US Restaurant Recovery Stalls As Pandemic Reemerges

Tyler Durden

Sun, 07/19/2020 – 19:00

The virus pandemic is now surging in 37 U.S. states with caseloads rapidly increasing, and the resulting factor is a terrified consumer unwilling to shop at malls or eat at restaurants.

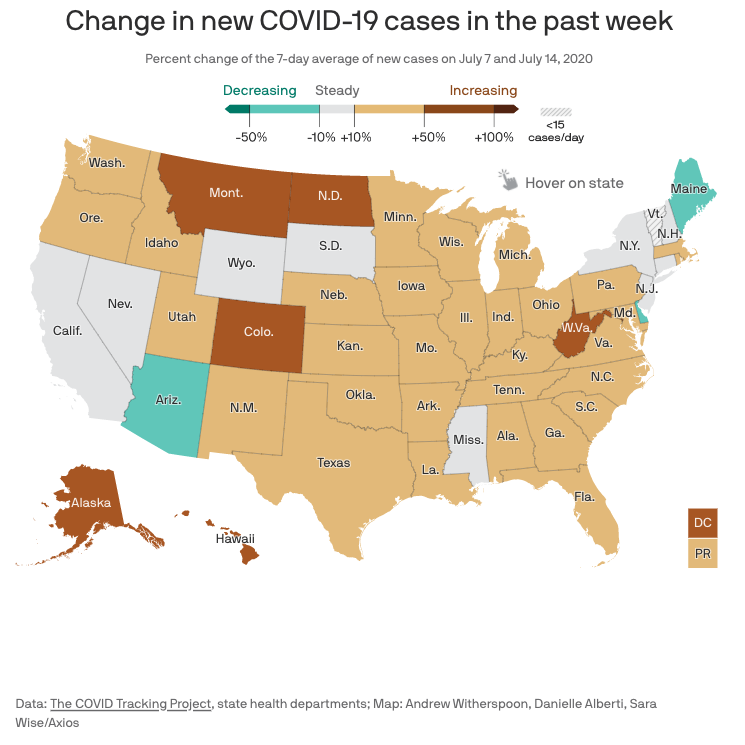

Before we dive into restaurant data via OpenTable, Axios published a fantastic visualization of where changes in new COVID-19 cases are occurring in the U.S. The map shows cases are exploding across much of the country, jeopardizing the recovery as governors in many states are either pausing or reversing reopenings.

Nationwide, new virus infections have increased 21% since last week — and before were up 24% from the prior week. The reemergence of the virus has had a profound impact on the recovery, due mainly to several factors: the first, governors pausing or reversing reopenings; second, the human psyche of a virus pandemic reemerging with no vaccine is forcing people to hunker down at home and consume less.

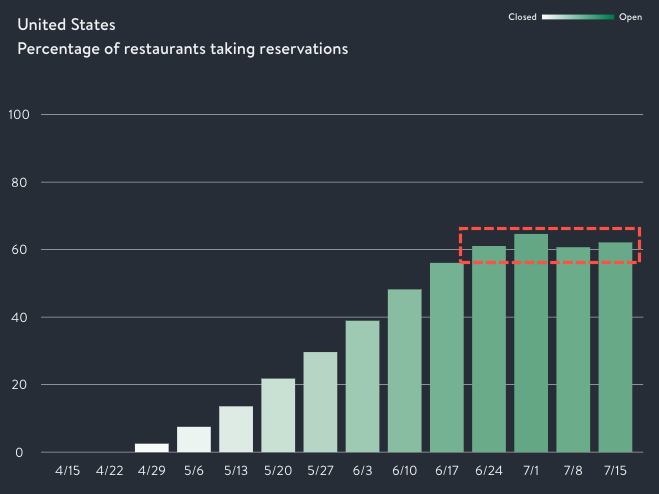

OpenTable data of restaurants across the country shows the percentage of eateries taking reservations has plateaued in the last 20 days, coinciding with the latest virus surge.

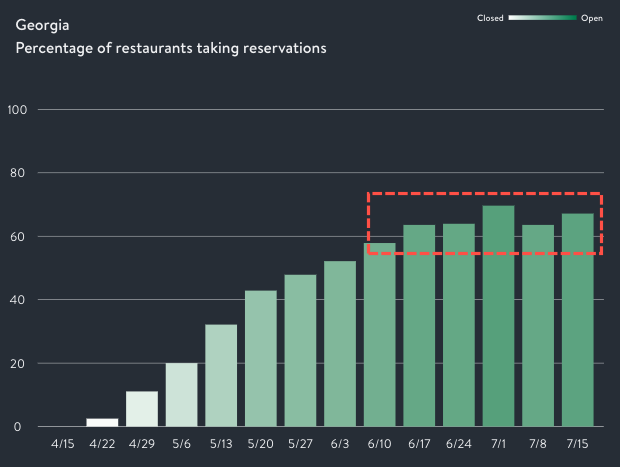

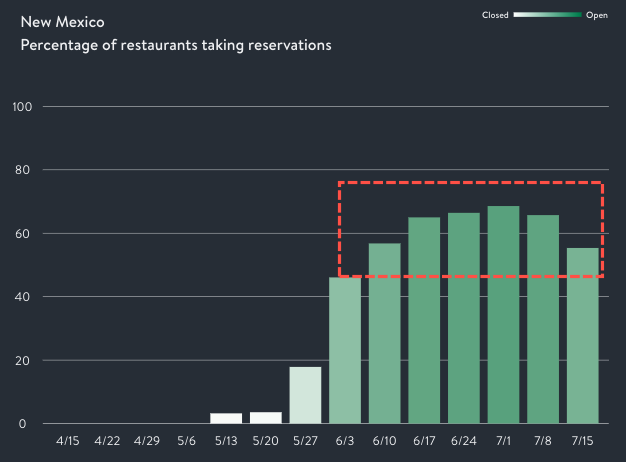

OpenTable found Arizona, California, Washington, D.C., Georgia, Illinois, Kansas, Louisana, Maryland, New Mexico, Ohio, Oklahoma, Pennsylvania, South Carolina, Tennesee, Texas, Virginia, Washington, and Wisconsin, were states with restaurant reservations stalling in late June, or in some cases reversing through the first half of July.

Arizona

California

Washington, D.C.

Georgia

Illinois

Kansas

Louisana

Maryland

New Mexico

Ohio

Oklahoma

Pennsylvania

South Carolina

Tennesee

Texas

Virginia

Washinton

Wisconsin

Readers may recall our latest reports on the stalling recovery:

- Real-Time Data Shows That After Peaking In Late June, Consumer Spending Is Now Declining

- U.S. Recovery Stalls As Pandemic ‘Second Wave’ Threatens To Unleash Double-Dip Recession

To make matters worse, as the recovery stalls due to reemerging virus cases, there’s also a fiscal cliff looming, threatening to crash consumption if another round of stimulus isn’t passed.

Here are some of the reasons why a fiscal cliff is ahead:

- expiration of extended unemployment insurance,

- the fading support from stimulus checks,

- exhaustion of PPP

- stress from state and local aid gov’ts.

Combine this all together, and there’s no way in hell a V-shaped recovery will be seen this year.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com