“Second Month Of Quasi-Paralysis” – Swiss Watch Exports Collapse 68% In May

Tyler Durden

Sat, 06/20/2020 – 07:35

It seems wealthy folks in Asia, Europe, and the US pulled back on purchasing Rolex Submariners and or any other type of fancy Swiss-made timepiece in May as Swiss watch exports continued to crash.

An industry representative told Reuters that economic fallout from the coronavirus pandemic “will have a lasting impact on demand for watches,” which could result in job cuts in the back half of the year at watch manufacturers.

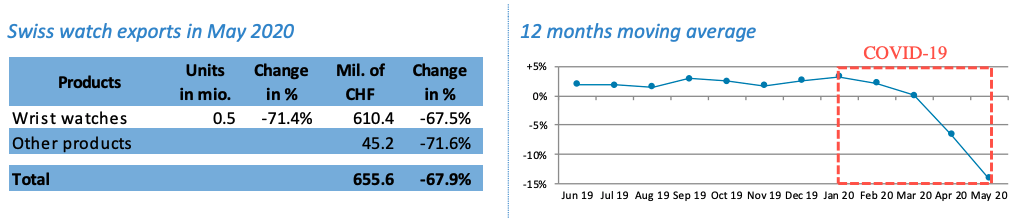

The Federation of the Swiss Watch Industry (FH) released a report Thursday morning describing May as a “second month of quasi-paralysis.” Following 81.3% declines in April, Swiss watch exports continued to plunge in May, down 67.9% compared with May 2019, with a value of exports around 655.6 million CHF ($690 million).

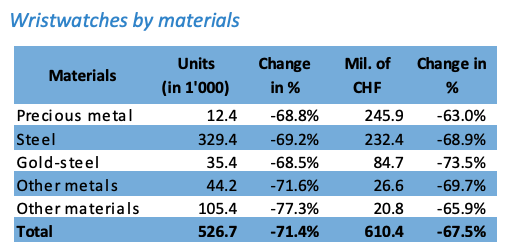

“Performance was similar across all the main groups of materials, but in volume terms, the Other materials category fell by more than the average. In total, the sector exported 1.3 million fewer items compared with May 2019,” FH wrote.

FH calls it: “It seems that the recovery in this market is not yet a given.”

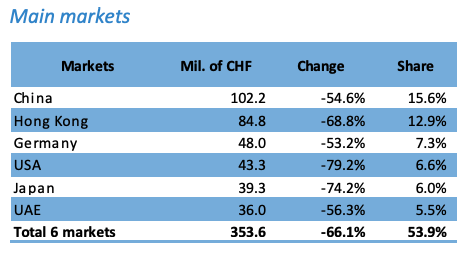

“The performance of the main markets fell by more than half compared with a year ago, across the board. The United States (-79.2%), Japan (-74.2%), France (-76.7%), Singapore (-74.8%), and the United Kingdom (-76.7%) were among the countries that fell by more than the average. While China (-54.6%) outperformed other countries for the second month in a row, it did not stand out to the same extent as in April and recorded a sharp decline.”

Francois-Henry Bennahmias, CEO of high-end watch brand Audemars Piguet, said: “It’s not that nobody wants to buy watches anymore, but in the after-COVID era many people will consume less, they will be more selective.”

Bennahmias told Reuters that he is the most concerned about the US market – expecting sales to fall up to 25% this year, diving below 1 billion CHF ($1.05 billion).

Joris Engisch, head of watchmaker Singer, said the watch industry is about to enter a period of pain: “Half of all the watches we sell go to Chinese customers and they won’t start traveling again soon.”

“We have not had a single new order in three months. We’ll have to shut down completely for several weeks this summer,” Engisch said, adding that smaller subcontractors with lower margins would struggle even more.

“I’m optimistic for the long term, but quite pessimistic for the end of the year, we’ll have one or even two extremely difficult years,” he said. “Companies will start laying off staff if they don’t see positive signals after the summer.”

Even before the virus-induced downturn, traditional Swiss watchmakers were locked in a war against tech companies who were taking market share via smartwatches. Apple Watch outsold the entire Swiss watch industry in 2019.

Changes in high-end Swiss watch exports has been a great leading indicator of the current economic downturn – virus or no virus – a plunge in economic growth was coming. Read what we wrote back in December:

“So could weakening consumer spending trends in diamonds, jewelry, and timepieces be an early warning sign that trouble is ahead for the global economy in 2020?”

With that being said, the latest collapse in Swiss watch exports suggests there will be no V-shaped recovery in the global economy this year.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com