World Out Of Whack: Global Market Commentary And Outlook

Submitted by Ritesh Jain of World Out Of Whack

Today, much like in the past, it is not the best idea that wins, but the narrative which captures the most mindshare. Nothing rings true than this quote of 1933 made by the Propaganda Minister of Nazi Germany

“It is the absolute right of the state to supervise the formation of public opinion.” – Joseph Goebbels

As Coronavirus cases continue to increase in many parts of the world and lockdowns are put in place, the story should look grim; but there is also light at the end of the tunnel because of vaccines. After the vaccines have been administered to most of the population, there will be plenty of pent-up demand that will help the economy recover. That said, who needs vaccines when you have the central banks backstopping the markets by introducing high amounts of liquidity?

What appear to be bubbles right now, could go exponential. As J.C Parets write “News was poison in 2020. It will be worse in 2021”. The investors who often get markets right knows how to shut off the news and focus on what is important.

The vast liquidity we have today is emanating from the balance sheets of central banks. As more electronically printed dollars are pumped into financial markets, the cost of financing goes down, thereby pushing asset valuations higher. This view is further reinforced by a weakening dollar, and even by the fact that Jerome Powell has called out the explicit link between low interest rates and the high valuations in markets.

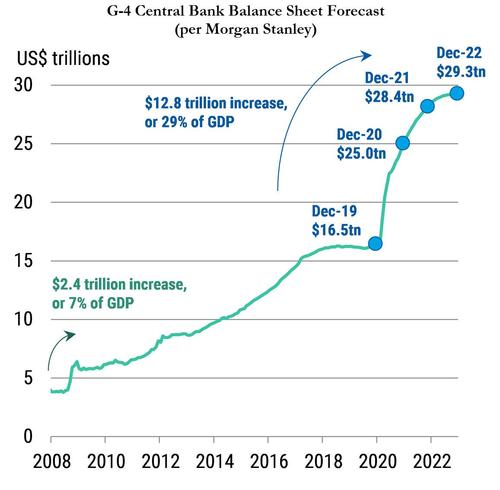

Vast amounts of liquidity can also create a lot of fragility in markets. Even if central banks continue injecting liquidity into the system, at some point markets will fully price it in. Once that happens, it can become the bigger driving force that may set up markets for a taper tantrum 2.0 of sorts as the system demands not just a continuation of liquidity provision but increasing amounts of it. Investors should no longer continue to think about how much central bank balance sheets have increased, but rather the rate at which the balance sheets are growing. The exhibit below by Morgan Stanley points to a deceleration in the rate of growth of G-4 central bank balance sheets as we approach the end of 2022.

As most readers will already know, financial markets are complex systems, which means they are highly interlinked and have feedback loops. These feedback loops lead to nonlinear effects, which means small shocks can transform into large ones due to each node in the system being interlinked to other nodes. For comparison, when too much snow accumulates, the probability that even a small snowflake can trigger an avalanche goes up significantly.

With the median correlation across asset classes reaching new highs, the probability of an avalanche goes up. Nobody could have predicted COVID-19 from appearing when it did; but what had been known for a while was that due to globalization, the world was much more prone to eventually experience a global pandemic. In a similar fashion, as markets become unhinged from their underlying fundamentals and become liquidity driven (which in turn drives correlations higher), the probability of an ‘avalanche’ occurring in the markets is becoming more and more likely.

The response to the global pandemic was to provide financing through loan guarantees and green asset financing by the government. We have had quantitative easing programs since 2008, but we have not seen inflation in goods and services because banks were not lending money. This meant that an increase in the money supply did not make it into the real economy. Today, however, after experiencing an economic shock caused by COVID-19, the government response has led to money reaching the real economy.

The pandemic has taught governments that they can now – through MMT-lite programs – lend directly to the economy through the commercial banking channel.

“You can lead a horse to water, but you can’t make him drink” is an apt quote for liquidity (M2) sloshing around in the system but refusing to multiply (M3). The M3 velocity has been stubbornly falling since March 2020 but as per Gavekal’s Velocity Indicator this money is finally looking to multiply. Said differently, the horse has finally decided to drink water.

But before you start admiring the below chart you should keep in mind that

What is good for the economy is bad for the markets and what is bad for the economy is good for the markets.

Let me explain. Liquidity is fungible. It can either go to the Financial markets or it can go the real economy. If vaccines work and business closures and layoffs subside then the money hiding in financial assets will spill over to the real economy and force Monetary policy to tighten financial conditions.

So, rising Money velocity is not good for Financial markets and on the contrary will lead to elevated volatility in financial assets.

The increase in velocity is bad for US dollar and US Dollar should continue to fall but not in a straight line. This liquidity is currently lifting all boats, but I think we will see some assets doing better than others in 2021. My bet is on Japan, Vietnam, African Continent, and commodities in general with a continuing bullish stance on precious metals, crude oil and agricultural commodities.

Central Bank digital currency.

A lot has been written in the media about central bank digital currencies (CBDC), and we might see the dawn of CBDCs with China increasingly looking like the first one to launch its version, known as CBEP.

As per a MicroStrategy paper titled “The cost of Money being nothing”:

If money supply is created centrally, it must also be used, or directed, centrally as indeed we are seeing at the moment with the lockdowns and the enormous surge in budget deficits. Under a CBDC scheme, the central bank would become arbiter of who should and shouldn’t be granted credit. By determining the price of money, it determines what is “value” and thereby what is produced and consumed, and how it is produced. It determines what the real return on capital is and how much capital is destroyed. By printing money to buy Treasuries, it has reshaped the entire economy around greater government spending and control. Under a central bank digital currency, monetary policy will become completely political.

Bullish on Japan

Japan is the only country in the G-7 where monetary policy and fiscal policy are working seamlessly thanks to embedded Abenomics reforms. Valuations are cheap, and more importantly, it is a very unloved market from an institutional and retail investor perspective. Below is a chart of 5-year flows into the biggest Japanese ETF (EWJ).

Further, this chart from Morgan Stanley explains the Japanese story in simple terms:

Bullish on Vietnam

Vietnam will be one of the few countries in the world that will boast double-digit nominal GDP growth rates once the COVID-induced slowdown is over. The country has real rates in the range of 200-300 bps and a low fiscal deficit, which is a rarity in today’s world. Positive real rates, low and stable inflation, low unemployment, and a positive current account balance are characteristics of a strong economy. India was exhibiting all these characteristics in 2002-2003 (except a positive CA balance) right before a domestic consumption boom began. Vietnam is also going to be a big beneficiary of a “reshoring boom” out of China

Bullish on Africa

Africa is resource rich and it is going to be the next frontier of growth led by technological advancement, connectivity and more importantly the battleground of largesse for the two competing superpowers i.e., US and China. China is already increasing its influence in Africa through its Belt and Road Initiative and it plans to complement that by extending its CBDC reach over the entirety of the continent.

African countries will have much better access to credit and will be able to sidestep a boom-and-bust cycle of currency devaluation, providing them with much needed economic stability.

Bullish on Commodities

Commodities almost always rise when there is a supply side shock. The rise in commodity prices is rarely demand driven because demand can be modeled, while supply shocks are much harder to predict. If you see the chart below you will find that all peaks and troughs happen around events, and I believe that COVID-19 was such an event, which has broken supply chains across the world. The years of underinvestment in commodities and energy in general was waiting for a catalyst to start showing up in prices and I think we have that catalyst firmly in place. I also believe that soft commodities, base metals, the entire energy complex including coal and Uranium and precious metals will see more inflow of capital as they are under represented in investors portfolio.

Where can we lose the most money?

We must understand that markets are not cheap by any measure.

I would say the easiest answer is in consensus, but the most concerning thing for me is the sentiment. Now, this does not mean we will get an imminent price correction, but it does mean that the market is vulnerable to any negative catalyst. I do not recall grappling with so many of these negative catalysts at the start of a year, and especially when most assets were not cheap from a historical perspective. The resurgence of the virus, a surprise increase in inflation, policy missteps, a jump in bond yields or bond spreads, fears of stagflation, China launching its digital currency, broken supply chains, geopolitical flashpoints etc. – and the list is still not exhaustive by any imagination, in my opinion.

I believe that there is a reasonable possibility that any of these catalysts could materialize and give us a risk-off environment at various points in 2021. I expect to see a 10-20% correction in broad indices whenever a risk-off episode materializes with much larger drawdowns for individual securities. All corrections will be met with a forceful response from Monetary and/or Fiscal authorities who are left with no choice but to support the system and hope to inflate away the massive overhang of debt built in the system.

The best way to play this environment is either through having cash (at least 30%) as an asset allocation, ready to be deployed at short notice, or by buying far out of money call options on volatility whenever the markets are in a euphoria stage.

The cash deployment during these events should be in commodity producers, asset owners or Emerging Markets

Tyler Durden

Mon, 01/04/2021 – 21:20![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com