“It’s Hard To Become Too Bearish”: Futures Surge Amid Optimism Selloff Has Gone Too Far

Tyler Durden

Mon, 09/28/2020 – 08:07

US stocks future indexes rose on Monday following Friday’s gains and tracking major gains in European and Asian markets amid optimism that the recent selloff in equity markets is overdone. The dollar weakened and Treasury yields rose. The pound strengthened on hopes that U.K. and European Union officials will be able to make progress as a key week of Brexit talks begins, while the Turkish lira crashed to a new all time low on fears the country would be dragged into the sudden breakout of war between Armenia and Azerbaijan.

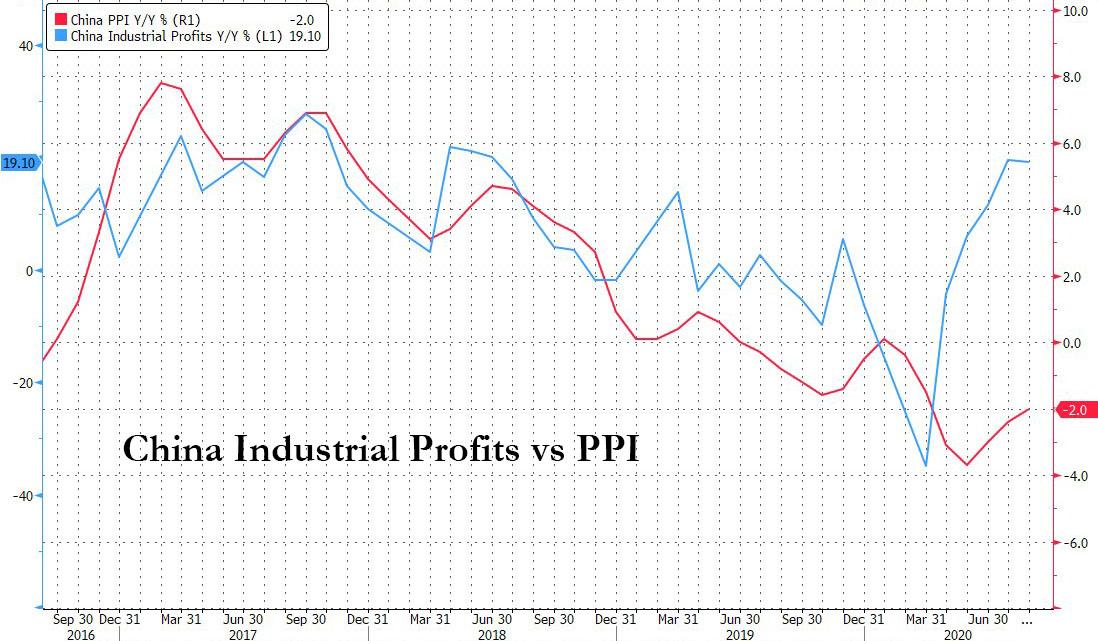

Hopes of a global economic recovery were supported by data showing continued growth in China’s industrial profits, despite fresh concerns that China’s data is once again being manipulated for political purposes with profits diverging massively from PPPI.

Shares of American Airlines, United Airlines, cruise operators Royal Caribbean Cruises Ltd and Carnival Corp rose between 2.5% and 5.6% in premarket trading as sentiment on covid-linked names reversed despite a continued rise in officially reported cases. The global death toll from Covid-19 will likely pass 1 million today, with cases already above 33 million. The milestone will be passed as governments continue to struggle to contain the disease, with authorities in many countries imposing or extending measures. The Times in London is reporting that the city may be forced into another lockdown. New York officials are concerned about localized spikes in infections, even as the city-wide rate remains low.

Late on Friday, American Airlines said it has secured a $5.5 billion Treasury loan and could tap up to $2 billion more in October depending on the allocation of extra funds under a $25 billion loan package for airlines. Uber surged in U.S. pre-market trading after a judge ruled that the ride-hailing app is “fit and proper” to operate in London. The FAAMG stocks rose between 1.1% and 2.2% as Nasdaq futures surged.

Global markets started the week solidly in the green, following Wall Street’s main indexes higher on Friday, helped by technology stocks, but the Dow Jones and the S&P 500 indexes posted their longest weekly losing streaks in a year on fears of a slowing pace of economic growth. Worries over rising coronavirus cases and waning hopes of more fiscal stimulus have led to a spike in market volatility in the past few weeks, and analysts expect trading to remain choppy in the run up to the Nov. 3 presidential election. The VIX spiked to its highest in nearly two weeks last Monday, with analysts warning of further upside to the index heading toward the end of the quarter, and Morgan Stanley warning of a “difficult trading environment” in the next 4-5 weeks.

Stocks also rose on lingering hopes a fiscal deal may still happen before the election. The rapidly diminishing chances of a new fiscal stimulus package ahead of the election got a modest kick after Speaker Nancy Pelosi said Democrats would unveil a new “proffer” shortly, adding that she would prefer the House majority to pass an actual deal than simply vote on a package that would be dead on arrival in the Senate. While there were some talks between Pelosi and Treasury Secretary Steven Mnuchin on Friday, the continuing deep divides on the size of any package and the very short timeline to the election means lawmakers remain skeptical a breakthrough is possible

The Europe Stoxx 600 Index rose more than 2% rebounding from the biggest weekly drop in more than three months as banks rallied the most in three weeks leading the advance among sectors. HSBC Holdings surged 9%, its biggest one-day gain since 2009 after Ping An Insurance Group, its biggest shareholder, raised its stake in the lender to 8%, in a bet the embattled lender will return to paying dividends and said it “remains confident” in HSBC’s long-term prospects.

European carmarkers rallied following comments from Nissan Motor that the company expects to return to profitability in 2021. Diageo rose after saying it expects business to improve as bars and restaurants reopen.

“It is hard to become too bearish,” said Mark Dowding, the chief investment officer at BlueBay Asset Management. “As we look into 2021, growth should be stronger, policy will stay supportive with further fiscal spending. A vaccine is also expected to be deployed and life to return closer to normal by the middle of next year.”

“Investors grapple with many variables that could bring increasing amounts of volatility in the week ahead,” said Hussein Sayed, chief markets strategist at FXTM.

Optimism spilled over from Asian trading hours after data over the weekend showed profits at China’s industrial firms grew for the fourth straight month in August.

Earlier in the session, Asian stocks gained, led by IT and industrials, after rising in the last session. Most markets in the region were up, with Taiwan’s Taiex Index gaining 1.9% and Japan’s Topix Index rising 1.7%, while Jakarta Composite dropped 0.8%. The Topix gained 1.7%, with Careerlink and Scala rising the most. The Shanghai Composite Index was little changed, with Shanghai Zijiang Enterprise Group advancing and Ribo Fashion declining the most.

At the same time, Bloomberg notes that tension between Beijing and Washington continues to simmer. President Donald Trump’s ban on TikTok was temporarily blocked by a federal judge, dealing a blow to the government in its showdown with the popular Chinese-owned app over national security concerns. China’s largest chipmaker, Semiconductor Manufacturing International Corp., sank to a four-month low in Hong Kong after the U.S. imposed export restrictions.

In rates, treasuries bear steepened, with long-end yields cheaper by ~2bp vs. Friday close as the the risk-on backdrop weighed on long-end. Treasury 10-year yields cheaper by 1.5bp at ~0.67%, trading broadly in line with bunds; gilts lag by ~1.2bp. Month-end flows may also support long-end with with Bloomberg Barclays U.S. Treasury index to extend by 0.09y, more than usual October extension. IG credit issuance slate includes AngloGold Ashanti Holdings 10Y; $25bn expected to price this week

In FX, the Bloomberg Dollar Spot Index retreated from a two-month high reached on Friday, and the greenback fell versus most of its Group-of-10 peers. The pound was on track for its biggest gain this month, even with the EU stiffening its demands over how any trade deal will be enforced after losing trust in Boris Johnson because of his attempt to rewrite last year’s divorce agreement. The Canadian dollar was the weakest performer as oil prices struggled to build on recent gains. Australian dollar edged up as investors unwound short positions after Westpac pushed out its forecast for RBA easing to Nov. 3 from Oct. 6. Aussie bond futures drop briefly before recovering. Japan’s currency caught a bid after The Times of London reported the U.S. may relocate American assets away from an airbase in Turkey to Crete to boost its military presence in the eastern Mediterranean

In commodities, oil and the dollar traded lower, while gold rebounded after hitting extremely oversold territory, aided by the drop in the dollar.

On today’s data calendar, we have the Dallas Fed Manufacturing Outlook, while Thor Industries and Cal-Maine Foods are set to report earnings.

Market Snapshot

- S&P 500 futures up 0.9% to 3,316.75

- STOXX Europe 600 up 1.7% to 361.53

- Brent Futures down 0.6% to $41.65/bbl

- Gold spot down 0.4% to $1,854.14

- U.S. Dollar Index down 0.2% to 94.45

- German 10Y yield rose 1.4 bps to -0.515%

- Euro up 0.04% to $1.1636

- Brent Futures down 0.6% to $41.65/bbl

- Italian 10Y yield fell 0.8 bps to 0.682%

- Spanish 10Y yield fell 0.3 bps to 0.245%

- MXAP up 1.1% to 170.21

- MXAPJ up 0.7% to 551.50

- Nikkei up 1.3% to 23,511.62

- Topix up 1.7% to 1,661.93

- Hang Seng Index up 1% to 23,476.05

- Shanghai Composite down 0.06% to 3,217.54

- Sensex up 1.6% to 37,968.28

- Australia S&P/ASX 200 down 0.2% to 5,952.32

- Kospi up 1.3% to 2,308.08

Top Overnight News from Bloomberg

- The Bank of England’s discussions on negative interest rates have been “encouraging,” according to policy maker Silvana Tenreyro, in a sign that the U.K. could yet follow peers such as the European Central Bank below zero

- London’s major clearinghouses for derivatives, energy and metal trades will be able to do business with banks in the European Union next year in a move that averts Brexit market disruption

- Bank of America Corp. and Lloyds Banking Group Plc have completed one of the first cross-currency swaps using Libor’s replacements, marking the latest step in the long exodus out of the scandal-tainted rate

- Safe-haven assets seen as traditional hedges aren’t panning out as they once did, according to JPMorgan Chase & Co. Easy- money policies may actually be keeping investors in cash and away from other traditional buffers, strategists led by John Normand wrote in a note Friday. That’s because such policies create a zero-yield environment where cyclical assets might be too difficult to hedge, they said

- A Conservative Party rebellion against Boris Johnson’s emergency coronavirus powers is gaining momentum after opposition parties signaled their support

- Battle lines are being drawn at the heart of the European Central Bank over whether to add monetary support soon to head off any economic slowdown, or wait for stronger evidence that it’s needed

A quick look at global markets courtesy of NewsSquawk:

Asian stocks began the week mostly higher, but ultimately finished mixed, as the region initially picked up the baton from last Friday’s tech-driven momentum on Wall Street. ASX 200 (-0.2%) and Nikkei 225 (+1.3%) were initially positive with Australia led by tech as the sector followed suit from US peers and with sentiment mildly underpinned by news Victoria state is to speed up its easing of COVID-19 restrictions. However, gains were capped and price action weighed on due to weakness in consumer staples and financials, while Tokyo stocks largely shrugged off a choppy currency. Hang Seng (+1.0%) and Shanghai Comp. (U/C) finished mixed mixed with underperformance in the mainland following a net liquidity drain by the PBoC and as participants digested the latest developments between the world’s 2 largest economies. This includes the US federal judge decision to grant a preliminary injunction against President Trump’s ban on TikTok downloads from US app stores which had been set to take effect from midnight, while SMIC shares slumped after the US Commerce Department announced tighter restrictions on China’s largest chipmaker on allegations that exports to the Co. posed an unacceptable risk of being diverted to military end-use. Nonetheless, the mood in Hong Kong was more constructive with HSBC registering its biggest intraday gain in over a decade after Ping An Insurance acquired 10.8mln H-shares to boost its stake to 8%. Finally, 10yr JGBs were rangebound with price action sideways as demand is sapped by the mildly positive risk tone but with downside stemmed amid the BoJ’s presence in the market for a total of JPY 900bln of JGBs.

Top Asian News

- Singapore Regulator, Banks in Talks to Extend Debt Relief Scheme

- Credit Suisse’s Pozsar Warns of Funding Flood: Liquidity Watch

- Betting on Yen Strength Is More Popular Than Ever Among Funds

Stocks in Europe kicked the week off higher across the board (Euro Stoxx 50 +2.1%) following a relatively mixed APAC session, with gains in Europe more pronounced than performance in State-side equity futures at present. Broad-based gains were seen across European bourses at the cash open, but since then Germany’s DAX (+2.6%) emerged as the front runner, whilst the UK’s FTSE 100 (+1.4%) waned on a currency dynamics and Switzerland’s SMI (-0.6%) remains the laggard due to a losses in large-cap stocks including Roche (-0.7%) and Nestle (-0.3%). Sectors are higher across the board with a cyclical/value tilt – with Banks outpacing on the back of HSBC (+8.8%) and Commerzbank (+5.1%) with the former bolstered by Ping An Insurance upping its stake in the Co. to 8% via a purchase of 10.8M, whilst the latter cheers the appointing of a new CEO effective Jan 2021. On the other side of the sector spectrum resides the defensive sectors such as healthcare, telecoms and consumer staples. In terms of individual movers, ArcelorMittal (+10%) extends on gains after M&A, with Cleveland-Cliffs (CLF) to acquire ArcelorMittal’s US operations for ~USD 1.4bln, meanwhile the Co. has also announced a share buyback programme. Diageo (+6.6%) is higher after highlighting that business is performing strongly and ahead of expectations. William Hill (-11.1%) unwinds some of Friday’s speculation-fuelled gains after Caesars offered to take over the group at GBP 2.72/shr (vs. Friday’s GBP 3.12/shr close). Rolls-Royce (-4.5%) also sees losses and resides towards the foot of the Stoxx 600 as the engine maker said there has been no final decision in regards any sovereign wealth fund taking a stake in the group. Despite the broader gains across the Travel & Leisure sector, Air France-KLM (-0.7%) bucks the trend as the Co. expects their November-December program to be at 50% of initial plan.

Top European News

- Siemens Energy Slumps on Debut Pushing Value Below Expectations

- Key London Clearinghouses Win Right to Operate in EU Post-Brexit

- Brexit Talks Enter Key Week With Time and Trust Running Out

- French Minister Says LVMH Letter Controversy Excessive

In FX, the Dollar has drifted down from Friday’s highs following a Wall Street recovery rally that has filtered through to APAC and EU equities to varying degrees. However, the DXY remains anchored around the 94.500 level and for once may derive some underlying support into month/quarter end given at least one bank model signalling a buy vs the Eur based on a relatively strong rotation into stocks from bonds to balance asset positions. Meanwhile, on an especially quiet Monday in terms of data, option expiries may have more influence on direction alongside another heavy slate of Central Bank speakers. The index is currently holding within a 94.344-640 range after reaching 97.745 at the tail end of last week, but the Buck is still maintaining strength vs EM currencies and extending gains against some.

- GBP – Sterling is firmer across the board, with Cable back on the 1.2800 handle again and Eur/Gbp down below 0.9100 amidst hope if not conviction of progress on a Brexit trade deal going into the latest formal negotiations between the UK and EU in Brussels this week. Moreover, the cross looks technically bearish (bullish from the Pound’s perspective) after breaching the 10 DMA and a key pivot point at 0.9153 and 0.9118 respectively, while Cable is nudging beyond 1.2850 having cleared its 10 DMA circa 1.2828 amidst latest NIRP nuances from the BoE (Tenreyro noting encouraging evidence from tests of sub-zero rates, but Ramsden more circumspect as he still sees the effective lower bound at 0.1%).

- AUD – Decent option expiry interest at the 0.7000 strike in Aud/Usd (1.3 bn) appears safe as the Aussie hovers near 0.7050 on a sudden change in RBA rate outlook from Westpac to -15 bp in November instead of the looming policy meeting next week, while COVID-19 restrictions are to be relaxed further in Victoria after the daily rate of infections in the state slowed to sub-20.

- JPY/CHF/EUR/NZD – All clawing back some losses vs the Buck, with the Yen rebounding above 105.50 where 1.8 bn expiries reside, but perhaps capped by another 1 bn sitting from 105.00 to 104.90, while the Franc has bounced just ahead of 0.9300 and is pivoting 1.0800 against the Euro following mixed weekly Swiss bank sight deposit balances. Elsewhere, Eur/Usd is just under 1.1650 and also eyeing option expiries as 1.1 bn roll off between the half round number and 1.1640, but ECB commentary could be more influential after a ramp up in verbal intervention from de Cos and Visco before 2 scheduled speeches by Schnabel and one from President Lagarde. Back down under, the Kiwi is straddling 0.6650 and 1.0750 against the Aussie awaiting official NZ election results that PM Adern’s Labour Party seems on course to win without requiring any assistance in the form of a coalition.

- SCANDI/EM – Contrasting starts to the new week as the Swedish and Norwegian Crowns recoup declines vs the Euro and unwind recent underperformance regardless of data that is weak on paper via retail sales and trade in the case of the former. Conversely, the Turkish Lira has lost all and more of its post-CBRT rate hike recovery momentum to trade at fresh record lows close to 7.7900 even though the country’s banking watchdog will lower the asset ratio for deposit banks to 90% from 95% effective this Thursday and President Erdogan reckons the resumption of talks with Greece will be constructive and views this week’s EU Summit as a chance to ‘reset’ relations.

In commodities, WTI and Brent front month futures are modestly firmer and are beginning to derive benefit from the improving risk-sentiment more broadly. For the majority of the morning, the benchmarks have been drifting lower in-spite of the aforementioned gains seen across the equity complex, with attention remaining on the demand outlook for crude given the resurgence of COVID-19 triggering talks of tighter lockdowns in certain economies. Russian Energy Minister Novak emerged on the wires today and noted that global oil markets have been stable with restored balance; albeit, cited a second wave of COVID-19 as a downside risk. Subsequently, reports highlight that Russia’s Rosneft is intending to cut output by 10% in October from September levels potentially due to weaker refining margins and an expected drop in demand for oil products in Russia and Europe, the sources stated. Elsewhere, conflict has erupted between Armenia and OPEC member Azerbaijan, although reports thus far point to the military actions being contained within border regions and not close to any Azeri fields, refineries or ports. Something to keep on the radar – Norwegian offshore workers are planning strike action if annual pay negotiations fail, which could lead to the shuttering of around 22% of Norway’s oil and gas output, according to The Norwegian Oil and Gas Association. WTI Nov currently resides around the USD 40.40/bbl level and towards highs of 40.46/bbl, whilst Brent Nov sees itself just north of USD 42.00/bbl (vs. high 42.12/bbl). Elsewhere, precious metals are marginally softer with spot gold just above USD 1850/oz (vs. high 1865.96/oz) and spot silver above USD 22.50/oz (vs. high 23.08/oz) having tested the level in late APAC trade. In terms of base metals, LME copper remains firmer given the strength in stock markets, contained Dollar and expectations for firmer demand from China. Similarly, Dalian iron ore futures were buoyed overnight with participants also keeping an eye on lower volumes ahead of the Chinese October 1st – 8th National Day Holiday.

US Event Calendar

- 10:30am: Dallas Fed Manf. Activity, est. 9.5, prior 8

DB’s Jim Reid concludes the overnight wrap

Asian markets have started the week on front foot this morning with the Nikkei (+0.72%), Hang Seng (+0.74%), Kospi (+1.49%) and Asx (+0.11%) all up. Futures on the S&P 500 are also up +0.43%. Chinese bourses are trading flat to down however with the CSI (+0.07%) and the Shanghai Comp (-0.22%) lower. In Fx, the US dollar index is down -0.16%.

Looking forwards now, this week we move into Q4, on which we have an in-line with consensus view that it will start on Thursday. Politics will move increasingly into the spotlight for investors, with the coming week featuring the first presidential debate in the US tomorrow. This comes in what is likely to be a febrile atmosphere after the expected weekend announcement of President Trump’s pick for the Supreme Court. Staying with politics we’ll see the resumption of Brexit negotiations between the UK and the EU. In data terms the US jobs report on Friday and global manufacturing PMIs on Thursday will be the keys.

Going into more detail now and tomorrow we see the much-anticipated first debate between Mr Trump and Mr Biden. This will be the first time that the candidates have directly debated each other, and will last for 90 minutes, with the debate divided into six segments. We’ve already been informed that subject to new developments, the topics will be: the Trump and Biden records; the Supreme Court; Covid-19; the economy; race and violence in our cities; and the integrity of the election. The New York Times report over the weekend on the President’s tax returns, which he had avoided disclosing in the 2016 race, as well throughout his first term in office, is quite likely to make an appearance as well. This is the first of three debates between the two, with the others taking place on October 15 and 22, and a debate between the Vice Presidential candidates taking place as well on October 7.

Heading into this debate, Mr Trump picked Amy Coney Barrett to be his choice for the vacant US Supreme Court seat. Confirmation hearings are expected to start on October 12th with a full Senate vote possible by October 26th and just before the election. As has been well flagged this could turn the Supreme Court 6-3 in favour of the Republicans and could have legal ramifications for the US for a generation. And as has also been well flagged, this nomination is highly contentious this close to an election with the Democrats looking at all options to address the balance if they win the White House and Senate in November – assuming the nomination goes through before a new Senate is seated in January.

Elsewhere in the US we see the September jobs report on Friday, which will be the last report we get before Election Day. In August, the unemployment rate fell to a lower-than-expected 8.4%, and the consensus is looking for a further decline to 8.2 % in September. In terms of nonfarm payrolls, the consensus is looking for job growth of +865k, but it’s worth bearing in mind that having lost over -22m jobs in March and April, even this figure would mean that just over half of them have been recovered, still leaving nonfarm payrolls over 10m below their peak back in February.

The other important data release to watch out for next week will be the release of the manufacturing PMIs and the ISM manufacturing index on Thursday. The flash readings we’ve already had generally showed manufacturing holding up relative to expectations, whereas the services readings disappointed, possibly as hospitality/entertainment related industries start to see heightened restrictions again. For example in the Euro Area, the flash manufacturing PMI rose to 53.7, which was its highest reading since August 2018 but the services reading was down to 47.6 from 50.5 last month.

Elsewhere, a special European Council meeting of EU leaders will be taking place on Thursday and Friday. This was originally meant to have taken place the previous week, but was postponed after European Council President Michel had to self-isolate after coming into contact with a security officer who tested positive. In terms of the agenda, there are a number of items, including relations with Turkey and the situation in the Eastern Mediterranean, as well as relations with China. The full day by day calendar is at the end including key central bank speakers.

Back to last week and global equity markets continued to fall as a mix of rising coronavirus cases and further deteriorating data weighed on risk sentiment. The S&P 500 dropped -0.76% despite a strong Friday (+1.47%), declining for a fourth straight week. Banks (-6.18%) and Airlines (-8.01%) were among the largest laggards as the selling expanded from large cap tech. Tech stocks actually broke its recent slide, with Friday’s +2.26% gain helping the NASDAQ to finish up +1.11% on the week. It was the first weekly gain in the index since August. European equities continued their slide with the Stoxx 600 ending the week -3.60% lower (-0.10% Friday). The DAX (-4.93%), FTSE 100 (-2.74%), FTSE MIB (-4.23%), IBEX (-4.35%) and CAC (-4.99%) all posted deep weekly losses as the increasing Covid-19 cases have caused some restrictions to be reinstated in countries, most notably the UK, France and Spain.

The dollar rose (+1.78%) for the third week out of the last four as investors sought protection in the downturn, it was the largest weekly dollar rally since early-April and the greenback finished at 2 month highs. Core sovereign debt rose as risk sentiment waned, with US 10yr Treasury yields falling -3.4bps (-0.7bps Friday) and 10yr bunds dropping -3.9bps (-1.1bps Friday). With the dollar’s rise and the weaker risk appetite WTI (-2.12%) and Brent crude (-2.76%) fell sharply for a second week. Elsewhere in commodities, gold fell (-4.36%) to two month lows as inflation expectations dropped in the US.

In terms of data last Friday, Italian Consumer Confidence came in at 103.4, which was above expectations (100.8) and 2.4pts higher than last month’s revised figure. This was driven by a jump in manufacturing confidence from 87.1 last month to 92.1 in September (vs. 87.4 expected). The overall confidence level remains below the pre-pandemic levels but continues to trend higher and may reflect the relatively smaller second wave of coronavirus cases in the country. In the US durable goods orders increased by +0.4%, a slower pace than expected (+1.5%), though August’s number was revised up three tenths of a per cent to +11.7%. Meanwhile core capital goods rose +1.8% (vs. 1.0% expected) while last month was revised up to +2.5%, indicating that business and manufacturing investment continues to rebound.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com