General Motors “Blue Sky” Scenario Could Send Stock To $160: B of A

This morning we noted that GM had risen to all time highs on the back of an autonomous driving investment from Microsoft and comments from incoming Treasury Secretary Janet Yellen about the importance of EVs for the country under a Biden administration.

Now, Bank of America – like the rest of the market – appears to be waking up to the idea that a “new autonomous General Motors” (as they refer to it) still could have plenty of runway ahead of it.

B of A says that the tie up with Microsoft “provides important cloud/computing value” to GM, especially for ride-hailing and fleet services:

Perhaps more important than the equity investment and increased valuation for Cruise (versus last mark of $19bn in 2019), the announcement with Microsoft this morning marks another important strategic partnership for Cruise (and GM), not dissimilar to the one that was established with Honda in 2018. As a reminder, Honda’s value-add to Cruise/GM was shared investment and core competencies (small car programs and form factors) to develop a purpose-built autonomous vehicle to be deployed in a mobility services model, as well as theoretical access to the Japan market for deployment.

As noted above, Microsoft’s value-add to the partnership will be its Azure cloud computing platform, which will help manage the extensive amount of data required for robust autonomous capabilities of the vehicles in fleet, not to mention mapping/point location, vehicle communication with Cruise’s back office (as well as infrastructure, vehicles, etc.), and the customer-facing app for ride-hailing services, among other potential collaborations.

The note continues: “Moreover, Microsoft’s cloud computing platform to enable Cruise to commercialize its autonomous vehicles and mobility services business puts the partnership at least in the league of the likes of Waymo/Google and Zoom/Amazon.”

It also says that Cruise – GM’s self-driving business that is now also co-owned by Microsoft, Honda, Softbank and other institutional investors – could be worth “a lot more than $20/share”:

In our updated theoretical sum-of-the-parts analysis for GM and its AMOD efforts, we used Lyft and Uber’s current valuations, at the low-end and high-end respectively, and divided by half for conservatism, which indicated a value for Cruise of $8bn to $53bn+. The $30bn mark, or a little over $20/share (again up from $19bn in 2019) for this (still) early stage venture could increase materially as the technology is commercialized and deployed through 2021+.

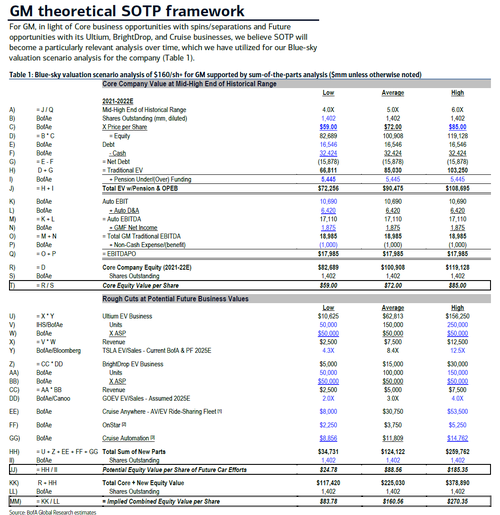

“With this in mind, we reiterate our SOTP framework, which suggests significant upside potential for GM (page 2) from our current PO of $72,” the note says.

The note continues, reminding the reader there could be “significant upside” from the bank’s already optimistic price target of $72. The bank laid out its analysis in a sum of the parts framework that sees GM’s core value between $59 and $85 per share and its “potential future business” values ranging from $24 to $185.

Combined, the bank sets three scenarios for GM’s implied combined equity value per share, ranging from $83 to $270. It notes its $160 “average” scenario at the top of its analysis.

Recall, we reported this morning that Microsoft is part of a group of companies that will invest more than $2 billion in Cruise, which is majority owned by GM. The stakes in Cruise raise its valuation to $30 billion, up from $19 billion in Spring 2019.

GM is also adding to its Cruise investment as part of the funding round and is going to maintain its majority stake. Among other companies investing is Honda, who is already a stakeholder, and “other institutional investors”. Cruise had previously pulled in $7 billion during 2018 and 2019 from investors that included Softbank.

The terms of the deal state that Cruise will use Microsoft’s Azure cloud service to help it roll out autonomous vehicle services. Cruise has been testing vehicles in San Francisco and plans on rolling out a robot-taxi service eventually. Meanwhile, Tesla’s promise of “a million robo-taxis” on the road seems to be a distance memory.

GM also noted that Microsoft is going to be its preferred cloud provided and will help streamline the company’s supply chains. Cruise has signaled that it is getting “closer to commercializing its technology” at the same time investor appetite in EVs and self-driving seems to have reached mass adoption.

This marks the first major investment round in Cruise in more than 18 months.

Some investors were already speculating (in jest) last week that GM could re-price according to its new self-driving and EV aspirations. Now, it looks as though the market may agree.

Fun fact: If the market priced the new “flying EV” $GM 2.0 at the same 29x EV to sales it prices $TSLA at (total, unadulterated insanity) it would be $1233 per share. Imagine if like, 10% of the EV hype crowd drifts over to GM…

— Quoth the Raven (@QTRResearch) January 14, 2021

Tyler Durden

Tue, 01/19/2021 – 15:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com