ECB’s Inflation Projections Crash: Now Sees Just 1.3% In 2022

Tyler Durden

Thu, 06/04/2020 – 08:51

Moments after Christine Lagarde announced that in the ECB’s latest economic projections, the central bank now expected a devastating drop in European GDP in 2020 following by modest rebounds in 2021 and 2022 as follows:

- 2020 GDP: -8.7% (vs +0.8% in March)

- 2021 GDP: +5.2% (vs +1.3% in March)

- 2022 GDP: +3.3% (vs +1.4% in March)

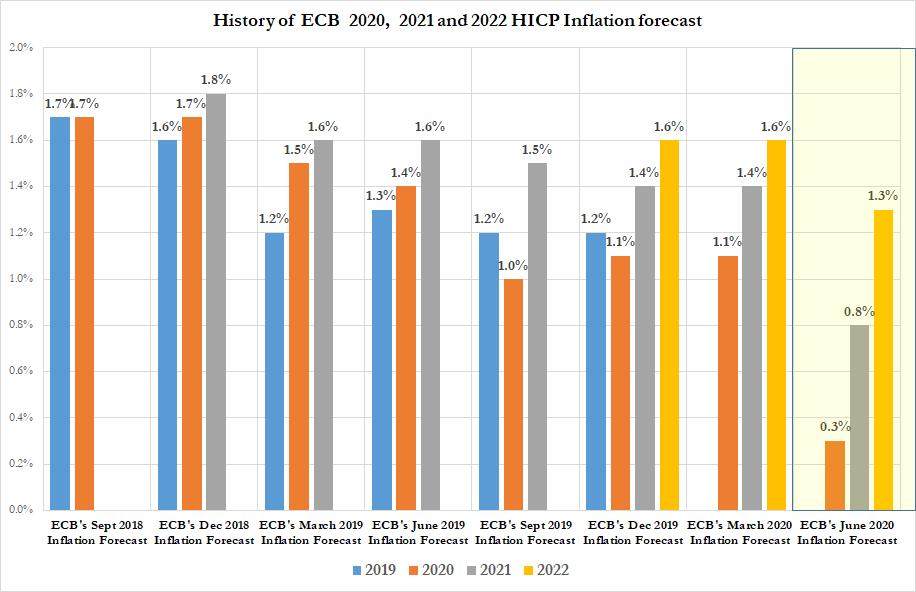

… which for those who can do simple math means that the Eurozone will still not recover all lost output by the end of 2022 even though Lagarde said that “activity is expected to rebound in QE”, the ECB also revealed its latest inflation projections and these were a doozy, with 2020 now expected to be a borderline deflation yes, with just +0.3% HICP, followed by a moribund 0.8% before recovering somewhat to 1.3% in 2022.

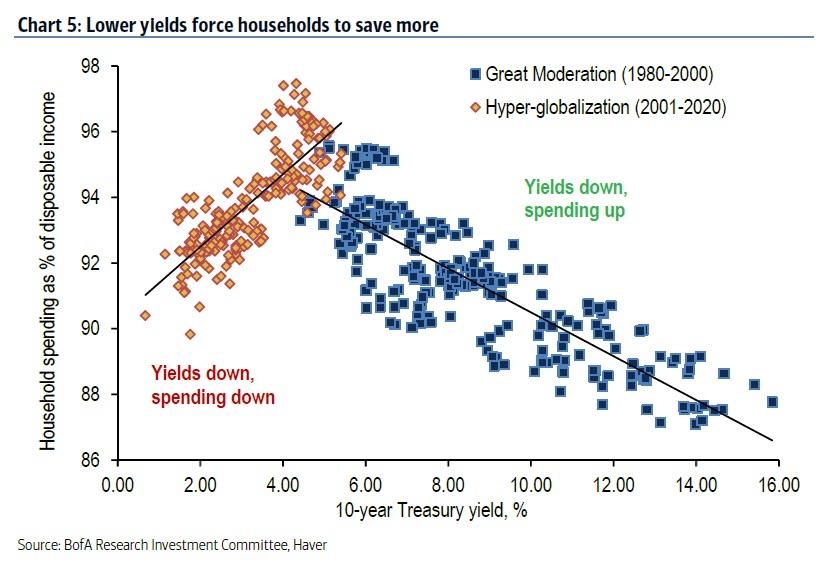

Of course, everyone knows the forecasting accuracy of the ECB, and as such the latest inflation forecast is merely a carte blanche for the ECB to do even more QE when the ECB’s latest massive QE expansion triggers even more deflation, because as we explained earlier this week, aggressive monetary policy is no longer inflationary but instead pushes yields – and inflation expectations – lower.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com