JPMorgan Asks “What If Trump Wins?”

Tyler Durden

Tue, 10/27/2020 – 20:25

On Monday, we were amused to note that amid a relentless barrage of Wall Street “analysis” predicting a Blue Wave on Nov 3, or at least a Joe Biden landslide victory, none other than the largest US Bank came out with a jarring counter-narrative when JPMorgan head of global equity strategy Dubravko Lakos-Bujas, said that not only is a Blue Sweep not the best possible outcome – instead it “is expected to be mostly neutral in the short term as it would likely be accompanied by some immediate positive catalysts (i.e. larger fiscal stimulus / infrastructure) but also negative catalysts (i.e. rising corporate taxes)” – but that “an orderly Trump victory as the most favorable outcome for equities (upside to ~3,900).”

Needless to say, this was a striking reversal to the now dominant narrative because over the past few weeks, Wall Street had spent so much digital ink “explaining” just why the Blue Wave scenario is the “best possible” one since the “positive catalysts” would greatly outweigh the negative ones, or said otherwise: dear clients if you believe the polls that Democrats will sweep Republicans, please don’t sell your stocks amid fears of sharply higher corporate and capital gains taxes (and a surge in business-crushing regulations). To which we asked: was Wall Street (or in this case JPMorgan) starting to hedge in case the priced-in “sweep” does not happen, and traders need a fall back “narrative cushion” in case of a Trump win and/or Congress gridlock?

The answer appeared to be yes, because overnight Goldman’s Alessio Rizzi echoed JPM’s sudden skepticism that a “Blue Wave” was virtually assured, writing that while the likelihood of a Democratic Senate majority has risen since September, “more recently it fell from 69% on Oct 8 to 60% based on prediction markets.” And although a Biden victory with a divided congress might also be market friendly, Goldman “thinks it could introduce renewed risks to the current reflationary rotation.” The bank then went on to recommend what it thought was the best trade in case a Blue Sweep does not happen (read about it here).

Finally, as to why JPMorgan was suddenly “hedging” in such a counter-trend way, the JPM strategist wrote that “last week we analyzed voter registration data and their possible implication for State outcomes, while this week we analyzed Twitter sentiment on US election and compared it with the traditional polling data – they all point to a tightening race.”

Which, we wrote, “of course means that JPM needs to prepare a narrative for why a Biden victory is bullish but a Trump victory is even more bullish: just in case anyone gets the crazy idea of selling on Nov 4.“

So fast forward to today, when in another peculiar instance of “doubt” about the fully priced-in “Blue Wave” scenario, a second JPMorgan analyst, this time Nick Panigirtzoglou who authors the popular weekly Flows and Liquidity newsletter, asked the apocryphal question: “What If Trump Wins?”

But why is the largest US bank suddenly uproot the meticulously crafted narrative that Trump, and the GOP, have has a snowball’s chance in hell of winning any of the three major races on Nov 3?

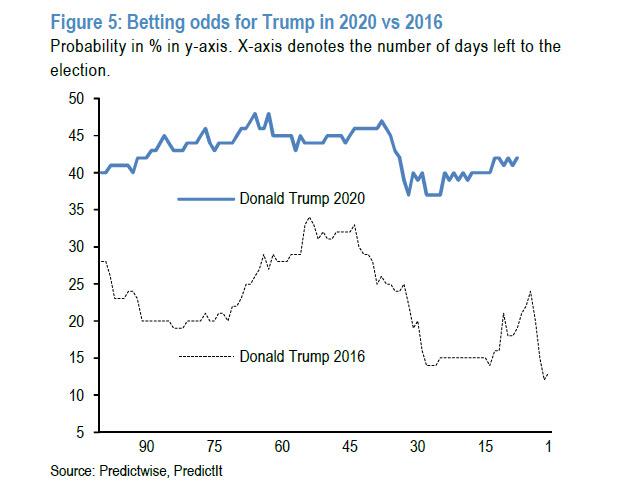

Well, as Panigirtzoglou explains, “polls and betting odds are still pointing to a high probability of a Biden win or a Democratic sweep in next week’s US presidential election.” Of course, this is similar if not identical to the backdrop four years ago when the probability of a Trump win was perceived to be rather low, in fact even lower than Trump’s odds now.

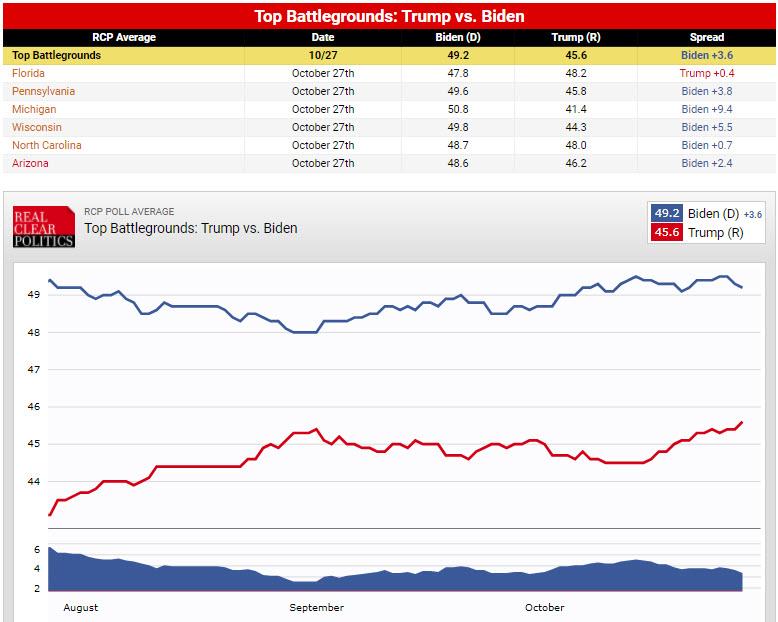

Then there is the latest RealClearPolitics battleground polling average, which shows that Trump’s average approval just hit its highest yet, with the president reportedly turning the critical Florida state in his favor, and is rapidly catching up in other “must win” states such as Pennsylvania, North Carolina and Arizona.

So, JPMorgan continues, what would happen to markets if the US election surprises the consensus like in 2016 and Trump wins again?

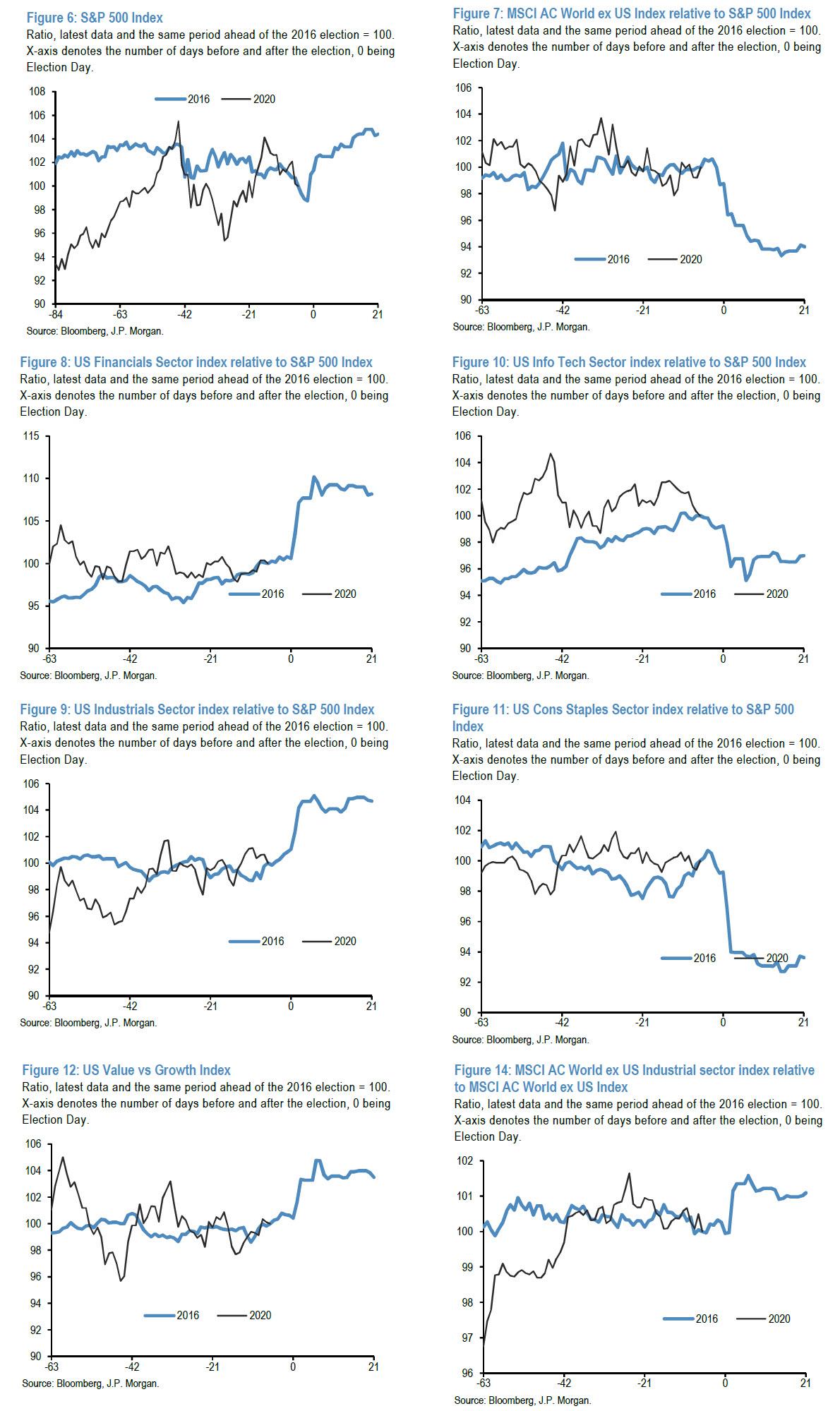

According to the JPM strategist, a simple way of answering this question is by looking at the pre-and post-2016 election pattern across asset classes, and consider where pledges from the candidates differ from 2016. This is shown in Figure 6 to Figure 23 across equities, rates, currencies and commodities.

Here are the main findings by looking at these charts:

For US and global equities, the market reaction favored US over non-US global equities. Given the betting odds and polls suggest that a Trump win would again be a surprise, there seems little reason not to expect a similar favoring of US vs. non-US equities. Among equity market sectors, the sectors that saw disproportionate gains relative to the rest of the index include financials and industrials, for both US and non-US equities. For the financials in the US, the reduced prospects for regulatory tightening could again see the sector gain in the event of a surprise Trump win. By contrast, those that lagged the broader index include consumer staples as well as tech.

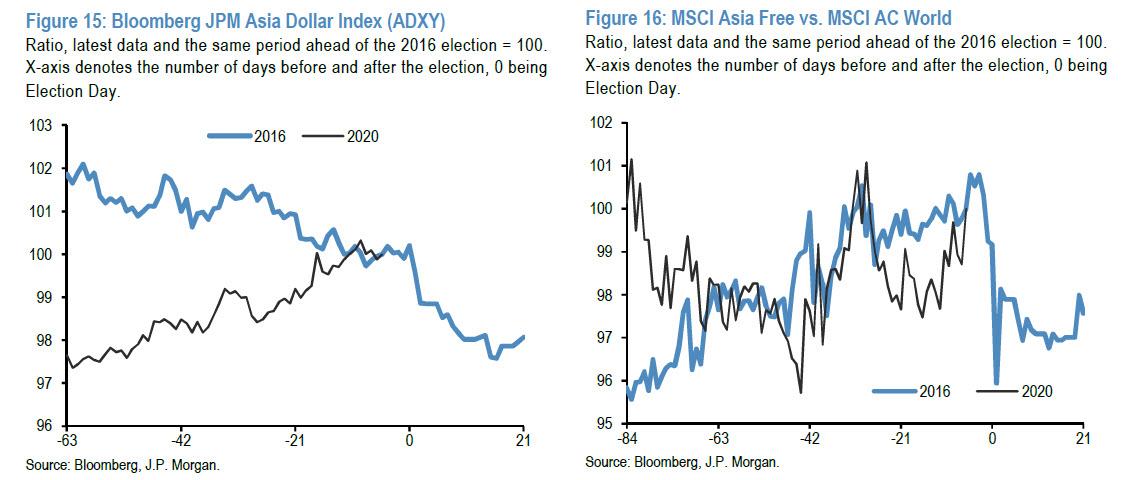

Regionally, among global equities and FX Asian assets are likely to be sensitive to a continued Trump Presidency as it would likely mean further US/China conflict on trade, technology and investments. Figure 15 and Figure 16 show the performance of the Bloomberg JPM Asian Dollar Index (ADXY) as well as the relative performance of the MSCI Asia Free float index vs. the MSCI AC World. The 2016 election result saw a depreciation on the ADXY in the month after the election and an underperformance in Asian equities relative to the MSCI AC World index. A depreciation/ underperformance of a similar order of magnitude would not be unreasonable as markets price in a continued escalation in the US-China conflict

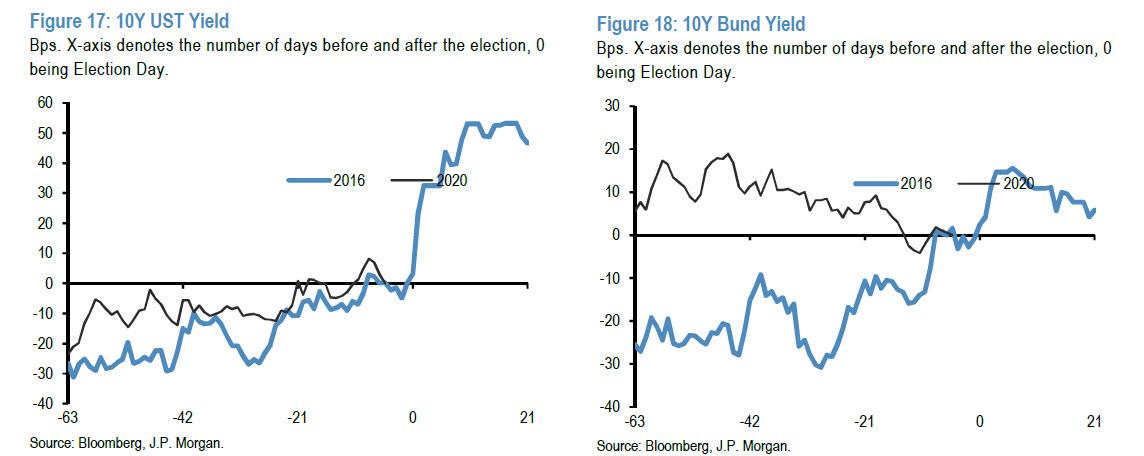

What about rate markets? Here, it is less clear-cut how different market pricing ought to be under a Biden or Trump Presidency under a split Congress than under a ‘Democratic Sweep’ scenario given the prospect of a more modest further fiscal support package. A clear victory by either candidate could reduce uncertainty, by dispelling fears of a contested outcome, and hence term premia priced in longer-maturity yields. But while the immediate reaction to a ‘Democratic Sweep’ scenario could in principle be to add some uncertainty given the potential for tax policy changes, the prospect of a significant further fiscal package would likely have a larger impact on yields and the curve in the medium term by adding to the already increased issuance needs of the US Treasury as well as potentially higher inflation expectations via infrastructure spending and minimum wage increases. As a result, while under a Trump victory there could be some pressure for further steepening and rise in 10y yields, it is less likely to be of a similar order of magnitude as in 2016 when markets began to price in prospects of significant deficit-financed tax cuts (Figure 17and Figure 18).

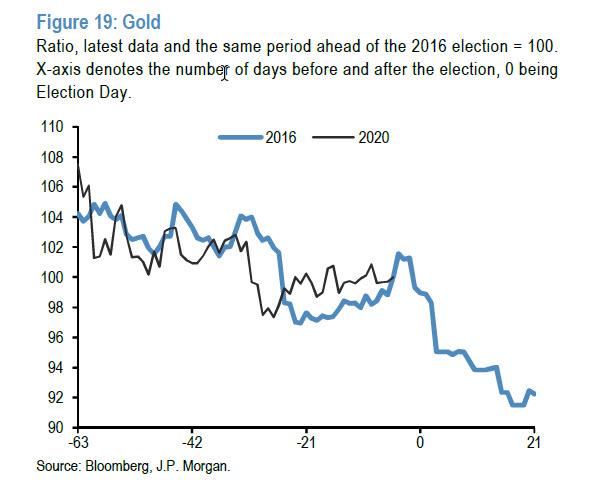

What about gold? Figure 19 shows the moves in gold around the time of the 2016 election and currently. However, the 2016 moves came amid a combination of a steepening US yield curve and more than 30bp rise in 10y real yields in the month after the election as markets began to price in deficit-financed tax cuts and infrastructure investment that featured in then candidate Trump’s election campaign. This time around, the prospect for a similar decline in gold prices appears to be more limited for similar reasons to why we see more limited upside for yields and the curve compared to 2016.

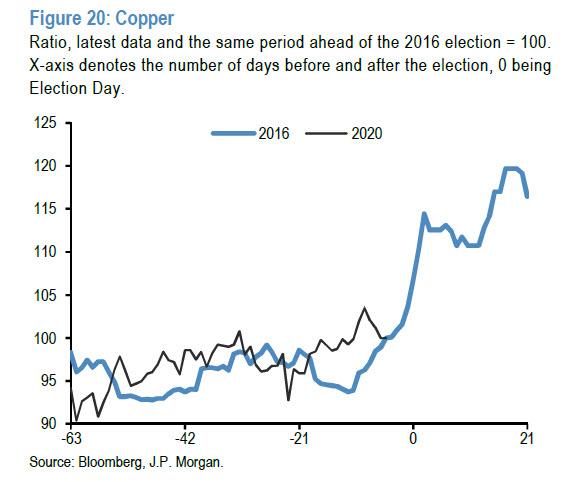

Among industrial metals, copper saw a sharp rise in the aftermath of the 2016 result, likely at least in part as markets priced in a prospect of infrastructure investment that then-candidate Trump’s election platform contained. In the current election, infrastructure investment has featured prominently on the Biden campaign platform but not on the Trump campaign, suggesting less of a prospect of a post-election rally in copper in the event of a Trump victory.

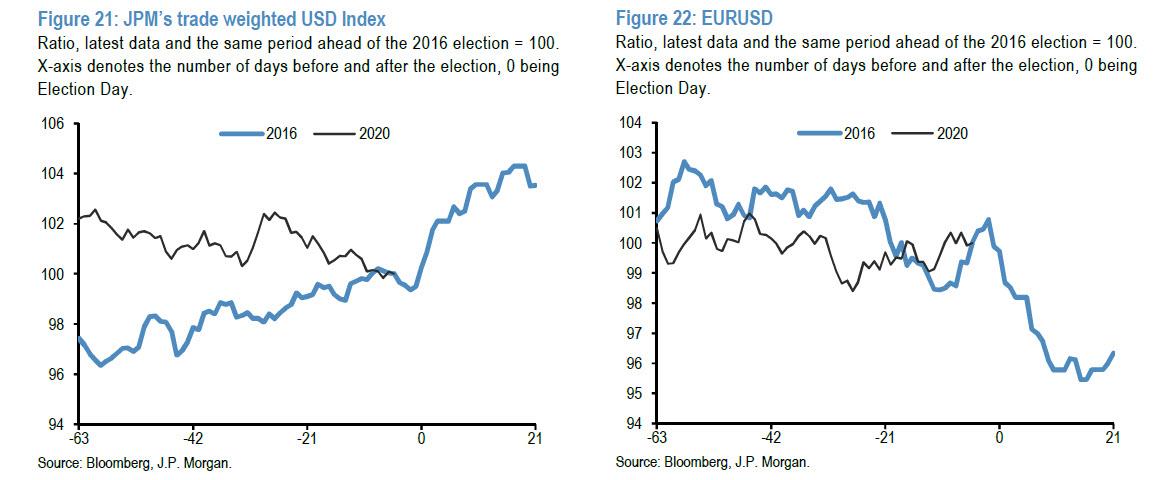

What about the dollar? As the global recovery began to take hold after the sharp contraction in 1H20, the trade-weighted dollar gradually gave back its March gains and is currently close to its levels at the start of the year. While questions over around the global cycle, in particular the degree to which its resurgence in Europe and the US would stall the recovery, are clearly key medium-term influences on the dollar, a re-pricing by markets of a Trump victory implying more risk of US exceptionalism and trade wars would likely see market reaction similar to what occurred after the 2016 election. This move in the trade weighted dollar in 2016 was mirrored by declines in both the euro and the yen vs. the dollar as well, and a market reaction to price in further US exceptionalism and trade conflicts could gain see a similar initial reaction.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com