Corn Prices Rocket To 6-1/2-Year High As Traders Focus On Argentina

Chicago-traded corn futures are up more than 2% Tuesday morning, hitting 6-1/2 year highs on Monday, as commodity traders are concerned about export disruptions in South America and new weather models that suggest dryness, according to Reuters.

Argentina announced last week that sales of corn for export would be suspended until late February. The move by the government was to ensure domestic food supplies were stable.

“This decision is based on the need to ensure the supply of grain for the sectors that use it as a raw material for the production of animal protein such as pork, chicken, eggs, milk, and cattle, where corn represents a significant component of production costs,” the government said.

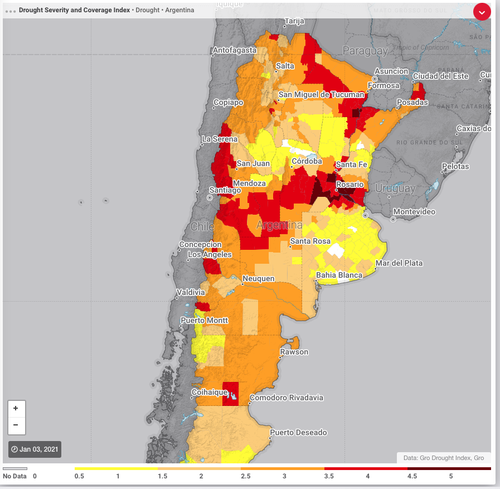

Besides export disruptions, traders are concerned about emerging weather trends that suggest dryness across the South American country that would impact potential yields.

“Corn is seeing support from concern about dryness in Argentina and the ban on Argentine corn exports,” said Matt Ammermann, StoneX commodity risk manager.

“Argentina has had some rain, but the debate is whether this is enough as some areas are looking dry,” Ammermann said.

Weather models provided by BAMWX show intense dryness for the region.

“Looks very typical La Nina, keeping Argentine crop areas and far southern Brazil dry,” said Arian Suderman, Chief Commodities Economist for StoneX Group.

Looks very typical La Nina, keeping Argentine crop areas and far southern Brazil dry. #corn #soybeans #oatt https://t.co/ltsV7wABpQ

— Arlan Suderman (@ArlanFF101) January 3, 2021

Reuters’ Karen Braun points out bullish bets on Chicago-traded corn futures have risen to levels not seen since August 2021.

Besides surging corn futures, soybean prices have flirted with a 6-1/2-year as well.

While soaring agriculture prices is great news for US farmers, Albert Edwards, global strategist at Societe Generale, warns that the recent spike in food inflation could result in socio-economic destabilization in emerging market economies.

Tyler Durden

Tue, 01/05/2021 – 13:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com