November Class 8 Truck Orders Third-Highest Ever

Tyler Durden

Fri, 12/04/2020 – 09:55

By Alan Adler of FreightWaves

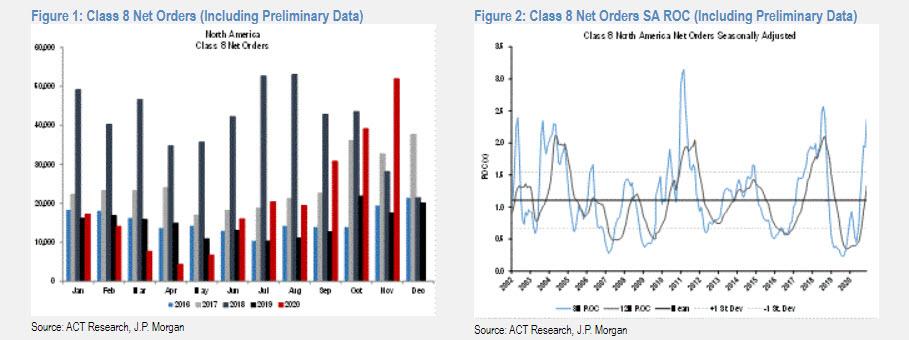

Preliminary Class 8 truck orders posted their third-highest number in history in November, continuing a stunning comeback from pandemic-depressed bookings earlier in the year.

Preliminary net North American Class 8 orders in November were 51,900 units, up 33% from October and 197% higher than November a year ago, ACT Research reported. FTR Transportation Intelligence pegged net orders slightly higher at 52,600.

“The pandemic-impacted economy continues to play into the hands of trucking,” said Kenny Vieth, ACT president and senior analyst. “With freight rates surging to record levels the past three months and carrier profits certain to follow, orders accelerated in November.”

Run rate recovers

Class 8 orders on a running basis for the past 12 months stand at 250,000 units, FTR said. Predictions as recently as April called for less than half that number.

“The Class 8 market is trying to rebalance after suffering through woeful order numbers early in the pandemic,” said Don Ake, FTR vice president of commercial vehicles.

“Fleets are still trying to catch up with the jump in freight volumes resulting from the economic restart and the generous stimulus money which is being spent predominantly on consumer goods and food,” Ake said. “This will only intensify if there is a second round of payouts.”

The volume reflects several large fleets placing all their orders for 2021 to lock up build slots, which they perceive could be in short supply next year, FTR said. FTR expects orders to slow in the next several months as large fleets wrap up seasonal orders. The ordering surge is restoring the backlog of trucks waiting to be built, which fell to a three-year low in September.

“The huge November orders mean that [the fourth quarter] will be a fabulous one, regardless of what comes in for December, and that portends well for the expected increase in production early next year,” Ake said.

Vieth said ACT’s axiom about new truck orders is borne out in the November numbers: When carriers make money, they buy, or at least order, new equipment.

Both FTR and ACT will publish final orders in mid-December. Changes are typically plus or minus 3%.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com