“This Is A Large Concern” – 3370 Is S&P’s Line In The Sand

Tyler Durden

Wed, 10/07/2020 – 11:19

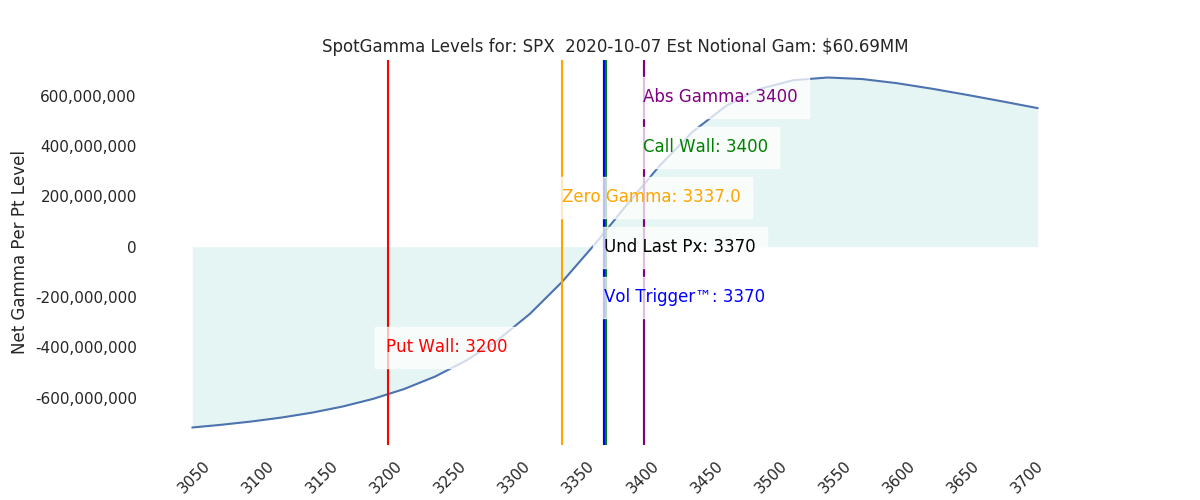

Futures initially pushed lower to 3330 overnight before recovering to 3375, squarely between the large 3350/3400 interest areas.

The overnight update to SpotGamma’s Gamma Index shows both SPX & NQ are sitting with very flat gamma positions. It appears Trump took to Twitter offering various “light stimulus” proposals which has helped stabilize things.

There was some interesting SPX volume yesterday with ~30k each (puts/calls) at 3400 and a decent uptick in 3350 put positions (~10k). You can see here how put OI increases as the market slides lower.

While we do not mean to sound like a broken record here, this is a large concern.

If the market does shift lower and “picks up” these larger put positions we could get a fairly substantial drawdown. The issue is of course a trigger – but that is always just “one tweet away”.

The other chart of note today is the Risk Reversal which is now starting to pick up the election. You can see that metric shows prices shifting in favor of puts, and it will be interesting to watch this over the next several days.

For today 3400 still markets the top of our range. We look at the cluster of levels around 3340 as support. Its important to note that 3350 is now more “put heavy” and we are therefore less enthusiastic about mean reversions off of this level.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com