Convoy Investments: The Bull Market Of Our Lifetime Is Explained By Two Words

Tyler Durden

Mon, 12/14/2020 – 22:10

Submitted by Howard Wang of Convoy Investments

Money is a topic I revisit frequently because it has been so central to our markets in the last decade. As money gets printed, the average price of everything goes up with the tide because there are more dollars in the system chasing assets. We must understand how much of an asset’s performance is explained by traditional factors like appreciation of fundamentals and how much is explained by money printing. Below I offer a simple but telling metric.

In a vacuum the S&P 500 going up 20% this year seems great, but then you realize that money supply has gone up an incredible 51% this year. So on a monetary inflation adjusted basis, the S&P 500 is sitting at a miserable -30% for the year. Of course, all that printed money is going somewhere else, as assets like crypto-currencies and individual stocks far outperform the money printing benchmark.

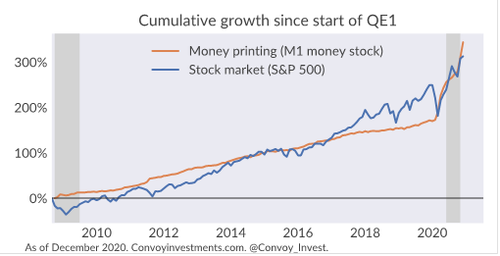

Looking further back, S&P 500 has had an incredible run during the QE era started in 2008, clocking in at over 12% annualized return for over a decade. However, this seems much less impressive when we see that money supply in our system has been growing at 13% a year over the same time. On a monetary inflation adjusted basis, S&P 500 actually lost -1% per year since 2008! In other words, the bull market of our life time is explained by two words, money printing.

This hasn’t always been the case, of course. Before the markets became hooked on QE, the S&P 500 used to actually outperform money printing rate by 6% a year.

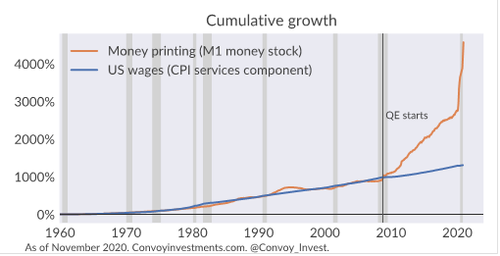

Stocks and other financial assets have come to be completely dependent on money printing like drug addicts, while the money has largely bypassed the real economy. For some context of the extreme divergence between financial conditions and real economic conditions, below I show the cumulative growth of wages in the US compared to growth of money supply since 1960. Prior to the QE era, money printing would go up and down with the business cycle, but wages grew at the exact same long-term rate as money supply. Since QE started in 2008 and even more so this year, money printing has become completely disassociated from the real economy.

Fast forward a year, as we recover from COVID (fingers crossed), the central banks will lose the political support to keep up the maniacal pace of money printing. The markets may have to remember how to stand up and function by itself again. Will central banks have the resolve to let the markets go through the nasty withdrawal and rehab ahead?

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com