October Payrolls Preview: It’s About To Get Ugly Again

Tyler Durden

Thu, 11/05/2020 – 22:40

With the nation transfixed by the bad game show that is the presidential election, now in its 3rd day and counting, it is safe to say that nobody, not even the algos will give a rat’s ass what October jobs data the BLS reports on Friday morning. Still, as we do every month, we will preview what the market expects of the first jobs report after the election, even if it is still unclear who the next president is, and the first report expected to shock Wall Street by how bad it is since the Covid mini-depression.

As NewsSquawk reports, the recent data has been somewhat downbeat, with the rate of Initial Jobless Claims rising in the October survey week against expectations it would, while ADP payrolls rose in October, less than expected and a slower pace from the prior month, although it remains to be seen if it will correlate to the BLS following recent divergences.

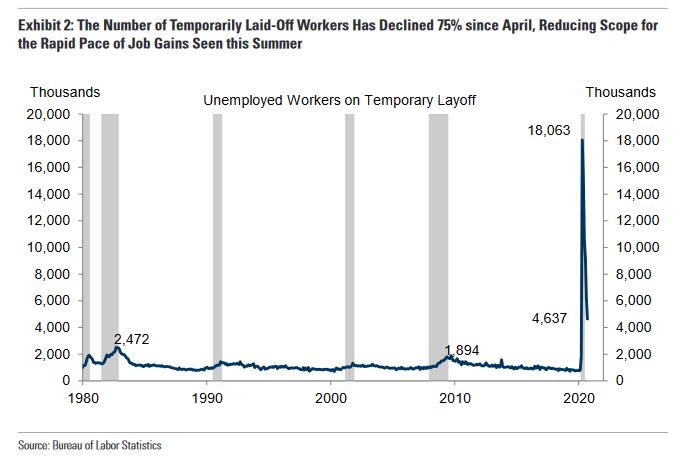

Goldman (which expects a below consensus 500K NFP print) agrees, noting that High-frequency labor market information indicates further deceleration in job growth, consistent with a drag from the virus resurgence and fiscal fizzle. The bank also expects virtual schooling and the accelerating shift to e-commerce this holiday season to weigh on education and retail payrolls in tomorrow’s report,respectively. The wind-down of the 2020 Census is also set to reduce payrolls by around 125k in Friday’s jobs report.

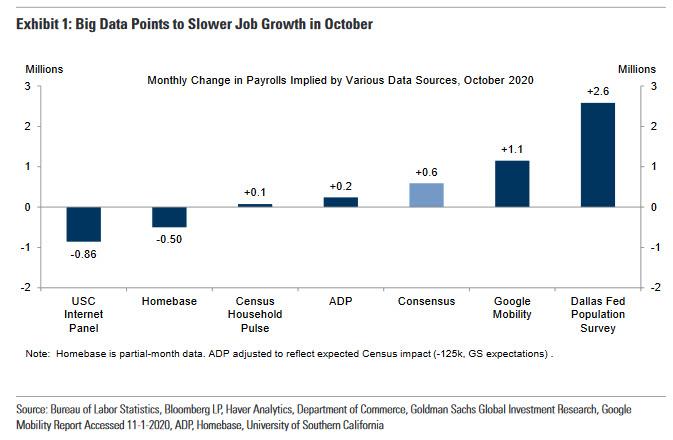

In addition to softer signals from Big Data sources, the smaller number of workers on temporary layoff (4.6mn in September, down from 18.1mn in April) reduces the scope for the rapid pace of gains seen in the summer. And while continuing claims declined sharply during the payroll month, much of the drop reflected the expiration of program eligibility as opposed to reemployment.

On the flipside, the manufacturing ISM survey saw employment return to expansionary territory at 53.2 after 14 months of contraction, a reading that is generally consistent with an increase in the BLS data on manufacturing employment. Philly Fed employment fell, although the report noted it still saw an overall increase on manufacturing employment. The ISM services employment report continued to grow in October, albeit at a slower pace than September. Challenger Job Cuts saw the best report in 7 months, with 80,666 layoffs, less than September’s 118k cuts.

With that out of the way, here is what consensus expects:

- Nonfarm Payrolls exp. +600,000 (range 0.300mln-1.221mln, prev. +0.661mln);

- Unemployment rate exp. 7.7% (range: 7.0-8.0%, prev. 7.9%);

- U6 unemployment (prev. 12.8%);

- Participation (prev. 61.4%);

- Private payrolls exp. 0.700mln (prev. 0.877mln);

- Manufacturing payrolls exp. 50k (prev. 66k);

- Government payrolls (prev.-216k);

- Average earnings m/m exp. 0.2% (prev. 0.1%);

- Average earnings y/y exp. 4.6% (prev. 4.7%);

- Average workweek hours exp. 34.7 (prev. 34.7).

Some more details courtesy of NewsSquawk

INITIAL JOBLESS CLAIMS:

Weekly initial jobless claims for the BLS survey period were above expectations (898k vs 825k expected, prior revised +5k to 845k). Continuing claims fell, however, to 10.02mln (expected 10.7mln from a revised up 11.18mln). Oxford Economics said the latest data was troubling, for a number of reasons: 1) Claims for regular initial state benefits rose to their highest level since late August and a decline in PUA claims seems largely a function of reporting issues in Arizona; 2) the positive trend in continuing claims is being offset by a rise in the number of individuals who have exhausted regular benefits, which OxEco says is further evidence of more long-lasting scarring effects from the pandemic. The situation in California, where there are a number of issues with its reporting, continue to cloud the picture, although these have since been resolved. OxEco warns that “failure to pass additional fiscal relief measures poses considerable downside risk to the economy, particularly as Covid-19 cases are on the rise and would likely lead to further job losses,” adding that a failure to provide more relief “raises the risk that some individuals will lose benefits altogether at the start of 2021.” As a caveat, it is worth noting that some analysts are questioning the usefulness of the initial jobless claims data series — notable economists like Oregon University professor Tim Duy have struggled to reconcile the positive economic momentum seen in housing and auto sales with the notion that the economy is collapsing.

UNEMPLOYMENT RATE:

Goldman estimates the unemployment rate declined by two tenths to 7.7%, reflecting an increase in household employment partially offset by potentially higher labor force participation. The labor force participation rate probably increased in October as the recovering labor market encouraged job searches. In interpreting the report, pay close attention to the number of unemployed workers on temporary layoff, which spiked to a record high 18.1mn in April and had retraced to 4.6mn in September.

Over the last 50 years, the three recessions with the highest share of temporary layoffs were followed by the fastest labor market recoveries (both absolutely and relative to consensus forecasts at the time). However, the smaller number of workers on temporary layoff in September reduces the scope for the rapid pace of gains seen in the summer (though it remains a positive factor relative to the pre-corona paceof job gains)

ADP:

Headline national employment rose by 365k, albeit a slower pace from the previous 753k and cooler than the expected 650k rise, although it is worth noting the Homebase small business employment numbers were weak. Nonetheless, Pantheon Macroeconomics highlights that this is still a soft ADP print. The desk notes the Homebase numbers suggest a 500k-1mln drop due to the pressure on the services sector, while leisure and hospitality have taken a hit amid the rise in cases. Pantheon expects to see ADP slightly undershoot NFP again and thus are looking for a print of 400k on Friday’s BLS report.

SURVEYS:

The national ISM manufacturing survey saw the employment metric at 53.2, up from the prior month’s 49.6, seeing growth in October after 14 months of contraction. Note, an employment index above 50.8 is generally consistent with an increase in the BLS data on manufacturing employment, ISM says. The ISM services report saw growth for the second consecutive month, albeit at a slower rate than September, printing 50.1 from 51.8 in September. Comments from respondents included: “Minor increase, filling positions” and “Slowly bringing back employees and investing in some areas as business returns”. Philly Fed employment fell in October to 12.7 from 15.7, although the report noted on balance, firms reported increases in manufacturing employment.

JOB CUTS:

Challenger job cuts were encouraging, only seeing 80,666 job cuts, less than the prior months 118.8k, showing the best reading in 7 months. Challenger, Gray & Christmas write the lower number this month indicates “some companies impacted by shutdown orders were able to reopen and stave off cutting jobs”. However, the firm warns uncertainty is likely due to the rise in coronavirus cases, stricter restrictions and lack of stimulus funds. A downturn in demand was the reason for 25,281 job cuts, the primary reason for the layoffs, while market conditions, cost-cutting and restructuring were the reasons for the remainder of job cuts this month.

ARGUING FOR A WEAKER-THAN-EXPECTED REPORT:

Big Data: High-frequency data on the labor market softened on net, averaging +450k across six measures (median +160k), as shown in Exhibit 1. We also note that the Google Mobility data may have difficulty distinguishing between employees returning to work and those transitioning between work-from-home and in-office labor market activity. Such a deceleration would be directionally consistent with the resurgence of the coronavirus in the middle of the country in late September and early October—or alternatively with the impact of waning fiscal support on spending.

Education seasonality. We expect a second month of weakness in education categories related to the coronacrisis, with the effect worth anywhere from -50k to-250k (mom sa, public + private). Some of the janitors and other school staff who normally return to work in mid- or late-September did not this year due to virtual school reopenings in much of the country. Reflecting this, we note scope for education payrolls to rise by less than the BLS seasonal factors anticipate.

Census hiring. Census temporary workers are set to lower nonfarm job growth by around 125k in October, as field operations wound down further.

ADP. Private sector employment in the ADP report rose by 365k in October, wellnbelow consensus expectations. the ADP report was viewed as incrementally negative news.

ARGUING FOR A BETTER-THAN-EXPECTED REPORT:

Job availability. The Conference Board labor differential—the difference betweennthe percent of respondents saying jobs are plentiful and those saying jobs are hardto get — rose further into expansionary territory (to +6.6 in October from +3.3 inSeptember and -2.2 in August).Job cuts. Announced layoffs reported by Challenger, Gray & Christmas fell byn39.7% in October to 77k after increasing by 3.7% in September (mom, sa by GS).They remain 57% above their October 2019 levels.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com