Traders Puzzled By “Mysterious Mega Flows” In Biggest Tech ETF

Tyler Durden

Wed, 10/14/2020 – 15:40

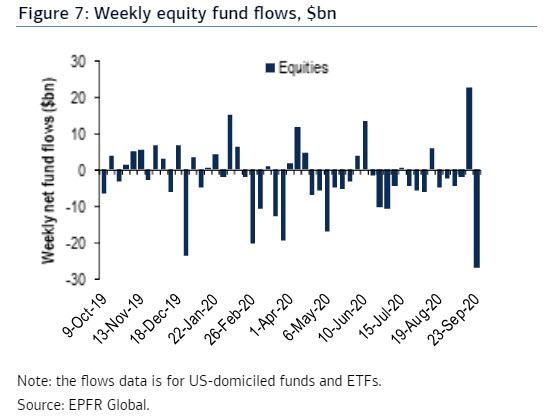

Three weeks ago, when looking at the latest EPFR fund flows we said that traders are getting whiplash after the “fastest ever fund flows swing from euphoria to despair” as US equity funds and ETFs reported $26.87 BN of outflows in the last week of September, the we observed the largest weekly outflow since December 2018 and the third largest outflow ever, more than reversing a $22.67bn inflow one week earlier; this was the third the biggest weekly swing in fund flows in history, and showed “how extreme market sentiment has become, and how it can seemingly swing overnight from euphoria to despair.”

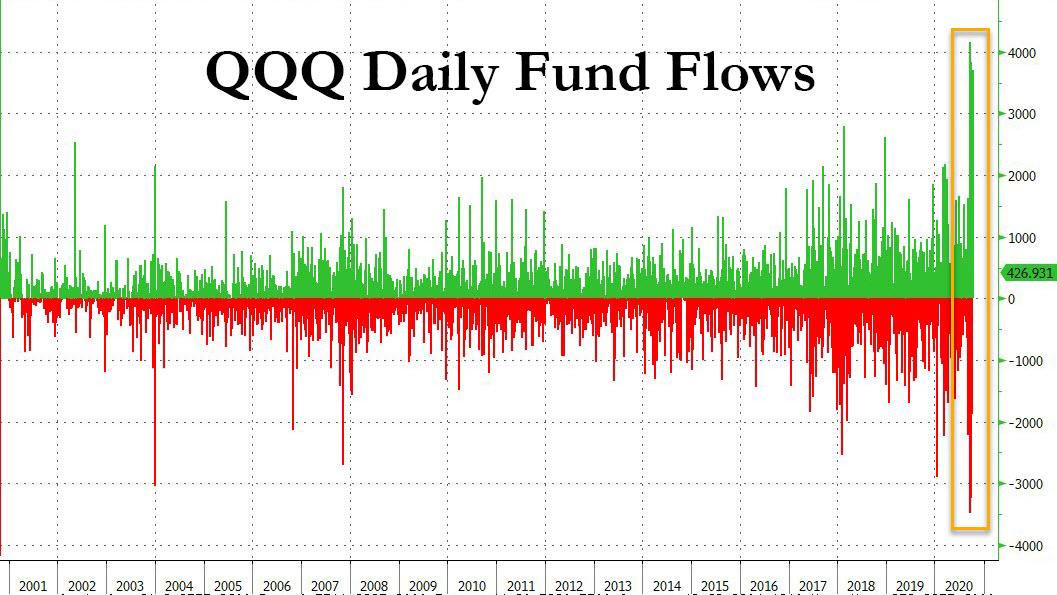

We also showed that similar, if even more acute swings, were observed in the QQQs the world’s largest tech ETF which tracks the Nasdaq, saying that “the QQQ fund posted record $3.5 billion outflows on Monday amid a Nasdaq slump, then got $4 billion the following day as sentiment recovered.”

In retrospect, this was not a bug but a feature, because today Bloomberg follows up on these wild swings, which have only gotten wilder since, and writes more than two weeks after our original observations that the “amount of cash cycling through one of the world’s largest exchange-traded funds is turning heads across Wall Street.”

According to Bloomberg’s calculations, the$146BN QQQ ETF, the largest tech ETF in the world, has seen a staggering $1.5 billion in daily flows (either in or out) over the past month, following the previously discussed largest withdrawal in two decades in late September, followed by its largest influx in the same time period one day later. The ETF saw $3 billion of inflows the following week, ahead of a $3 billion exit the next day. This week brought another $3.7 billion inflow in a single day.

The startling spike in the size of flows is clearly visible in the chart below, where the new “regime” is highlighted in yellow…

… with the consistency and sheer magnitude of the “mega flows” has analysts at odds over what’s driving them, Bloomberg’s Katherine Greifeld writes, “given that they don’t appear to line up with any rebalancing schedule or model portfolio shifts.

One possible explanation is that the recent surge in retail option trading has left the ETF as a hedging vehicle, while some say that renewed appetite among retail investors is fueling the flows. Others speculate that the cash churn amounts to a massive tug-of-war over the outlook for technology shares, which have staged a remarkable 73% rally since the March lows.

Another argument validating that this is largely a byproduct of retail traders is the just observed record inflows in the 3x inverse SQQQ Nasdaq ETF (see our post “Robinhooders Discover 3x Levered ETFs” from a month ago on how retail traders are flooding into 3x levered ETFs).

“That tells me there is a lot of day trading going on related to the Nasdaq 100,” said Tribeca Trade Group CEO Christian Fromhertz. “They’re super liquid and really move on Covid-related headlines.”

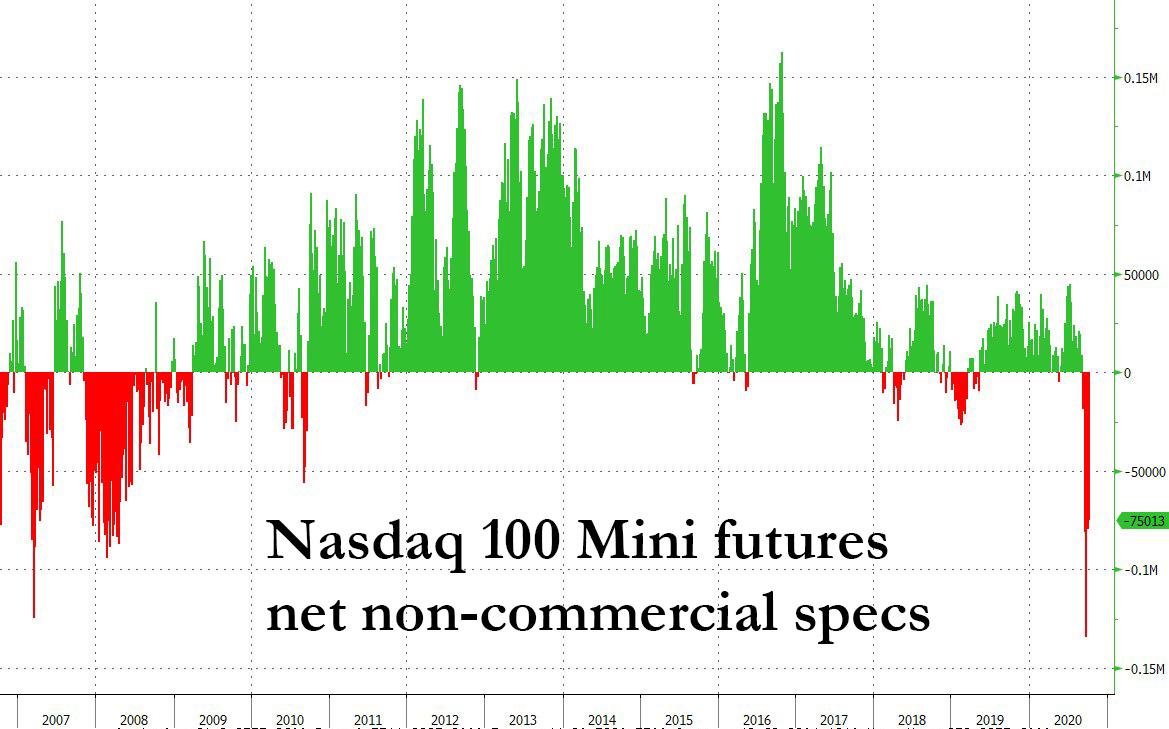

That said, options certainly play a role too. As Bloomberg explains, the “massive cash movements may be a byproduct of building options appetite” as roughly 3.7 million options contracts tied to Apple traded on Tuesday, well above the stock’s 20-day average of 1.95 million, in what many saw another attempt by SoftBank to forced a gamma short squeeze, which coupled with a near-record short position in Nasdaq futures unleased a massive 4% surge in the tech index.

Meanwhile, the latest sighting of “Nasdaq whale” SoftBank, meant that call open interest in Facebook, Amazon.com, Netflix, Alphabet, Apple and Microsoft averaged 12.9 million contracts over the 30 days through Friday, the highest since early 2019.

And here is another brief explanation of how dealer gamma works (for a much more comprehensive take, please read “All You Ever Wanted To Know About Gamma, Op-Ex, And Option-Driven Equity Flows.)” As Bloomberg notes, dealers selling calls will typically buy the underlying stock in order to delta hedge their position. However, with FAANGs comprising nearly half of QQQ, buying the ETF works as a “quick and dirty hedge,” according to Steve Sosnick.

“This is where the concentration comes into play,” said Sosnick, chief strategist at Interactive Brokers. “It would not be surprising that dealers would find themselves hedging the huge call activity with QQQ — especially when Facebook and Google followed along.”

Finally, it’s possible that this is nothing more than institutions using the QQQ to express a view on the future of the tech sector, and getting caught in the recent whiplash forcing them to be stepped out on both sides of the trade.

Whatever the reason, there is no sign of the outsized flows ending any time soon: “There’s a battle between top callers and those who believe tech has further to run,” said ETF Store president Nate Geraci. “The swings between massive inflows and outflows reflects that battle.”

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com