The Spread Between High & Low Growth Firms Has Never Been Greater

Tyler Durden

Sun, 11/01/2020 – 13:40

Over the past decade we have closely watched the unprecedented divergence between growth and value stocks, which has made 13-year-old momentum-chasing Robinhooders millionaires, while bankrupting countless seasoned value investing titans.

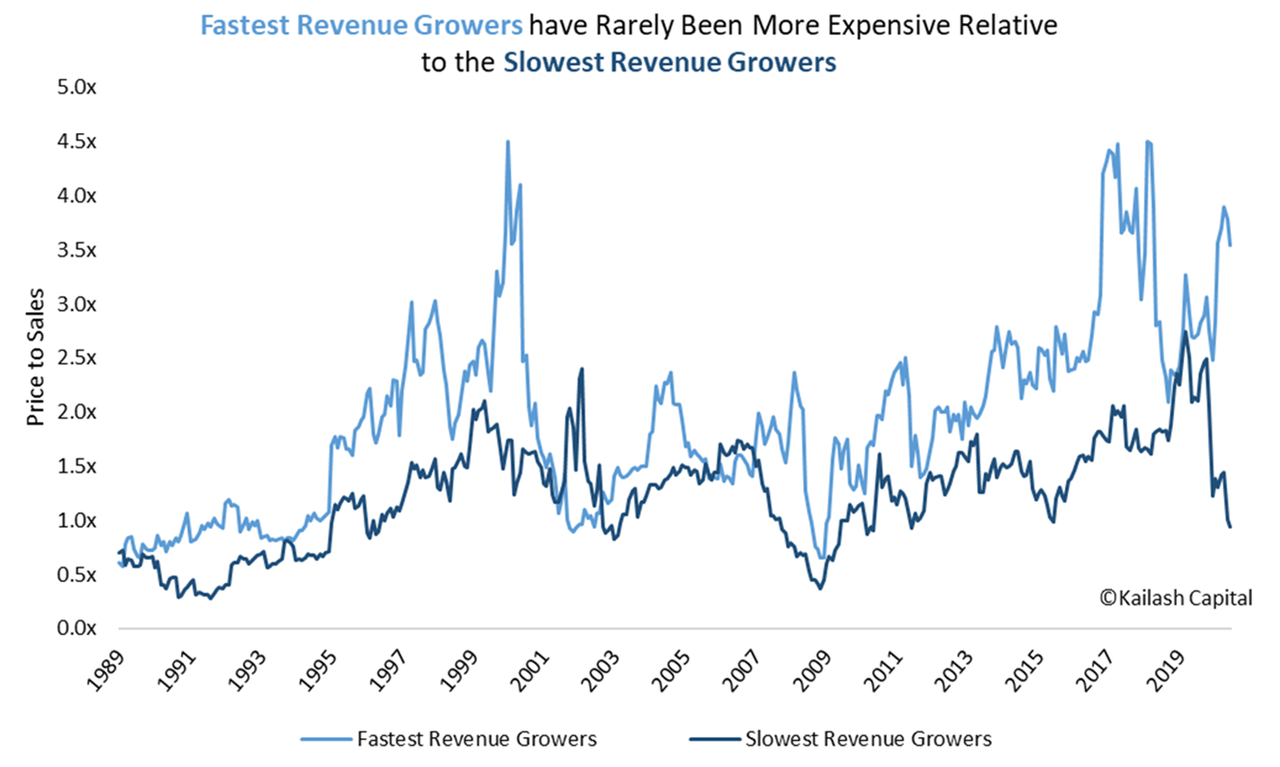

However, as our friends at Kailash Concepts show, there is another historic divergence worth noting. The chart below shows the following:

- Light Blue Line: The Price to Sales ratio of the firms in the S&P500 with the fastest revenue growth

- Dark Blue Line: The Price to Sales ratio of the firms in the S&P500 with the slowest revenue growth

The fastest growers have almost never been more expensive and conversely the slowest growers have almost never been cheaper. Most importantly, the spread between the two has almost never been wider.

Those curious for more may find value, no pun intended, in Kailash’s May 2016 white paper, “The Revenue Wreck – Are We Paying Rational Prices for an Ex-Growth America?”

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com