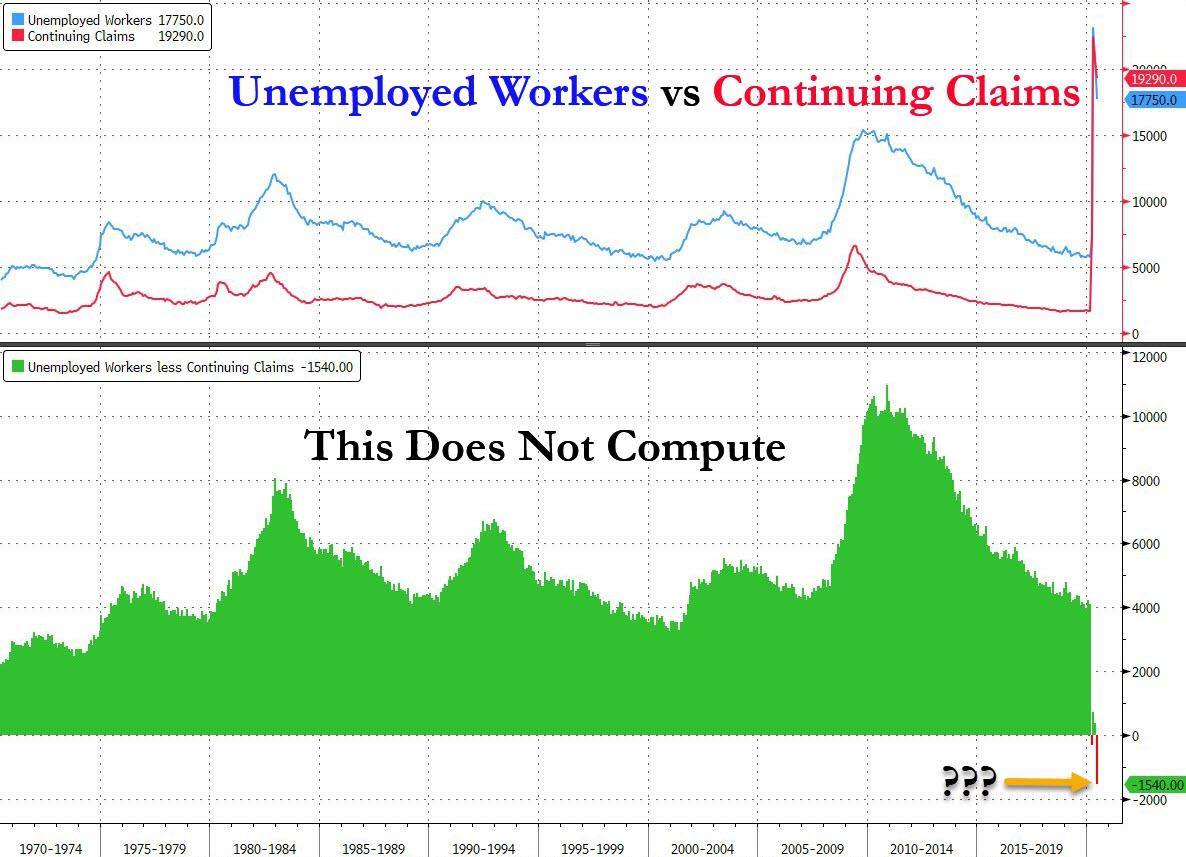

Jobs Data Officially Broken? More People Getting Unemployment Benefits Than There Are Unemployed Workers

Tyler Durden

Thu, 07/02/2020 – 15:15

It’s official: “data” released from the Bureau of Labor Statistics has just crossed the streams and has given birth to the Stay Puft marshmallow man jumping the shark. Alas, it also means that jobs “data” is now completely meaningless.

For all the analysis of today’s job report, is it good, is it bad, is this data series too hot, and does it mean that the Fed will soon be forced to hike, we have just one response. None of it matters.

Why? Because a simple sanity check reveals that as of this moment the jobs report no longer makes logical sense.

Consider the continuing jobless claims time series, also also referred to as “insured unemployment”, and represents the number of people who have already filed an initial claim and who have experienced a week of unemployment and then filed a continued claim to claim benefits for that week of unemployment

By its very definition, insured unemployment is a subset of all Americans who are unemployed. In a Venn diagram, the Continuing Claims circle would fit entirely inside the “Unemployed” circle, which also includes Initial Claims, Continuing Claims, and countless other unemployed Americans who are no longer eligible for any benefits.

Alas, as of this moment, the definitionally smaller circle is bigger than “bigger” one, and as the DOL reported today, there were 19.29 million workers receiving unemployment insurance. And yet, somehow, at the same time the BLS also represented that the total number of unemployed workers is, drumroll, 17.75 million.

If you said this makes no sense, and pointed out that the unemployment insurance number has to be smaller than the total unemployed number, then you are right. And indeed, for 50 years of data, that was precisely the case.

Until this week.

And yes, there is a “forced” explanation to justify how this may actually happen in the current situation where everyone is abusing jobless benefits, but in theory this should not be happening, and we fully expect that in the coming weeks, the already highly politicized BLS will quietly close this gap.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com