Some See A Dark Cloud Hanging Over The European Rally

Tyler Durden

Wed, 07/08/2020 – 02:00

Authored by Bloomberg macro commentators Jan-Patrick Barnert and Michael Msika

Equities are still creeping higher even as more voices become cautious about the market rally. Although bulls and bears both have valid arguments, it seems that the technical data could flip the balance in favor of the latter.

European stocks just hit a one-month high and the daily Euro Stoxx 50 Future chart is knocking at the 200-day moving average again — a mark that saw a sharp three-day decline in June when the market was overheating from its previous rally. Overcoming this strong resistance could spur further gains for the index.

Yet relative strength indicators are very close to being overbought, which may suggest that potential gains could be limited.

With charts trading in such a range for the past weeks “short-term positioning has been a challenge,” writes LCM technical analyst Andy Dodd in a note to clients.

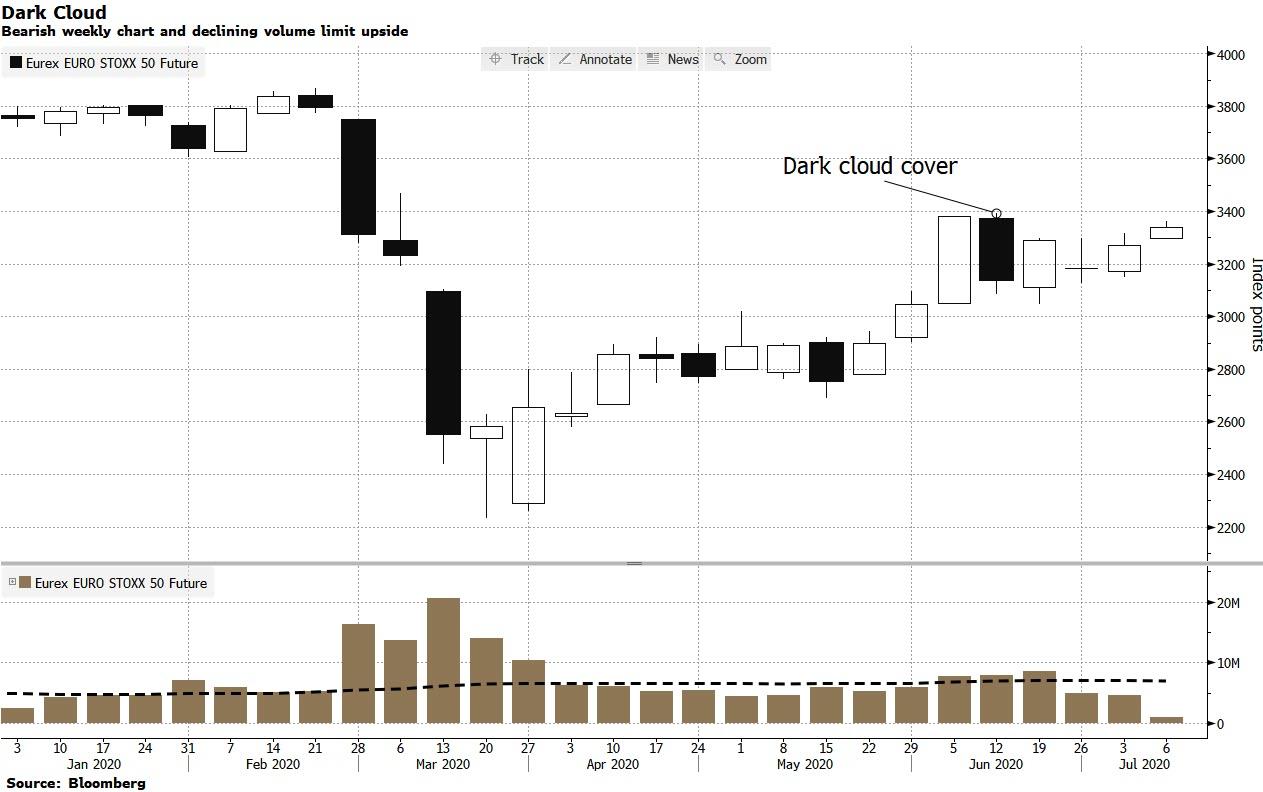

There’s also some ominous bearish signals hanging over markets for the longer term. A few weeks ago, the weekly chart for the Euro Stoxx 50 Future showed a so-called bearish Dark Cloud Cover candle as the future sold off from the cluster of moving averages. “That candle suggested limited upside in this time frame and was the reason I sold the rally,” says Dodd.

His cautious comments are echoed by Christian Curac, a technical analyst at Fuerst Fugger Privatbank AG, who notes that consolidation, with shares trading within a range, is still the name of the game in the medium-term. We “therefore consider the upside potential to be limited,” Curac says by email. “Defensive positioning appears advisable from a risk-return perspective.”

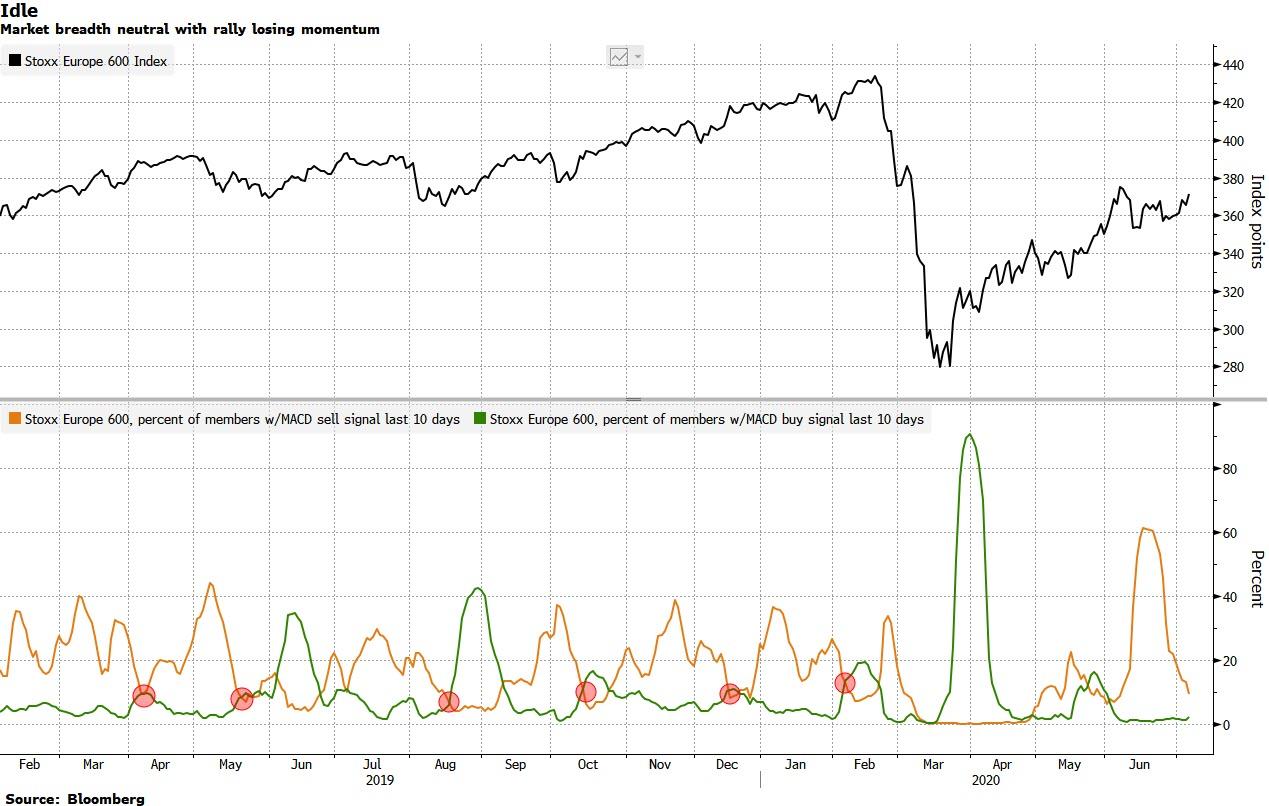

Turning to market breadth, the picture is neutral at best. There’s been a visibly steady decline in trading volume in cash and futures since the peak in June, suggesting investors are less engaged amid warnings not to chase the rally.

The picture would fit the view of Citigroup Inc. strategists that bullish and bearish forces will cancel each other out over the next few months. With the massive stimulus and improving economic backdrop on one side, and weak earnings and rising Covid-19 infections on the other, the preference is to wait for the next dip, they say.

To be sure, in this sideways environment, some investors might be tempted to listen to Morgan Stanley strategist Graham Secker, who thinks it makes sense to “keep things simple.” Improving economic data at the start of a new cycle, strong monetary and fiscal policy support, and muted investor participation in the rally to date ultimately implies an upbeat environment for stocks, he says.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com