Canadian Car Sales “Recover”, Only Crashing 44% In May, After April’s 75% Plunge

Tyler Durden

Wed, 06/03/2020 – 18:40

The ripple effects of the worldwide economic shutdown due to the coronavirus continue to be felt in the global auto market, which was already a sad state of affairs prior to the pandemic.

New auto sales in Canada are the latest indicator of an industry that has been flipped on its head. Sales fell 44% in May, according to Automotive News Canada. DesRosiers Automotive Consultants estimates that 113,224 light vehicles were sold in the month after new vehicle sales in April fell an estimated 75% from a year prior.

The firm’s seasonally annual adjusted rate of sales is now about 1.1 million after automakers sold 1.9 million vehicles in 2019. DesRosiers Automotive Consultants said: “May’s year-over-year decline can evoke a touch of cautious optimism as the first tentative shoots of recovery spring up from a badly damaged marketplace.”

The monthly numbers coming out of Canada remain estimates, as most firms now report quarterly.

Test drives were banned in places like Quebec and Ontario during the height of the coronavirus outbreak, but have now began to re-open slowly, under new guidelines. Quebec and Ontario make up 80% of the country’s new car market.

The 44% drop also “beats” estimates that had suggested as much as an 80% potential drop for the country in May.

DesRosiers concluded: “As dealerships slowly reopen—even with reduced hours or appointment-only visits—the new light vehicle sales market may well and truly have begun the arduous climb back to recovery. So, a touch of optimism for the coming weeks is warranted – and attention can be focused toward the shape and the speed that the recovery will follow.”

Recall, we noted days ago that the numbers for the U.S. in May were looking similarly grim. US auto sales are expected to continue their historic plunge in May, further pressuring an industry that is on the brink of all out collapse due to the pandemic lockdowns, plunging used car prices and suffering from a pre-virus recessionary environment.

Sales figures for May are expected to fall 33% to just 1.05 million units, according to Cox Automotive and CNBC. Even worse, data from Bank of America indicates that demand for new vehicles could be dropping off a cliff at the same time the industry is getting ready to ramp up production again.

The numbers show a sequential improvement from April, just like Canada, but still offer an ominous outlook for the auto industry heading into the second half of 2020. Cox Automotive estimates the pace for U.S. car sales to be about 11.4 million units sold by the end of the year, which would make 2020 the worst year for car sales since 2009. These numbers compare to 17.4 million cars sold in 2019.

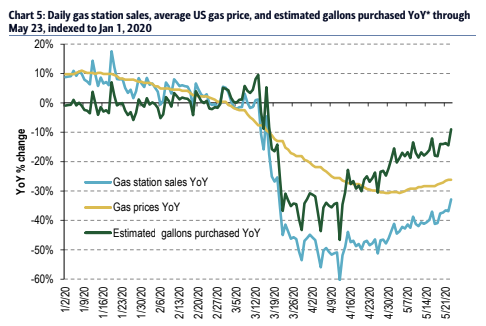

And it may not be because drivers are staying home anymore. Bank of America data from gas stations shows that drivers are back on the road again. “We estimate that gas consumption (in gallons) was still down about 30% YoY in April, but improved to -14% for the week ending May 23rd (latest available),” the bank wrote in a May 29 note.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com