Morgan Stanley: “There Is A Way For Markets To Know Relatively Quickly Who Is The Next President”

Tyler Durden

Sun, 11/01/2020 – 19:30

As discussed earlier, the record-shattering growth in vote-by-mail which means that the bulk of votes in key battleground states has already been cast…

… is likely to distort the pattern of vote counting and reporting on election night that we’ve become accustomed to. And, as we also touched upon in an earlier post, there’s potential for many twists and turns, with candidates seemingly ahead falling back quickly behind as different types of votes are counted at different times.

But, according to Morgan Stanley, there’s an increasingly viable path to knowing the result on election night. For investors, the bank laconically notes that “knowing the result is all about when markets will conclude who has won, not necessarily when a candidate has conceded or when media networks call the winner.” And the road to having a result on election night goes through Florida and North Carolina.

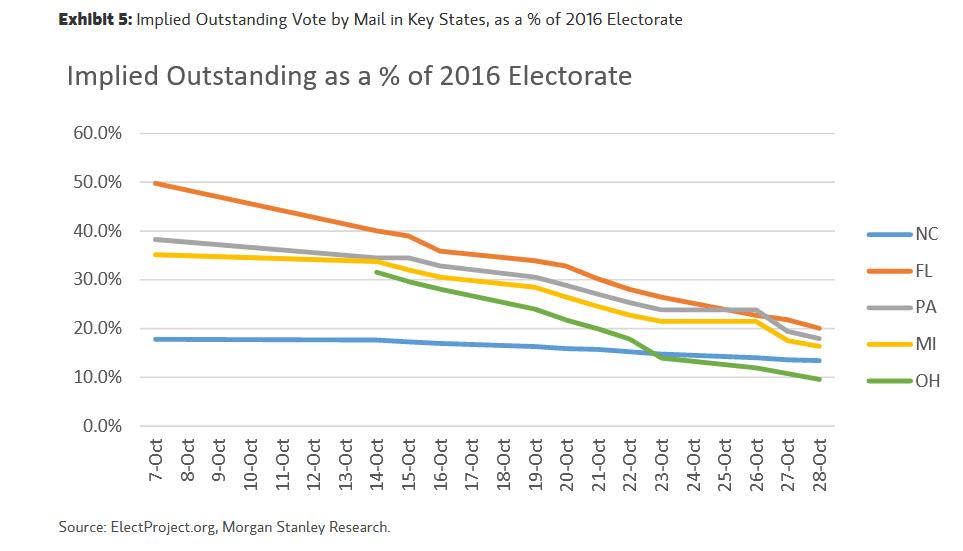

According to Morgan Stanley’s chief political strategist Michael Zezas, 65% of Florida mail-in ballots have been returned, as have 56% of NC ballots. Both states can count those votes ahead of Election Day, and have stated publicly those counts will be quickly released upon poll closing. Hence, both states could return quick results, which opens the possibility of knowing the election outcome early in the night. For example, President Trump’s path to victory without Florida is a much more narrow one. In fact, if he appears to have lost Florida, markets may quickly conclude he has probably lost the presidency.

Similarly, if the North Carolina senate race is won by Cal Cunningham (the Democratic candidate), then that, Morgan Stanley believes, will be an indicator to markets that Democrats have taken control of the Senate by also winning seats in other close races, like Colorado or Arizona where polls close later in the night. And while networks likely won’t call it that early because there are slow-counting states with enough electoral votes in play still out there, in particular Michigan, Wisconsin and Pennsylvania, Morgan Stanley thinks “markets would bake it in relatively quickly.“

Still, the bank sees as more likely that markets will need 24 hours or more to form a reliable view. If President Trump wins Florida or keeps the vote count close, both of which are viable possibilities given close polling numbers, then the Electoral College outcome may depend on those slower-counting states of Michigan, Wisconsin and Pennsylvania.

And while they have substantial amounts of mail-in ballots already returned, 65%, 62%, and 50%, respectively, they can’t count these votes until Election Day, so those results could take a few days to come in reliably.

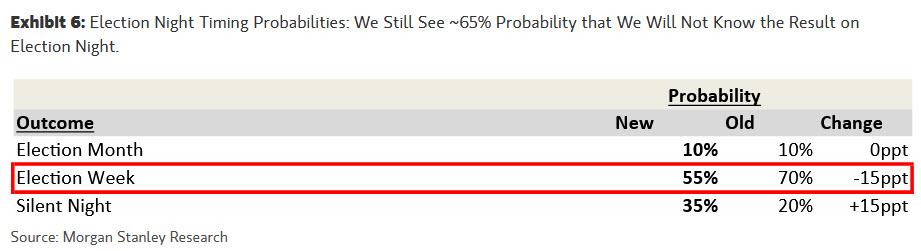

As a result, Morgan Stanley is adjusting its election night timing probabilities, and while it no longer sees the odds of an “election week” at 70% as it did last month, it still gives 65% odds that we will not know the result on election night.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com