Here Are The Top 10 Questions Goldman Clients Have About China

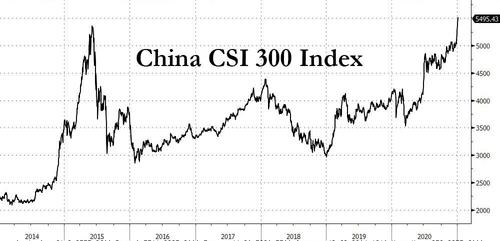

With Chinese stocks soaring in recent weeks, and the blue chip CSI 300 index surpassing its 2015 Chinese stock bubble highs..

… momentum chasers investors from around the world are predictably once again poking around in Chinese markets (especially amid the recent confusion surrounding the bilateral crackdown on Alibaba, and the US-led sanctions on Chinese telecom and various megacap stocks), which is why Goldman’s top China strategist Kinger Lau writes that amid the “extensive client conversations” he had in recent days, investor interests and questions have revolved around ten particular topics. Here are the Top 10 China FAQs by Goldman clients, from the latest Goldman “China Musings” report:

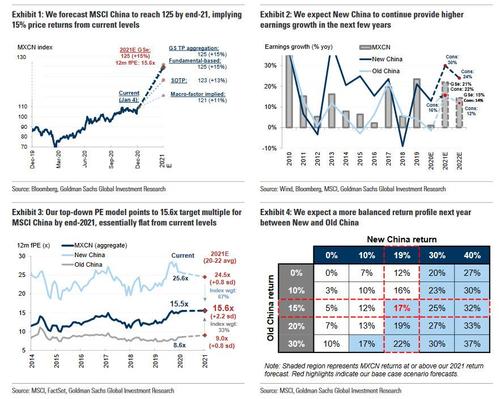

1. Upside and drivers? China rallied 26% in 2020. Strong EPS growth (21%/15% for 21E/22E) on stable PEs (GSe: 15.6x vs 15.5x now) will drive 17% total returns for MXCN this year. Goldman expects a more balanced return profile (New vs.Old China) and prefers China A tactically given its higher macro cyclicality and lower sensitivity to external and Internet policies.

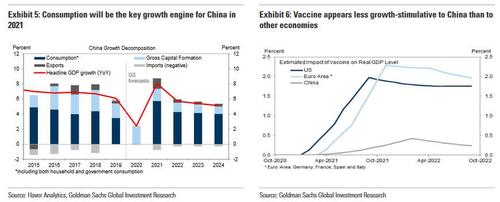

2. GDP growth and vaccine? China’s output has surpassed its pre-Covid levels. (GSe: 2%/8% GDPg in 20/21), with consumption being a key growth driver in2021. The first Chinese vaccine has been approved last week but should have only moderate growth impulse.

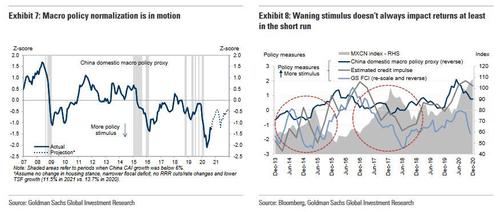

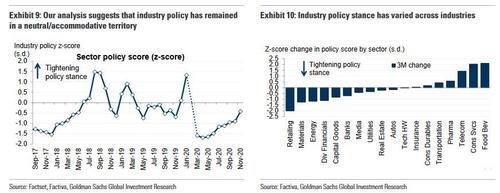

3. Is China tightening? Policy stimulus should fade this year as growth recovers. However, the recalibration should be gradual and growth-dependent, and, in what may be the most laughable statement in modern history, Goldman claims that “moderating policy support doesn’t always deflate equity returns.” Brilliant.

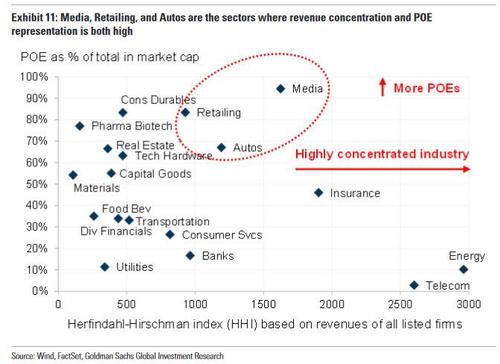

4. Industry regulation? Antitrust and FinTech regulations are top policy priorities for 2021, but unlike in 2018, regulatory oversight isn’t tightening across the board although it may pressure valuations for certain companies/sectors.

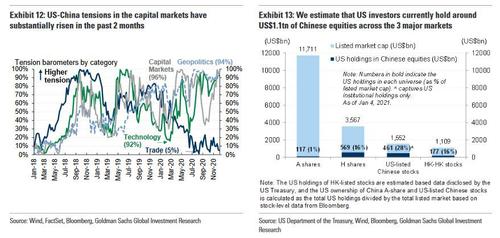

5. US restrictions on Chinese stocks? Clarity has recently emerged for ADR de-listing risks but uncertainty remains regarding the Executive Order, notably the scope of restriction, index exclusion, and forced de-listing.

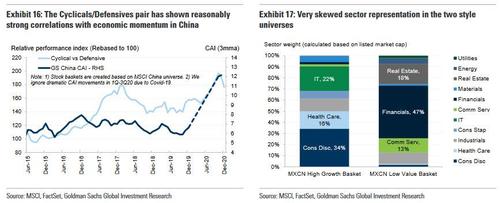

6. Rotating from Growth to Value? Goldman stays structurally positive on Growth, but have been scaling up cyclical exposures, instead of pure Value, in its allocation.

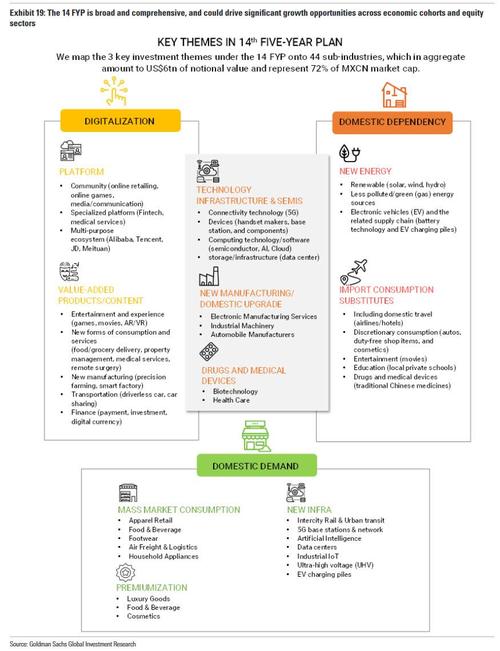

7. Themes and sectors for 2021? Following the 14th Five Year Plan as the anchor for thematic investing, Goldman favors a hybrid of Growth and Cyclicals sectors to start 2021.

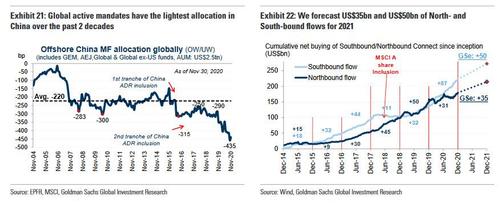

8. Is China crowded? No, in fact, positioning is at all-time lows according to GS, which expects robust inflows on decent growth, continuing market reforms, and an appreciating Rmb.

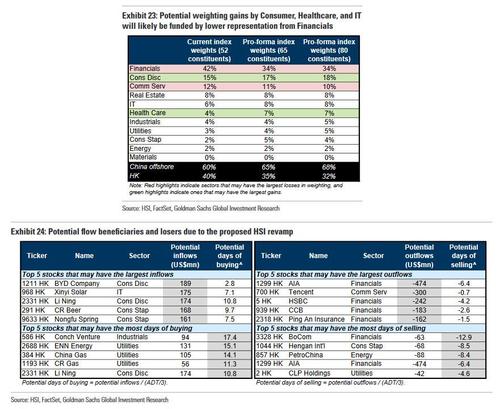

9. HSI revamp? More New China, less Old China and HK representation are likely after the index rebalancing in Mar.

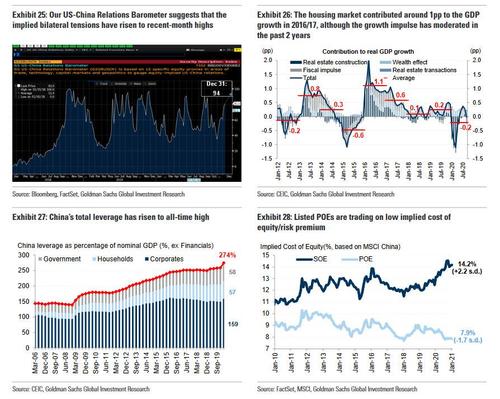

10. Risks? Sino-US tensions, private sector policy, leverage, and property tightening:

- The developments of US-China relationship under a new US administration;

- Over tightening in China property which contributes to around 20% of GDP via direct and indirect channels;

- China leverage, which is at all-time highs with rising number of defaults;

- POE regulation tightening which my present upside risk to equity risk premia.

Tyler Durden

Sun, 01/10/2021 – 20:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com