Futures Hit New Record High After Buffett Reveals 5% Stakes In Five Major Japanese Trading Companies

Tyler Durden

Sun, 08/30/2020 – 20:27

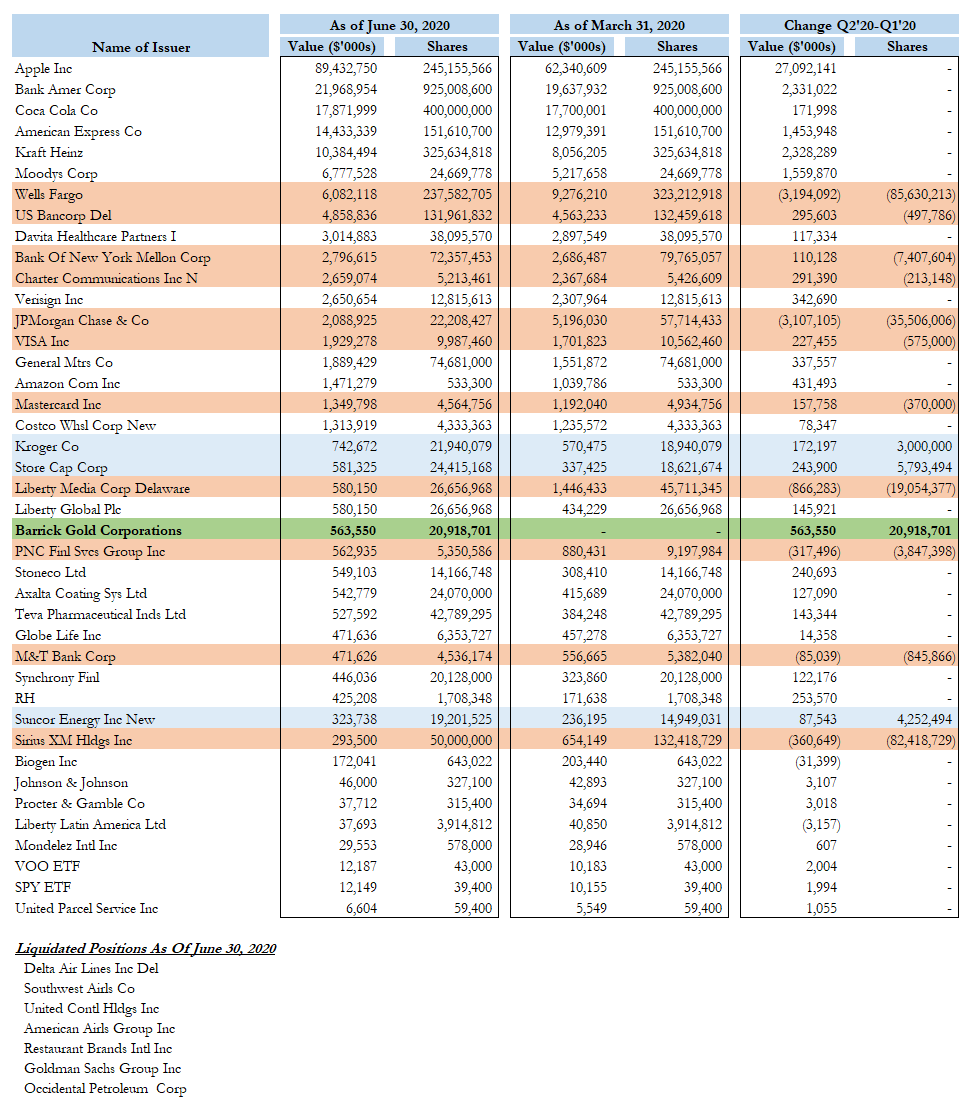

There were audible gasps across Wall Street on August 15th when the latest Berkshire 13-F revealed that the Oracle of Omaha had cut his stakes in most US banks (and fully sold out of Goldman), while taking a new and unprecedented for Berkshire Hathaway position in Barrick Gold.

But while Warren Buffett, who turns 90 today was dumping US banks, he was quietly building up sizable stakes in the five of the largest Japanese trading companies.

In a press release published late on Sunday, Berkshire Hathaway revealed that it had acquired stakes in Itochu, Marubeni, Mitsubishi Corp., Mitsui and Sumitomo of “slightly more” than 5%, signaling it may increase those holdings in the future. These holdings were acquired over a period of approximately twelve months through regular purchases on the Tokyo Stock Exchange.

According to the statement, Berkshire Hathaway’s intention is to hold its Japanese investments for the long term. “Depending on price, Berkshire Hathaway may increase its holdings up to a maximum of 9.9% in any of the five investments. However, Warren E. Buffett, CEO of Berkshire Hathaway, has pledged that the company will make purchases only up to an ownership of 9.9% in any of the five investments. The company will make no purchases beyond that point unless given specific approval by the investee’s board of directors.

Buffett expressed his pleasure with the investments:

“I am delighted to have Berkshire Hathaway participate in the future of Japan and the five companies we have chosen for investment. The five major trading companies have many joint ventures throughout the world and are likely to have more of these partnerships. I hope that in the future there may be opportunities of mutual benefit.”

The release also noted that Berkshire Hathaway has 625.5 billion of yen-denominated bonds outstanding, maturing at various dates beginning in 2023 and ending in 2060. Consequently, the company has only minor exposure to yen/dollar movements.

Following the report, the five named stocks spiked and Nikkei futures jumped by more than 1%…

… while S&P futures were last seen at a new all time high of 3,122.

It wasn’t immediately clear what prompted Buffett to transition out of US money-center banks whose performance has been dismal in 2020 compared to the surge in tech, and into Japanese traders at a time when the BOJ dominates most capital markets (and was last seen in possession of 80% of all local ETFs), and just as Abe announced his resignation, putting the future of the entire Abenomics platform in question, but we are confident that some bullish spin will be forthcoming.

On the other hand, the fact that Buffett – who famous has said “never bet against America” – just turned 90 today may be the more accurate explanation.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com