Futures Slide As Euphoria Fizzles On Renewed Lockdown Fears

Global shares slid from record highs, and US equity futures stumbled on Friday, halting a rally fuelled by stimulus hopes, amid renewed investor concern about tighter, extended coronavirus restrictions after Hong Kong announced it would lock down 150 residential buildings in an “unprecedented” bid to contain an outbreak of covid, coupled with Joe Biden’s warning that U.S. deaths will hit 500,000 next month. Treasuries edged up and the dollar strengthened for the first time this week. Bitcoin rebounded sharply overnight, rising as high as $32,000 after tumbling almost 20% on Thursday and sliding below $29,000.

S&P futures were down 0.8%, or 29 points, to 3,817. Among the top movers were Intel which beat on EPS and revenue making gains just before the close before paring to trade lower by 4% in the pre-market after the company unveiled plans to keep chip production in house until 2023 while IBM tumbled 8.2% in premarket trading on Friday, after it reported fourth-quarter revenue that missed expectations. Analysts were broadly disappointed by the results, which was seen as the latest sign of weak growth prospects. Cryptocurrency-exposed stocks extended losses in premarket trading on Friday, with Bitcoin holding steady under $32,000 during a week that saw a drop of about 13% for the digital asset.

The risk-off mood followed a period of relief after the transition of power in the United States, culminating in Biden’s inauguration on Wednesday and strong expectations that U.S. stimulus will provide continued support for global assets. President Joe Biden, who is pushing for $1.9 trillion in additional spending, unveiled a strategy to combat the virus while warning the pandemic will worsen before it improves. Restrictions intensified from Germany and the U.K. to Hong Hong, and the European Central Bank cautioned that the euro area is headed for a double-dip recession.

“Recent news flow on the pandemic has not been favorable,” said Jean-Francois Paren, global head of market research at Credit Agricole. “After the post-election wave of optimism from the U.S., markets have been left facing the reality of vaccine delivery and new lockdown measures, and the perspective of a double-dip in Europe.”

“The fact that there would be U.S. stimulus was well known and the size of the package and the very high-level details of what they’re aiming for with the package was well known some while ago,” said James Athey, investment director at Aberdeen Standard Investments. “The realities of what is likely to be achievable relatively quickly are not supportive of just blindly buying cyclical assets. There’s a lot more nuance and a lot more politics to go on before we get there.”

The MSCI world equity index was 0.2% softer following three straight sessions of gains which pushed it to a record.

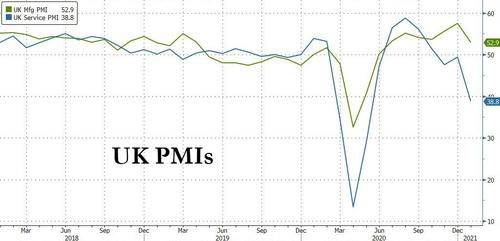

The Euro STOXX 600 was 0.8% weaker as investors digested weaker flash PMI readings for January. Lockdown restrictions to contain the coronavirus pandemic hit the bloc’s dominant service industry with Lagarde warning that Europe was in a recession in Q4. All industry sectors were in the red, with travel, energy and resources leading the decline. The FTSE 100 index slipped 0.5% as data showed British retailers struggled to recover in December from a partial coronavirus lockdown the previous month, while Uk PMIs dropped sharply.

The Stoxx 600 Energy index fell as much as 1.9%, hitting the lowest since Jan. 6, after crude prices fell on pessimism about the demand outlook. Oil majors Shell, BP and Total were all lower and dragging on the index; pipe manufacturer Tenaris the worst performer in the index, down as much as 5.1%.

Sentiment in Europe was already more cautious after Thursday’s European Central Bank meeting, in which the bank’s message was perceived as more hawkish than expected. The yield on Italian 10-year benchmark bonds touched its highest since early November on reports that Prime Minister Giuseppe Conte may be tempted by the prospect of a snap election.

MSCI’s broadest index of Asia Pacific stocks outside of Japan was 0.8% lower as investors paused for breath following a recent string of climbs to fresh record highs amid concerns over the latest coronavirus-related restrictions. China’s composite stock index slid 0.4%, while the blue-chip CSI300 index edged up 0.1%. TSMC was the biggest drag on the MSCI Asia Pacific Index after Intel’s incoming CEO pledged to regain the company’s lead in chips, aiming to move the majority of manufacturing internally by 2023. Hong Kong stocks fell 1.6% after the South China Morning Post reported the government will lock down tens of thousands of residents in parts of Kowloon in an effort to limit the spread of Covid-19. Philippine stocks dropped for a sixth straight day. New Zealand stocks bucked regional declines, climbing after the country’s inflation was firmer than economists expected in the fourth quarter.

Data from Japan overnight showed that factory activity slipped into contraction in January and the services sector was more pessimistic as emergency measures to combat a COVID-19 resurgence hit sentiment.

Treasury futures hovered near top of daily range on light volume, leaving cash yields richer by 2bp-3bp across long-end of the curve. Risk-aversion is a driver, as virus-related global restrictions are back in focus. The 10-year yield at around 1.09% was richer by ~2bp on the day, led by gilts and bunds amid weakness in European stocks, and little changed on the week; long-end-led gains flatten curve, with 5s30s in retreat from highest level since November 2016. With February Treasury options set to expire, large open interest in 137 strikes on 10-year futures contract trading just below that level may help limit movement away from it. Yields on German bunds edged lower, while Italian bonds dropped after Corriere della Sera reports Italian Prime Minister Giuseppe Conte could seek new elections, adding to a selloff sparked Thursday by concerns over the pace of ECB bond buying.

With China reporting 103 COVID-19 cases on Friday. travel plans were in limbo for tens of millions of people in China’s northern cities. They have been under some kind of lockdown amid worries that undetected coronavirus infections could spread quickly during the Lunar New Year holiday, which is just weeks away.

In FX, the Bloomberg Dollar Index advanced and the greenback was higher against risk-sensitive Group-of-10 peers while trading little changed versus the euro and the Swiss franc. The U.S. dollar paused after three straight days of losses, though it was still on track for its biggest weekly loss since mid-December. Its recent slide has been led by investors ploughing money into higher-yielding currencies on optimism about a rapid economic recovery led by the U.S. stimulus. The euro touched a session high of $1.2190 following slightly better- than-forecast German PMI data, only to trim those gains after the euro-zone wide PMI didn’t offer the same positive surprise. The pound was also lower after a disappointing PMI print and weak retail sales data; Boris Johnson refused to rule out the U.K.’s lockdown lasting into summer. Nokkie, Aussie and Kiwi all snapped three days of gains versus the greenback.

Bitcoin steadied, rebounding as high as $32,000 after earlier slumping below $30,000 on Friday in a retreat that stoked fresh questions about the sustainability of the cryptocurrency boom.

In commodities, oil prices were weighed down by worries that new pandemic restrictions in China will curb fuel demand in the world’s biggest oil importer. Brent crude futures fell 2.3% to $54.81 a barrel, while WTI was 2.4% lower at $51.87 per barrel. Spot gold was down 0.7% at 1,845 an ounce.

Looking at the day ahead, the December Markit PMIs and existing home sales are the main highlight. Schlumberger is among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.6% to 3,821.25

- MXAP down 0.7% to 213.09

- MXAPJ down 0.9% to 718.03

- Nikkei down 0.4% to 28,631.45

- Topix down 0.2% to 1,856.64

- Hang Seng Index down 1.6% to 29,447.85

- Shanghai Composite down 0.4% to 3,606.75

- Sensex down 1.6% to 48,848.02

- Australia S&P/ASX 200 down 0.3% to 6,800.37

- Kospi down 0.6% to 3,140.63

- STOXX Europe 600 down 1% to 406.97

- German 10Y yield fell 0.6 bps to -0.502%

- Euro up 0.07% to $1.2172

- Italian 10Y yield rose 6.6 bps to 0.574%

- Spanish 10Y yield rose 1.2 bps to 0.138%

- Brent futures down 1.4% to $55.33/bbl

- Gold spot down 0.5% to $1,860.70

- U.S. Dollar Index little changed at 90.17

Top Overnight News from Bloomberg

- ECB officials have asked staff to propose new ways to measure financial conditions in the euro area, potentially assisting future decisions on how much stimulus the region’s pandemic-hit economy needs

- Europe’s bond markets are becoming wary that the European Central Bank may just be easing off the gas after President Christine Lagarde emphasized that the central bank’s entire 1.85-trillion-euro pandemic stimulus package may not be needed, should financing conditions in the euro area remain favorable

- Federal Reserve officials meeting next week are likely to put off any changes in their bond-buying program until 2022, when a tapering of purchases may begin, according to economists surveyed by Bloomberg News.

- Japan’s pension fund, the world’s largest, is determining the impact of FTSE Russell adding Chinese government debt to its bond benchmark, according to Masataka Miyazono, the president of the Government Pension Investment Fund

- European leaders painted a bleak picture of the continent’s health emergency, warning that mutant coronavirus strains will result in longer and potentially stricter lockdowns with no clear sense of when they may end

- Iran has started ramping up its oil production and expects to reach pre-sanctions levels in one to two months, said Deputy Oil Minister Amir Hossein Zamaninia

Quick look at global markets courtesy of Newsquawk

Asian equity markets traded cautiously after the mixed lead from Wall St where most indices stalled at record levels aside from the Nasdaq which was bolstered by continued strength in large tech including firms gains in Intel which announced its results prior to the closing bell and beat on both top and bottom lines and with Apple also boosted by optimism from Morgan Stanley regarding the tech giant’s upcoming earnings report. Nonetheless, trade across the Asia-Pac region was subdued with ASX 200 (-0.3%) pressured by heavy losses in the energy sector and as smaller tech stocks were shunned in the shadow of the global industry giants, with a larger than expected decline in Retail Sales adding to the glum mood. Nikkei 225 (-0.4%) was negative following soft inflation data, which was not as bad as feared, but still registered the fastest pace of decline since September 2010. In addition, there was an initial report that Japan’s government is said to have privately concluded the Tokyo Olympics will have to be cancelled due to the pandemic and focus will be on securing games for Tokyo at the next available year in 2032, although PM Suga later pushed back against this and said they are determined to realize the Olympics. Hang Seng (-1.6%) and Shanghai Comp. (-0.4%) conformed to the downbeat picture with Hong Kong weighed on by expectations of a tough lockdown to be imposed from this weekend for certain districts and with CNOOC the worst performer after MSCI announced yesterday it will delete the Co. from its MSCI ACWI and MSCI China All Share Indexes. There were also recent comments from US Treasury Secretary nominee Yellen who suggested the US will use a full array of tools to counter China’s abusive and illegal practices, while she added that they will not alter China tariffs until allies have been consulted and that a new approach is needed for meaningful pressure on China. Finally, 10yr JGBs are lower after its pullback from resistance near the 152.00 focal point and alongside similar lacklustre trade in T-notes, with prices ignoring the improved results and stronger demand seen at the enhanced liquidity auction for JGBs ranging from 2yr- 20yr maturities.

Top Asian News

- Shiseido Is in Talks to Sell Personal-Care Business to CVC

- Hong Kong Stocks Drop on Report City to Lock Down Some Buildings

- Oil Giant Cnooc Turns Index Pariah After U.S. Blacklists Parent

Bourses in Europe continue to extend on losses (Euro Stoxx 50 -1.1%) as the downbeat APAC performance reverberates into the region amid woes of further shut downs due to worsening COVID-19 outbreaks. This fallback in sentiment has also been reflected in the EZ and UK PMI figures which waned M/M. The risk-off mood is Europe has also seeped into US equity futures which are also dented – with the ES -0.6%, NQ -0.5%, RTY -0.9% and YM -0.8%. Cash bourses in Europe mostly see broad-based losses with a few of outliers – UK’s FTSE (-0.7%) sees more contained declines with the aid of favourable Sterling dynamics, Italy’s FTSE MIB (-2.1%) underperforms as COVID-fears fuse with political jitters as reports via Corriere suggested that Italian PM Conte is reportedly considering the possibility of elections, and is becoming increasingly tempted by early voting due to the current state of polls. Meanwhile, losses in the SMI (-0.2%) are cushioned by risk-off defensive flows into pharma names. As such Healthcare resides as one of the better performing sectors in the region. On the other end of the spectrum, Oil & Gas is the laggard amid price action in the crude complex (see the commodities section), with Travel & Leisure also hit in a similar vein on further lockdown woes. Banks reside towards the bottom of the pile against the backdrop of a lower yield environment and drag from the politically-hit Italian banks, with UniCredit (-3%), Bper Banca (-2.8%) and Intesa Sanpaolo (-2.6%) all towards the bottom of the Italian benchmark index. The IT sector also feel some pressure despite positive metrics from Intel (-4% pre-mkt) but underwhelming earnings from IBM (-7.5% pre-mkt) – with some also suggesting profit-taking/sell-the-fact play after the recent tech rally. In terms of individual movers, DAX heavyweight Siemens (+4.5%) is bolstered and in turn is stemming downside in the DAX (-0.5%) following stellar prelim-earnings in which Q1 revenue rose 5% Y/Y, exceeding expectations. Airbus (-0.1%) is relatively flat following a mixed update but noted that overall production rates are to remain lower for longer.

Top European News

- EU Warns City of London That Brexit Finance Deal Is Distant

- ECB Seeks New Gauges by March to Aid Pandemic Stimulus Plans

- Brexit Sparks Record Slowdown in Deliveries, Hitting U.K. Output

- U.K. Considers Paying People to Stay Home Amid Lockdown Breaches

In FX, there was another downturn in broad risk sentiment, softer crude and commodity prices have combined with a retreat in several currency counterparts to save the Buck from a further collapse, while perma bulls may also derive more encouragement from the fact that the DXY fended off the latest attempt to flush out underlying and psychological bids at 90.000, albeit even more narrowly (at 90.039 vs 90.043 yesterday). Indeed, the index and Greenback overall remain depressed, with rebounds running into offers at increasingly lower levels and readily, ie 90.286 so far compared to 90.454 on Thursday and 90.699 the day before. Ahead, US Markit preliminary PMIs and existing home sales are scheduled and could provide impetus, but perhaps on the good news is bad and vice-versa mantra for the downbeat Dollar.

- GBP/CAD/AUD/NZD – The writing was on the wall for the Pound after early UK data disappointment in the form of retail sales and public sector finances, but the so called flash PMIs were anything but, and have seen Cable relinquish the 1.3700 handle, while Eur/Gbp has rebounded to 0.8900+ from its pre-ECB low around 0.8830. Elsewhere, the aforementioned retreat in oil and perhaps some trepidation ahead of Canadian consumption figures have exacerbated the Loonie’s reversal to circa 1.2700 from 1.2590 or so on Thursday, while a bigger than expected drop in Aussie retail sales and the negative risk tone have dragged Aud/Usd back under 0.7750. Conversely, the Kiwi is only holding up marginally better in wake of firmer than forecast NZ CPI and another RBNZ rate outlook upgrade (Kiwibank not looking for a sub-zero OCR any more) by virtue of a retracement in the Aud/Nzd cross to test 1.0750.

- EUR/CHF/JPY – More post-ECB volatility for the Euro, though above 1.2150 vs the Buck, as a significant deterioration in already contracting French services sector activity outweighed strength in manufacturing in stark contrast to Germany that compensated sufficiently to keep the pan Eurozone prints close to consensus. However, an official German GDP downgrade for 2021 and technical resistance ahead of 1.2200 via the 21 DMA (1.2196) is capping Eur/Usd, while Eur/Chf is softer again sub-1.0780 on renewed Italian political uncertainty amidst reports that PM Conte is contemplating calling an early election to give Usd/Chf the impetus to breach 0.8850. On the flip-side, not much in the way of safe-haven demand for the Yen following fractionally less deflationary than anticipated Japanese inflation data, as Usd/Jpy bounces from beneath 103.50 towards 103.75 eyeing decent option expiry interest between 103.40-50 (1 bn).

- SCANDI/EM – The Nok is unwinding post-Norges Bank strength alongside the retracement in crude prices to 10.3345 vs 10.2120+ against the Eur, while the Mxn is also having to contend with more Government moves that would put the onus on Banxico to mop up excess Usd and other foreign currency reserves. Nevertheless, the Krona and Peso are not depreciating as much as some on risk-off or averse positioning ahead of the weekend.

In commodities, WTI and Brent front month futures continue to edge lower in early European trade in a continuation of the price action seen overnight, as sentiment is dented by some supply and demand side developments. Firstly, the complex has been knocked off-course as the severity of the new COVID-19 outbreaks have prompted further economies to impose lockdown measures, with Hong Kong the latest to restrict city residents for the first time, whilst UK PM Johnson suggested UK’s lockdown could run into the summer. On the supply side, Iran’s OPEC governor said the country has started ramping up oil production, which comes as Biden took the helm of the White House – with hope for Iranian sanctions to be unwound. That being said, we have yet to see any firm commitment from the Biden admin and the reaction from the OPEC+ de-facto heads – Saudi and Russia, namely the former after the 1mln BPD voluntary cuts announced in Jan for Feb and Mar. Iran is currently exempt from quotas but increased flows into the market during the rise of COVID-19 variants may not bode well with fellow producers. Brent relinquished its USD 55/bbl handle as it extends its decline from USD 56.20/bbl highs, while its WTI counterpart dipped south of USD 52/bbl (vs high USD 53.13/bbl). Looking ahead, today sees a delayed release of the weekly EIA stockpiles (crude exp. -1.167mln bbl) given Monday’s MLK holiday and Wednesday’s US inauguration. Elsewhere, spot gold and spot silver are softer as the Dollar regains traction and extends its gains, with the former around USD 1860/oz with nearby levels including the 50 DMA (1859.50/oz), USD 1850/oz and 200 DMA (USD 1846.4/oz). In terms of base metals, LME copper is faltering amid a similar performance in Shanghai amid the resurgence of the virus causing demand jitters ahead of Lunar New Year holiday next month in China. Similar downside was also seen in Dalian iron ore futures overnight, with near-term outlook also impacted by weakening steel margins.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 56.5, prior 57.1; 9:45am: Markit US Services PMI, est. 53.4, prior 54.8

- 10am: Existing Home Sales, est. 6.56m, prior 6.69m; Existing Home Sales MoM, est. -1.94%, prior -2.5%

DB’s Jim Reid concludes the overnight wrap

Back to bubbles, and time will tell whether today’s valuations prove sustainable, but US equities witnessed yet more records yesterday as large cap tech stocks fueled the NASDAQ (+0.55%) to new all-time highs and dragged the S&P 500 (+0.03%) to a fresh one too. Yesterday’s gains were driven by Tech Hardware (+2.85%) and Semiconductors (+2.21%). The big laggards on the day were actually the more cyclical stocks like Energy (-3.34%), Transportation (-1.95%) and Banks (-1.29%). The moves may point to a crowded cyclical trade for now as oil prices were fairly flat – Brent crude was down just -0.12% – and rates were higher with yield curves steeper. Indeed the reflation trade was alive and well in fixed income, with 10yr US breakevens hitting yet another 2-year high of 2.18% and up a pretty substantial +5.6bps and within touching distance of 6 year highs although a new 10yr TIPS auctions probably had much to do with the move. In addition the 5s30s Treasury curve steepened to its highest in over 4 years, as 10yr yields themselves rose +2.6bps. The mood was further bolstered by some positive economic data out of the US, with the weekly initial jobless claims for the week through January 16 coming in at a lower-than-expected 900k (vs. 935k expected), whilst the previous week’s number was revised -39k lower. On top of this, housing starts in December hit an annualised rate of 1.669m (vs. 1.560m expected), taking them to levels not seen since 2006, as did building permits at 1.709m (vs. 1.608m expected).

European assets didn’t have such a strong day however, as the ECB made some moderately hawkish noises in its latest policy meeting. While the Governing Council left their main policy rates unchanged as expected, there was a new section in the statement on the symmetric flexibility of their pandemic emergency purchase programme, which said that “If favourable financing conditions can be maintained with asset purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full. Equally, the envelope can be recalibrated if required to maintain favourable financing conditions to help counter the negative pandemic shock to the path of inflation.” This nod to the fact that the envelope might not be used in full wasn’t in itself new news, since it was mentioned in the minutes of the ECB’s December meeting, but its inclusion in the statement in addition underlined the hawkish point. While our European economists saw the message about symmetry around the PEPP envelope as a significant new point, they also highlighted President Lagarde emphasis on the conditional nature of that symmetry. Meaning that holistic financial conditions need to reach a certain threshold before support is eased. They feel that the statement implies that ECB sees sovereign yields as low enough currently but now attention has shifted to ensuring that the stimulus gets passed through to the whole economy. See their full reaction note here.

Against this backdrop, the euro strengthened +0.48% against the dollar yesterday and sovereign bond yields rose across the continent, with those on 10yr bunds (+3.3bps), OATs (+3.6bps) and BTPs (+6.7bps) all moving higher. Italian BTP yields rose to the highest levels in just over two months, this comes even as reports continue to show Prime Minister Conte being able to cobble together a governing coalition. Equity markets similarly weakened through the day, with the STOXX 600 paring back its intraday high of +0.76% after the open to eke out a gain of just +0.01%.

One of the main highlights today will be the release of the flash PMIs from around the world, which will give us an early indication of how the global economy is performing into 2021. With the resurgence of the virus in Europe and fresh restrictions, the consensus is pointing to further declines from December’s numbers, though with manufacturing doing better than services as has been the case throughout the pandemic. Overnight we’ve already had the releases from Australia and Japan with Japan’s manufacturing (at 49.7 vs. 50 last month) and services (at 45.7 vs. 47.7 last month) PMIs on the softer side as the country imposed a state of emergency across several prefectures. Australia’s PMIs were a bit more mixed with services softer at 55.8 (vs. 57.0 last month) while the manufacturing reading improved to 57.2 (vs. 55.7 last month). In other overnight data, Japan’s Dec CPI (-1.2% yoy vs. -1.3% yoy) and core CPI (-1.0% yoy vs. -1.1% yoy) both came in weaker than expectations.

Asian markets are trading softer this morning with the Nikkei (-0.21%), Hang Seng (-1.22%), Shanghai Comp (-0.61%) and Kospi (-0.05%) all down. The underperformance of the Hang Seng is coming on the back of news that the city will for the first time lockdown tens of thousands of residents in Yau Tsim Mong, the core urban district of Kowloon, to control the spread of the coronavirus outbreak. Futures on the S&P 500 are also trading down -0.25% while Brent crude oil prices are down -1.12%.

Meanwhile, Bitcoin which received a 10/10 bubble rating from 50% of respondents in our survey was down as much as -7.7% today at one point to trade at $28,818 before popping back up to $31.785 (+1.82%) as we type. The crypto currency is now down -24.3% from its peak of $41,981 reached on January 8, 2021. In other news, Google has said that it will disable its search engine in Australia if it’s forced to pay local publishers for news. This came as Australia is working on a law that will require Google to compensate publishers for the value of their stories. Facebook is the only other company besides Google which is being targeted by this legislation. Facebook has said that it is considering blocking Australians from sharing news on Facebook if the law is passed. Is this a small sign that the regulatory/legal framework for big tech is changing?

On the coronavirus pandemic, President Biden’s first full day in office saw a number of executive orders that mark a shift in approach from the previous administration. The executive actions seek to stabilise supply chains as well as boost the government’s ability to rapidly deploy vaccines to states, but the administration also acknowledged that it needed Congress to pass legislation for additional spending in order to make a significant change in trajectory. There are new quarantine measures for all international travellers. The Biden administration also will require masks on airplanes, trains and other modes of transportation that cross state lines and in a short address, the President urged mask-wearing broadly and promised to try and make vaccinations free where possible. He also tempered expectations a bit, warning that, “it’s going to take months before we can get the majority of Americans vaccinated.” The administration is aiming to get 100mn doses administered in the presidents first 100 days, and Dr Fauci has said he does indeed expect that the country will soon be able to register one million doses per day in the near future, with the majority of Americans vaccinated by mid-year. On a related note, he announced that the Johnson & Johnson vaccine would have sufficient data to analyse by early-February, with emergency authorisation taking another week or so after that. The Johnson & Johnson shot has the potential to accelerate the amount of vaccinated people in the population as it only requires one shot compared to the two needed by the Moderna and Pfizer jabs. Overnight, J&J has said that it aims to have 100 million vaccines available for Americans by the spring.

Otherwise, there was some positive news out of the UK, where more than 4.9m people have now had their first vaccine dose, with the current rate putting the UK on track to meet the government’s target of having offered a first dose of the vaccine to the over-70s, health and social care workers, and the clinically extremely vulnerable by February 15. However, Portugal announced that schools and universities would be closing for at least 15 days as they reported their highest number of daily deaths since the start of the pandemic. Overnight China has banned residents of an area of Shanghai from leaving the city after six Covid cases were found in the finance hub, the first cases there in almost two months. The country is also suspending schools in Beijing from Saturday and one Beijing district and multiple cities in neighbouring Hebei province have been put under lockdown as the current outbreak is continuing to grow.

To the day ahead now, and the aforementioned release of the January flash PMIs will be the main highlight. Other data releases include December data on UK retail sales and US existing home sales.

Tyler Durden

Fri, 01/22/2021 – 07:52![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com