As Stocks Tumble Fed Swoops In With A Stick Save, Expanding Bailout Facility Counterparties

Tyler Durden

Thu, 07/23/2020 – 14:47

With stocks weak all day, and accelerating to the downside in the afternoon, some were wondering when Jerome “Jay” Powell would answer Steve Mnuchin’s phonecall.

— zerohedge (@zerohedge) July 23, 2020

https://platform.twitter.com/widgets.js

Well, it took it’s sweet time, but at exactly 2:30pm the Fed fired a warning shot at all the racist criminals known as “sellers” when it announced that it had “broadened the set of firms eligible to transact with and provide services in three emergency lending facilities.”

Encouraging a broader range of agents for the Term Asset-Backed Securities Loan Facility (TALF) and counterparties for the Commercial Paper Funding Facility (CPFF) and Secondary Market Corporate Credit Facility (SMCCF) will increase the Federal Reserve’s operational capacity and insight into the respective markets.

The TALF, CPFF, and SMCCF are facilities created under section 13(3) of the Federal Reserve Act, established with the approval of the Treasury Secretary and with equity investments provided by the Treasury to help support the flow of credit to households, businesses, and the broader economy.

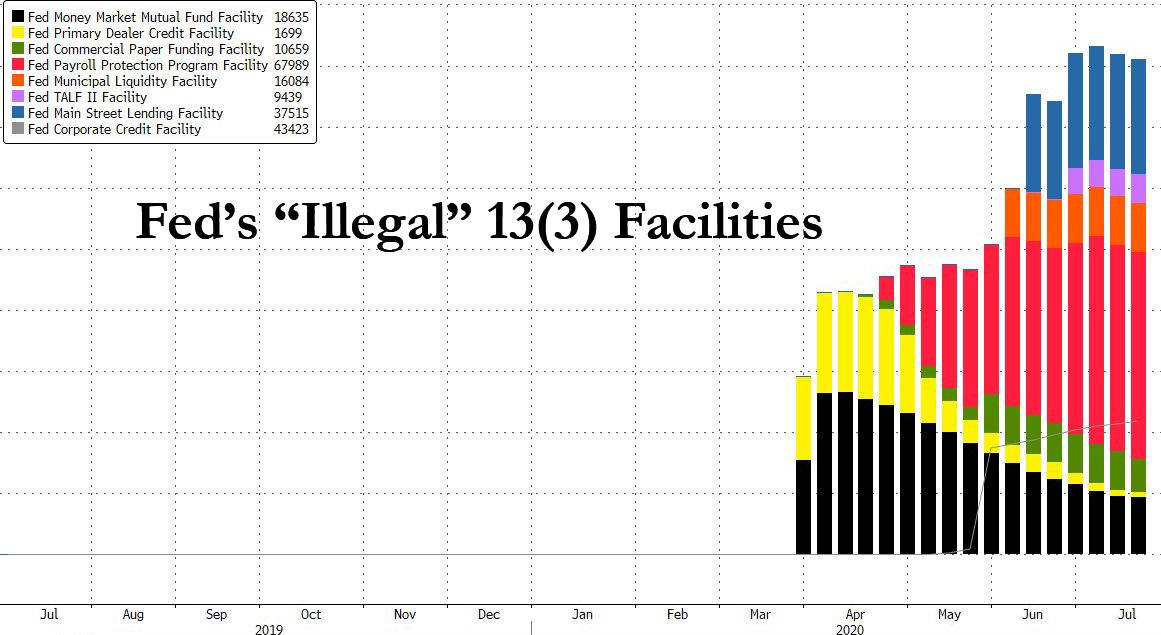

The TALF, CPFF and SMCFF are all some of the “illegal” 13(3) facilities that the Fed needed an explicit permission from the Treasury to enable, as their sole purpose was to prop up risk assets. As of last Thursday, there was roughly $160 billion in 13(3) facilities outstanding, and while the total notional was shrinking due to lack of demand…

… apparently the Fed decided that the only reason there is not even more demand, is because the program is too… limiting, and so it decided to expand the list of counterparties. The signal was clear: any more selling and the Fed starts buying stonks.

Joking aside, here is the list of Term Sheets Fedsplaining just what Powell plans on doing next, so please frontrun it so you too can enjoy life like this.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com