Low-Income Households Crushed By Covid Inflation Shock

Tyler Durden

Sun, 07/05/2020 – 21:30

As The Fed continues to flood the system with money – insisting that inflation is merely a boogeyman and it is doing everything in its power to support the middle class, Bloomberg has found that inflation due to coronavirus is real, and is disproportionately hammering poor households.

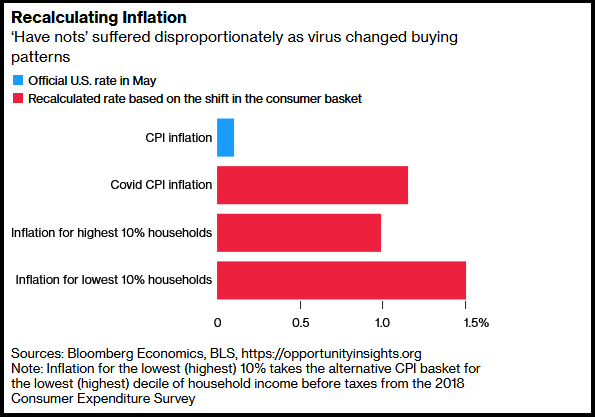

Due to higher grocery and housing costs for the bare necessities during the pandemic lockdown, the study found that the bottom 10% of households by income currently face inflation of 1.5%, while those in the top 10% face 1%. Meanwhile, the official overall average in May was 0.1%.

According to the report, the difference is primarily due to changes in consumption habits during the pandemic – as households have been forced to buy more food, which has shot up in price, while spending less on recreational activities and transportation.

“In a period of protest and increasing anger about inequality, the differential inflation rate experienced by low- and high-income households is a concern,” said Bloomberg Economics’ Björn van Roye and Tom Orlik.

The suggestion the virus is less disinflationary than many economists believe poses a challenge for the Federal Reserve which is eyeing a slower inflation rate than that experienced by lower earners, who are instead facing a steady erosion of their purchasing power. –Bloomberg

“Taken together with concerns about central banks bailing out investors ahead of firms and workers, and the benefits rich, asset-owning households gain from quantitative easing, it adds to the sense that central banks are unintentional contributors to the problem of inequality,” they added.

Meanwhile, adding insult to injury, CCN points out that blue-collar workers are more likely to contract the virus, adding “If you can’t work remotely and you haven’t been laid off, chances are you’re headed into work and putting yourself at risk every day.”

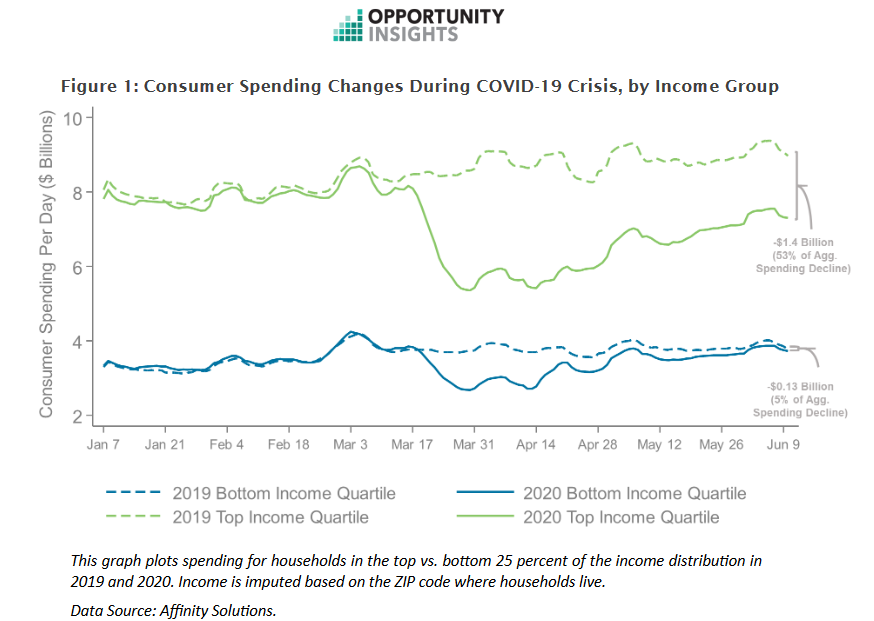

Looking a bit more closely at spending habits during the pandemic, Opportunity Insights, which contributed to Bloomberg‘s report, found that those in the top income quartile had a significant decline in spending of 53%, while those in the bottom quartile spent virtually the same.

High-income households cut spending primarily because of health concerns rather than a loss of income or purchasing power. Spending fell most on services that require in-person interaction and thereby carry a risk of COVID-19 infection, such as transportation and food services.

The pattern of spending reductions during this recession differs sharply from that of prior recessions, during which spending on services remained essentially unchanged while spending on durable goods (e.g., new appliances or cars) fell sharply. –Opportunity Insights

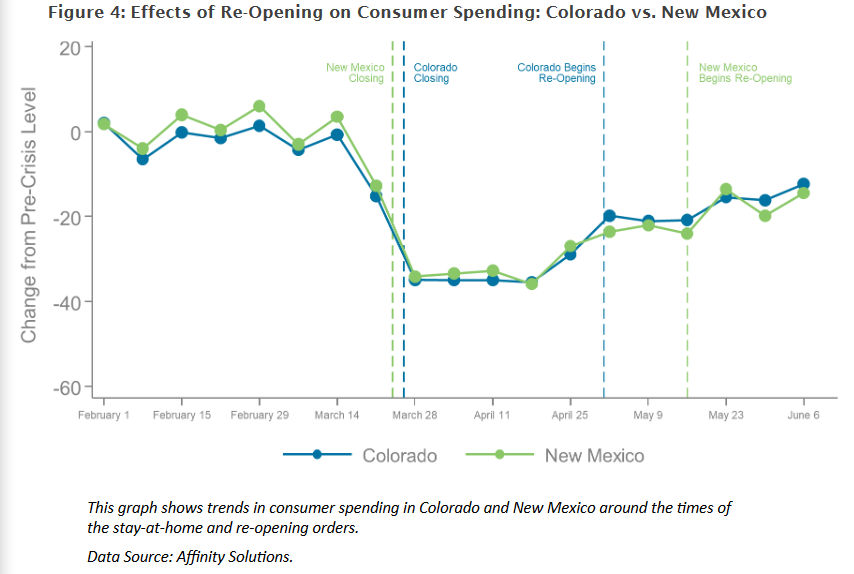

Opportunity Insights also found that small businesses in the most affluent zip codes lost over 70% of their revenue due to COVID-19, vs. 30% in the least affluent (low rent) zip codes. Meanwhile, reopenings have had little impact on economic activity, as illustrated by Colorado – which reopened on May 1, vs. New Mexico, which reopened on May 16.

And while stimulus payments significantly increased consumer spending – particularly among low-income households, they didn’t lead to large gains for businesses hardest-hit by the pandemic – small businesses in affluent areas.

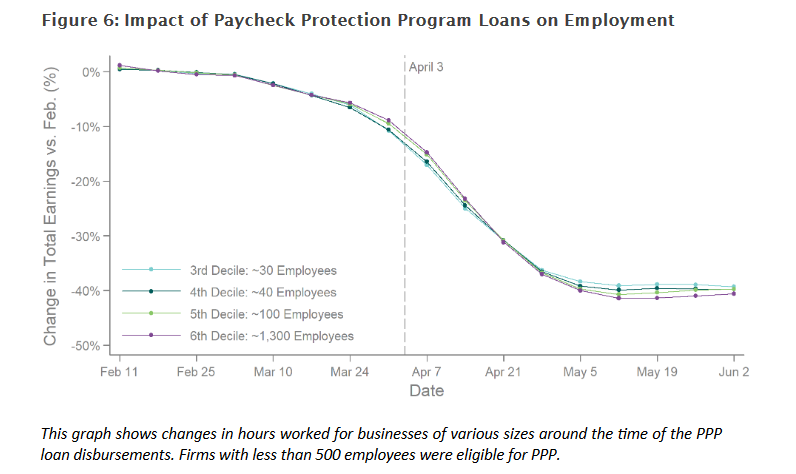

Even more surprising is that Opportunity Insights found that $500 billion in PPP loans had virtually no impact on employment rates.

Which begs the question: is there a vaccine for ineffective fiscal policy? (we already know that the only solution to failed monetary policy is much more of it).

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com