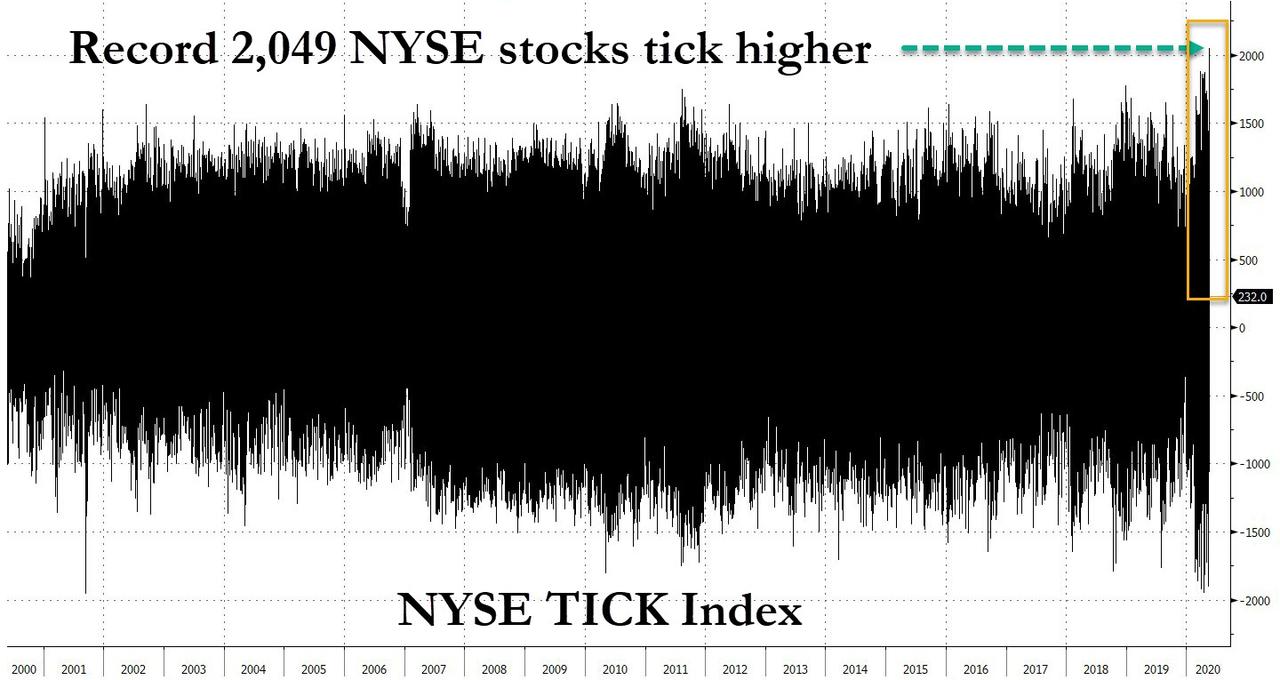

In fact, Powell’s promise to do “whatever it takes” sparked the greatest opening buying pressure in history at today’s open…(Who the hell was seriously surprised by anything Powell said?)

Source: Bloomberg

But the Moderna meltup really took it to ’11’:

-

*TRUMP SAYS TODAY WAS VERY BIG DAY THERAPEUTICALLY

-

*TRUMP SAYS TODAY WAS BIG DAY FOR CURES, VACCINES

-

*TRUMP SAYS THERAPEUTICS, CURES MORE IMPORTANT THAN VACCINES NOW

So, to clarify the day’s early action – we soared on the back of Fed fears and promises to print more due to bad news and we soared on positive vaccine headlines which would end the bad news.

Macron and Merkel made some promises they can’t keep alone (i.e. the Dutch among others have to agree to the joint debt malarkey) but that didn’t matter today. The euro soared and peripheral debt yields crashed…

Source: Bloomberg

Crude oil exploded higher into tomorrow’s June contract expiration, further reassuring stock market buyers that… well demand must be back, right? June WTI topped $33 intraday (the highs from before the crash) before fading into settlement…

Just feel sorry for all the muppetry who was buying USO and utterly failed to gain anything…

Source: Bloomberg

Gold and Silver were clubbed like baby seals on the Moderna vaccine news – after ramping higher after Powell’s promise to do more money printing…

Gold was down on the day…

But silver held on to its gains… even with the clubbing

And, aside from a brief spike, the gold/silver ratio continued to slide…

Source: Bloomberg

Bonds were a bloodbath today (all but 2Y now higher on the month)…

Source: Bloomberg

10Y Yields exploded higher today

Source: Bloomberg

Powell manage to reignite credit market exuberance…

Source: Bloomberg

The Dollar was also puked lower today (EUR strength)

Source: Bloomberg

Bank stocks ripped higher today…

Source: Bloomberg

The Virus Fear Trade (Long Food, Short Leisure) plunged…

Source: Bloomberg

Another new record highs for FANG Stocks…

Source: Bloomberg

Cryptos were bid…

Source: Bloomberg

Finally, it seems the market doesn’t need negative rates anymore…

Source: Bloomberg

And this made us wonder a little… after Dr.Scott Gottlieb came on CNBC and offered a sense of reality about just how modest this Moderna data is, the broad market didn’t even blink…

Source: Bloomberg

Remember Remdesivir…

Source: Bloomberg

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com