“The General Public Gets It”: Sheila Bair Blasts Fed For Creating Income Inequality, Slams Politicians For Keeping Silent

Tyler Durden

Mon, 08/24/2020 – 17:25

Since its inception, this website has preached that at the root of all evil in US – and frankly any other society which prints its own currency – is the central bank. Month after month, year after year, we have warned that the Fed, which Thomas Jefferson among the founding fathers prophetically warned against in a warning that carried all the way until 1913 when, following a secret meeting at the aptly named Jekyll Island, the Fed was sprung into existence, just in time for the first World War.

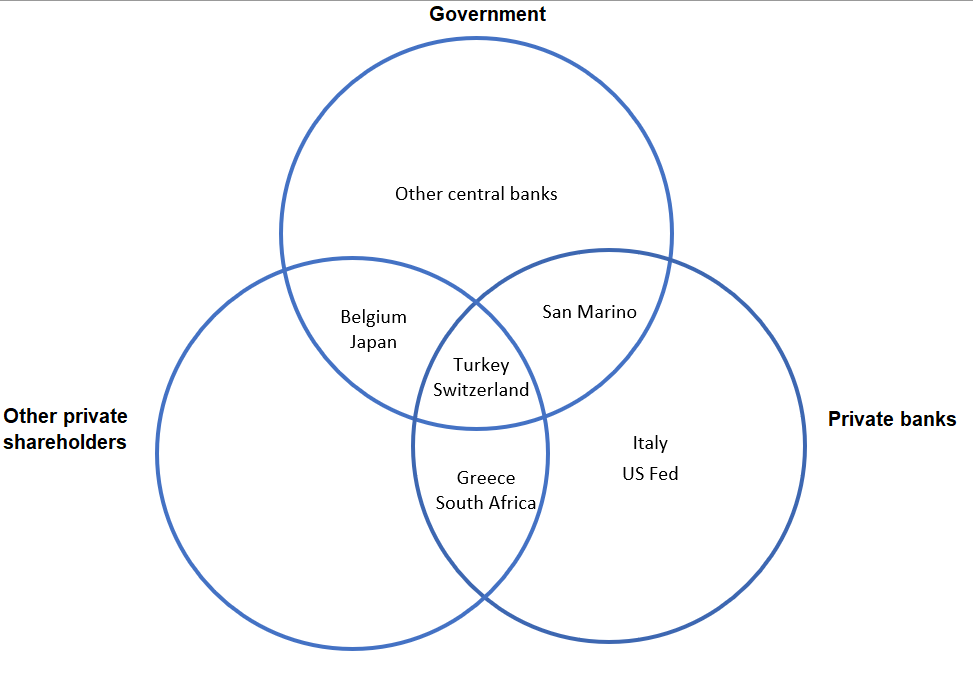

And while superficially the charter of the Fed – which to this day remains a fully private institution unlike most of its peers…

… has operated under the superficially noble mandate to “promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates”, yet by constantly prompting a inflationary mandate and debasing the dollar, has spawned a series of boom-bust cycles, which have resulted in an unprecedented wealth (and income) divide, with a handful of people owning the vast majority of financial assets, while the rest of the population – including the vast majority of the middle class – has seen its purchasing power decline year after year.

Stock ownership increasingly concentrated among small share of population; top 10% of earners owned 87% of all U.S. stocks in 1Q 2020—up from 82.4% in 2009—while bottom 50% owns just a sliver @WSJ @federalreserve pic.twitter.com/HpbAVuYOsH

— Liz Ann Sonders (@LizAnnSonders) August 24, 2020

https://platform.twitter.com/widgets.js

Yet despite, or perhaps due to the Fed’s bubble-blowing powers which have now culminated in the Fed effectively nationalizing the bond market and going so far as purchasing corporate bonds from such companies as Apple, Berkshire Hathaway and Intel (implicitly funding their shareholder friendly actions), and terminally breaking price discovery in the process, few among the establishment – either financial or political – have ever dared to join our crusade against central banks.

Which is why we were pleasantly surprised when over the weekend, none other than Sheila Bair broke ranks with the establishment, when in a serious of tweets the former bank regulator dared to say the unspeakable: the truth about the Fed, and that it’s policy of “sustained low interest rates help the big get bigger, stifling innovation and productivity, while inflating the value of financial assets overwhelming owned by the rich.”

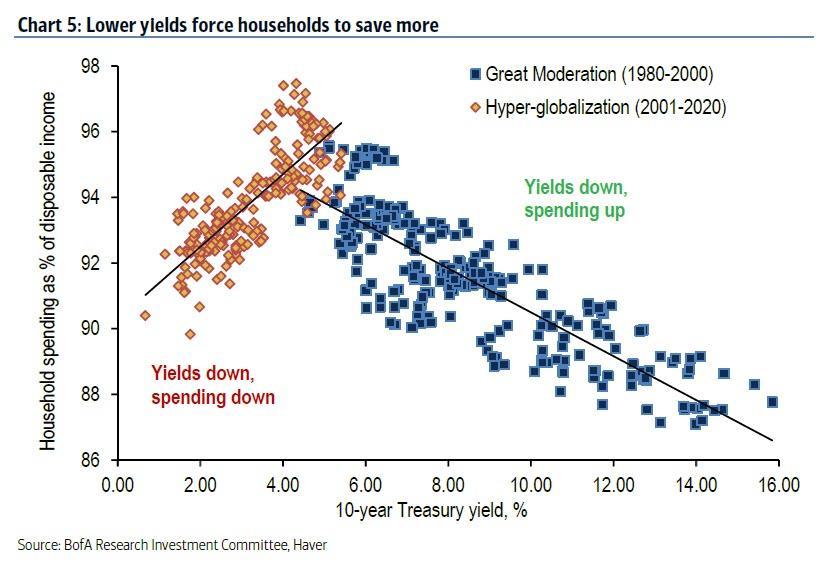

Bair started off innocently enough, commenting on a recent Princeton research paper, which came to the “shocking” conclusion that low rates are deflationary (i.e., “aggregate productivity growth declines as the interest rate approaches zero”), something we first pointed out months ago…

… when she said that she is “all for robust antitrust enforcement. Markets don’t work without competition. Yet, overlooked is the role of low interest rates in driving market concentration.”

And not just “concentration” – which can readily be seen in the handful of megatech stocks such as Apple, Amazon, Google and Microsoft whose market caps are on either side of $2 trillion – but as Bair warns, the Fed’s actions have led to such “side effects” as “yawning wealth and income inequality, sustained low interest rates help the big get bigger, stifling innovation and productivity, while inflating the value of financial assets overwhelming owned by the rich.”

As with the related “side effects” of yawning wealth and income inequality, sustained low interest rates help the big get bigger, stifling innovation and productivity, while inflating the value of financial assets overwhelming owned by the rich.

— Sheila Bair (@SheilaBair2013) August 23, 2020

https://platform.twitter.com/widgets.js

And in a stunning follow up which exposes just how deep the institutional rot has spread, her next tweets hits right at the $64 trillion question: “no one in either party talks about this.” In fact, “if there is bipartisan consensus on anything, it is to rely more, not less, on cheap debt to fuel economic growth.”

Yet, no one in either party talks about this. If there is bipartisan consensus on anything, it is to rely more, not less, on cheap debt to fuel economic growth.

— Sheila Bair (@SheilaBair2013) August 23, 2020

https://platform.twitter.com/widgets.js

The piece de resistance was her final tweet, in which Bair dared to call out the naked emperor, and asked – why, in a world where even “the general public gets it”, is our political leadership so “unwilling to fundamentally rethink the role of monetary policy in our economy.“

Ironically, I think the general public “gets it”. But our political leadership seems unwilling to fundamentally rethink the role of monetary policy in our economy.

— Sheila Bair (@SheilaBair2013) August 23, 2020

https://platform.twitter.com/widgets.js

While Bair doesn’t follow up on her own rhetorical observation, we are happy to do so: the reason our “political leadership” refuses to address the fundamental driver of inequality in the US, the bubble-blowing machine behind the stock market, and the primary driver for growing class, ethnic and race hatred within the country’s population, is because US political ceased to matter long ago. In fact, one can argue that both parties only exist to stoke even greater polarization within society which serves as a convenient smokescreen to deflect attention from the true source of most things that are rotten in US society: the Federal Reserve. Meanwhile, the Fed’s money printing merely enables the existing flawed system to get even more entrenched, with consequences which have led to a nation that is on the tipping point – and in some cases beyond – armed violence with itself.

And unfortunately, since there is nothing that will force this “political leadership” to take any measures to fundamentally restructure the role monetary policy plays in our economy, the greatest catastrophe in US history awaits.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com