Investor Euphoria At “Record High” As Tailwinds For Stocks Could Soon Dissipate

Over the last month, we made it quite clear to readers that there was no other way to characterize today’s market behavior as one of the most euphoric periods in history.

-

Dec 1: Market Euphoria Surpasses Dot Com Levels: What’s An Investor To Do?

-

Dec 2: Citi Warns Most “Euphoric” Market Since Dot Com Bubble

-

Dec 6: JPMorgan Warns Crowded Trades And Euphoric Consensus Are The Biggest Threats For Markets

-

Dec 15: Record Wall Street Euphoria Triggers First BofA “Sell Signal” Since February 2020

-

Dec 17: Euphoria Goes To 11: Futures, Global Markets, Bitcoin Soar As Dollar Collapse Continues

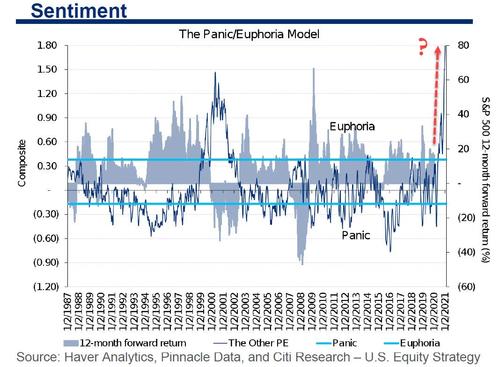

One of the most stunning charts outlining today’s insanity is the Citi Panic/Euphoria model that just hit a record high of 1.83.

What does this mean? It’s simple: as Citi chief economist Tobias Levkovich writes when looking at market returns following previous euphoria extremes, there is now a “100% historical probability of down markets in the next 12 months at current levels.”

Expanding more on market exuberance is RIA Advisors Chief Investment Strategist Lance Roberts who published a short video on Monday morning explaining how Wall Street’s party is getting absolutely out of hand.

Roberts points out that equity inflows over the last couple of months have been unprecedented. Adding to the speculation, he points out that call option volume is hoovering at near-record levels.

He said today’s speculative environment is a byproduct of the Federal Reserve’s easy money policies as investors believe there is no risk as a “Powell put” is in place.

Lance said it’s probably time to take some risk off the table.

On currencies, he said the “dollar has quietly been gaining some strength here in recent days,” adding that the decline in the dollar has been the tailwind in equities.

An upswing in the dollar would be bad news for stocks.

Video: Lance Roberts: Does Market Exuberance Match Reality? | Three Minutes on Markets & Money

Lance concludes by saying “we’re entering the first year of a new decennial cycle which happens to be one of the lowest-performing years of the entire ten year period.”

Besides a rising dollar, what else could pop the stock market bubble?

A breakout of 10Y nominal yields, of course, read more about this here: “What Is The Yield On The 10Y That Will Burst The Stock Bubble?”

Tyler Durden

Tue, 01/12/2021 – 05:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com