Homebuyers Face Affordability Crisis, Worst In 12 Years

Between record-low mortgage rates (thank you Federal Reserve), Congress’ fiscal stimulus checks, record debt-fueled demand, and extremely low supply, the housing market entering 2021 is in bubblelicious territory, surpassing levels not seen since the 2006/7 housing bubble.

Of course, surging home prices mean that millennials can’t afford to buy as this has pushed affordability to a 12-year low.

Blomberg, citing a new report from Attom Data Solutions, said homebuyers in the fourth quarter had to spend at least 30% of their wages to afford the average American home, the largest share of any quarter since 2008.

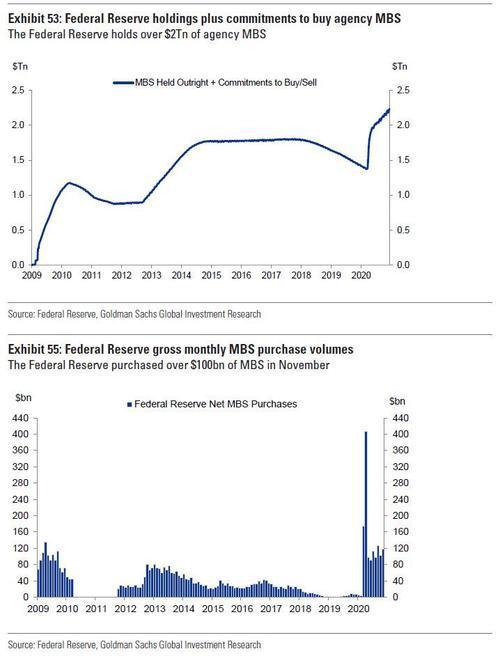

Thanks to the Fed, which has been on an MBS buying spree, purchasing more than $100 billion in mortgage-backed notes in November – borrowing costs are now below 3% for a 30-year loan, have spurred a buying frenzy, driving up prices across the country as bidding wars for homes erupt amid shrinking supply, as per a new Goldman Sachs report.

“The future remains wholly uncertain and affordability could swing back into positive territory,” said Todd Teta, chief product officer at Attom. “But, for now, things are going in the wrong direction for buyers.”

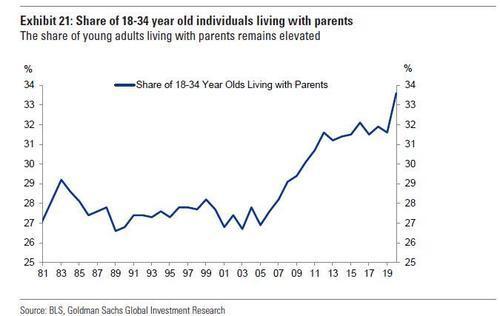

And the wrong direction indeed as more millennials than ever are living with their parents.

With that in mind, here is Goldman’s housing activity tracker.

If this isn’t a bubble… Then what is?

Tyler Durden

Sun, 01/03/2021 – 16:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com