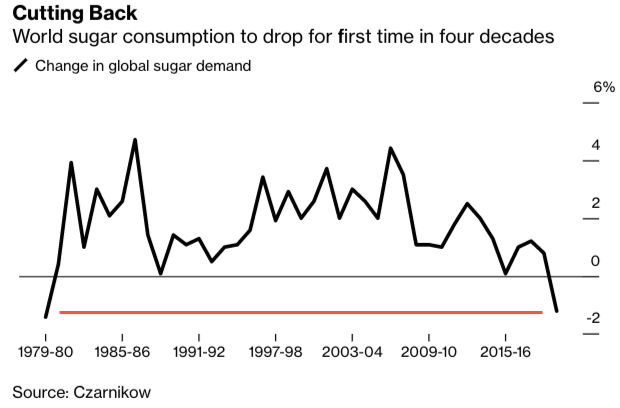

Global Sugar Consumption Declines For First Time In Forty Years

Tyler Durden

Tue, 06/16/2020 – 02:45

The pandemic has thrust the global economy into a crippling recession. It could take several years for the world to return to either its long-term linear or exponential growth trends, resulting in diminishing demand for certain commodities.

According to research firm Czarnikow Group, the virus-induced economic downturn has led to the first year-on-year decline in global sugar consumption since 1980, when sugar prices hit a high of 45c/lb.

The global closure of the travel and tourism industries has been one of the most significant contributing factors behind sliding demand for sugary food products. Czarnikow wrote lockdowns have led to reduced consumption out-of-home and at-home:

“There has been a reversal of this recent trend of 1% growth each year. Due to this fall, we have reduced our consumption estimates for locations that are still under lockdown by 5%. Under lockdown, there are associated reductions in at-home-consumption due to shortages in stockists, supply chain delays, and the closure of the entertainment industry.

“This final factor is particularly important when estimating consumption patterns. This is because we believe that out-of-home sugar consumption is likely to be even more reduced than in-home sugar consumption. When people can’t go to the shops, cinema, sports events, and bars, the amount of sugar – mostly in the form of sugary drinks, fast food, and treat foods – is also reduced. We can verify this by looking at soft drinks sales, which have been particularly affected by lockdowns and the reduction of social gatherings.” – Czarnikow

“Consumption out of home is normally more than what you would now substitute and have at home,” Ben Seed, an analyst at Czarnikow in London, told Bloomberg.

“If you go to the cinema, you would probably quite happily have a liter or maybe more of soda while you watch the film, whereas we just don’t think people would drink a whole liter of soda while watching Netflix,” Seed said.

Coca-Cola’s sales volumes were down 25% during the month of April, and the company warned the economic downturn will weigh heavily in the second quarter. PepsiCo Inc was another that expects second-quarter revenue to slide.

Czarnikow said global sugar consumption will decline 1.2% to 169.9 million tons this year.

ICE-US Sugar July contracts plunged from $15.9 to $9.05, or about 43% decline in 52 sessions, bottoming out in late April. Since the bottom, contracts have soared 35% into mid-June — have hit resistance just shy of the 50% Fibonacci retracement level ($12.47).

John Stansfield, an analyst at trader Group Sopex, told Bloomberg that falling demand could result in large sugar surpluses this year and next.

“The bigger picture of falling sugar consumption comes from sales data of Coke and Pepsi, which is terrible,” Stansfield said, adding that, “but what I fear more is falling global GDP. Unemployed people won’t be going to restaurants and bars. As GDP stalls, so will sugar consumption.”

To sum up, with no V-shaped recovery in the global economy this year — the road to recovery will be slow and long — suggesting the sugar industry is about to go bust.

If you’re wondering about the latest data on the type of recovery ahead, read our latest piece titled “OECD Warns Of Deepest Global Downturn In Century, Second Virus Wave.”

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com