JPMorgan Tries To Slam Bitcoin Again, Fails Spectacularly

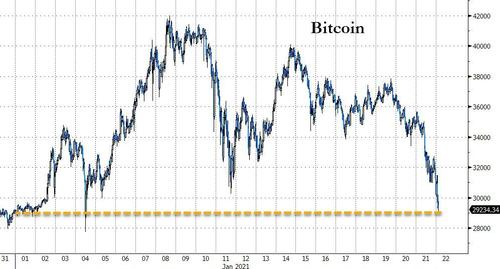

In its third attempt to talk down bitcoin in the past two months (see here for attempt #1, and attempts #2), and one which may be succeeding for the time being with bitcoin sliding below $30,000 on Thursday night, erasing all of its YTD gains…

… JPMorgan has published a report aimed at all those bitcoin investors who buy the cryptocurrency for its “diversification” benefits. And in what may come as very bad news for anyone who is buying bitcoin on the assumption that it will serve as a hedge to massively overvalued risk assets, the report published by head of cross-asset strategy John Normand, finds that not only is bitcoin “the least reliable hedge during periods of acute market stress) but because of its popularity among momentum chasing retail investors (who just refuse to HODL), it actually accentuates broad market drawdowns. Which, of course, is obvious to anyone who saw what bitcoin did during the March crash when it lost half its value in days.

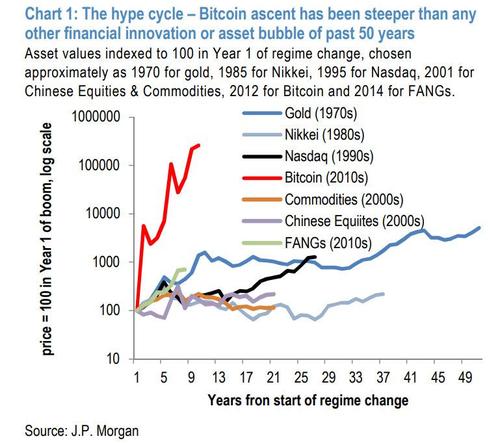

Before we go into the details of the report, JPMorgan first gives bitcoin its due (something which its CEO refused to do back in 2017 when he warned that any JPM employee caught trading bitcoin would be fired). As Normand writes, “whether cryptocurrencies are judged eventually as a financial innovation or a speculative bubble, Bitcoin has already achieved the fastest-ever price appreciation of any must-have asset to which it is often compared (chart 1), such as Gold (1970s), Japanese Equities (1980s), Tech stocks (1990s), Chinese Equities (2000s), Commodities (2000s) and FANG stocks (2010s).”

Each of these predecessors began with a compelling narrative and a tagline (“honest money” for Gold, “Japanese economic miracle” for Nikkei, “dot-com revolution” for Nasdaq, “a billion Chinese consumers” for China Equities, “supercycle” for Commodities and “secular growth” for FANGs), and each delivered extraordinary price momentum that challenged standard valuation models at that time. Each also delivered at least one, high-volatility price crash during the price discovery process that reversed more than half the market’s previous gain. Amusingly, while the JPM strategist is basically calling all these phenomena bubbles, he amusingly admits, that “several of these markets (Gold, Nasdaq, Chinese Equities, FANGs) were later vindicated via further all-time highs.”

Needless to say, so has bitcoin which rose above $40,000 just a few days ago, and despite its recent “crash”, it still trading at a level that was a never before seen all time high… some three weeks ago.

So, as Normand rhetorically asks, why bother considering hedging with an asset as unconventional and high-volatility as cryptocurrencies?

He gives a few reasons. One is that “extraordinary monetary and fiscal stimulus over the past year has created one of the broadest and earliest valuation problems of the past 25 years (chart 2), which creates general concerns about portfolio vulnerability to a macro or policy shock.” This can be seen in the chart below showing the near record number of markets whose valuations are more than one std deviation about their long-term average.

In short, JPM is conceding that stocks, and other risk assets, which have market value of over $100 trillion are a bubble, one which can be pricked by any number of “spoilers.” These spoilers range from somewhat familiar ones such as an inability to tame COVID, a destabilizing rise in inflation, a debt-related aftershock, significant regulatory tightening, renewed US-China or US-North Korea conflicts; to the as-yet unseen ones such as an economically debilitating cyberattack or an economically- significant climate catastrophe in a large economy. Another reason to hedge with bitcoin is that the collapse in DM Bond yields to negative levels in Japan and Europe and to only 1% in the US has limited their role as a defensive hedges in global portfolios and forced investors to focus on a range of second-best substitutes across Equities and FICC (Quality stocks, EM Bonds FX hedged, USD vs EM FX, JPY vs any currency, Gold), with cryptocurrencies considered by some to be the private and digital alternative to Gold.

Amusingly, even in a report which seeks to debunks bitcoin’s diversification abilities, the JPM analyst writes that “Bitcoin improves long-term portfolio efficiency, but its contribution will probably diminish as its mainstreaming increases its correlation with cyclical assets. And crypto continues to rank as the least reliable hedge during periods of acute market stress. “

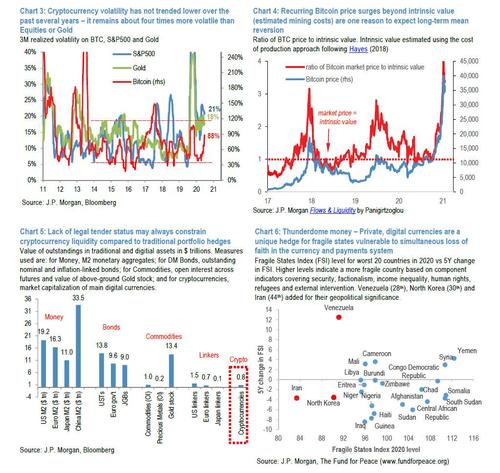

Sidestepping the fact that anyone who bought bitcoin and held over the past several years is now exorbitantly rich (and with zero concerns about bitcoin’s diversification capabilities), Normand then observes that developments “over the past year and particularly during the COVID-19 recession, have confirmed this view on the distinction between long-term efficiency and short-term risk management. As a stand-alone asset, cryptocurrencies remain several times more volatile than core asset markets, with 3M realized volatility of 90% compared to about 20% on US Equities and Gold” (chart 3 above).

But herein lies the problem, because when coupled with extraordinary returns in some years, crypto has often generated a much higher Sharpe ratio on average than core markets like Equities or hedge assets like Commodities in general and Gold specifically (chart 7).

Obviously, these averages when cryptos makes tremendous gains, obscure stretches like 2019-20, when crypto proves less efficient than its nearest competitor Gold. Thus, according to JPM the debate over whether Bitcoin or Gold can deliver superior volatility-adjusted returns remains unresolved, unlike some other quite reliable relationships informed by decades of performance trends. Amusingly, according to JPM, US High Yield Credit, for example, “is almost always more efficient than Equities for taking exposure to the US corporate earnings cycle (chart 8), while EM Corporates (CEMBI) and Sovereigns (EMBIG) almost always dominate Local Currency Bonds (GBI-EM in USD terms) for trading EM cycles. And, of course, those who trade any of these non-bitcoin assets would likely end up paying JPM a hefty commission on these trades, whereas purchase of bitcoin tend to make the likes of Coinbase richer. Which, a cynical person, may say is the reason behind JPM’s continued bashing of cryptos.

But we digress. So in its latest attempt to denigrate bitcoin, JPM then goes on to point out that far from a viable risk hedge, “the mainstreaming of cryptocurrencies – particularly with retail investors – appears to be raising its correlation with all cyclical assets (Equities, Credit, Commodities, the EM complex). If sustained, this development could erode diversification value over time.”

True… but said “mainstreaming” of crypto will also push its price higher. Much higher, especially considering just how narrow its penetration is among both institutional investors and the broader investing public. So if one is asked if they would be willing to stick with a few harrowing roller-coaster rides – with zero diversification to such other bubble assets as stocks – if the endgame is bitcoin above $100,000, we are confident that absolutely everyone would respond affirmatively.

What is even more amusing, is that in the very next sentence the JPM strategist seems to observe a fact that refutes his own conclusion, to wit:

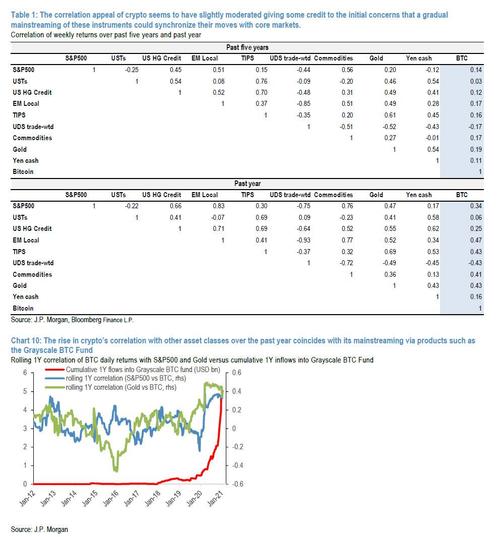

Table 1 refreshes correlations amongst cryptocurrencies (proxied by Bitcoin), major asset classes and conventional portfolio hedges (Treasuries, TIPS, Gold and Yen). Measured over a five year sample (top half of table), cryptocurrencies’ co-movement with all markets remains low and seems to highlight their potential diversification value. Indeed, Bitcoin’s correlation coefficients range from 0 to 0.2 and would seem to position it better than the Yen or Gold for hedging purposes.

Which is odd since the whole purpose of the JPM paper is to show that bitcoin is not a good hedge and yet, lo and behold, it turns out to be the best hedge, even if over the past year these correlations have doubled or tripled, coinciding with surging interest in access products such as the Grayscale BTC Fund (chart 10). And yet, even after their rise, JPM still finds that many pairwise correlations remain moderate (around 0.4), which again confirms that bitcoin is arguably the best hedge around. Still this is “concerning” to Normand who notes that “this trend bears watching.” Sure… as does bitcoin’s ascent from 0 to $40,000 in just a few short years, making billionaires out of all its early adopters.

Perhaps realizing that he is not helping his own argument, Normand then cuts to the chase and asks if bitcoin will act as a defensive asset and rise (or remain flat) when stocks selloff. Not surprisingly, he finally finds something that “validates” his thesis:

For tactical investors focused on risks that could crystalize over the next year, the better test of hedge effectiveness is whether a defensive or quasi-defensive asset rallies when Equities experience a material drawdown of perhaps 10% on Global Equities. On this measure, Bitcoin ranks 7th out of 10 alternatives, including: US Treasuries, USD vs EM Currencies, JPY vs USD, CHF vs EUR, Gold, S&P Quality stocks vs Value, EM Local Currency Bonds and UG High Grade. The first five in this list (Treasuries through Gold) are the most conventional and could be backtested further over at least two decades. The last two (EM Bonds with an FX hedge, US High Grade Credit) are potential, emerging hedges on a view that the COVID recession has sponsored two regime changes that alter these asset classes’ correlation with Equities during a crisis. One is that many EM central banks (though of moderate-debt economies) will cut interest rates, and the other is the Fed will buy High Grade Credit. The risk-return properties of these two markets will not approximate what Treasuries delivered when yields were higher and therefore offered greater offsets to declining stock markets during a crisis. But the behavior of EM Bonds and HG Credit could still change enough post-COVID to qualify them as potential diversifiers in a world with few good options.

Here, finally, Normand has successfully goalseeked a chart that fits his narrative, and notes that “for each of these assets, chart 13, chart 14 and table 2 show returns and success rates (the percentage of Equity drawdowns in which the hedge rallied) during the 20 largest Global Equity corrections of the past decade. Bitcoin ranks as the worst in terms of median returns (-5%) and the third worst in terms of success rate (42%).”

Ok so bitcoin sells off even more than stocks do during risk off periods. But why is that any news? And why does JPM even care about bitcoin’s diversification abilities, when instead one should look at it from a very different lens: bitcoin – and all crypto – are merely extremely volatile, ultra high beta assets which rise much more than stocks during times of massive liquidity injection and drop at or near the pace that stocks drop when liquidity is withdrawn. There is no advanced calculus class one needs to figure this out. In fact, the best explanation of what is going on – and one that JPMorgan will never admit – came from Howard Wang, a former Bridgewater analyst, who put is simply: “Bitcoin Is A Giant Bubble… But The Global Fiat System Is An Even Bigger Bubble.” In fact, Wang’s short note is far more relevant than Normand’s meandering ramblings. Here’s what he said:

Investors are forced to hold $18 trillion of negative yielding debt while $trillions are being printed all around the world. Investors are drowning and are grabbing onto cryptocurrencies as a lifeline.

While the sustained low yields will increase prices and suppress expected returns across all markets, many investors will choose the unknown expected returns of risky assets over the guaranteed losses in bonds. Like panicked prey chased by predators, investors prefer to hide in markets that either have no fundamental metrics, like Bitcoin, or assets with growth stories that leave ample room to imagination, like Tesla.

In the short-term, there is still a lot of dry powder from stimulus checks and some institutions are also making the leap into the crypto space. So this Bitcoin party could continue as long as rates remain low and the printing press hot.

Bitcoin is the flip side of the same coin as fiat currencies, pun intended. Its long-term fate depends on the future of our fiat system. Since the 1980s, deflationary pressures have suppressed interest rates and ultimately necessitated money printing around the world. As long as this trend continues, investors will run away from guaranteed losses in government bonds. Capital will flee up the risk spectrum, pushing up prices, dropping yields and producing asset bubbles along the way.

As long as the world is flooded with money and safe assets offer poor compensation, Bitcoin will be relevant. Volatility and asset bubbles will be a fact of life. Calling the tops of these bubbles will be difficult because the fiat currency yard stick by which we measure prices is itself in a bubble.

That’s all one really needs to know, and any attempts to talk down bitcoin – as JPMorgan has been steadfastly doing for the past few months, whether with hopes of buying some lower or merely talking bitcoin holders out of the asset and transferring them to more conventional holdings where JPM can charge a commission – will prove futile as long as central banks keep rates at zero and inject hundreds of billions of liquidity (while massively diluting existing fiat) into the system. It’s as simple as that.

Actually, buying bitcoin does provide one extra, and absolutely critical, benefit: as even JPMorgan admits, it is the perfect hedge to the financial collapse that always follows such periods of unprecedented monetary experimentation:

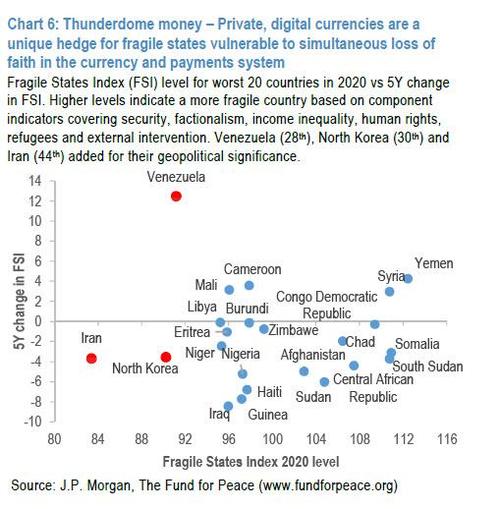

Relative to any other asset class or portfolio hedge, cryptocurrencies would uniquely protect portfolios against a simultaneous loss of faith in a country’s currency and its payments system, because they are produced and they circulate outside conventional and regulated channels (chart 6).

And, as Normand concludes: “as insurance (or a lottery ticket) against dystopia, some exposure to these assets could be always justified irrespective of liquidity and volatility concerns.“

Well, in this insane world where everyone should be seeking insurance against “dystopia”, we would be delighted to own as much of the cryptocurrency as we possibly can, “irrespective of liquidity and volatility concerns”. So just like your boss back in 2017, thanks for making the decisive case for bitcoin yet again, John.

Tyler Durden

Thu, 01/21/2021 – 21:40![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com