The Fed Put Narrative Era

Tyler Durden

Sat, 07/11/2020 – 17:35

Submitted by The Swam Blog,

For years, I have heard fund managers and economists claiming that “a financial crisis is unlikely as long as central banks intervene”. This postulate has been the foundation of the well-known “Fed put”. Stocks should only go up thanks to monetary policy.

The past ten years have reinforced that conviction, since all the actions of the Fed and the ECB had strong positive impact on risky assets. But, as Tyler Durden would say, “on a long enough timeline the survival rate for everyone drops to zero”.

In fact, if you study economic history, then you are likely to realize that such relationship between money supply and asset prices has no real foundations. Besides, the purchasing power of money theory tells us that increasing money supply can lead to higher prices, but only if the so-called velocity of money does not decrease. Thus, velocity is a key variable. When it comes to investment, it seems that velocity is mostly driven by psychological factors. In other words, if QE has become so bullish for stocks or bonds, it is mainly because people believe that it is.

Therefore, everyone should remember that “the greatest trick the devil ever pulled was convincing the world he didn’t exist”. Not only can the market drop despite the Fed, but it might crash precisely because of such dominant belief.

Intersubjective Markets and Narratives

Intersubjectivity can be thought as a share agreement of meanings between multiple people. According to Yuval Noah Harari, without intersubjective frameworks like religions, governments, money, firms, etc., anatomically modern humans would not be able to form and control large social groups.

Financial markets can also be treated as an intersubjective framework. From that perspective, a market narrative can be defined as a subculture (or ideology) common to multiple investors, sharing a common vision on how markets work and how assets are priced.

Without narratives, there would be no bull or bear markets. Of course, bull markets can be driven by positive news such as earning growth. However, speculative bubbles would make no sense without intersubjectivity. The concept of narratives is the key to understand how markets work and how investor price assets.

The “Fed put” can regarded as the dominant narrative since 2009. And it has become so dominant that Nasdaq stock prices have disconnected from economic fundamentals like they did in 1999.

Fractals and Avalanches

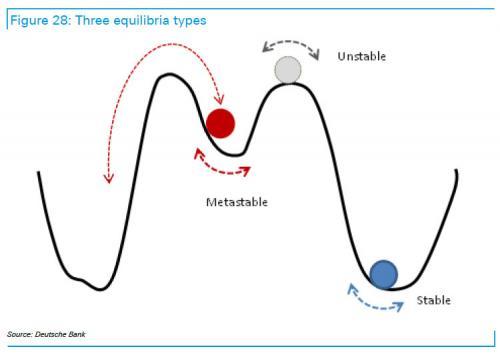

Today, equity markets seem to display a macro-behavior, since almost everyone has turned bullish. Despite a few skeptical folks, even pessimistic investors have resigned themselves to the idea that markets would not drop anymore because of Jerome Powell. In other words, a form of order has emerged (i.e. low entropy), and the market has reached a critical state.

The problem is that such a state is very unstable, and a fast reversal becomes more and more likely. What could be the trigger? It could be anything like the acceleration of the pandemic, bankruptcies, geopolitical tensions, etc. However, answering this question is not essential.

Indeed, the bubble has been driven by endogenous feedback loops. So, the market can crash without any obvious reason. This is what we observed on US equity markets in 1929, 1987 and 2000. And this is also how ended the bitcoin mania in 2017, and the China A shares rally in 2015.

What we know so far is that a reversal can lead to a significant volatility spike since the apparent order will be suddenly broken.

Hidden Risks Behind the Tech Rally

Some physicists state that the whole boom and bust process can be captured using the so-called log-periodicity power law singularity (LPPLS) model. Whether it is purely theoretical or not, the model indicates that Nasdaq euphoria is likely to terminate by the end of the summer (see It is All About Waves – Tech Stocks and The Log-Periodicity Power Law Singularity Model and We Are Warned – Precisions About the Log-Periodicity Power Law Singularity Model).

Beyond that statistical prediction, it is important to have a look at technicals as the current trend looks quite unsustainable (see Sven Henrich’s chart above) with numerous unfilled gaps below. And while the Nasdaq is breaking records every day, the VIX remains at historically high levels.

At this stage, the question is, what will support the market if the dominant narrative is broken? The Fed has our backs, until it has not. Extreme concentration and short-volatility bets are major risks for equity investors, especially Robinhood retail traders.

As Nassim Nicholas Taleb says, “missing a train is only painful if you run after it”.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com