S&P Futures Surge As Chinese Stocks Explode Higher

Tyler Durden

Mon, 07/06/2020 – 07:54

After two consecutive weeks of cautious Sunday sessions entering the new week, overnight futures blasted out from the gate, surging more than 1%, sparked by fresh animal spirits out of China, after the country’s state media stoked bullish enthusiasm. S&P futures were up 35 points, rising to 3,165 and finally breaking above the 3,150 zone that has proven to be stern resistance over the past month. The dollar index fell for a fifth day and Treasuries dipped even as surging coronavirus cases delayed business re-openings across the United States, while precious metals and oil rose.

MSCI’s All-Country World Index rose 0.7% to its highest since June 6 after the start of European trading, with investors putting their faith in an economic recovery powered by historic government stimulus.

European stocks also jumped, with the STOXX 600 index rising 1.64%. Banks and autos lead gains in early European trading, with the sectors up 4.5% and 3.5% respectively, as both industry groups trade at the highest level since June 10. The gains come amid an overall bullish market Monday with global stocks higher, led by gains in China after the country’s influential state media stoked enthusiasm in the market. Stocks exposed to China, like carmakers, industrials, energy firms and luxury goods makers rose strongly, while banks also rallied. U.K. homebuilders rallied after a report that the government is considering a temporary increase in the threshold at which buyers pay stamp duty.

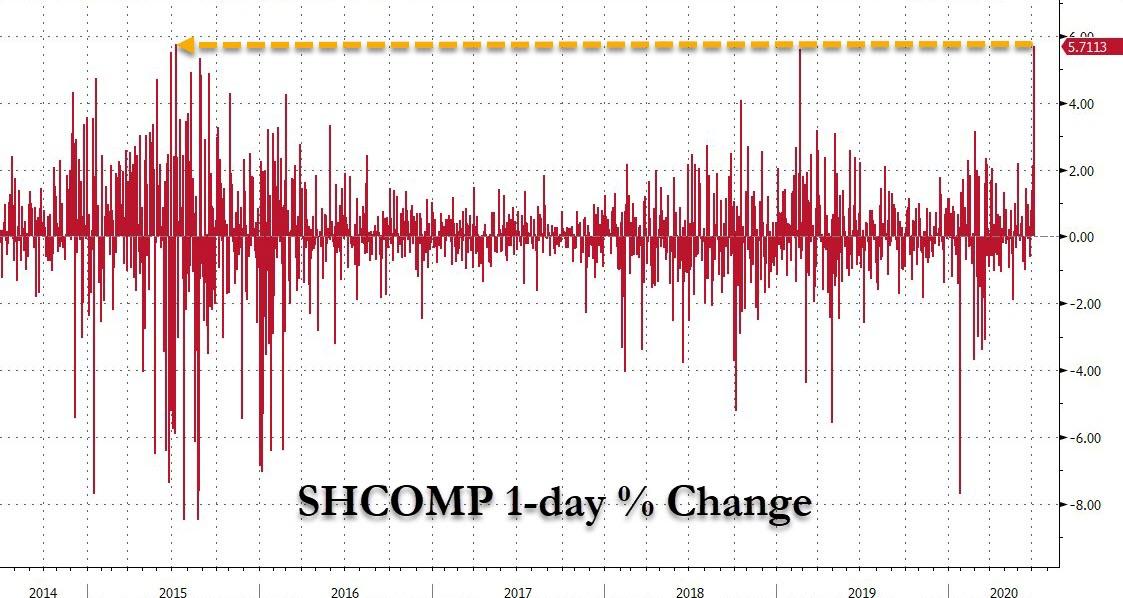

In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan climbed 1.6% to its highest since February, with the bullish sentiment spilling into other markets. China’s Shanghai Composite surged 5.7% on top of a 7% gain last week to the highest level in five years. Even Japan’s Nikkei, which has lagged with a soft domestic economy, managed a rise of 1.8%.

A front-page editorial in China’s Securities Times on Monday said that fostering a “healthy” bull market after the pandemic is now more important to the economy than ever, as there now appears to be a full-blown race between the US and China who has a bigger stock bubble.

It’s now a race whose bubble is biggest https://t.co/PTTWCIRs1k

— zerohedge (@zerohedge) July 6, 2020

https://platform.twitter.com/widgets.js

Similar to the US daytrading euphoria, Chinese social media has exploded with searches for the term “open a stock account,” with bullish sentiment also lifting the yuan. The Shanghai Composite Index closed up 5.7%, the biggest advance since 2015.

In Hong Kong, Jefferies chief global equity strategist Sean Darby said the positive sentiment towards Asian markets was the result of better than expected regional economic data and elevated liquidity levels. “All of the global monetary policy indicators are flashing green right now. It is very loose and that should mean markets which have underperformed should do well,” Darby told Reuters. “The dollar has also been weaker over the past five days so emerging markets, led by China, normally do well on that back of that.”

Among the reasons investors cited for the buying was improving economic data – UBS noted Citi’s Economic Surprise Index for the U.S. has risen to its highest level on record. The index measures how well economic data releases are faring relative to consensus forecasts.

“We advise against regarding uncertainty as a reason for exiting markets. Instead, we see ways for investors to cope with uncertainty – including averaging into markets – or even take advantage of volatility,” said Mark Haefele, chief investment officer at UBS Global Wealth Management.

Ironically, the surge comes just hours after JPMorgan said the risk-reward in 2H Is ‘Unattractive’ (which in turn comes just two weeks after the bank upgraded US stocks to Overweight), and after Goldman Sachs cut estimates for U.S. growth this quarter and said consumer spending appears likely to stall this month and next. Still, economists led by Jan Hatzius said other economies have proved it’s possible to resume activity and changes in behavior such as wearing masks will help too.

“The willingness of investors to look through the current disruption to an anticipated recovery this quarter is imperiled by still rising virus infection rates,” said Michael McCarthy, a markets strategist at CMC Markets Plc in Sydney.

Meanwhile, confirming that away from markets the reality is getting more concerning by the day, two U.S. aircraft carriers conducted exercises in the disputed South China Sea on Saturday, the U.S. Navy said, as China also carried out military drills that have been criticised by the Pentagon and neighbouring states.

The risks, combined with unceasing stimulus from central banks, have kept sovereign bonds supported in the face of better economic data. While U.S. 10-year yields edged up to 0.7% on Monday, well off the June top of 0.959%. Germany’s benchmark 10-year Bund yield edged up, pulling further away from recent five-week lows in the face of rallying equity markets.

Analysts at Citi estimate global central banks are likely to buy $6 trillion of financial assets over the next 12 months, more than twice the previous peak.

In FX, major currencies were largely rangebound with the dollar index down 0.3% at 96.894, having spent an entire month in a snug band of 95.714 to 97.808. The Bloomberg Dollar Spot Index fell a fifth day after a slowdown in the U.S. infection rate and a call by Chinese state media to support a bull market spurred risk appetite. The dollar was a shade firmer on the yen at 107.57 on Monday, while the euro rose above the $1.13 mark. The Norwegian krone and Swedish krona led advances against the greenback among G-10 currencies. The rise in Brent crude underpinned the krone.

The yuan led commodity currencies higher against the dollar on Monday as investors lapped up risky assets on growing expectations of a strong Chinese economic rebound and the United States continued to report a surge in coronavirus infections. “The rally in mainland China equities has been the big catalyst,” said Stephen Gallo, European head of FX strategy at BMO Financial Group. “The only caveat is that China’s economy not driven purely by free-market forces. But if regulators in China are engineering a stronger equity market, it can still feed through to the rest of the world.”

“Risk appetite is higher as reflected in Asian stock markets and the Australian dollar, and the U.S. dollar is down because of that,” said Janu Chan, senior economist at St. George Bank in Sydney. “A global economic recovery, though uneven, is expected to point to a weaker USD over the medium term.”

In commodity markets, oil prices were mixed with Brent crude futures up 1.87% at $43.58 a barrel, while U.S. crude gained 0.84% to $40.99 amid worries the surge in U.S. coronavirus cases would curb fuel demand. Gold traded at $1,776.21 per ounce, just off last week’s peak of $1,788.96. The precious metal continues to benefit from super-low interest rates across the globe as negative real yields for many bonds make the non-interest paying metal more attractive. Copper is on the cusp of erasing this year’s losses after virus-related disruptions tightened supplies.

Expected data include PMI and ISM Non-Manufacturing Index. Immunomedics reports earnings

Market Snapshot

- S&P 500 futures up 1% to 3,159.50

- MXAP up 1.6% to 164.57

- STOXX Europe 600 up 1.6% to 371.12

- German 10Y yield unchanged at -0.432%

- Euro up 0.3% to $1.1285

- Brent Futures up 1.8% to $43.57/bbl

- Italian 10Y yield rose 4.3 bps to 1.127%

- Spanish 10Y yield fell 0.3 bps to 0.443%

- MXAPJ up 1.7% to 542.15

- Nikkei up 1.8% to 22,714.44

- Topix up 1.6% to 1,577.15

- Hang Seng Index up 3.8% to 26,339.16

- Shanghai Composite up 5.7% to 3,332.88

- Sensex up 1.5% to 36,565.50

- Australia S&P/ASX 200 down 0.7% to 6,014.61

- Kospi up 1.7% to 2,187.93

- Brent futures up 1.5% to $43.46/bbl

- Gold spot up 0.3% to $1,777.41

- U.S. Dollar Index down 0.3% to 96.93

Top Overnight News from Bloomberg

- The dramatic moves in Chinese stocks over the past week are inviting comparisons with a bubble that burst spectacularly five years ago.

- U.S. virus cases increased by 1.2%, less than the seven-day average of 1.8%. A former Food and Drug Administration head said the U.S. needs a better pandemic strategy and should start by stockpiling therapeutic antibodies before authorizing their use.

- Chinese companies last month shelved the biggest amount of domestic bond sales in almost three years, after a sell-off in government debt pushed up corporate borrowing costs.

Asian equity markets and US equity futures began the week mostly firmer as trade picked up from the holiday lull in which the broad heightened risk appetite consigned the increasing COVID-19 infection rates to the backseat. ASX 200 (-0.7%) and Nikkei 225 (+1.8%) were mixed as the Australian benchmark lagged due to weakness in industrials and the commodity related sectors and with sentiment also subdued by rising infections in the country’s 2nd largest city of Melbourne which prompted the Victoria state government to close the border with New South Wales from tomorrow, while Tokyo stocks coat-tailed on the favourable currency flows and after the decisive victory by Tokyo Governor Koike at the gubernatorial election on Sunday. Hang Seng (+3.8%) and Shanghai Comp. (+5.7%) surged despite the lack of solid fundamental catalysts and amid the ongoing global reproach towards China with Canada suspending its extradition treaty with Hong Kong in the wake of the security law and with the UK set to end the use of Huawei technology in the 5G networks as early as this year due to security issues, while it was separately reported that China is considering retaliatory measures against Britain and Australia in the form of increased tariffs. Nonetheless, this failed to impede the rally in Chinese stocks and the mainland bourse extended to its highest level seen since the beginning of 2018 with financials leading the ascent amid increased IPO activity and after the latest PBoC survey showed the loan demand index surged to 75.8 in Q2 vs. Prev. 66.0 in Q1. Finally, 10yr JGBs were lower amid similar weakness in T-notes as havens were shunned by the heightened risk appetite, which saw prices retreat further away from resistance near 152.00, but with downside also stemmed by the BoJ’s presence in the market whereby it upped purchases of 5yr-10yr maturities.

Top Asian News

- China Stokes a Stock-Market Mania, Risking Repeat of 2015 Bubble

- Hong Kong Stocks Enter Bull Market After $1.1 Trillion Rebound

- Chipmaker SMIC Eyes China’s Biggest Share Sale in a Decade

- World’s Largest Listing of 2020 Comes From China: ECM Watch

- Tokyo Finds 102 Virus Cases as It Tries to Avoid Mass Curbs

European stocks kick the week off on a firm footing [Euro Stoxx 50 +1.9%] albeit off highs, but nonetheless supported by the stellar Chinese performance which saw the Shanghai Comp rally over 5% amid a number of factors including commentary from Securities Times which suggested that fostering a “healthy” bull market is now more important to the economy than ever. The article said investors could look forward “to the wealth effect of the capital markets”. This coupled with Friday’s announcement of easing margin financing rules stoked gains in the Mainland whilst Hong Kong’s Hang Seng ended the day in bull market territory – some 21% off March lows. Gains in Europe are broad-based with the SMI (+0.8%) somewhat lagging amid its heavy exposure to the health sector – which lags amid inflows into cyclicals. Sectors are all in positive territory with cyclicals outpacing defensives on the constructive risk tone, whilst the detailed breakdown paints a similar picture; Travel & Leisure names piggyback on the risk appetite and reside among the winners. In terms of individual movers, UK housing names were bolstered at the open on the back of reports the Treasury is said to plan to increase the property tax threshold to as high as GBP 500,000. As such, Persimmon (+5.7%), Barrat Development (+6.7%) and Taylor Wimpey (+5.0%) hold their positions as the top Stoxx 600 gainers. GSK (+1.3%) and Sanofi (+0.8%) performs better than the overall Health sector amid reports the Cos are close to agreeing a GBP 500mln deal to supply the UK government with 60mln doses of its COVID-19 vaccine, should it work in human trials due to begin in September. Commerzbank (+6.0%) derived support from reports Co. is said to be mulling cuts to its foreign business as part of its revised strategy – which would include cutting 450/1000 branches, 10k job cuts in total and cuts to the international businesses. Finally, no reprieve for Wirecard (-17%) as FT reported the Co’s European and American core businesses have reportedly been lossmaking for years, with profits appearing to have largely existed on paper, according to the KPMG confidential appendix of the special audit.

Top European News

- German Factory Orders Rise Less Than Forecast After Lockdown

- Banks Are Ditching London Offices and Not Just Because of Covid

- Rolls-Royce Seeks Pension Halt to Save Cash in Virus Crunch

- Cerberus Urges Orderly Process After Commerzbank CEO Ouster

In FX, broad USD weakness after the long US holiday weekend amidst a pronounced upturn in risk sentiment on the back of bullish Chinese stock market remarks in the Securities Journal overnight that has boosted the YUAN from a fractionally softer PBoC midpoint fix through a key Fib (7.0441) to test 7.0300 in both onshore and offshore terms. The DXY has lost grip of the 97.000 handle in response and is hovering just above a 96.818 low awaiting final Markit services and composite PMIs, the non-manufacturing ISM and employment trends.

- NOK/EUR/AUD – The major beneficiaries of heightened risk appetite, also manifest in firm crude prices, and general Greenback weakness, as Eur/Nok nudges down towards 10.6000 and Eur/Usd extends above several chart resistance levels, like the 100 and 200 HMAs plus a Fib retracement (1.1241, 1.1243 and 1.1157 respectively) to retest 1.1300. Meanwhile, the Aussie has revisited near 1 month peaks around 0.6980 in the run up to the RBA policy meeting on Tuesday and potential reaction to the renewed COVID-19 outbreak in the state of Victoria.

- NZD/CHF – Both firmer vs their US counterpart as the Kiwi holds near 0.6550 and Franc close to the upper end of a 0.9462-14 range in advance of NZIER’s Q2 survey, but with Eur/Chf acknowledging latest Swiss bank sight deposit rises more than Fitch’s AAA ratings affirmation between 1.0650-25 parameters.

- CAD/GBP/JPY – All narrowly mixed, as the Loonie meanders from 1.3520-65 against the backdrop of buoyant oil benchmarks and eyeing the looming BoC outlook survey for some independent direction, while Cable has ventured beyond 1.2500, but unsustainably despite a significant rebound in the UK construction PMI. Elsewhere, the Yen is marginally lagging on less safe-haven demand, albeit vying with the Dollar on risk factors, with the headline pair in a relatively tight 107.77-49 band and hardly reacting to BoJ sources suggesting that the Bank will stick to view for as gradual economic recovery in the latter part of 2020.

- EM – The Lira remains tethered to 6.8500 even though the Turkish Government has taken more measures to restrict negative positioning in stocks from foreign entities via a short-selling for 6 banks for up to 3 months.

In commodities, WTI and Brent crude futures extended on APAC gains in early hours as the contracts coat-tail on the overall risk appetite across the market as rising COVID-19 cases across the globe are somewhat side-lined, albeit prices have since waned off highs. The fundamental landscape is little changed but from the supply slide of the equation, OPEC’s JMMC is set to meet mid-July ahead of the planned tapering of cuts in August – with the Committee set to advise OPEC as opposed to setting policy. On that front, Saudi Aramco upped the price for its flagship Arab Light grade to Asia by USD 1/bbl from July – alluding to firmer demand in the region. Looking ahead, the week will see the release of the EIA STEO and IEA Monthly Oil Market report ahead of OPEC’s take next week. WTI and Brent futures reside under USD 41/bbl (vs. low 40.20/bbl) and below USD 43.50/bbl (vs. low 42.74/bbl) respectively. Elsewhere, spot gold remains underpinned on Dollar-dynamics around the USD 1775/oz mark ahead of its recent almost-8yr peak at around 1789/oz. Copper prices receive a double boost from the softer Buck coupled with the surge in Chinese stock markets – with the red metal reclaiming USD 2.75/lb to the upside and nursing steep losses posted at the latter end of last week.

US Event Calendar

- 9:45am: Markit US Services PMI, est. 47, prior 46.7; Markit US Composite PMI, prior 46.8

- 10am: ISM Non-Manufacturing Index, est. 50, prior 45.4

DB’s Jim Reid concludes the overnight wrap

As you may have seen late last week, Torsten Slok is leaving DB to join a good client of the bank. We wish him well in the future and will try to persuade him to vote for DB Research in all the analyst surveys now. I will be taking over responsibilities for sending out DB charts of the day and will also be sending out repackaged chart books soon. If you’ve previously got Torsten’s emails then you’ll be continuing to get them from me. If you didn’t get anything from Torsten and want to be included then please send me an email. I sent my first missive out to 30,000 new people on Friday and it ended up taking me five hours and ended up with my mail account suspended with a third left unsent. So if I don’t reply to anyone today you’ll know why. Off to speak to IT first thing this morning. We think we have a solution. Thankfully the EMR distribution list is handled externally so I don’t have to worry about that.

As the US comes back from the long weekend it’s difficult to make too much of the weekend’s covid-19 new cases and fatality data. The weekend normally sees some under reporting but on a holiday weekend that could be magnified. However in my opinion the trend remains the same. A continued strong rise in new cases but fatalities that aren’t going up anywhere near as much as they did in the first wave even with the appropriate lag. Overall, cases in the US surged by an average of +1.7% over the weekend versus an average of +1.9% in the five days prior while fatalities on average rose by +0.2% as against an average of +0.6% in the five days prior. At a state level, California, Florida and Arizona saw cases rise +2.1%, +5.3% and +3.7% yesterday respectively. In the short-term this surge in cases isn’t good news for the US economy’s reopening pace. However if we continue to see fatalities much lower in this second wave then it should give us more medium-term confidence that we are getting better at treating the virus or protecting the most vulnerable. Let’s see where the data is by mid-week to further reflect on whether we’re correct or not. Our H2 2020 credit outlook (link here) partly rests on this view so we’ll be watching carefully.

In terms of markets this morning we’ve seen big gains for the Shanghai Comp (+4.24%) and Hang Seng (+3.45%). Those moves are being attributed to positive commentary on the stock market from Chinese state media, namely a front-page editorial in the Securities Times which suggested that a “healthy” bull market after the pandemic is now more important to the economy than ever. The Nikkei (+1.67%) and Kospi (+1.72%) are also up however gains have been more modest while the ASX is flat. Yields on 10y USTS are up +2.6bps while futures on the S&P 500 are also up +1.14%.

In other news, ECB President Lagarde said over the weekend that the euro zone faces about two years of disinflation, followed by inflation as the coronavirus crisis accelerates the transformation of the economy towards greater digitization and automation. She added that the ECB will need to keep its monetary policy exceptionally loose, and financial instruments will need to be developed that allow the economic transformation to be funded. Meanwhile, Bank of France Governor Francois Villeroy de Galhau said the country’s economy is picking up faster than expected and that forecasts from the IMF may be too gloomy.

Moving on. As the US comes back after the Independence Day holiday, one of the main data releases this week will be the ISM non-manufacturing index today, along with the services and composite PMIs. The ISM manufacturing release already surprised to the upside at 52.6, its highest since April 2019 and above the 50-mark that separates expansion from contraction. So the question will be whether this momentum has been seen elsewhere in the economy. Otherwise in the US, investors will also be attuned to the weekly initial jobless claims on Thursday. These have been worse-than-expected for 3 consecutive weeks now, and are still running at more than double their pre-Covid record, raising concerns that the pace of improvement in the labour market is slower than had originally been hoped for. This theme may continue with the second virus wave sweeping through the US.

In terms of data elsewhere, the releases are somewhat more backward-looking in Europe now that the PMI releases are out. Today will see the release of Euro Area retail sales for May, while Germany, France and Italy will all be releasing their industrial production data for May through the week. Elsewhere, China will be releasing CPI and PPI data for June on Thursday.

Here in the UK, Chancellor Sunak will be delivering a statement in the House of Commons on Wednesday. It might be a bit early to get full clues as to how policy will change post crisis but markets will look for evidence as to how much fiscal policy will be unleashed going forward. The worry for some so far is that the words are big but the numbers relatively small. So one to watch. Against this backdrop, the UK and the EU will continue their discussions on their future relationship in London this week. That comes after last week’s negotiations, where chief EU negotiator Michel Barnier said that “serious divergences remain”, and on the UK side chief negotiator David Frost said that the talks had “underlined the significant differences that still remain between us on a number of important issues.”

Recapping last week now and also Friday’s news. It was a fairly quiet end to the week for markets with the US out on holiday. However, European equities pared back their gains from earlier in the week to close the 5 days with a +1.98% advance (-0.78% Friday). This was in spite of some fairly positive services and composite PMI data from Europe, with the numbers generally revised up relative to the flash readings, a picture consistent with the fact that the extra data covered a longer period of reopening. In terms of the specific numbers, the composite PMI for the Euro Area was revised up to 48.5 (vs. flash 47.5), while France at 51.7 and Germany at 47.0 also saw upward revisions relative to the flash print. In all these cases, as well as in Spain and Italy, the composite PMIs were at their strongest level since February, though it’s worth noting that only France had a reading above the 50-mark separating expansion from contraction.

Although Europe fell back somewhat, the broader picture of the week was still one of a rotation out of safe havens into risk assets. By the end of the week, the S&P 500 was up +4.02% albeit with futures down just under 0.5% on Friday as the US was closed. Meanwhile core government bonds lost ground, with yields on 10yr Treasuries and bunds up +2.8bps and +4.9bps respectively, as the US Dollar index (-0.27%) and the Japanese Yen (-0.27% vs USD) both lost ground through the week. Peripheral bonds advanced however, with the spread of both 10yr Italian (-8.7bps) and Spanish (-6.1bps) debt over bunds tightening.

One news report that might be worth noting from Friday was a Bloomberg article saying that there was a rift on the Governing Council over the extent to which the ECB’s asset purchases should deviate from the capital key – which is based on countries’ GDP and population size. The deviation from the capital key in the ECB’s Pandemic Emergency Purchase Programme (PEPP) has allowed them to purchase larger amounts of Italian debt than the capital key would suggest, but the article cited officials who said that views differed among the members on this issue. One to watch moving forward.

And finally, we also got some political news out of France, as President Macron named Jean Castex as the new Prime Minister. French presidents have previously ditched their PMs mid-term, so this wasn’t an exceptional move, and marks an attempt at revitalising his presidency following some poor municipal election results in June. Castex was previously in charge of coordinating the 2024 Olympic Games in Paris and managed the government’s lockdown exit strategy, which has been perceived as a success.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com