Green Spam: Fed Joins Global Group For “Greening” Financial System

Tyler Durden

Tue, 12/15/2020 – 19:05

As if the Fed didn’t have far bigger problems on its plate – like, for example, what it will do when the inflation it has been doing everything in its power to create finally materializes and how it will tighten financial conditions without sparking the biggest tantrum in history and sending risk assets plummeting, on Tuesday morning the following bizarre headline hit terminals around the world:

- FED FORMALLY JOINS NETWORK FOR GREENING THE FINANCIAL SYSTEM

Immediately there were questions: does this mean the Fed will literally make it rain dollar bills to “green” the financial system, or is this another pathetic, desperate attempt to deflect attention from the Fed’s catastrophic actions that have pushed the world to the verge of collapse and only purchasing $1.3 trillion in assets every hour is preventing an all out collapse?

Turns out it was the latter, because it turns out that headlines was refering to a Fed announcement according to which the central bank formally joined the Network of Central Banks and Supervisors for Greening the Financial System, or NGFS as a less idiotically sounding acronym, as a member. Why is the Fed engaging in the disgusting virtue signaling of epic proportions? This is what it said:

By bringing together central banks and supervisory authorities from around the world, NGFS supports the exchange of ideas, research, and best practices on the development of environment and climate risk management for the financial sector. The Board began participating in NGFS discussions and activities more than a year ago.

“As we develop our understanding of how best to assess the impact of climate change on the financial system, we look forward to continuing and deepening our discussions with our NGFS colleagues from around the world,” said Federal Reserve Board Chair Jerome H. Powell.

Oh, so now the Fed cares about the environment? That’s so touching. But once we pass the virtue signaling stage, maybe Federal Reserve Board Chair Jerome H. Powell can explain why the Fed’s explicitly enabled the emission of billions of CO2 gasses in the atmosphere as a result of its policy of keeping zombie companies – such as uber-polluting shale corporations – alive by depressing yields so low that any junk bond issue by an insolvent shale was snapped up in millisecond by yield starved managers of other people’s money.

What’s that? The Fed won’t touch that topic and instead it will point all media inquiries to its noble pursuit of “greening the financial system?” Well, that’s a surprise: one almost wonders if the Fed is joining this group, which also includes the European Central Bank, the Bank of England and the Bank of Japan, just so it has a way to deflect questions that touch on the Fed’s true nature of being – along with its Chinese central bank peer – the biggest enabler of massive global pollution.

And not just the Fed: one wonders if the true motive of all those billionaires who take their private jets to Davos year after year (their gargantuan carbon footprint clearly exempt from the rules they impose upon ordinary peasants) and virtue signal for days on end how the world has to fight global warming (without ever pointing the finger at their biggest sponsor, China), is likewise not quite as pure. But that’s impossible: it would suggest that the world’s “through leaders”, top politicians and top 0.001% richest are… hypocrites!?

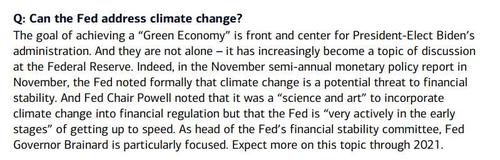

Perish the thought. But before you do, consider that we have officially hit peak stupid, because in a note published by Bank of America last week, the bank’s chief economist actually asked the dumbest question possible: “Can the Fed address climate change?” Here is her answer:

Well, if the Fed is really committed to “greening”, it can start by hiking rates and making it impossible for shale zombies to keep raising billions in capital year after year, keeping their toxic operations. We won’t be holding our breath.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com