Another Iconic Deflationist Capitulates: According To Russell Napier, “Control Of Money Supply Has Permanently Left The Hands Of Central Bankers

Tyler Durden

Sun, 07/12/2020 – 16:05

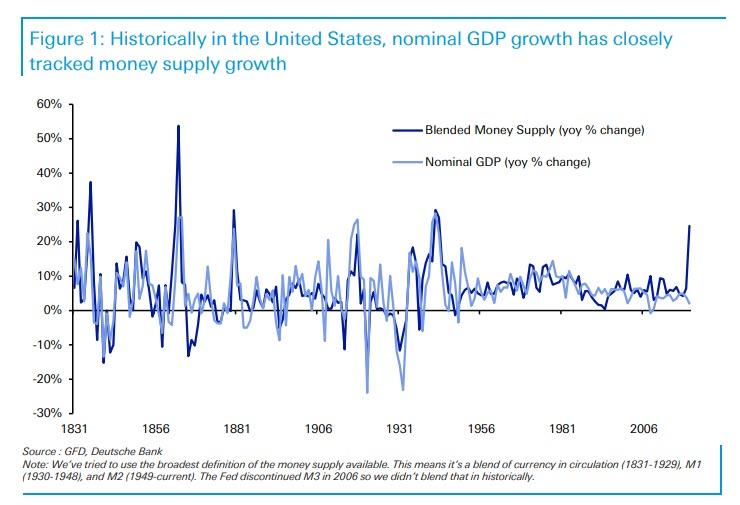

One by one the world’s legendary deflationists are taking one look at the following chart of the global money supply (as shown most recently by DB’s Jim Reid) and after seeing the clear determination of central banks to spark a global inflationary conflagration, are quietly (and not so quietly) capitulating.

One month ago it was SocGen’s Albert Edwards, who after calling for a deflationary Ice Age for over two decades, finally threw in the towel and conceded that “we are transitioning from The Ice Age to The Great Melt” as “massive monetary stimulus is combining with frenzied fiscal pump-priming in an attempt to paper over the current slump.”

At roughly the same time, “the world’s most bearish hedge fund manager“, Horseman Global’s Russell Clark reached a similar conclusion writing that “all the reasons that made me believe in deflation for nearly 10 years, do not really exist anymore. China looks okay to me, and potentially very good. Commodity supply is getting cut at a rate I have never seen before. The US dollar is strong but will likely weaken from here. And it is clear to me Western governments will only ever attempt fiscal austerity as a last resort, not a first. The conditions for both good and bad inflation are now in place.“

And now, it is the turn of another iconic deflationist, Russell Napier, who in the latest Solid Ground article on his Electronic Research Interchange (ERIC) writes that “we are living through another deflation shock but [he] believes that by 2021 inflation will be at or near 4%.”

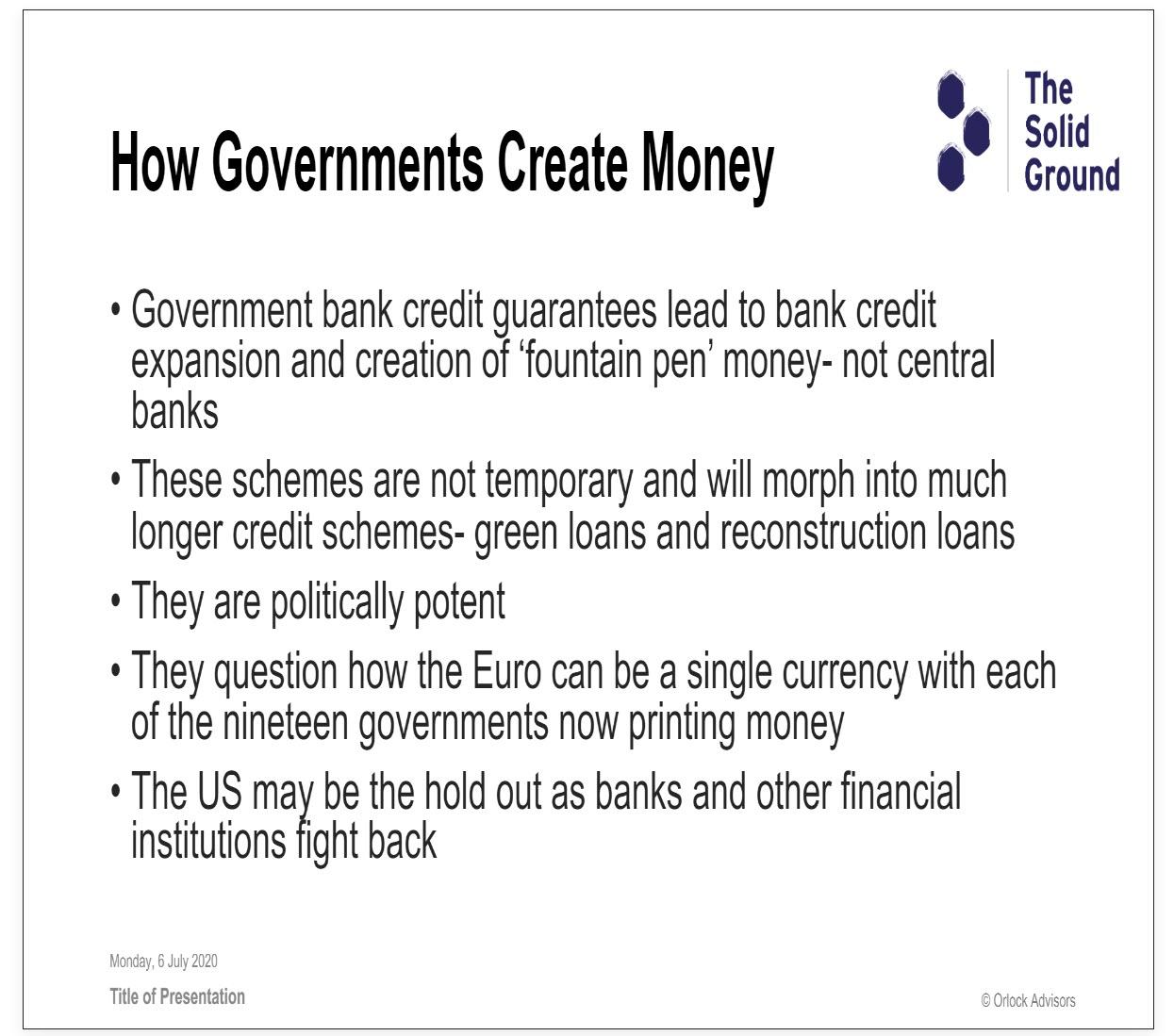

Why the historic shift in monetary perceptions? Because similar to Albert Edwards’ conclusion that MMT, i.e., Helicopter Money, is a gamechanger, Napier writes that “what has just happened is that the control of the supply of money has permanently left the hands of central bankers – the silent revolution.” As a result, “the supply of money will now be set, for the foreseeable future, by democratically elected politicians seeking re-election.” His conclusion: “it is time to embrace the silent revolution and the return of inflation long before such permanency is confirmed.“

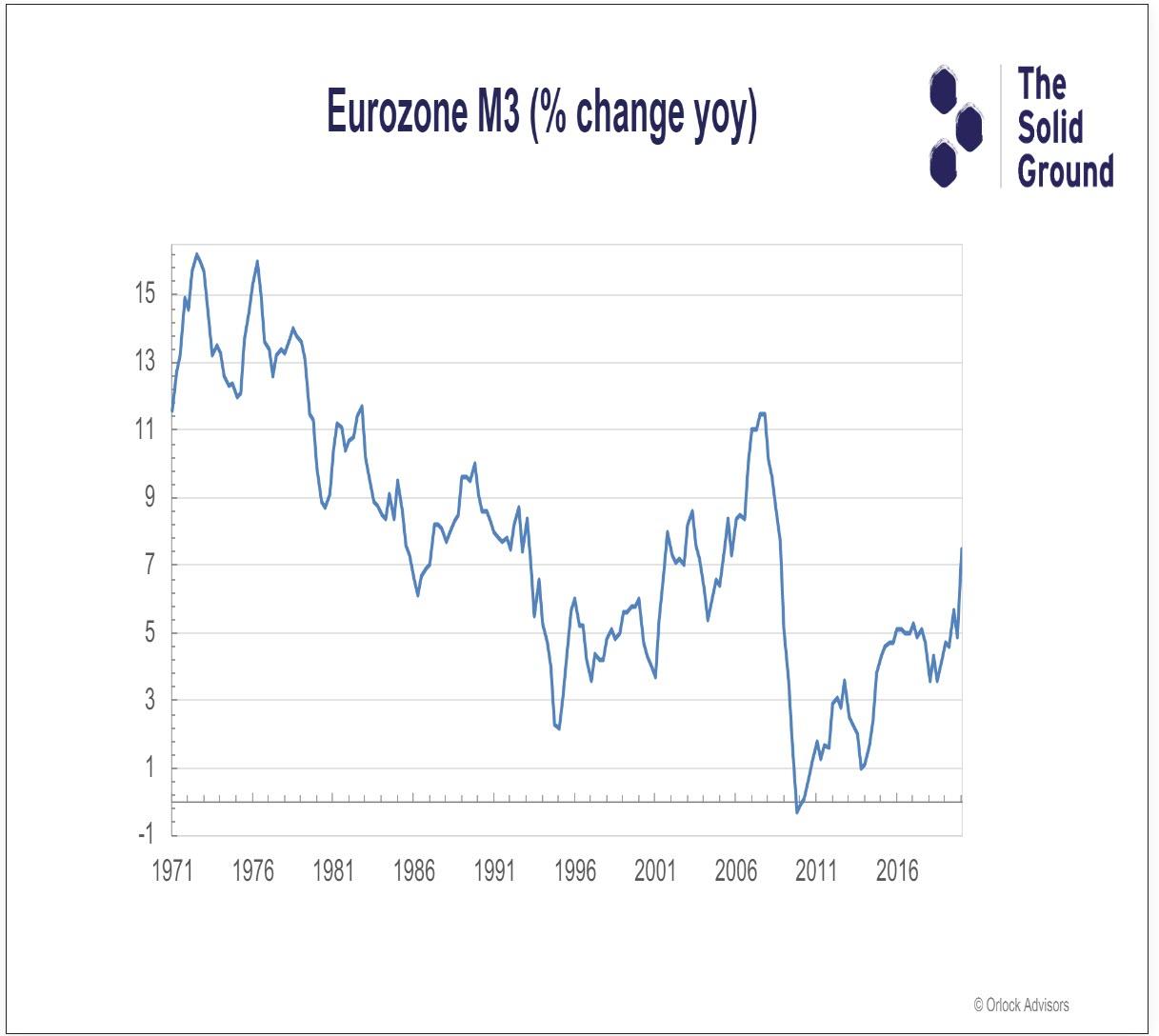

What does this mean for asset prices? According to Napier, “a trading opportunity does now exist in European equities in particular. With the impact of bank credit guarantees not yet fully positively impacting broad money growth, we can expect Eurozone broad money growth to go even higher. Eurozone M3 is already growing at 8.9% year on year and in just a few months will likely exceed its peak of 2007.”

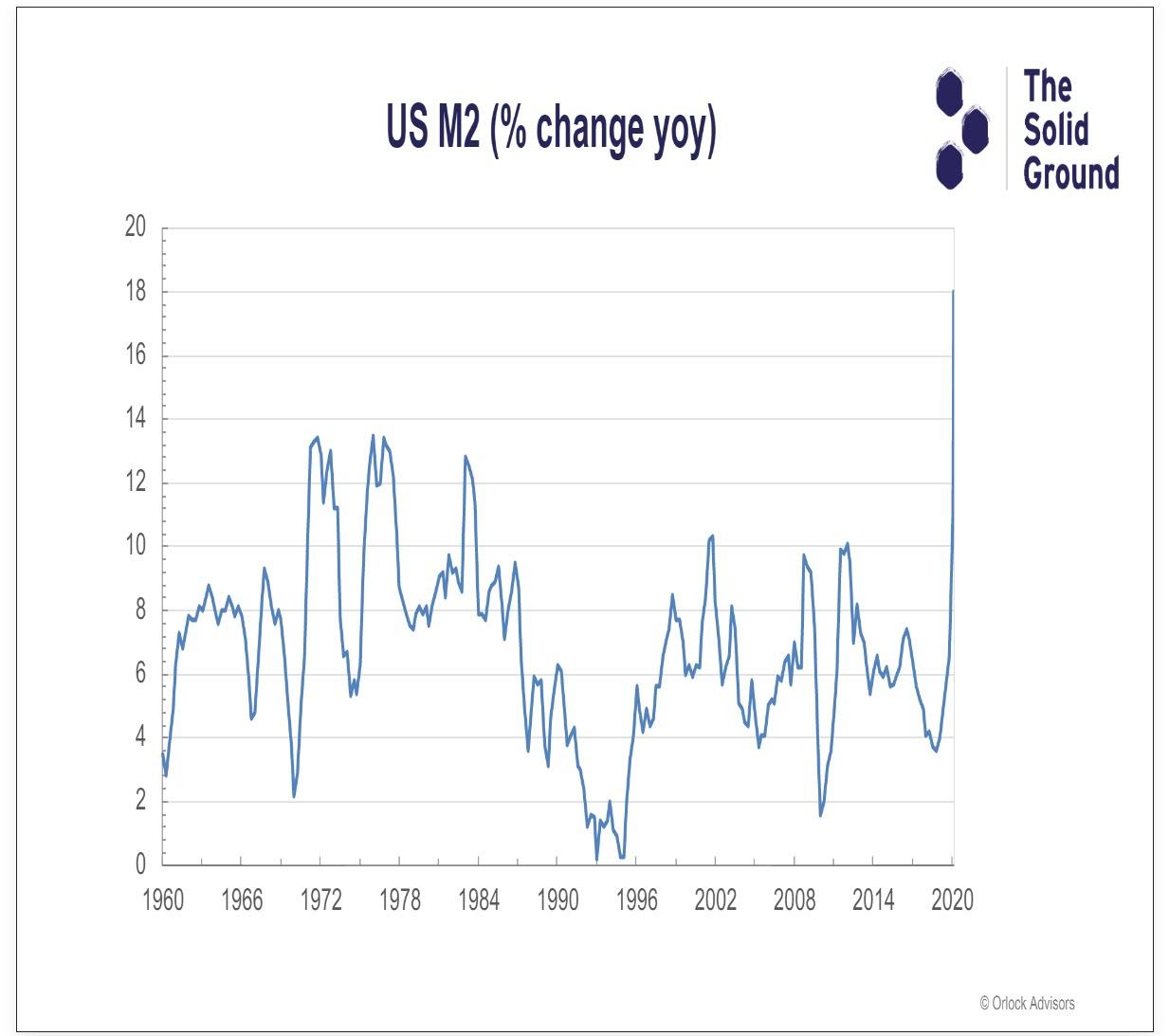

An even more dramatic picture emerges in the US (see top chart), where Napier highlights the surge in M2 which is now the biggest since the Great Depression:

In short, money creation is shifting away from central banks and is being handed off to governments. And that, in a word, will have catastrophic consequences:

This explosion in money supply will eventually have an impact on interest rates with Napier’s best guess is that “ten year bond yields will have to be forced to settle between 2% and 3%. This level comes from working backwards from the highest rate of inflation that governments might dare target to bring escalating debt-to-GDP ratios under control. At levels of annual inflation above 6% there is a growing risk that the velocity of money could shift markedly higher and the prospects of controlling inflation thus reduce.”

The take home here, is that Napier expects inflation to approach 4% by 2020 with velocity of money troughing soon and then surging to 1.4x.

Does the coming surge in inflation mean buy stocks hand over fist? Yes… and no: as Napier explains, “at this stage it is probably best to hold equities as the market begins to discount the silent revolution and, with a lag, inflation itself begins to rise. Should you hold them for the entire journey to 4%? The Solid Ground is skeptical that the rise in equities will last for the duration of inflation’s journey to 4%.“

But what if rates are simply capped a la Japan or the US ca. 1943, with the help of Yield Curve Control? Surely such a disconnect between the yield curve and inflation expectations would be beneficial for stocks? Here, too, Napier pours cold water:

… at some stage in the reflation the government will have to move to cap yields in the knowledge that it is probably too risky to allow inflation to rise above 6%. Many investors seem to believe that this combination of a capped yield curve and rising inflation will be positive for equity prices. That will depend upon what savings institutions are selling in order to fund their compelled purchases of government debt. The most likely asset for liquidation will be equities and, as yields are to be capped possibly for decades, that liquidation could be prolonged.

Needless to say this is clearly at odds with prevailing convention wisdom that yield curve control would “unleash a mindblowing stock rally.” And incidentally Napier seems to agree with this, at least in the short-term:

Time will tell whether that is a good or a bad guess but for now inflation is low, long-term inflation expectations are ridiculously low and equities will benefit from the change in inflationary expectations that are still before us.

While there is much more in the full report below, here are his conclusion:

And so, without further ado, here is Russell Napier and his latest ERI-C note:

Equities & The Rise of Inflation: How Much Inflation Before Repression? (07/07/20)

In 1Q 2009 The Solid Ground called for the bottom of the bear market in equities and then went on to recommend that investors should hold US equities until inflation reached around 4.0%. This proved to be good advice for those who followed it but unfortunately your analyst was not one of them! By 2011 The Solid Ground saw problems ahead for the global banking system in boosting credit growth and thus, with the likelihood that broad money growth would remain anemic, inflation would decline and deflation was likely. Inflation did peak just below 4% in 2011 and by early 2015 the US was indeed reporting mild deflation. The problem was that the journey of inflation from close to 4% back to just below zero was not negative for US equities. Only in the latter period of that journey, when inflation went below 1% and corporate earnings declined, did the S&P500 index decline. The original advice from mid-2009 – hold US equities until inflation nears 4%, even if you think it will subside from that level back towards zero – was the best advice. Now we are living through another deflation shock but The Solid Ground believes that by 2021 inflation will be at or near 4%. Can your analyst take his own advice this time and learn to stop worrying and love the early reflation?

In the 4Q 2019 report (Inflation, Disinflation & Deflation: Their Impact on Equities & Problems for Europe) The Solid Ground revisited the advice from mid-2009 and concluded that those who believed in rising inflation should buy European equities. While that quarterly report forecast a deflation shock, it was clear that European equities would be a major beneficiary of rising inflation if that forecast proved to be wrong. Since the publication of the 4Q report we have had a deflation shock, with probably some expected deflation to come, and equity prices and inflation break-evens on Indexed Linked Bonds (ILBs) have moved sharply lower. If European financial markets were pricing in prolonged low inflation in December 2019, they are pricing in even lower inflation now. So if The Solid Ground is correct in expecting inflation, even in the Eurozone, to near 4% by next year, there must be an opportunity to profit from a rise in European equity prices?

A trading opportunity does now exist in European equities in particular. With the impact of bank credit guarantees not yet fully positively impacting broad money growth, we can expect Eurozone broad money growth to go even higher. Eurozone M3 is already growing at 8.9% year on year and in just a few months will likely exceed its peak of 2007. Most investors your analyst has spoken to in the past few weeks then expect bank loan growth and money supply growth to subside, as emergency lending ends, and this brief surge in broad money growth to become an historical aberration with almost no impact on inflation. While that is possible, The Solid Ground believes it is not probable as politicians fully recognize the possibilities of commercial bank balance sheet control and launch a series of new initiatives, probably focused on guarantees on loans for green initiatives. The more the duration of this guaranteed lending extends, the more investors will come to realize that there is nothing temporary regarding governments use of commercial banks balance sheets to create credit and in the process to create money. Already the Spanish government’s bank credit guarantee programme has been extended from EUR100bn to EUR150bn. While cautious investors will want to wait to see the permanency in the bank credit guarantee policy, your analyst suggests it is time to embrace the silent revolution and the return of inflation long before such permanency is confirmed.

It is now probable that deflation will be reported across the developed world. It might also be somewhat irrelevant for investors. If The Solid Ground is correct what has just happened is that the control of the supply of money has permanently left the hands of central bankers – the silent revolution. The supply of money will now be set, for the foreseeable future, by democratically elected politicians seeking re-election. Imagine two economies, identical in every way, except that in one an independent central banker seeks to control the supply of money while in another a democratically elected government directly determines the supply of money through commercial bank balance sheet control. Would these two economies have the same level of long-term interest rates? The Solid Ground’s answer to that question is that they would not and it is because they would not that long-term interest rates should now rise – even if the near term outlook is for deflation. The 2Q 2020 report (The Birth of the Age of Inflation: Why It Is Now and What to Own) shows just how governments have seized control of money creation and thus your analyst believes that financial markets will soon be pricing in this silent revolution long before the inevitable inflation, governments so crave, has actually been created.

So at this stage it is probably best to hold equities as the market begins to discount the silent revolution and, with a lag, inflation itself begins to rise. Should you hold them for the entire journey to 4%? The Solid Ground is skeptical that the rise in equities will last for the duration of inflation’s journey to 4%. The key reason for that skepticism is that it seems highly unlikely that governments will accept the likely long-term interest rates that would probably follow if inflation reached 4%. With total debt-to-GDP ratios just below record highs before the COVID-19 crisis, they are now spiraling even higher – in both the government and private sectors. These record high debt levels risk crushing any reflation if the cost of interest rises dramatically in any recovery. The Solid Ground has long forecast that no such rise in interest rates will be permitted — see Capital Management in An Age of Repression: A Handbook (3Q 2016). So when might government action begin to stop such a rise in interest rates and what does it mean for equity prices?

Judging what level of long-term interest rates will be deemed unacceptable by policy makers is one of the most difficult calls in investment. It is probable that policy makers do not currently know the answer to that question themselves. They might not know the answer until there are negative economic impacts from higher long-term interest rates and only then might repressive action be triggered. Your analyst’s best guess is that ten year bond yields will have to be forced to settle between 2% and 3%. This level comes from working backwards from the highest rate of inflation that governments might dare target to bring escalating debt-to-GDP ratios under control. At levels of annual inflation above 6% there is a growing risk that the velocity of money could shift markedly higher and the prospects of controlling inflation thus reduce. Perhaps some governments might flirt with higher levels and of course there is always the risk of over-shooting any economic target, whether of a government or a central banker. However if we conclude that governments will not want to risk inflation rising above 6%, what level of long-term interest rates would they need to pull off a successful financial repression? Perhaps they could allow long-term interest rates to reach 3% but as the success of a repression is based primarily upon the gap between inflation and interest rates, any smaller gap might just slow the process of inflating away debts by too much. These are very clearly back of an envelope calculations but they suggest that even if inflation is permitted to rise as high as 6%, investors should expect aggressive moves to repress long-term interest rates once they are even as low as 2% to 3%. Allowing interest rates to rise to higher levels risks too slow a de-leveraging or a need for a rate of inflation that is too destabilizing.

In the last newsletter (The Silent Revolution: How To Inflate Away Debt… With More Debt) The Solid Ground explained why central bankers would not be able to control long-term interest rates in a world of rising inflation expectations. Such a cap on interest rates would only be possible by forcing savings institutions to buy government debt at the targeted yields. So at some stage in the reflation the government will have to move to cap yields in the knowledge that it is probably too risky to allow inflation to rise above 6%. Many investors seem to believe that this combination of a capped yield curve and rising inflation will be positive for equity prices. That will depend upon what savings institutions are selling in order to fund their compelled purchases of government debt. The most likely asset for liquidation will be equities and, as yields are to be capped possibly for decades, that liquidation could be prolonged.

The conclusion from all of the above is that equities will benefit on the road to higher inflation. That will occur even if deflation happens first as markets begin to discount the impact from the shift in the powers of money creation from central bankers to governments. However the move to cap interest rates between 2% and 3% may well come before inflation hits 4%. As one would normally expect long-term interest rates to be above the rate of inflation, a forced purchase of government bonds by savings institutions is likely before inflation reaches 4%. If the move to force savings institutions to cap yields occurs before inflation reaches 4%, then the mass liquidation of equity portfolios by those institutions also begins before inflation hits 4%. That does not suggest that equity prices can rise ever higher into the financial repression and the liquidation may be met by high equity issuance in a period when non-bank debt availability will be significantly curtailed (see The Silent Revolution: How To Inflate Away Debt… With More Debt).

Is your analyst guilty of once again ignoring his own advice? Perhaps, but tactically the advice is the same. Equities can be held as long as the markets continue to discount higher rates of inflation and only when the move to the forced purchase of government debt securities is likely is that upward movement in equities likely to end. We cannot be sure when that will be but should receive some warning on the timing as higher longer term interest rates begin to impinge on the economic recovery. Your analyst, seeing this move as part of a much longer financial repression, would be surprised if long-term interest rates were allowed to rise above the 2% to 3% level, given the implications for the acceptable rate of inflation. Time will tell whether that is a good or a bad guess but for now inflation is low, long-term inflation expectations are ridiculously low and equities will benefit from the change in inflationary expectations that are still before us.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com