BMO Asks Can Gold Surpass The S&P500

Tyler Durden

Wed, 07/29/2020 – 15:04

Yes, it’s a completely meaningless and arbitrary comparisons but some are asking: can/will the price of gold surpass the value of the S&P?

As BMO chief economist Douglas Porter writes, amid all the recent excitement over the new all-time high for gold prices, spare a thought for the humble S&P 500.

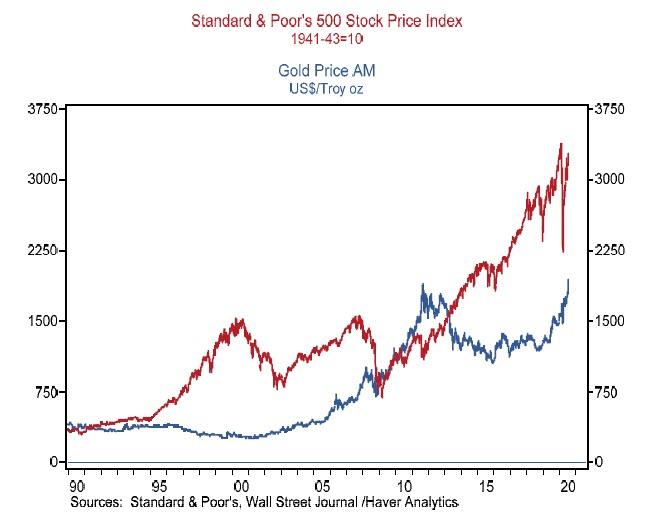

“Fully aware that this is like comparing apples to orangutans, but consider the level of the S&P index to gold prices over the past 30 years. On July 20 1990, those many years ago, gold changed hands at just over US$361 the ounce, while the S&P 500 finished the day at 361.”

Since then, the annualized rise in gold has been 5.8%, while the S&P 500 is up 7.6% per year (plus dividends). That has left the S&P about 66% above gold prices now (which of course ignores the fact that central banks have been doing everything they can to boost the “wealth effect” of global stocks while keeping gold prices as low as possible). Finally, as Porter shows in the chart below, “the last time these two prices crossed paths was April 9, 2013 (at around the 1570 mark for both).”

Separately, BMO senior economist Sarah Howcroft does not expect gold to surpass the S&P any time soon:

While we expect gold and silver to remain well supported over the next 18 months as global monetary conditions remain accommodative, any slight rebound in U.S. yields or the dollar could trigger a modest pullback in prices. Conversely, a further deterioration in U.S./China relations or failure to contain regional COVID-19 outbreaks could push gold above $2,000.

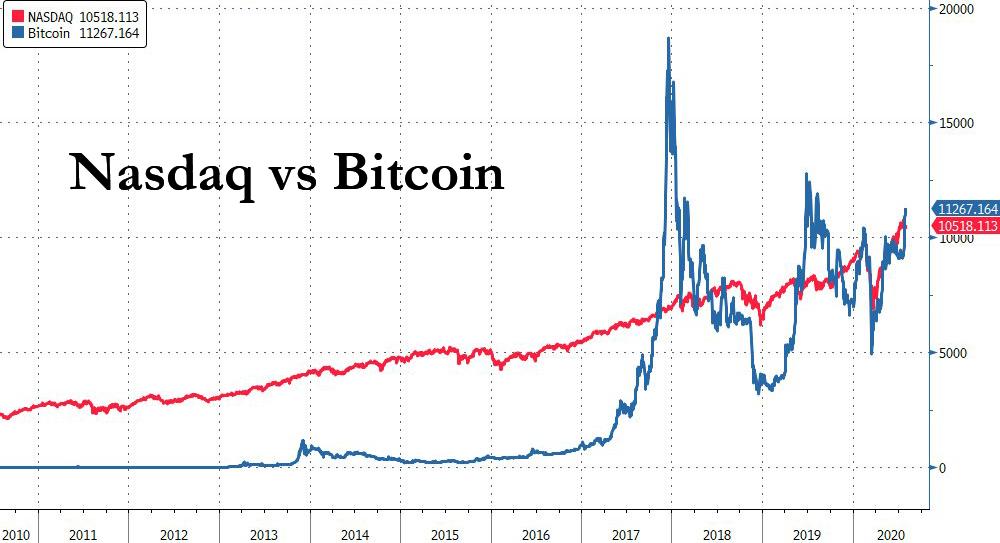

That said – apples to orangutans and all – one wonder can one ounce of gold, currently trading at $1,961 surpass one unit of the S&P500, currently at 3,247? And speaking of totally arbitrary comparisons, just this past week one bitcoin – currently trading just around $11,000 – surpassed the Nasdaq once again…

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com