“It’s Happening Again” – Traders Store Oil At Sea As Recovery Falters

Tyler Durden

Thu, 09/10/2020 – 13:50

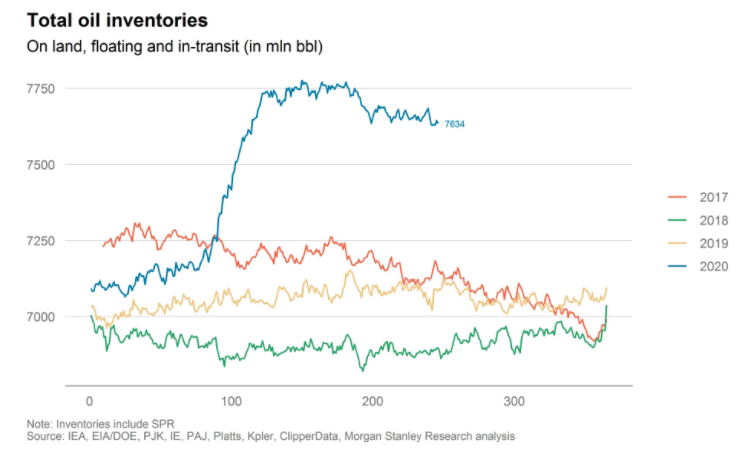

Crude prices slid Thursday as the stalled global economic recovery from the virus pandemic triggers a “second wave” of demand fears and sparks renewed interest in floating storage as the oil market flips bearish.

Reuters said a “fresh build-up of global oil supplies, pushing traders including Trafigura to book tankers to store millions of barrels of crude oil and refined fuels at sea again.”

Floating storage, onboard crude tankers, comes as traditional onshore storage nears capacity as supply outpaces demand.

Total Oil Inventories

Refinitiv vessel data shows trading house Trafigura has recently chartered at least five crude tankers, each capable of 2 million barrels of oil.

The inventory build up, driving up demand for floating storage comes as OPEC+ recently trimmed supply curbs from earlier this year on expectations demand would improve. Though with the peak summer driving season in the US now over, demand woes and oversupplied markets are pressuring crude and crude product prices.

Very large crude-oil carrier (VLCC) storage has started to rise once again.

“Despite the recent slide in oil prices, we think that the OPEC+ leadership will continue to direct its efforts towards securing better compliance rather than pushing for deeper cuts at this stage,” RBC analysts said.

Another catalyst for the bearish tilt in crude markets is that China’s oil imports are likely to subside as independent refineries have reached maximum annual oil import quotas.

Reuters notes, in a separate report, that other top commodity traders are booking tankers to store crude products at sea, including diesel and gasoline.

Refinitiv vessel data also shows Vitol, Litasco, and Glencor have been booking tankers in the last several days to store diesel for the next three months.

“The market is soft and bearish, and floating storage is returning again,” a market source told Reuters.

Morgan Stanley analyst Martijn Rats said in a note that “it is increasingly clear that market fundamentals are not improving as quickly as expected, particularly on the demand side.”

A faltering global economic recovery, combine with oversupplied crude markets and waning demand, is weighing down November Brent crude contracts, down 15% in the last seven sessions.

For more color on why the oil market rally is ‘fizzling out’ – OilPrice.com’s Simon Watkins explains the emerging themes to watch.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com