European Stock Markets Suffer 3 Hour Outage Due To “Technical Issue”

Tyler Durden

Wed, 07/01/2020 – 07:34

Trading in Germany’s main index DAX and various other European cash and futures exchanges was halted for nearly three hours on Wednesday due to a “technical issue” at German electronic trading platform Xetra. The interruption in the fully-electronic cash market trading system affected stock exchanges in Frankfurt, Vienna, Ljubljana, Prague, Budapest, Zagreb, Malta and Sofia as they use the Xetra T7 system, exchange operator Deutsche Boerse said.

Xetra’s T7 system for cash stock trading was unavailable starting around 847am CET, the exchange operator says on its website. Trading of derivatives on Deutsche Boerse’s Eurex also faced technical difficulties, and only about 30 of 99 stocks on Germany’s HDAX large and mid-cap index were showing trades as of open of trading in Frankfurt.

“Due to technical problems, the Eurex T7 system is not available at the moment. We are investigating and will keep you informed,” Eurex noted on its website. However, alternative exchanges like the Tradegate Exchange in Berlin were functioning properly.

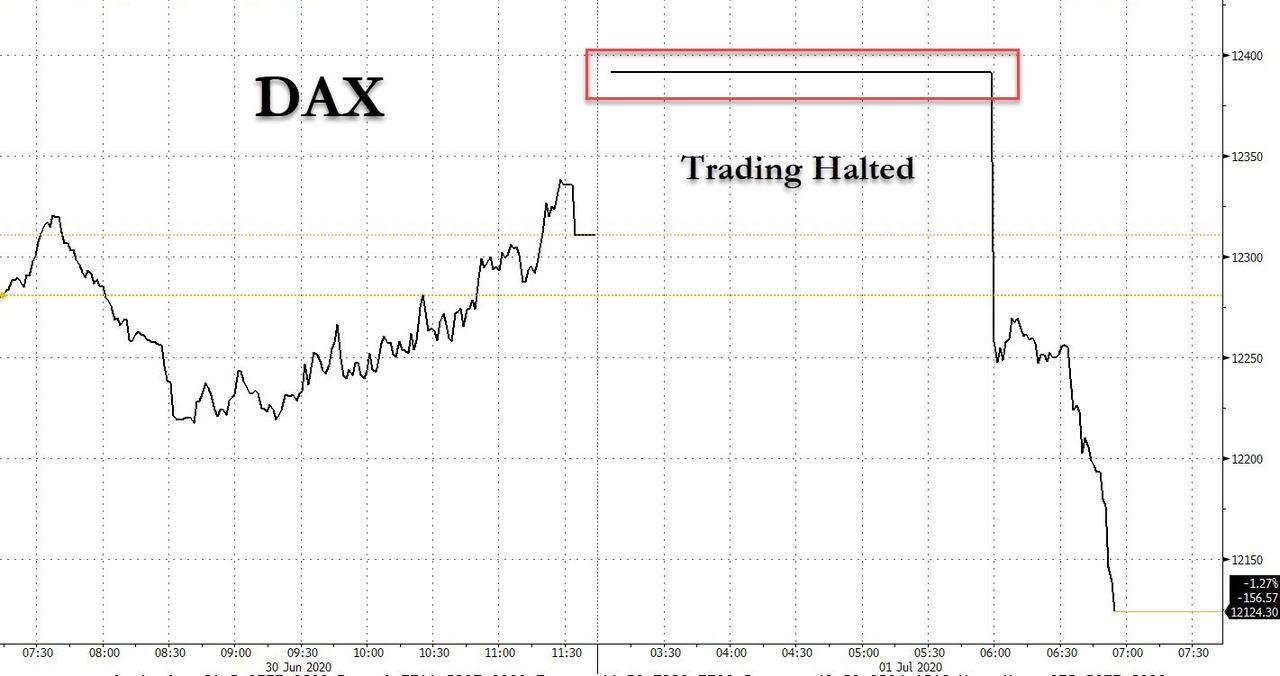

The chart below show the nearly 3 hour long trading halte in the cash DAX, which tumbled as soon as trading resumed.

The technical snag was a further blow to Deutsche Boerse, which saw one of its longest outages in April when the Frankfurt stock exchange was halted for more than four hours.

As Reuters reports, Deutsche Boerse CEO Theodor Weimer said after the April blackout that the stock exchange had taken precautions to avoid such a breakdown in the future. Just two months later, it was followed by another 3-hour-long halt.

Exchanges slowly came back online around 0930 GMT, but the cause of the disruption in Xetra on Wednesday was not immediately clear. The DAX eventually reopened just around 1145am CEST.

The German stock exchange’s cash markets generated a turnover of 159.8 billion euros ($179.5 billion) in May. Some European bond and stocks futures affected by the Xetra issue also resumed trading.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com