Human-Run Hedge Funds Beat Quants In Pandemic

Hedge funds that use complex, automatic-trading strategies have been beating human stock-pickers for several years. But that all seemed to change in 2020, as wild market swings in all asset classes, driven by the virus-pandemic, along with an unprecedented flood of central bank money into capital markets has resulted in a year where human-run hedge funds trounced quants, according to Bloomberg.

Many of these so-called quants – Renaissance Institutional Diversified Alpha, Odey European, QAR Global Stock Selection, and Bridgewater Pure Alpha II are expected to record significant losses this year as the March stock market crash upended their computer trading models.

Meanwhile, human-run funds logged in some of their best returns in a decade, including Saba, Pershing Square, and Whale Rock.

John Thaler, an equity manager at Hampton Road Capital Management, said, “stock-pickers had several years of self-inflicted under-performance in the past decade, and the narrative was that computers had defeated humans.”

“Then, the quants hit an air pocket of tough relative performance, and this year, long-short equity managers outperformed by an enormous amount,” Thaler added.

The bigger winners this year, as we noted, are the “13-year-old Robinhooders” who outperformed everyone.

Human-Run Hedge Funds Beat Quants in Year Ruled by Pandemic: Bloomberg

And 13-year-old Robinhooders beat everyone: there’s your real headline

— zerohedge (@zerohedge) December 30, 2020

In June, Goldman Sach’s David Kostin wrote that institutional clients were becoming increasingly angry about how their relative portfolio performance fell behind retail investors.

Andrew Beer, the founder of Dynamic Beta, said designing trading strategies based on decades of numbers “don’t matter today might well be a fool’s errand.”

“This year should call into question some quant strategies,” Beer warned.

Even before the pandemic swoon in markets, “quant funds were already starting to struggle under the weight of their own success. Several had amassed tens of billions of dollars in assets, meaning market inefficiencies detected by their high-speed computers tended to vanish before they could make much money from them,” Bloomberg noted.

Jon Caplis, head of research firm PivotalPath, said, “most quant strategies haven’t made much money in several years.”

Caplis said quants are about 55% of funds that have posted losses since 2016. “These strategies were supposed to revolutionize trading, but they didn’t do that,” he said.

“We had every possible volatility scenario over the last five years: high vol, low vol, dislocated markets,” said Jay Raffaldini, global head of distribution for UBS O’Connor. Whatever the strategy, if a firm missed the opportunity to make money, it begs the question, “How viable is your business model?”

Another interesting trend is that top mutual fund managers who are handsomely beating major stock averages this year are seeing large outflows as customers gravitate towards cheaper index-trackers.

Bloomberg Intelligence estimates that actively managed stock mutual funds could report the largest outflows ever this year (approximately $500 billion), despite outperformance versus main equity indexes. By contrast, $200 billion flowed into ETFs with a passive investing structure that replaces human decision-makers.

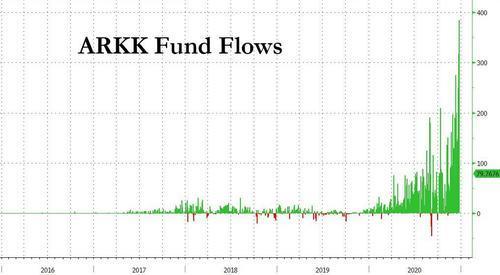

The recent surge in ETFs is a reminder of retail investor euphoria, which is best captured by the mindblowing inflows into Cathie Wood’s ARKK momentum/growth/”story”-chasing ETF, the ARKK Innovation ETF (profiled here), which just passed JP Morgan “for the largest actively managed exchange-traded fund” with $18 billion in assets and which owns more than 10% of 15 different stocks.

Many quant funds underperformed this year as human stock-pickers reigned supreme, but the real kicker here is that Robinhood traders outperformed everyone.

Tyler Durden

Thu, 12/31/2020 – 15:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com